Australia Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Australia's Significant Investor Visa requires an investment of AUD 5 million in complying investments for a minimum of 4 years.

- Benefits include access to a high standard of living, excellent education and healthcare systems, and eventual pathways to citizenship.

- The program allows for the inclusion of family members, offering a comprehensive approach to family relocation.

- Complying investments include Australian venture capital, emerging companies, and managed funds, focusing on the Australian economy's growth sectors.

- The timeline involves a provisional visa for four years, after which investors can apply for permanent residency.

Australia isn't just home to stunning landscapes and unique wildlife; it's also a land of immense economic opportunity, boasting the world's 12th-largest economy and being one of the world’s most popular immigration destinations.

Did you know that, with the right resources and strategy, you can gain more than just a vacation down under?

Through Australia’s residency by investment program, also known as its Business Innovation and Investment Program, savvy investors can secure a future for themselves and their families on this dynamic, sun-kissed continent.

In This Article, You Will Discover:

Let’s peel back the layers of this rare opportunity as our team of experts guides you through the intricate tapestry of benefits, processes, and outcomes.

Whether you're seeking a new home for your family, a retirement paradise, or a strategic economic move, read on to understand how this program could be the key to unlocking your wildest aspirations…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

What Are the Benefits of Residency by Investment in Australia?

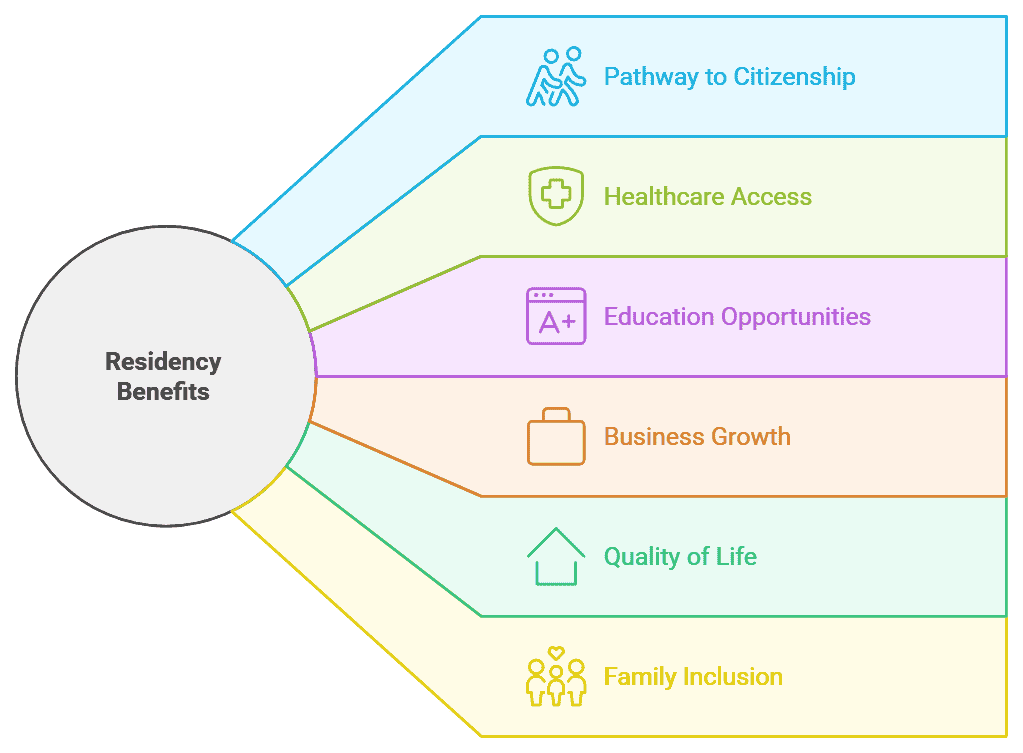

The benefits of residency by investment in Australia are numerous, from access to cutting-edge healthcare to participation in a leading business landscape.

The following aspects of residency by investment in Australia made it into our curated list of the top benefits:

- Pathway to citizenship: Permanent residency status can eventually lead to Australian citizenship, offering long-term security and additional benefits.

- Healthcare access: Gain access to Australia's public healthcare system, Medicare, which provides comprehensive coverage for you and your family.

- Education opportunities: Residents can enroll in Australia’s world-class educational institutions, often at the same tuition rates as Australian citizens.

- Business growth: Australia's stable economy and strong trade links provide an ideal environment for business investment and expansion.

- Quality of life: Enjoy a high standard of living with access to clean environments, cultural diversity, and a balanced lifestyle.

- Family inclusion: You’ll be able to include family members in your application, securing their status alongside yours.

- Visa-free travel: Holders of Australian permanent residency can travel to many countries without a visa.

- Tax advantages: Australia has a non-domicile tax system, potentially offering tax advantages on foreign income for new residents.

- Real estate ownership: You’ll have the right to purchase property in Australia, which is often restricted for non-residents.

- Social services: Get access to certain social services and benefits, including schooling and social security payments.

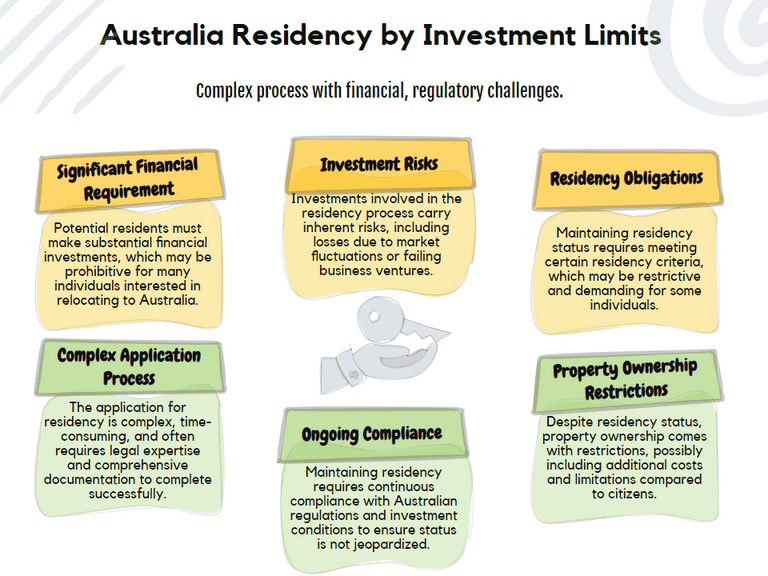

What Are the Limitations of Residency by Investment in Australia?

The limitations of residency by investment in Australia revolve mainly around the complexity of obtaining it and the risk and regulatory factors that accompany it.

We’ve gone ahead and broken down the main limitations to consider below:

- Financial requirement: A significant financial investment is required, which may not be feasible for all potential applicants. Remember, the financial outlay of this process extends far beyond the investment amount required to qualify.

- Residency obligations: To maintain residency status, you must meet certain residency requirements, which can be restrictive.

- Investment risk: Investments carry inherent risks, including the potential for loss, especially if tied to fluctuating markets or new business ventures.

- Complex process: The application process can be complex and time-consuming, often requiring legal assistance and extensive documentation.

- Property ownership restrictions: While residents can own property, there may still be restrictions and additional fees compared to citizens.

- Ongoing compliance: Investors must comply with Australian laws and investment conditions to maintain residency status.

- Changing policies: Immigration policies are subject to change, which could affect the stability of residency status in the future.

- Cultural and social adaptation: Moving to a new country requires cultural adaptation, which can be challenging for some individuals and families. Even if you hail from another English-speaking country, cultural differences apply.

Which Investment Types Qualify for Residency by Investment in Australia?

The investment types that qualify for residency by investment in Australia fall into 4 different streams under its Business Innovation and Investment program.

We’ve detailed the 4 investment options for you as follows:

The Business Innovation Stream

You’ll be required to pass a points test to apply for this visa.

With the provisional visa that’s awarded under this stream, you’ll be able to operate a new or existing business in Australia.

The Investor Stream

This stream also awards successful applicants with a provisional visa.

You’ll be required to invest a significant sum of capital in suitable Australian investments, and you must maintain the business or investment in Australia.

Applying for this investment stream also requires that you pass a points test.

The Significant Investor Stream

This stream also allows you to invest a large sum of money in Australian investments in return for a provisional visa.

The investment must meet certain requirements, and, once again, you’ll be required to maintain the investment activity in Australia.

Under this investment stream, you won't be required to pass a points test.

The Entrepreneur Stream

This is an investment option that encourages startups and early-stage entrepreneurs to develop their concepts in Australia.

You must be endorsed to qualify for this option.

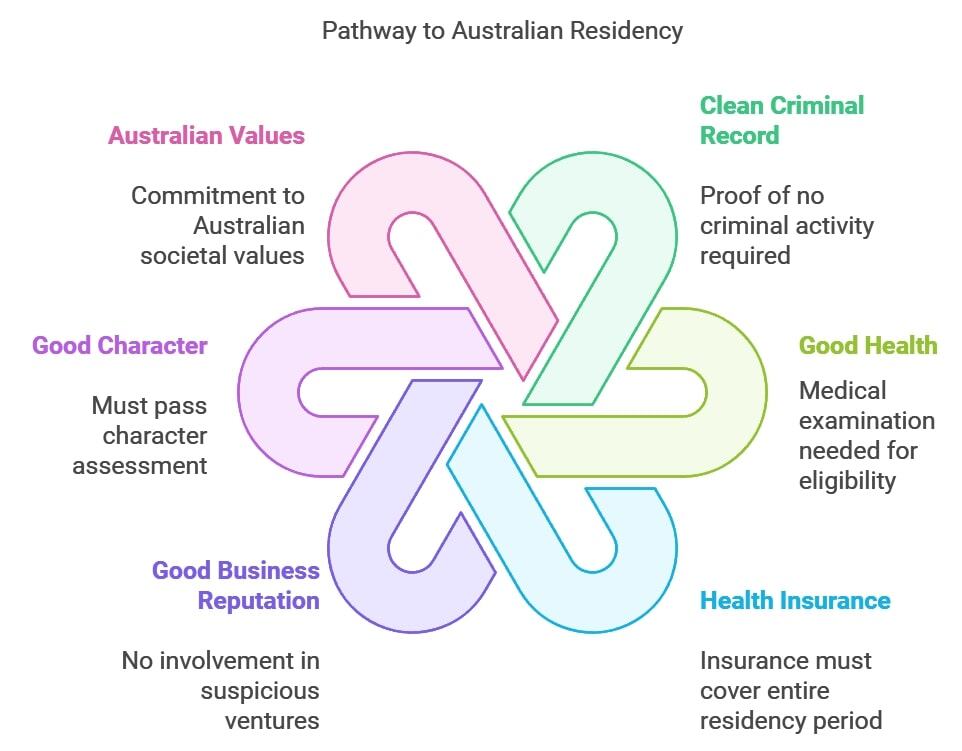

What Are the Eligibility Requirements for Residency by Investment in Australia?

The eligibility requirements for residency by investment in Australia vary according to which investment stream you opt for.

However, some general eligibility requirements do apply as a prerequisite.

Read on.

General Eligibility Requirements

General eligibility requirements apply to all potential residency applicants, regardless of your chosen investment stream.

These requirements include the following:

- Clean criminal record: You can prove this with a police clearance certificate.

- Good health: A medical exam and chest x-ray will be required. Some countries are exempted from this requirement, though.

- Health insurance: Your health insurance should remain in force for the entire duration of your residence in Australia.

- Good business reputation: You must prove that you’re not involved in any suspicious or unacceptable business or investment ventures.

- Good character: You must be of good character to be eligible for Australian residency by investment. According to the Migration Act of 1958 (Section 501),1 you’ll fail the good character test if, amongst other reasons, you have a criminal record, you’ve ever committed crimes against humanity, or there’s reason to suspect that you’re likely to sow discord in the greater Australian society.

- Australian values: You’ll be required to commit to and sign the Australian values statement. Australian values include respect for the freedom and dignity of the individual, freedom of religion, freedom of speech, freedom of association, and commitment to the rule of law.2

- No visa cancellations or refusals: If you’ve ever been refused a visa or had a visa canceled, Australia reserves the right to refuse you entry to the country.

Requirements for the Business Innovation Stream

Under the Business Innovation investment stream, you’re specifically required to contribute to the commercial activity and competitiveness of the Australian economy.

This includes:

- developing business links with international markets

- employing people in Australia

- exporting Australian goods

- introducing new or improved technology, or

- producing goods or services that Australia would otherwise import

So how do you know whether you’re eligible to apply for this provisional visa?

Let’s get into it:

Invitation & Nomination

The process to apply for this investment stream kicks off when you submit an expression of interest (EoI) to the Department of Home Affairs in Australia.

An Australian state or territory government agency must accept your EoI and nominate you.

If this happens, the Department of Home Affairs will invite you to apply.

Bear in mind

If the State or Territory withdraws its nomination after you’ve submitted your application, the visa won’t be granted.

Business Ownership

Under this investment stream, you must provide your business ownership experience.

Essentially, you must show that you have an ownership stake in at least 1 existing business.

For at least 2 of the 4 financial years prior to submitting your application, your business(es) must have shown the following:

- At least AU$500,000 turnover in each of those 2 years if you were invited to apply before 1 July 2021

- At least AU$750,000 turnover in each of those 2 years if you were invited to apply on or after 1 July 2021

You must own at least:

- 51% of the business if the business has an annual turnover of less than AU$400,000.

- 30% of the business if the business has an annual turnover of AU$400,000 or more.

- 10% of the business if a publicly listed company operates the business.

There’s more

If your business provides professional, technical, or trade services, you must have spent less than half your time providing those services personally.

In other words, you need to prove that your role in the business is mainly related to the management of the business.

Assets

This covers business and personal assets.

You, your partner, or you and your partner combined must show that your total net business and personal assets are equal to:

- at least AU$1.25 million if you were invited to apply on or after 1 July 2021.

- at least AU$800,000 if you were invited to apply before 1 July 2021.

Within 2 years of receiving your provisional visa, your funds must be available to transfer to Australia.

Points

You’ll need to take a points test and pass with at least 65 points.

The points test rates you on a variety of characteristics, such as:

- your age

- your English language proficiency

- qualifications

- business experience

- net personal and business assets

- business turnover

- innovation

Business Success

You must have a successful business career and a genuine desire to own and manage a business in Australia.

Age

The age cutoff for this investment stream is 55.

If you’re older than 55, you won’t be invited to apply unless, in rare instances, your investment is likely to be exceptional.

Requirements for the Investor Stream

The Significant Investor stream requires you to commit to actively maintaining your investment and complying with Australian workplace laws.

Here are the details:

Invitation & Nomination

As with the Business Innovation stream, if an Australian state or territory government agency accepts your EoI, it’ll nominate you.

The Department of Home Affairs will then invite you to apply.

Assets & Investments

This eligibility criterion requires you to have owned and managed business and personal assets and investments.

Specifically, you must comply with the following criteria:

- You’ve managed a business or eligible investments: For at least 1 of the 5 financial years before you’re invited to apply, you must have directly managed a qualifying business in which you, your partner, or you and your partner combined had at least 10% ownership interest or eligible investments.

- Have the required assets: For the 2 financial years before you’re invited to apply, you, your partner, or you and your partner combined, have had business and personal assets with a net value of at least:

- AU$2.5 million if you were invited to apply on or after 1 July 2021.

- AU$2.25 million if you were invited to apply before 1 July 2021.

Needless to say

Your assets must have been lawfully acquired.

They also need to be available for transfer to Australia within 2 years of receiving your provisional visa.

Minimum Investment

The minimum investment amount for this investment stream is AU$2.5 million, which must be diverted into various approved investment vehicles.

These investments must be maintained for the duration of your provisional visa.

The investment must be made via the following routes:

- At least AU$500,000 must be invested in venture capital and growth private equity funds, which invest in start-ups and small private companies.

- At least AU$750,000 must be invested in approved managed funds. The managed funds must invest in emerging companies listed on the Australian Stock Exchange.

- Invest a balancing investment of at least AU$1.25 million in managed funds.

Experience

You’ll need to demonstrate that you have the right experience.

This means you must:

- have at least 3 years' experience managing 1 or more qualifying businesses or eligible investments.

- have a successful record of eligible investment or qualifying business activity.

- have a proven high level of management skill concerning the eligible investment or qualifying business activity.

Points

As with the Business Innovation stream, you must pass a points test with at least 65 points to make the cut for this application.

Reside in a Preferred State or Territory

This investment stream will only work for you if you genuinely intend to live in the state or territory in which you have made the investment application for at least 2 years .

Age

Once again, you won’t receive an invitation to apply if you’re 55 or older.

If the state or territory government agency that wishes to nominate you determines your investment will be of exceptional economic benefit, this age limit may be waived.

Requirements for the Significant Investor Stream

A few commitments required under this investor stream include the genuine desire to live in Australia and a realistic intention to continue your business involvement with Australia even after this provisional visa expires.

If this sounds doable to you, let’s get into some of the finer eligibility details.

Invitation & Nomination

The same invitation and nomination process outlined under the Business Innovation and Investor streams initiates the application process under this Significant Investor stream.

You need to submit an expression of interest that the relevant government agency must approve for a state or territory.

If a state or territory then nominates you, you’ll be invited to apply.

Minimum Investment Amount

The minimum investment amount under the Significant Investor stream is AU$5 million.

The investment must be made upon (or shortly after) submitting your application.

The investment must be made in the following way:

- Invest at least AU$1 million in venture capital and growth private equity funds that invest in start-ups and small private companies.

- Invest at least AU$1.5 million in approved managed funds. The managed funds must invest in emerging companies listed on the Australian Stock Exchange.

- Invest a balancing investment of at least AU$2.5 million in managed funds.

Requirements for the Entrepreneur Stream

Under this investment stream, you must be engaged in or proposing to launch a complying entrepreneurial activity in Australia.

Invitation & Nomination

As with other Australian residency by investment streams, you must initiate your application process by submitting an expression of interest (EoI) to the Department of Home Affairs in Australia.

If a state or territory nominates you following your EoI submission, you’ll be invited to apply.

Age

You simply won’t receive an invitation to apply if you’re older than 55.

However, if you submit your EoI and a state or territory deems your proposed entrepreneurial activity to be of extensive economic benefit to Australia, you may be able to bypass the age criterion.

Entrepreneurial Activity

Importantly, your proposed entrepreneurial activity must comply with certain criteria for it to be considered.

A complying entrepreneur activity involves an innovative idea that’s likely to lead to:

- the commercialization of a product or service in Australia, or

- the development of an enterprise or business in Australia.

Your proposed venture can’t relate to any of the following categories:

- residential real estate

- labor hiring

- purchase of an existing enterprise or a franchise in Australia

Endorsement

If you were invited to apply for this visa on or after 1 July 2021, you must be endorsed by your nominating state or territory government agency to develop your entrepreneurial concepts.

Note that this is an additional criterion and isn’t the same as being nominated.

Language Requirements to Qualify

There are language requirements to qualify for residency by investment in Australia.

You must have functional English.

This means that your English proficiency will, at the very least, allow you to function in day-to-day tasks and responsibilities.

Nationalities Restricted from Applying

While certain individuals have been banned from entering Australia, no nationality is restricted from applying for its residency by investment program.

If you meet the eligibility criteria for your chosen investment stream, you may be invited to apply.

Will My Dependents Be Included Under My Australian Residency by Investment Visa?

Yes, your dependents are included under your Australian residency by investment visa.

Regardless of the investment route you opt for, your family will be welcome to join you in Australia as you manage your investment.

How Long Is the Residency by Investment in Australia Valid & Can It Be Extended?

The provisional visas awarded under the various investment streams have a baseline validity period that can be extended.

Continue reading for all the details.

Validity Period

All 4 of the investment streams mentioned are valid for up to 5 years.

With this provisional visa, you can leave and re-enter Australia as often as you want while the visa is valid.

Visa Extension

The options for extending your visa under each of the investment streams will vary slightly.

Business Innovation Stream

You have a few options if you wish to extend your visa under the Business Innovation stream.

They are:

- Apply for a different visa.

- Apply for the Business Innovation Extension stream.

- Apply for permanent residency via the Business Innovation and Investment (Permanent) visa (Subclass 888) in the Business Innovation stream.

Investor Stream

Once you have this visa, you can either apply for an entirely new visa or apply for permanent residence via the Business Innovation and Investment (Permanent) visa (Subclass 888) Investor stream.

Needless to say, the new application will have a host of new requirements that must be met to qualify.

Significant Investor Stream

You’ll have a few options to extend your stay under this stream.

These options are:

- Apply for an entirely new visa.

- Apply for permanent residence through the Business Innovation and Investment (Permanent) visa (Subclass 888) in the Significant Investor stream.

- Apply for a new Business Innovation and Investment (Provisional) visa (Subclass 188) in the Significant Investor Extension stream.

Interestingly…

If you’re granted a new provisional visa under the Significant Investor Extension stream, you can remain in and re-enter Australia for up to 7 years after the date of the grant of the original Business Innovation and Investment (Provisional) visa (Subclass 188) in the Significant Investor Extension stream.

What’s more, you can apply under the Extension stream twice, and if you’re granted the provisional visa again, it’ll be valid for up to 9 years after the date of it being granted.

Entrepreneur Stream

Under this stream, you can apply for a new visa before your provisional visa expires if you wish to stay longer.

Alternatively, once you have this visa, you can apply for permanent residence through the Business Innovation and Investment (Permanent) visa (Subclass 888) Entrepreneur stream if the requirements are met.

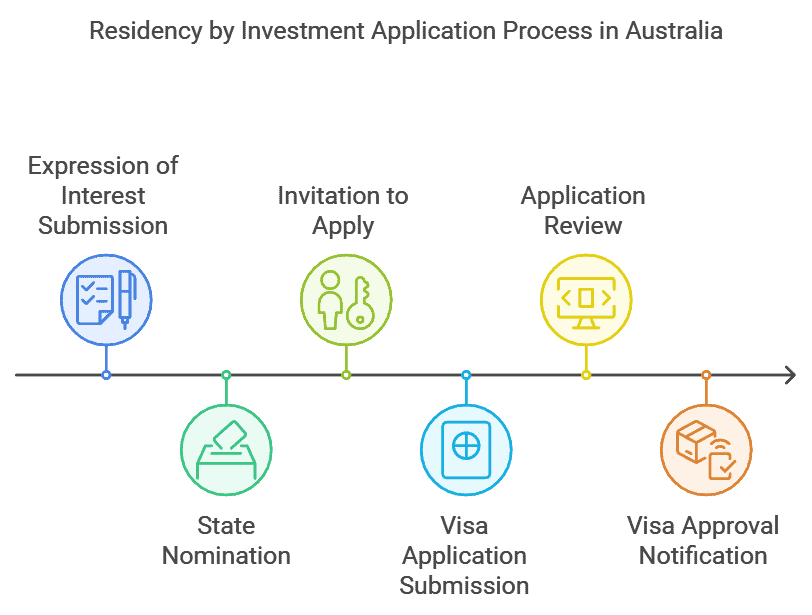

What’s the Application Process for Residency by Investment in Australia?

As we’ve seen thus far, the application process for residency by investment in Australia starts with submitting your expression of interest (EoI).

You might be wondering whether the process differs slightly at key points, depending on the investment stream you participate in.

We’ve got you covered.

Step-by-Step Application Process

Our team of knowledgeable consultants has whittled the process down into a series of 3 easy steps for you.

Keep reading.

Step 1: Expression of Interest

This is the very 1st step in the application process, regardless of the investment stream you elect to participate in.

The expression of interest (EoI) form is easily available on Australia’s Department of Home Affairs website.

Following submission of your EoI, a state or territory may nominate you, at which point you’ll be invited to apply.

Take note

You can only commence the actual application if you receive an invitation to apply.

We advise that you gather your supporting documents in anticipation of receiving an invitation to apply.

Step 2: Apply for the Visa

Your invitation letter will contain detailed instructions on how to lodge your application.

You can apply online in the ImmiAccount profile.

You’ll need to upload your supporting documents with your application.

Step 3: Wait for Approval

If your application is successful, you’ll receive a written notification.

In this notification, you’ll receive information about:

- your visa grant number

- the date your visa starts

- your visa conditions

If your visa stream requires direct capital investment, you’ll be directed as to how and when the investment will be payable.

Required Documents

The required documents for residency by investment in Australia will range from basic proof of identity to proof of financial means.

Here’s a general list of the documents you can expect to provide:

- A valid passport

- Proof of payment for the application fee

- Recent passport-sized photos of yourself and all your dependents

- Evidence of having sufficient financial resources and assets

- Annual financial statements, bank statements, and tax returns

- A comprehensive business plan if investing in a new business or entrepreneurial activity

- Certificate of good health

- Valid health insurance

- Police clearance

What Costs Are Involved in Getting Residency by Investment in Australia?

The costs involved in getting residency by investment in Australia don’t stop with the investment required.

You can expect to pay application fees and legal and advisory costs, not to mention often-unplanned additional costs.

We’ve compiled the full list for you so that you can budget accordingly.

Application Costs

The application fees for residency by investment in Australia are non-refundable and vary slightly according to the investment stream you choose.3

The application fees per stream are detailed below:

- Business Innovation stream: AU$9,450

- Investor stream: AU$9,450

- Significant Investor stream: AU$13,860

- Entrepreneur stream: AU$6,395

Legal & Advisory Costs

The costs associated with a residency by investment application can vary widely depending on the country and the complexity of the individual case.

However, here’s a general bulleted list of the types of legal and advisory costs you should expect:

- Initial consultation fees: These fees cover the first meeting with an immigration lawyer or investment advisor to discuss the residency by investment program.

- Due diligence fees: The cost of background checks and the gathering of personal documentation required by the residency program.

- Legal fees: Some firms require a retainer fee, whereas others will charge an hourly rate.

- Investment advisory fees: The fees for financial advisors regarding investment options and decisions, and costs related to the evaluation of investment opportunities.

- Translation and notarization fees: These include the costs for translating documents into English, and fees for notarizing documents as required.

- Tax advisory fees: This covers the consultation with tax professionals to understand the tax implications of residency by investment in Australia.

Additional Associated Costs

These costs are estimates, and additional expenses may arise during the application process.

In our experience, these are the additional costs that arise most often:

- Medical exams (per person)

- Police clearance certificates

- Relocation costs

What’s the Processing Time for Australian Residency by Investment Applications?

The processing time for Australian residency by investment applications ranges from a few weeks to several months.

Here's an overview:

Average Processing Time

The average processing time for residency by investment applications is 13 months.

This can vary depending on the investment stream you’ve opted for as well as other contributing factors.

Factors Affecting Processing Time

Several factors can affect the processing time of your application.

Understanding these factors can help set realistic expectations for the timeline of obtaining residency by investment in Australia.

These are the most common ones:

- Application volumes: High numbers of submissions can cause backlogs at immigration offices, leading to longer processing times.

- Completeness of your application: Incomplete applications or incorrectly filled forms can cause delays.

- Due diligence checks: Extensive background checks can take time, especially if there are issues in verifying the information. International checks or verifications can add to the processing time.

- Investment complexity: The nature and complexity of the investment can affect how long the assessment takes. Investments involving business ventures usually require more due diligence.

- Legal and regulatory requirements: Changes in immigration law or policy can impact processing times. Compliance with evolving legal frameworks may require additional verification steps.

- Health and character assessments: Health examinations and police checks can add to the processing time, especially if there are medical or legal issues to consider.

- Consultation with external agencies: Sometimes, immigration authorities need to consult with other agencies or external stakeholders, which can delay decisions.

- Government quotas: Some residency by investment programs have quotas, and reaching the limit can delay processing until the next cycle.

- Applicant's nationality: Applicants from countries with higher fraud rates or political tensions may face longer processing times due to additional scrutiny.

- Time of year: Application processing can be slower during peak times, such as holidays or the end of the financial year.

- Response times: The time it takes for applicants to respond to requests for additional information can also impact the overall processing time.

- Intermediaries' efficiency: The speed at which an intermediary (lawyer, agent, or consultant) prepares and submits your application can affect processing times.

Expedited Processing Options

Australia has a priority processing tier for visa applications that promise to yield great benefit to the country (skilled visas).

These are generally assessed faster than those with less benefit (family visas).

How Soon Will I Receive My Residency Permit After My Residency by Investment Application is Approved?

Once your application is approved, you’ll receive your residency permit—that is, your provisional visa—immediately.

Your provisional visa will be valid from the date on which it’s approved.

What Are the Tax Implications of Residency by Investment in Australia?

The tax implications of residency by investment in Australia are significant and should play a major part in the decision-making processes surrounding your investment in the country.

In our experience, these are the tax implications that you should consider:4

- Resident for tax purposes: Once you become a resident of Australia for tax purposes, you are taxed on your worldwide income, not just income earned in Australia.

- Income tax: Tax rates for residents are progressive and may be different from non-resident rates. Residents have a tax-free threshold, while non-residents are taxed on the first dollar of income.

- Capital gains tax (CGT): Residents must pay CGT on worldwide assets, not just those in Australia. Some assets may be subject to CGT concessions or exemptions.

- Dividends, interest, and royalties: Taxed at the resident rate, which might be different from the rate for foreign residents. Dividends from Australian companies often come with franking credits, which can offset part of the tax payable.

- Superannuation: As a resident, you may be required to contribute to a superannuation (retirement savings) fund, which is taxed at a concessional rate.

- Medicare levy: Most Australian residents are subject to a Medicare levy to fund the public healthcare system. Some residency by investment applicants may be exempt, depending on their visa category.

- Medicare levy surcharge: High-income residents without private hospital coverage may pay an additional surcharge.

- Goods and services tax (GST): As a resident, you'll pay GST on most goods and services purchased in Australia.

- Double taxation agreements (DTAs): Australia has DTAs with many countries, which may affect the tax you pay on foreign income and prevent double taxation.

- Tax reporting: Tax residents must file annual tax returns with the Australian Taxation Office (ATO).

- Departure tax: When ceasing residency, you may be subject to departure tax or deemed disposal rules on worldwide assets.

- Inheritance and gift taxes: Australia doesn’t levy inheritance or gift taxes, but large gifts may have implications for the donor's income tax.

- Temporary residency: Temporary residents may have different tax implications compared to permanent residents, particularly regarding income from outside Australia.

- Wealth and property taxes: There are no wealth taxes in Australia, but property taxes and stamp duty may apply to real estate investments.

It's crucial that you consult with a tax advisor who's familiar with both Australian tax law and the tax regulations of your home country to understand the full range of tax implications.

Is Residency by Investment in Australia a Pathway to Australian Citizenship?

Yes, residency by investment in Australia can be a pathway to citizenship.

You’ll be eligible to apply for citizenship after 5 years.

Common Questions

Can I Get Permanent Residency if I Buy Property in Australia?

What Rights Do I Have as a Permanent Resident in Australia?

How Much Does It Cost To Live in Australia for a Year?

Which Australian City is Best for Expats to Settle In?

How Strict Are Residency Laws in Australia?

Must I Pass an English Test to Get Australian Residency?

Is Healthcare Free in Australia?

Is It Easy to Permanently Move to Australia?

In Conclusion

Residency by investment presents a viable pathway for individuals looking to become permanent residents of Australia, offering an opportunity to enjoy the country's high standard of living, robust economy, and diverse cultural landscape.

While the process involves significant financial investment and thorough adherence to legal and regulatory frameworks, it also opens doors to a range of benefits, from healthcare access to education.

With careful planning, consultation with experts (like WorldPassports!), and compliance with Australian immigration policies, you can embark on a journey to making Australia your new home.

Australia isn’t the only country in the Asian and South Pacific region offering an enticing residency by investment pathway; check out some of the other countries we’ve covered!

Learn More: Residency by Investment in Asia & the South Pacific

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure