Cayman Islands Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- The Cayman Islands offer several residency by investment options, including direct investment in real estate, business ventures, or through a certificate of direct investment, appealing to individuals seeking a tax-efficient jurisdiction.

- The minimum investment amounts vary, with premium options providing permanent residency rights without the need to reside in the territory.

- Investors benefit from no direct taxation, a high standard of living, political stability, and a strong legal system.

- The application involves detailed financial disclosures, background checks, and proof of investment, ensuring compliance with international standards.

- Permanent residency can lead to British Overseas Territories citizenship, further increasing the attractiveness as a destination for investors.

Nestled in the shimmering Caribbean waters a mere 90-minute flight from the US state of Florida, the Cayman Islands is a self-governing British territory renowned for breathtaking beaches and luxurious resorts.

Aside from a reputation as a tax haven for high-net-worth individuals, did you know that these islands are made up of 3 distinct parts, with Grand Cayman being the most recognized, while Cayman Brac and Little Cayman offer secluded escapes?

The unique Cayman Islands residency by investment programs offer an enticing blend of lifestyle and financial advantages.

In This Article, You Will Discover:

Read on as we unravel the allure and intricacies of securing residency by investment in this tropical haven…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

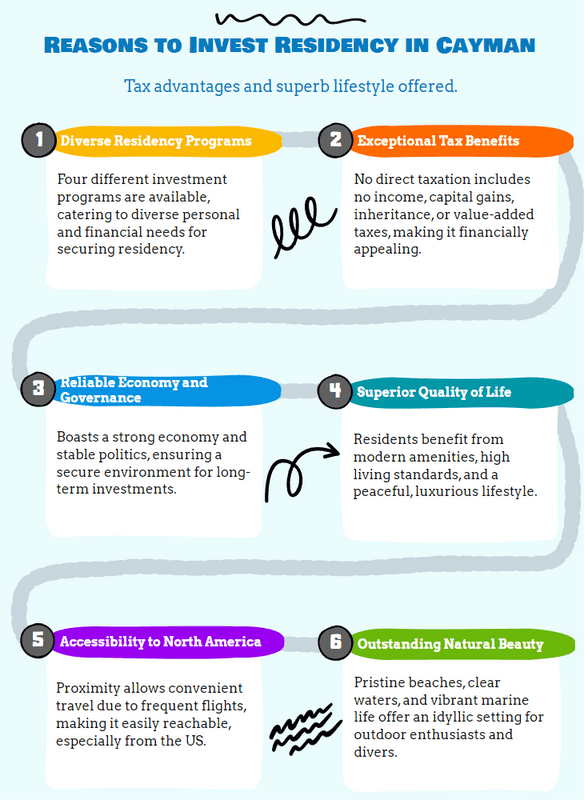

What Are the Benefits of Residency by Investment in the Cayman Islands?

The benefits of residency by investment in the Cayman Islands range from the expected tax perks to an exceptional quality of life.

In our opinion, these are the most prominent benefits of residency by investment in the Cayman Islands:

- Different residency by investment programs: The Cayman Island government offers 4 different routes for individuals and families seeking long-term or permanent residency in the Cayman Islands.

- Tax advantages: There’s no direct taxation in the Cayman Islands, which includes no income tax, capital gains tax, inheritance tax, or value-added tax.

- Stable economy and government: The Cayman Islands has a robust economy and a stable political environment, offering a safe place for investments.

- High quality of life: Residents enjoy a high standard of living, modern infrastructure, and a range of top-tier amenities.

- Easy accessibility: Its proximity to North America makes it easily accessible with frequent flights, especially from the US.

- Natural beauty: The Cayman Islands is a tropical paradise with pristine beaches, clear waters, and a vibrant marine life, ideal for those who love the outdoors and water activities.

- Security of investment: The Cayman Islands property market is mature and offers a tangible asset in exchange for residency, making it a secure option for many investors.

- Flexibility in residency: Depending on the category of residency by investment, there isn't always a requirement to reside in the Cayman Islands for a minimum number of days annually.

- High-quality healthcare and education: The islands offer excellent healthcare facilities and international schools for families.

- Privacy: The Cayman Islands are known for their financial privacy and confidentiality, which extends to investors and residents.

- No restriction on property ownership: Foreign investors have the right to own land and property in their name without any restrictions.

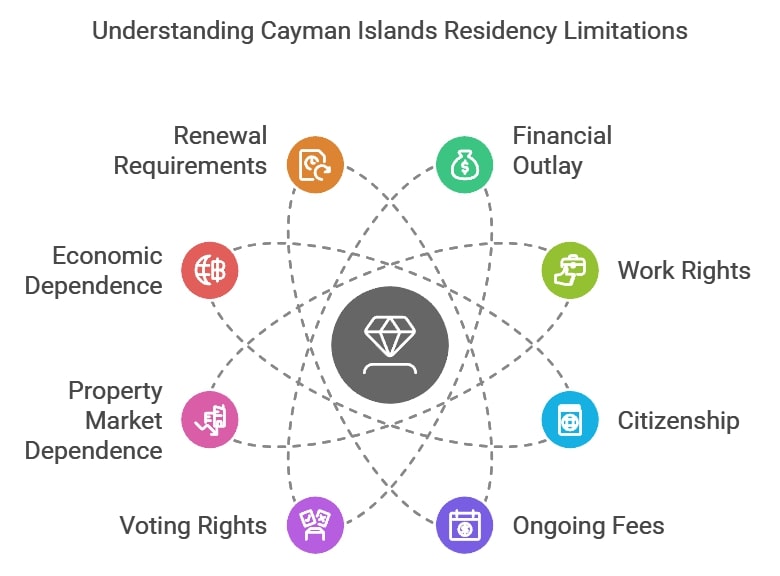

What Are the Limitations of Residency by Investment in the Cayman Islands?

It’s important to note the limitations of residency by investment in the Cayman Islands.

Here’s our expert take:

- Significant financial outlay: The investment required to gain residency can be substantial and isn’t feasible for everyone, making this a highly elite route.

- No automatic right to work: Gaining residency through investment doesn’t automatically grant the right to work in the Cayman Islands. Separate permissions or endorsements may be needed.

- Residency ≠ citizenship: Residency by investment doesn't immediately lead to citizenship. Gaining Caymanian citizenship requires fulfilling additional criteria.

- Ongoing fees and duties: There may be annual fees or other charges associated with maintaining residency status.

- Limited voting rights: As a resident and not a citizen, you don't have the same voting rights as Caymanian citizens.

- Dependent on property market: If the main route to residency is through property investment, any downturns in the property market could affect the value of your investment.

- Economic dependence: The local economy is heavily dependent on finance and tourism. Any global events impacting these sectors could have a ripple effect on the Cayman Islands.

- Renewal and reporting requirements: Some residency permits may have renewal processes or require periodic reporting to maintain their status.

- Limited natural resources: The Cayman Islands import most of their goods, which can lead to higher living costs compared to other countries.

- Climate considerations: While the Cayman Island archipelago is beautiful, these islands are also in the hurricane belt, which means potential risks associated with tropical storms and hurricanes.

As always, when considering residency by investment or any significant relocation and investment decision, it's advisable to seek consultation with experts familiar with the specific regulations and nuances of the jurisdiction.

Which Investment Types Qualify for Residency by Investment in the Cayman Islands?

The investment types that qualify you for residency by investment in the Cayman Islands vary depending on which of the 4 available RBI programs you choose.

The 2 accepted types of investment include:

- Developed real estate

- Employment-generating business

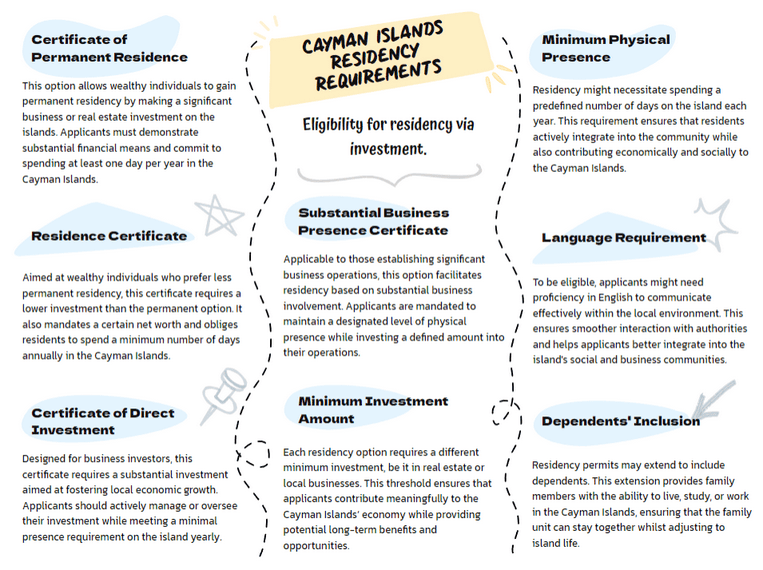

What Are the Eligibility Requirements for Residency by Investment in the Cayman Islands?

The eligibility requirements for residency by investment in the Cayman Islands vary depending on which residency by investment program you opt for.

Here are the specific requirements for each of them:1

Option 1: Certificate of Permanent Residence for Persons of Independent Means

This residency by investment route qualifies you to become a naturalized British Overseas Territories Citizen (BOTC).

After 5 years as a BOTC, you can apply to become a Caymanian citizen.

Under this visa, your spouse and dependents can work in the Cayman Islands, too.

Here are the basics about this option:

Minimum Investment Amount

The minimum investment to qualify for a Certificate of Permanent Residence is US$2.4 million in real estate.

Personal Net Worth

You’ll need to prove that you have sufficient financial resources to sustain your family once you receive this permit.

Minimum Physical Presence Requirement

The minimum physical presence requirement for this is a mere 1 day per year.

Option 2: Residence Certificate

This residence permit has a lower minimum investment amount but comes with a number of additional conditions.

Here’s an overview of this option:

Minimum Investment Amount

The minimum investment differs depending on whether you aim to live on the island of Grand Cayman or on the islands of Little Cayman or Cayman Brac.

If your aim is to live on the island of Grand Cayman, you need to make the following investment:

- Make a local investment of US$1.2 million, of which:

- US$600,000 must be invested in developed real estate, and

- US$600,000 must be invested in a company or property.

On the other hand, if you want to live on the islands of Little Cayman or Cayman Brac, you need to invest as follows:

- US$600,000 locally.

- Of the US$600,000, at least US$300,000 must be in developed residential real estate.

Personal Net Worth

To reside in Grand Cayman, you must prove that you earn at least US$150,000 per year from sources outside of the Cayman Islands.

To reside in Little Cayman or Cayman Brac, you must prove that you earn at least US$90,000 from sources outside of the Cayman Islands.

Minimum Physical Presence Requirement

The minimum physical presence required to maintain this permit is 30 days per year.

Option 3: Certificate of Direct Investment

This residency by investment route allows you to live in the Cayman Islands and work for the company or companies you’ve invested in.

It also includes your spouse and dependent children.

Here’s what you should know about this option:

Minimum Investment Amount

The minimum investment amount for this option is US$1.2 million in a business or businesses in the Cayman Islands.

The business must be employment-generating, and at least 30% of the employees must be Caymanian.

You also must have substantial management control in the business you invest in.

Minimum Physical Presence Requirement

The minimum physical presence requirement under this RBI option is 90 days per year.

Option 4: Substantial Business Presence Residency Certificate

This residency by investment route allows you to reside in the Cayman Islands and work in business(es) where you have substantial investments or where you're employed in a senior management capacity.

Here are the finer details:

Minimum Investment Amount

The minimum investment amount under this option requires you to own (or intend to own) at least 10% of shares in a business in the Cayman Islands.

The business has to be on the list of approved businesses, according to the Caymanian government.

Alternatively

If you can prove to the satisfaction of the Chief Immigration Officer that you are or will be employed in a senior management position in an approved business, you’ll qualify under this option.

The senior management position you fill must attract an annual work permit fee of not less than CI$20,925.

Minimum Physical Presence Requirement

The minimum physical presence requirement under this investment route is 90 days per year.

Language Requirements to Qualify

There’s no language test to qualify for residency by investment in the Cayman Islands, which are predominantly English-speaking.

Nationalities Restricted from Applying

Officially, no nationality is restricted from applying for residency by investment in the Cayman Islands, provided the applicant can meet the requirements and pass the due diligence process.

Will My Dependents Be Included Under My Caymanian Residency Permit?

Yes, for additional fees, your dependents will be included under your Caymanian residency permit.

How Long is the Caymanian Golden Visa Valid?

The Caymanian Golden Visa, regardless of the investment option you choose, is, on average, valid for a long time.

Let’s go through the validity periods of the 4 residency by investment routes available to you.

Option 1: Certificate of Permanent Residence for Persons of Independent Means

This permanent residence permit has no expiration date.

What’s more, it qualifies you as a British Overseas Territories Citizen (BOTC); after 5 years of holding this status, you can apply for Caymanian citizenship.

Option 2: Residence Certificate

The residence certificate is valid for 25 years, provided you fulfill the minimum physical presence requirement.

Option 3: Certificate of Direct Investment

The Certificate of Direct Investment is also valid for 25 years, provided you fulfill the minimum physical presence requirement and maintain your investment.

Option 4: Substantial Business Presence Residency Certificate

You’ll receive a 25-year validity period under this residency certificate as well, provided you fulfill the minimum physical presence requirement and maintain your investment or approved senior management position.

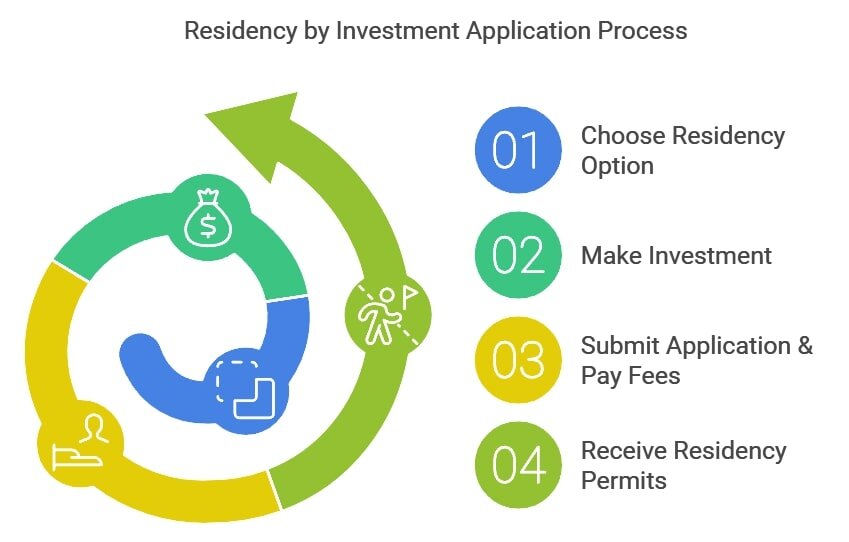

What’s the Application Process for Residency by Investment in the Cayman Islands?

Although each of the 4 residency by investment options stipulates different requirements, it’s possible to extrapolate a general application process for each of them.

Here you go:

Step-by-Step Application Process

You can expect to go through 4 steps to submit your Cayman Islands residency by investment application.

Here’s what to expect:

Step 1: Choose Your Residency by Investment Option

Choose one of the 4 different investment routes to get to the Cayman Islands Golden Visa.

You’ll know which route meets your financial goals, preferences, and liquidity.

Step 2: Make Your Investment

The minimum required investment under your chosen residency by investment route should be made prior to submitting your application.

Step 3: Submit Your Application & Pay Fees

Once you’ve made your investment, you can submit your official Cayman Islands Golden Visa application with any supporting documents required.

You’ll need to pay any application processing fees at this point.

Note

There’s a specific application form for each of the 4 investment options; ensure that you complete and submit the appropriate one.

Step 4: Receive Your Residency Permits

If your application is approved, you’ll receive residence permits for yourself and your family members.

Required Documents

Your Caymanian residency by investment application must be accompanied by supporting documents as evidence of the information supplied in your application form.

In our experience, these are the required documents you’ll likely have to supply:

- Cover letter

- Proof payment for associated fees

- A copy of passport and passport pages

- Passport photo

- Birth certificate

- Certified police clearance

- A medical report signed by your doctor

- Proof of financial means (these could include bank statements, financial statements, and tax returns)

- Proof of investment

- Health insurance policy with coverage in the Cayman Islands

- Copy of business or trade licenses (if applicable)

- Marriage certificate (if applicable)

Just a note

You may be required to provide additional supporting documentation, depending on your circumstances; this is completely normal.

What Costs Are Involved in Getting Residency by Investment in the Cayman Islands?

As with any significant investment in residency, it’s accompanied by a number of other costs and fees.2

We’re all about preparing you for every eventuality, so stay with us.

Application Costs

The application costs for any of the 4 Cayman Island investment routes typically range between US$600 and US$1,200.

There’s an additional US$1,200 for additional applicants (i.e., your dependents).

Certificate for Employment

If you’re likely to be working in the Cayman Islands, you’ll need to obtain a Certificate for Employment, which gives you permission to work in the country.

The fee for this comes to US$5000

Certificate of Permanent Residence Fee

Once your Certificate of Permanent Residence is issued, you’ll be required to pay this substantial fee to accept it.

The cost of this can rack up to US$120,000.

Legal & Advisory Costs

At this point in our article, you no doubt appreciate the significance of the investment required to access the benefits of residency by investment in the Cayman Islands.

For this reason, legal and advisory costs will likely be an expected cost center in your residency by investment budget.

These are some of the legal and advisory costs you can expect to factor in:

- Attorney fees: Engaging a local attorney experienced in the Cayman Islands' immigration laws is crucial. Fees can range widely based on the complexity of the application, from US$5,000 to US$15,000 or more.

- Financial advisors: If you're considering investing in real estate or a business, a financial advisor can provide valuable insight. Their fees can vary based on the nature and duration of the consultancy, but they usually charge between US$1,000 and US$5,000.

- Due diligence fees: Before granting residency, the government will undertake a thorough background check. Some legal firms may charge for this service as part of their package, while others might bill separately. This cost typically ranges from US$500 to US$2,000 per adult applicant.

Additional Associated Costs

Additional associated costs should be factored into your budget, too.

Here are the most common ones to expect:

- Stamp duty: If you're buying real estate as part of your investment, be prepared for stamp duty. This is a one-off tax on property transactions, and the rate can vary based on the property's location. As of my last update, it's generally around 7.5% of the property's purchase price or its market value, whichever is higher.

- Annual fees: Depending on the type of residency certificate obtained, there might be annual fees payable to maintain the status. This could range from US$1,000 to US$10,000 per year.

- Renewal fees: Some residency categories may require renewal after a set period, and this comes with associated fees, which can be several thousand dollars.

- Health insurance: As a part of the application, proof of health insurance may be required. The cost of this will depend on the coverage chosen, but expect to pay upwards of US$2,000 annually for a comprehensive plan.

- Miscellaneous costs: This includes notary fees, courier charges, translation of documents (if they're not in English), and other administrative expenses. Collectively, these can add another US$500 to US$2,000 to the total.

Please note

The mentioned figures are rough estimates.

Always consult with local experts and official sources for the most accurate and up-to-date information.

What’s the Processing Time for the Caymanian Golden Visa?

Processing times for Caymanian Golden Visa applications may vary, depending on the investment route you’ve selected.

However, it is possible to provide average estimations.

Let’s investigate further.

Average Processing Time

Typically, it can take around 3 months for the Cayman Islands government to process your residency by investment application.

Factors Affecting Processing Time

Various factors might affect the processing time of your residency by investment application.

These can include:

- Application volume: Peak application seasons, especially when global events prompt more people to seek alternative residencies, can slow processing times due to the sheer number of applications.

- Completeness of application: If there are missing documents, incorrect information, or other discrepancies in your application, expect delays.

- Due diligence checks: The thoroughness of background checks can vary based on your nationality, financial history, and any discrepancies they might encounter during the review.

- Type of investment: Some investments, such as those in existing real estate, might process faster than others that require more vetting, like new business ventures.

- Government changes or policy revisions: Any sudden changes in immigration or investment policies can cause delays in processing as staff adapt to new requirements.

Expedited Processing Options

Although expedited processing options aren’t advertised, they may exist for some of the investment routes.

In some jurisdictions, for an additional fee, there might be an option to expedite the processing of your application.

How Soon Will I Receive My Residency Permit After My Residency by Investment Application is Approved?

Once approved, the actual residency permit or certificate is typically issued within a few weeks.

However, the exact timeline can vary based on administrative backlogs or other factors.

What Are the Tax Implications of Residency in the Cayman Islands?

The tax implications of Caymanian residency are some of the main reasons that high-net-worth individuals choose to invest in this destination.

But are there hidden taxes?

These are the main tax implications to expect from residency by investment in the Cayman Islands:3

- No direct taxation: The Cayman Islands don’t levy direct taxes, meaning residents aren't subjected to income tax, capital gains tax, or inheritance tax.

- Indirect taxes: While there's no value-added tax (VAT), there are indirect taxes, such as import duties on goods brought into the islands.

- Stamp duty: There's a 1-time stamp duty on property transactions. The rate can vary, but as of my last update, it's generally around 7.5% of the property's purchase price or market value, whichever is higher.

- No corporate income tax: Businesses established in the Cayman Islands don't pay corporate income tax on earnings.

- Tax neutrality: The Cayman Islands are tax-neutral, making it an attractive location for global investors looking to structure their investments efficiently.

- Tax information exchange agreements (TIEA): While the Cayman Islands itself might not tax you, it has TIEAs with numerous countries. This means financial information might be shared, which could have tax implications in your home country or other jurisdictions where you have tax obligations.

- Reporting obligations: Depending on your country of citizenship, you might have to report your global income, including any income or gains from Caymanian sources. For instance, US citizens and green card holders are required to report worldwide income to the IRS.

- Estate planning considerations: While the Cayman Islands don't have an inheritance or estate tax, it's essential to understand how assets in the Cayman Islands would be treated from an inheritance perspective based on your domicile or other jurisdictions connected to your beneficiaries.

- Local fees and licenses: While not taxes in the traditional sense, businesses may encounter various fees and licenses required to operate in the Cayman Islands.

Remember

Tax implications can be complex and are subject to regulatory change.

It's crucial to consult with a tax advisor familiar with the Cayman Islands and any other jurisdictions relevant to your financial situation.

Is Residency by Investment in the Cayman Islands a Pathway to Caymanian Citizenship?

The only residency by investment option that’s a pathway to Caymanian citizenship is the Certificate of Permanent Residence for Persons of Independent Means.

As detailed above, this option requires a US$2.4 million minimum investment.

Common Questions

Can You Buy Residency in the Cayman Islands?

Must My Real Estate Purchase for My Cayman Islands RBI Application Be Government-Approved?

For Which Investment Do You Pay Tax in the Cayman Islands?

Is the Cayman Islands a Tax Haven?

Can I Get Permanent Residency in the Cayman Islands if I Buy Property?

How Safe Is Residency by Investment in the Cayman Islands?

Which Areas in the Cayman Islands Are Best to Live In?

How Wealthy Do I Need to Be for a Cayman Golden Visa?

In Conclusion

The allure of the Cayman Islands goes beyond its pristine beaches and crystal-clear waters.

Its residency by investment programs offer a gateway to a life filled with financial benefits, an inviting climate, and an enviable lifestyle.

However, as with any significant decision, it's essential to understand both the rewards and responsibilities.

Engaging in thorough research and seeking advice from experts like those at WorldPassports can ensure that your path to Caymanian residency is as smooth as the island's tranquil seas.

Compare this enticing opportunity with other Caribbean residency by investment programs on our well-stocked portal.

Learn More: Caribbean Countries Offering Residency by Investment Programs

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure