Barbados Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Barbados has introduced residency by investment programs targeting high-net-worth individuals, offering an attractive lifestyle, stable governance, and access to world-class amenities.

- Investments can include real estate purchases or contributions to the country's economy, with specific criteria for applicants to meet.

- Benefits extend beyond the pleasant climate to include a robust legal system, excellent healthcare, and educational facilities, making it ideal for families.

- The application process requires proof of investment, health insurance coverage, and a clear criminal record, among other documents.

- While offering permanent residency, they also provide pathways to citizenship under certain conditions, enhancing the appeal of its investment program.

Barbados, renowned for its azure waters and golden sands, has more to offer than just a picturesque getaway.

Did you know that the island boasts the 3rd-oldest parliament in the entire Commonwealth?

As this nation melds its rich history with a progressive vision, the opportunity to obtain residency by investment in Barbados emerges as an enticing prospect with its Special Entry and Reside Permit (SERP).

In This Article, You Will Discover:

Stay with us as we explore how this Caribbean gem can become more than just a holiday destination for savvy investors…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

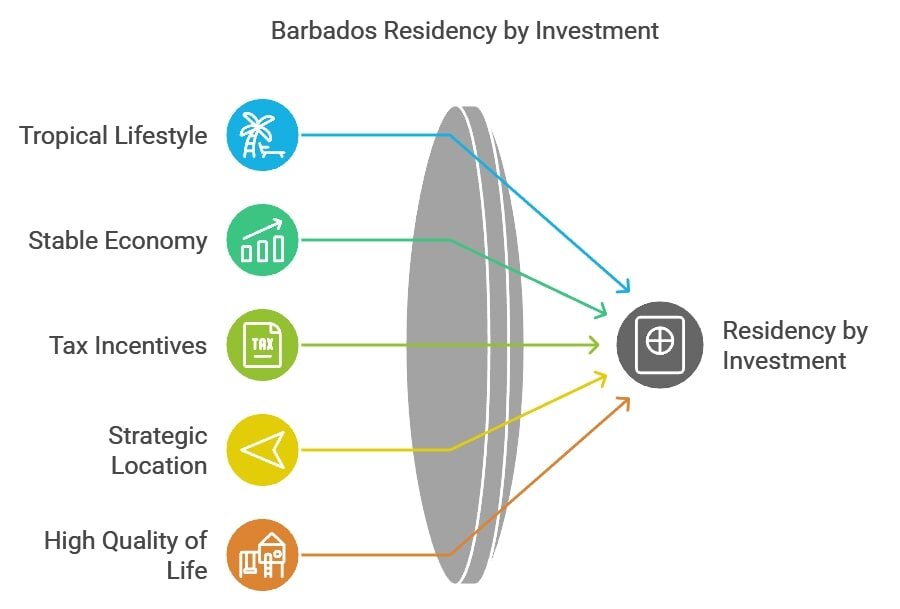

What Are the Benefits of Residency by Investment in Barbados?

The benefits of residency by investment in Barbados range from the allure of a Caribbean climate to its wealth of business opportunities.

In our expert opinion, these are the top benefits of residency by investment in Barbados:

- Tropical lifestyle: Experience year-round sunshine, pristine beaches, and a relaxed Caribbean vibe.

- Stable economy: Barbados boasts a robust and diverse economy, offering investors a sense of security.

- SERP offers 2 residency by investment options: Unconditional permanent residence is available in return for US$2 million investment, while a renewable 5-year residence permit is available to those able to invest US$300,000 in real estate.

- Tax incentives: There are potential tax advantages and double taxation treaties with several countries.

- Minimum physical presence requirement: The flexibility in residency requirements allows for limited time spent on the island.

- Strategic location: Barbados is a gateway to North and South America, with well-established air and sea links.

- High quality of life: Residents have access to top-tier healthcare, education, and modern amenities.

- Free movement: Residents are able to travel freely within the Caribbean Community (CARICOM) member states.

- Business opportunities: There’s a growing entrepreneurial ecosystem supported by progressive governmental policies.

- Cultural enrichment: Dive into the rich Bajan culture, from music and dance to culinary delights.

- Real estate investment: There’s a potential for property appreciation in a sought-after tourist destination.

- English-speaking: The language spoken on the island and in business is English.

- Community and networking: Join a diverse community of expatriates and investors from around the globe.

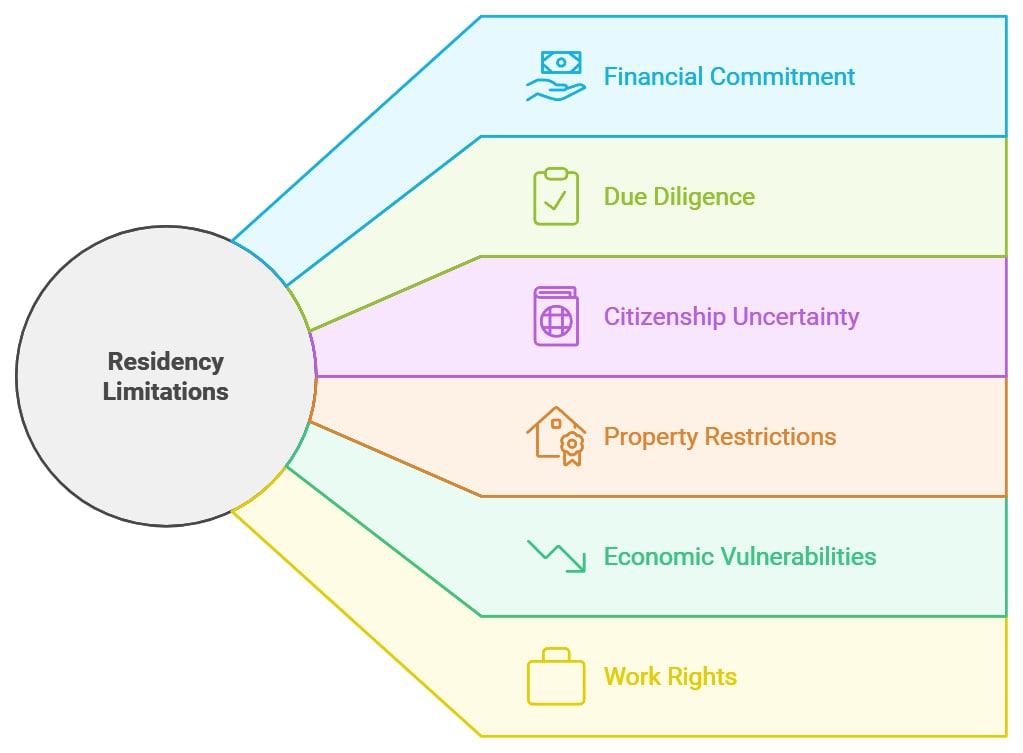

What Are the Limitations of Residency by Investment in Barbados?

The limitations of residency by investment in Barbados needn’t deter you from applying, but we always advise investors to weigh up the benefits as well as the drawbacks of these decisions.

Here’s our shortlist of the main limitations to consider when weighing up residency by investment in Barbados:

- Financial commitment: A significant upfront investment is typically required, which may not be suitable for all potential residents.

- Due diligence process: Applicants undergo rigorous background checks, which can be time-consuming and require extensive documentation and patience.

- No automatic citizenship: Residency by investment doesn’t guarantee citizenship, which might involve a separate process or additional requirements.

- Property ownership restrictions: Some types of properties might be off-limits for foreign investors, or they might face additional regulations.

- Economic vulnerabilities: Like all economies, Barbados can face downturns that might impact your investment.

- Limited work rights: Residency might not grant you the automatic right to work in Barbados; separate work permits or approvals might be necessary.

- Residency obligations: Some programs may require maintaining the investment for a fixed duration or other stipulations to retain the residency status.

- Cultural adjustment: Living in a new country comes with its challenges, including adapting to local customs, laws, and way of life.

- Renewal and maintenance fees: There might be recurring fees associated with maintaining the residency status, which can add to the overall cost.

- Foreign exchange risks: Currency value fluctuations can impact the value of your investment if it's not held in Barbadian dollars.

Which Investment Types Qualify for Residency by Investment in Barbados?

Several types of investment are accepted for residency by investment in Barbados.

To qualify, you can invest in any of the following asset classes:

- Real estate investment

- Business investment

- Bond investment

- Fund investment

- Securities investment

- Bond deposit

What Are the Eligibility Requirements for Residency by Investment in Barbados?

You might be wondering if you qualify to become a resident of Barbados.

Our expert team has researched the main eligibility criteria for you.

Read on.

Minimum Investment Amount

The minimum investment amount requirements for residency by investment in Barbados, also known as its Special Entry and Reside Permit (SERP), vary slightly between the 2 available investment routes.

We’ll break it down.

Category 1

Under the Category 1 option, you need to invest at least US$2 million, and the funds must originate from outside of Barbados.

You’ll also need to prove that your net worth exceeds US$5 million.

In exchange, you’ll receive unconditional permanent residency and the right to work in Barbados, if you choose to.

Consider this

If you can make the US$2 million investment but can’t prove a personal net worth of US$5 million or more, you may still be eligible for Barbados residency, but it’ll be a 5-year renewable permit.

Category 2

If you choose to invest under Category 2, you’ll need to invest a minimum of US$300,000 in real estate.

In exchange, you’ll receive a 5-year residence permit, which you can renew for a fee.

Be aware

Under this category, you won’t be allowed to work in Barbados.

Health Insurance

To qualify for residency by investment in Barbados, you’ll need to prove that you have health insurance to the value of US$500,000.1

Language Requirements to Qualify

Although Bajan, a Creole language, is widely spoken, Barbados is a predominantly English-speaking country.

There’s no official requirement to prove English proficiency to obtain residency by investment in Barbados.

Nationalities Restricted from Applying

There’s no official list of nationalities restricted from applying for residency by investment in Barbados.

Will My Dependents Be Included Under My Barbadian Residency Permit?

Yes, your dependents will be included under your SERP application.

Keep in mind that an additional application fee will apply to each dependent added to your application.

How Long is the Barbados Special Entry & Reside Permit (SERP) Valid & Can It Be Extended?

Depending on which SERP category you invest in, the validity period of your permit differs.

Here are the details:

Validity Period

If you obtain Barbados residency by investment through SERP Category 1, your residence permit validity will vary according to your age.

The validity periods of SERP Category 1 are as follows:

- Between the ages of 50 and 60: Your SERP validity term is 5-10 years.

- Under the age of 50: Your SERP validity term is 5 years until the age of 60.

- After the age of 60: Your SERP validity will be valid indefinitely.

On the other hand

If you invest through SERP Category 2, your residency permit will be valid for a period of 5 years.

Extension

You can extend your residence permit every 5 years (or as required depending on your Category 1 age bracket above) for an additional fee per renewal.

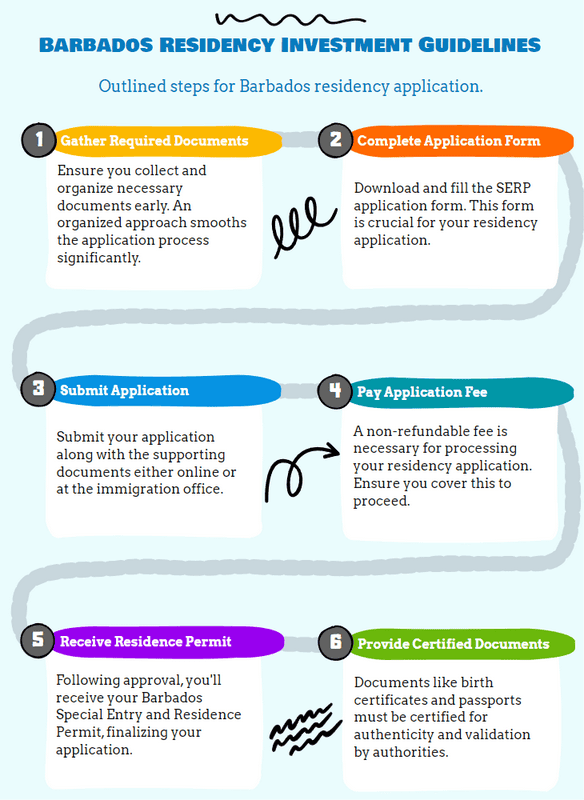

What’s the Application Process for Residency by Investment in Barbados?

The application process for residency by investment in Barbados will depend largely on the investment route you’ve chosen.

Let’s take you through the basics.

Step-by-Step Application Process

For your convenience, we’ve broken the process down into a few handy steps.

Here you go:

Step 1: Gather Your Application Documents

The more organized you are, the smoother your application process is likely to go.

Confirm which supporting documents will be required and collate them in advance of submitting your application.

Step 2: Complete & Submit Your Application Form

The SERP application form can be downloaded from the Barbados government website.

Once you’ve completed it, you can submit it with your supporting documentation at the Barbados immigration office or online.

Step 3: Pay the Fees

A non-refundable fee will be charged to process your Barbados residency by investment application.

Stay with us; we’ll cover all required fees in detail.

Step 4: Receive Your Permit

Once your application has been processed and approved, you’ll receive your Barbados Special Entry and Residence Permit.

Required Documents

Several supporting documents will be required as evidence for the information you’ll furnish in your SERP application.2

Here’s a comprehensive list of the documents you’ll be required to submit:

- Medical certificate of health

- Proof of health insurance

- A police certificate of character issued in your country of origin

- One passport-size photo

- Original birth certificate and a copy

- A certified copy of the bio-data page of your passport

- Marriage certificate, if applicable

- If you’re divorced or your spouse is deceased, a divorce agreement, decree, or death certificate

- Proof of relationship to dependents where applicable (for example, birth certificates or legal documents)

- Proof of financial resources

- If applying for Category 1 SERP, a certified statement of assets exceeding US$5 million from an auditor or broker, as well as evidence of investment in Barbados valued at US$2 million or more

- If applying for Category 2 SERP, proof of ownership of property in Barbados as well as evidence that you can financially support yourself for the duration of the residency period.

Don’t forget

All documents provided must be legible in English.

This means that you’ll need to get any non-English documents translated to English for the purposes of this residency by investment application.

What Costs Are Involved in Getting Residency by Investment in Barbados?

The costs involved in getting residency by investment in Barbados vary slightly depending on whether you’re applying for Category 1 or Category 2 under the Special Entry and Reside Permit (SERP).

Take a look:

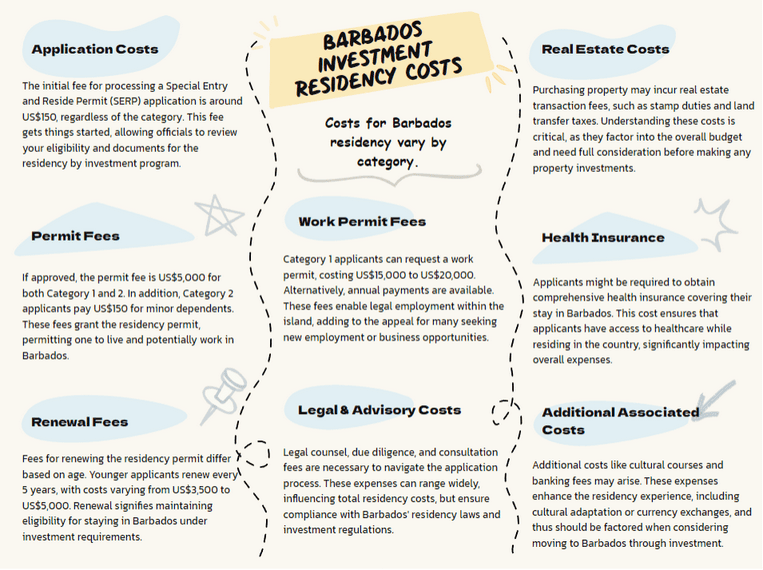

Application Costs

The SERP application processing fee comes to about US$150, regardless of the category under which you’re applying.

Permit Fees

If your application is approved, the permit fee for both Category 1 and Category 2 comes to US$5,000.

Under Category 2, you’ll also need to pay US$150 for any minor dependents included under your SERP.

Renewal Fees

Depending on whether you’ve applied for your residency by investment under SERP Category 1 or Category 2, the renewal fees will vary.

SERP Category 1

As detailed above, whether your Category 1 residency permit is renewable or indefinite will depend on your age.

Here’s the breakdown of renewal fees based on your age bracket:

- If you're under the age of 50: You’ll renew your SERP every 5 years until the age of 60, for a fee of US$5,000 each time.

- If you’re aged 50–60, You’ll renew your SERP every 5–10 years for a 1-time fee of US$3,500.

- If you’re 60 or older: You’ll renew your SERP once for US$5,000 if renewed at age 60. Your SERP is now valid indefinitely!

SERP Category 2

Under SERP Category 2, you’ll need to renew your permit every 5 years for a fee of US$5,000.

An additional fee of US$150 per dependent will also apply every time you renew.

Work Permit

If you obtain a Category 1 SERP, you’ll qualify to apply for a Barbados work permit.

The fees for your work permit are as follows:

- If you’re older than 60: You’ll pay either an upfront, 1-time fee of US$15,000 or US$1,750 per year.

- If you’re younger than 60: You’ll pay an upfront, 1-time fee of US$20,000, or US$2,000 per year.

Legal & Advisory Costs

Legal and advisory costs are an almost unavoidable part of obtaining residency by investment in a new country.

In our expert opinion, these are the main legal and advisory costs to budget for:

- Legal counsel: Hiring a local attorney familiar with Barbados' investment residency laws is crucial. This could range from a few thousand to tens of thousands of dollars, depending on the complexity of your case.

- Due diligence fees: Barbados might require 3rd-party background checks to verify the legitimacy of your funds and evaluate any potential risks. These fees can vary based on the depth and breadth of the investigation.

- Consultation fees: Financial advisors, tax consultants, or property evaluators may be necessary to structure your investment optimally. Their rates can vary widely based on their expertise and the specific services required.

Additional Associated Costs

Beyond the primary investment and legal fees, several other costs could arise during your Barbados residency by investment application and post-approval phases.

Here are some common additional costs that arise:

- Real estate transaction costs: If your investment involves purchasing property, expect to pay stamp duties, land transfer taxes, and other transaction-related costs.

- Maintenance fees: For those investing in managed properties or developments, there may be annual maintenance or homeowner association fees.

- Health insurance: Some programs may require applicants to have a comprehensive health insurance policy covering their stay in Barbados.

- Language or cultural courses: While English is the official language, newcomers might choose to invest in courses or workshops to better understand the Bajan culture and lifestyle.

- Banking and transfer fees: Transferring large sums internationally can sometimes incur substantial bank fees or unfavorable exchange rates.

- Renewal fees: Depending on the terms of your residency, there might be periodic renewal fees to maintain your status.

What’s the Processing Time for SERP Application Approval?

The processing time for SERP application approval can take a few months, depending on your circumstances.

Average Processing Time

On average, the SERP application process takes between 3 and 6 months from the time of submission to receiving approval.

This time frame includes initial submission, background checks, document verifications, and eventual approval.

Factors Affecting Processing Time

Several factors can influence how quickly your SERP application is processed.

In our experience, the factors that tend to affect application processing time are as follows:

- Completeness of application: If there are missing documents or errors in the submitted forms, the application can be delayed, pending corrections.

- Volume of applications: During peak times, when there's a high number of applicants, processing might take longer due to the backlog.

- Background checks: The complexity and depth of the required background checks can vary depending on the applicant's nationality, source of funds, and other individual factors.

- Document verification: Some documents might require additional time for verification, especially if they originate from countries with which Barbados has limited diplomatic ties or if they need translations.

- Government policy changes: Any sudden changes in government policies or regulations can influence processing times.

Expedited Processing Options

Barbados is said to offer expedited processing options, although it doesn’t publish its fee for this service.

Under this option, applications are typically prioritized and can be processed in as little as 4 to 8 weeks.

However

It's crucial to note that while expedited processing speeds up the review, it doesn’t guarantee approval.

How Soon Will I Receive My Residence Permit After My Residency by Investment is Approved?

As soon as your SERP application is approved, you’ll receive your residency permit.

What Are the Tax Implications of Residency in Barbados?

The tax implications of residency by investment in Barbados start with the mandate that SERP holders are required to declare tax residency to the Barbados Revenue Authority in writing.3

Having tax residency in a country makes you subject to its tax regulations.

Be aware of the following tax implications of residency in Barbados:

- Residence-based taxation: Barbados operates on a residence-based tax system, meaning residents are taxed on their Barbadian-source income and specific types of foreign income.

- Personal income tax rates: Depending on your income bracket, personal income tax rates can range from a lower to a higher percentage.

- Foreign currency tax credit (FCTC) for SERP-holders: SERP-holders are entitled to claim a tax credit in relation to income that is foreign-sourced if such income is transferred to Barbados through the banking system. Depending on the percentage of foreign currency earned in relation to total earnings, the potential tax credit can amount to 93% of the income tax that would otherwise be payable in Barbados.

- Tax exemptions: Certain types of income, like some pensions, may be exempt from Barbadian income tax.

- Tax treaties: Barbados has double taxation agreements with numerous countries, which can prevent residents from being taxed on the same income in both Barbados and their home country.

- No capital gains tax: Barbados doesn’t levy capital gains tax on residents.

- Value-added tax (VAT): Residents are subject to VAT on goods and services consumed in Barbados.

- Property tax: Owners of real estate in Barbados, including non-residents, are subject to an annual property tax based on the property's value.

- Offshore companies: Barbados offers attractive taxation structures for International Business Companies (IBCs) and other offshore entities, but specific requirements must be met.

- No estate and inheritance tax: Barbados doesn’t have estate or inheritance taxes, but there may be other associated fees upon the transfer of assets.

- Reporting obligations: Residents may have to declare their worldwide income, even if it’s not taxable in Barbados, depending on the nature of the income and the existing treaties.

Note

Tax laws can be intricate and subject to change.

That’s why we advise consulting with a local tax professional or advisor to understand the full implications and any updates to the Barbados tax structure.

Is Residency by Investment in Barbados a Pathway to Barbadian Citizenship?

Yes, residency by investment in Barbados can be a pathway to Barbadian citizenship.

To become a Barbadian citizen, you must live in Barbados for at least 5 out of 7 years (amounting to naturalization).

Common Questions

What Are the Barbados Social Demographics?

If I Buy Real Estate in Barbados, Can I Get Permanent Residency?

Is It Hard to Get a Barbados Golden Visa?

How Risky Is Residency by Investment in Barbados?

What Language is Spoken in Barbados?

Is Barbados a Tax Haven?

Can I Retire in Barbados?

In Conclusion

Residency by investment in the Barbados Special Entry and Reside Permit (SERP) offers a unique blend of Caribbean lifestyle, potential tax benefits, and strategic global positioning.

While the journey entails careful planning and consideration, the allure of Bajan sunsets, coupled with financial incentives, makes it an enticing option for many seeking a serene yet advantageous second home.

Our experienced team at WorldPassports is on hand to answer any burning questions you might have about seizing this golden opportunity; don’t hesitate to reach out!

Has this article whetted your appetite for learning about Caribbean residency by investment programs?

We’ve already done the homework, so check out our library of articles on residency by investment programs in the Caribbean.

Learn More: Caribbean Countries Offering Residency by Investment

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure