Citizenship By Investment Factors & Criteria

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Factors to consider when applying for citizenship by investment include the investment amount, the country's economic stability, the benefits of citizenship, and the eligibility criteria.

- The main criteria typically include making a significant financial investment, maintaining a clean criminal record, and passing any language or knowledge tests required.

- To qualify, you typically need to meet the investment threshold specified by the country, have a good reputation, pass background checks, and fulfill any additional requirements set by the government.

- The requirements for obtaining citizenship through investment may include making a substantial financial contribution, investing in approved sectors, demonstrating a clean criminal record, and meeting certain residency or language requirements.

- Countries generally look for factors such as the applicant's investment amount, their ability to contribute to the country's economy, and their adherence to the country's residency or language requirements when considering citizenship by investment applications.

Are you considering becoming a global citizen?

If you’ve answered yes, then citizenship by investment (CBI) might just be the opportunity you’re looking for!

However, investing in citizenship isn’t a decision to be made lightly.

With dozens of programs available - each with its own benefits, costs, and requirements - choosing the right one for yourself can be a daunting task.

That's why our team at WorldPassports has compiled this comprehensive guide to help you navigate the 6 top factors to consider before investing in your citizenship.

In This Article, You Will Discover:

From choosing the right country to investing in the right program, read on to find out everything you need to know when applying for CBI…

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

What are the Factors and Criteria for Citizenship By Investment?

When considering citizenship by investment, several factors and criteria play a crucial role.

Firstly, the reputation and stability of the country offering the program are essential.

A strong and reliable political system, robust economy, and favorable business environment demonstrate a promising investment for prospective citizens.

Secondly, the investment amount and required contribution should be reasonable and aligned with the benefits offered.

Transparency and clarity regarding the investment options and their associated requirements are vital.

Lastly, the opportunity for visa-free travel is often a key consideration for individuals seeking citizenship by investment.

Access to a wide range of countries without the need for additional visas enhances the attractiveness of the program.

In addition to these factors, it is important to consider the due diligence process implemented by the country offering citizenship by investment.

A thorough vetting and background checks of the applicants ensure the integrity and security of the program.

Moreover, the duration of the application process is a crucial criterion for potential citizens.

Efficiency and a streamlined procedure demonstrate a commitment to attracting investors and providing a smooth journey towards citizenship.

By carefully evaluating these factors and criteria, individuals can make informed decisions when pursuing citizenship through investment, ultimately achieving their goals of global mobility and secure residency.

Factors and Criteria for Citizenship by Investment include:

Financial Requirements

It’s essential that you consider the financial requirements of citizenship by investment programs before applying.

CBI programs often require a significant capital outlay, including a minimum investment amount as well as additional fees, which may place you under significant financial pressure.

It’s crucial to ensure you have the necessary funds available and budget accordingly to avoid any unexpected financial setbacks.

Let’s take a look at the specific financial requirements to consider with CBI programs.

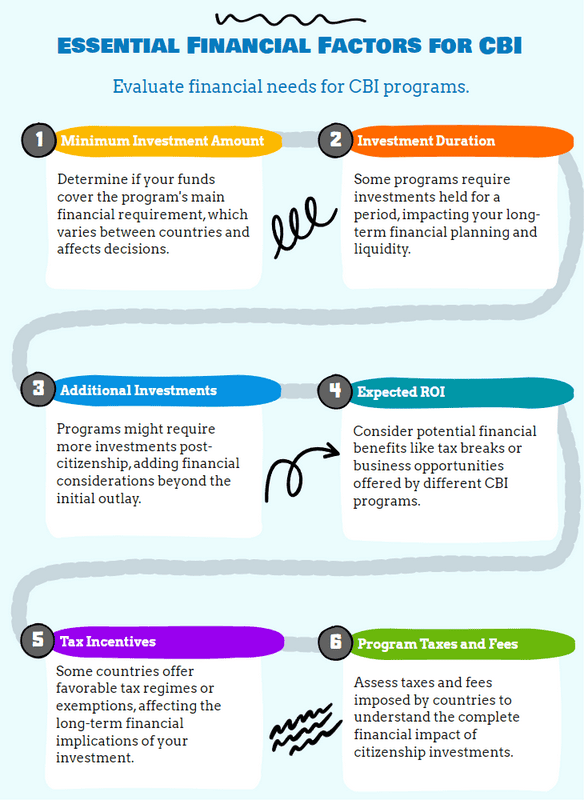

Minimum Investment Amount

The minimum investment amount is an essential factor to consider when applying for a citizenship by investment program, as it’ll be your main financial requirement.

This investment amount varies among countries and programs and can have a significant financial impact on your decision to pursue citizenship.

Before applying, it's crucial to determine whether you have the funds readily available or whether you need to transfer assets to fulfill the minimum investment requirement.

Additionally

Some programs may require the investment amount to be held for a certain period or require additional investments after becoming a citizen.

By carefully evaluating your CBI program's minimum investment amount, you can ensure that you choose the right program that aligns with your financial goals and capabilities.

Expected Return on Investment

Considering the return on investment is another critical aspect to consider when applying for a citizenship by investment program.

Some countries offer significant tax breaks, favorable business opportunities, or even potential returns on investment.

However, others may not provide any financial incentives for your investment.

For example

Dominica’s CBI program offers numerous business incentives to assist in creating a return on your investment, whereas other programs might require you to hold your investment for a minimum number of years.

By considering the potential return on investment, you can ensure that you choose a program that aligns with your finances and long-term goals.

Taxes & Fees

Taxes and fees are crucial factors to consider when applying for a citizenship by investment program, too.

Some countries impose taxes or fees on investment income, while others provide tax incentives such as favorable tax regimes, tax exemptions, or low taxes.

Check this out…

St. Lucia offers a friendly tax regime with no wealth, gift, inheritance, foreign income, or capital gains taxes, whereas Malta’s CBI program is known for imposing stringent tax laws, with few incentives offered for new citizens.

By considering taxes and fees, you can assess the long-term financial implications of your program and plan ahead to make the most of your investment.

Cost of Living in the Country

Considering the cost of living in your chosen country is another crucial factor to consider when applying for a citizenship by investment program.

For instance, some countries in Europe, such as Switzerland and Monaco, have a high cost of living, with expensive housing, food, transportation, and medical care.

On the other hand

Some Caribbean countries offer a lower cost of living and affordable healthcare options.1

By considering your chosen country's cost of living, you can ensure that your program aligns with your lifestyle and financial goals.

Choice of Country

When deciding on a country to invest in for citizenship, there's a host of factors that should be taken into consideration before your investment is made.

For instance, it’s crucial to consider factors such as the country’s economic and political stability, the country’s cost of living, the business environment, and the quality of life.

So, to ensure that you select the right country to invest in, we’ll walk you through a few major factors to keep in mind.

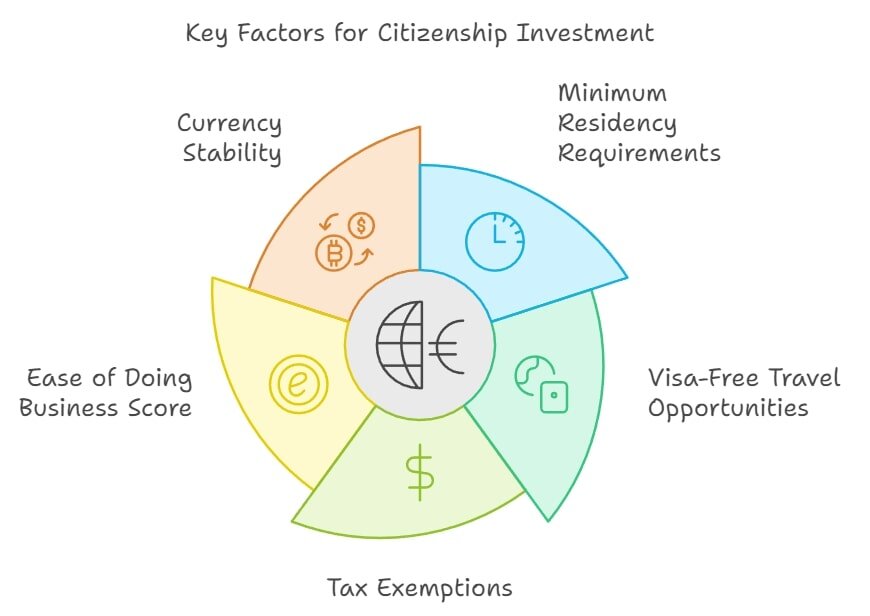

Minimum Residency Requirements

Considering a program's minimum residency requirements is essential when selecting a country to invest in for citizenship.

This requirement refers to the amount of time an applicant is required to spend in the country before they’re eligible to apply for citizenship.

For instance

Malta’s CBI program requires applicants to hold residency status for 36 months before they can apply for citizenship, whereas Dominica’s CBI program has no minimum residency requirements at all.

As such, it’s essential that you consider and select a country’s CBI program that aligns with your residency requirements.

Visa-Free Travel Opportunity

CBI programs often provide the opportunity to travel to a host of countries without the requirement of a visa.

When applying for a CBI program, it’s vital that you consider its travel opportunities, as this may improve your global mobility, enhance your business opportunities, and increase access to healthcare and education.

How about this?

Malta’s CBI program permits successful applicants visa-free travel opportunities to 180 countries, whereas St. Lucia’s CBI program offers significantly fewer visa-free travel opportunities.

By carefully reviewing and considering your CBI program's travel opportunities, you can make an informed decision that aligns with your personal and professional mobility goals.

Whether the Country Offers Tax Exemptions

Many CBI programs offer favorable tax systems and exemptions, which can significantly reduce your tax burden and increase the profitability of your investment.

As such, it’s essential for investors to understand and consider a country's tax policies when applying for a CBI program.

For instance, Antigua and Barbuda’s CBI program offers no capital gains tax, no estate tax, and no worldwide income tax, making it an attractive option for investors.

On the other hand

Malta’s CBI program has a high corporate tax rate and doesn’t offer exemptions on capital gains tax.

Therefore, it’s vital for you to consider your chosen CBI program's tax laws and regulations when applying to ensure you make the most of your investment and budget effectively.

Ease of Doing Business Score

The Ease of Doing Business Score is a measure of the regulatory environment of a country and provides an objective assessment of the ease or difficulty of starting and operating a business in any given country.2

Considering a CBI program's Ease of Doing Business score is crucial when applying for CBI, especially for investors, as it’ll give you confidence in the viability of conducting business and making investments in the country.

Additionally

A higher Ease of Doing Business score indicates a more favorable regulatory environment, with fewer obstacles and red tape for your businesses, whereas a low Ease of Doing Business score indicates an unstable and unfavorable business environment.

By reviewing and considering a CBI program's score, you can make informed decisions and choose a country that offers a favorable business climate for your business or investment.

Stability of the Country's Currency

Currency stability refers to the likelihood that a country's currency will maintain its value over time and not experience significant fluctuations or devaluations.3

The stability of the country's currency should be taken into consideration when applying for its CBI program, particularly by investors.

A stable currency provides greater certainty and predictability, reduces currency risk, and makes it easier to conduct business and make investments in the country.

On the other hand

An unstable currency can lead to inflation, devaluation, and increased currency risk, making it difficult to plan and invest effectively.

Thus, it’s vital to consider the stability of a country's currency when applying for its CBI program to ensure your investment is risk-free and stable in the long run.

Type of Investment

When applying for a citizenship by investment program, you’ll be required to select and commit to a specific type of investment in order to qualify for that country’s citizenship.

When applying for a CBI program, the type of investment you’re making should be considered to ensure that it aligns with your investment goals and financial standing.

We’ll discuss the types of investments you can consider when applying for citizenship by investment.

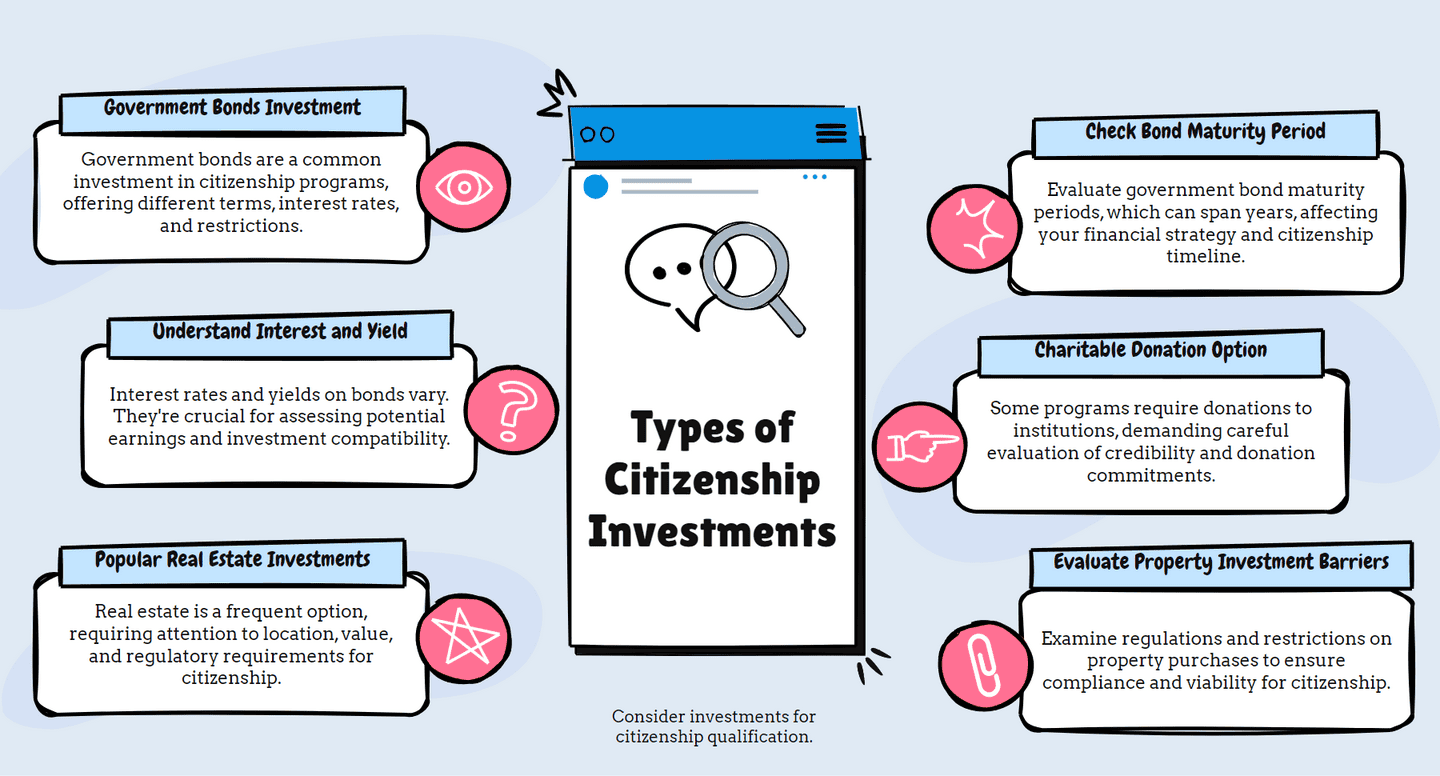

Government Bonds

Government bonds are a specific type of investment you can make to qualify for many citizenship programs.

It's essential to consider several factors when evaluating government bonds, such as the terms, prices, and risks associated with purchasing the bonds.

One of the key factors to consider is the maturity period, which determines the duration for which the government will hold the investment.

Additional key factors to consider with these types of investments are:

- The interest rate

- Yield on the bonds

- Restrictions on trading

- Redeeming your bonds

For example, the Bulgarian citizenship by investment program requires a minimum investment in Bulgarian government bonds, which may only be redeemed after 5 years.4

By evaluating these factors, you can make an informed decision about whether government bonds are the right type of investment for you to apply for citizenship.

Charitable Donation

Some countries offer a charitable donation option as part of their CBI program, requiring investors to commit to donating a specific amount to government-approved institutions, such as schools, hospitals, or cultural centers.

When applying for CBI with this type of investment, it's crucial that you understand your specific program's required donation, the goal of the donation, and the process for making donations before you commit.

Remember this…

It’s also critical to evaluate the credibility and transparency of your chosen charity institution to ensure your donation is going to good use.

Countries such as St. Kitts and Nevis, Antigua and Barbuda, and Grenada offer this type of investment as a route to qualifying for CBI.

Real Estate

Real estate is one of the more popular forms of investment that many citizenship by investment programs accept.

Factors to consider with this investment type include:

- Property location

- Value

- Potential returns

- Minimum investment amount

- Restrictions or regulations involved in purchasing the property

- Market trends

- Potential yields

For example, the Portugal citizenship by investment program requires a minimum investment of €280,000 (approximately US$304,500)* in real estate, and the property must be held for a minimum of 5 years.

By evaluating the factors of real estate investment for citizenship, you can make an informed decision about whether real estate is the right type of investment for you.

Read On: Citizenship By Real Estate Investment Explained

Business Investment

Some countries offer business investment as a form of investment to qualify for citizenship.

This type of investment requires you to contribute a significant sum to a new or existing business in the country.

It's essential to understand the investment amount, type of business, and regulations involved before committing to this type of investment.

In addition

It’s important to consider the potential risks and returns of the investment, as well as the local market and business climate.

For example, Turkey’s citizenship by investment program offers the option to invest at least US$500,000* in new or existing businesses, but this investment must be maintained for a minimum of 3 years.

*Please note: All amounts mentioned in this article were correct at the time of publication and are subject to change.

Processing Times

Each country's application process and timeline may differ depending on various factors, such as your profile, investment type, and the government's administrative procedures.

It’s advised to consider the program's processing times when applying in order to help manage expectations, prepare the necessary documentation, and plan for any potential challenges or delays.

This is particularly the case if you plan to relocate or start a business in your target country.

Let’s look at examples

Some programs, such as Dominica’s CBI program, have a more streamlined process, with approvals processed within a few months, while others, such as Malta’s CBI program, may take longer due to enhanced background checks and due diligence.

By evaluating the processing times and requirements beforehand, you can make informed decisions and ensure that the program aligns with your personal goals and expectations.

Dependents Covered by Citizenship by Investment Programs

Different countries that offer citizenship by investment have their own program requirements.

One program criterion that’s vital to consider is whether family dependents such as spouses, children, and parents are eligible to apply.

In particular, it’s important to understand how the program defines dependents and the rules surrounding their inclusion in the application process.

Consider this…

Some countries may limit the age of dependents, require specific documents proving their relationship to the applicant, or impose additional fees for their inclusion.

By understanding the criteria and requirements for dependents on your CBI program, you can make informed decisions about whether the program meets your personal and familial goals.

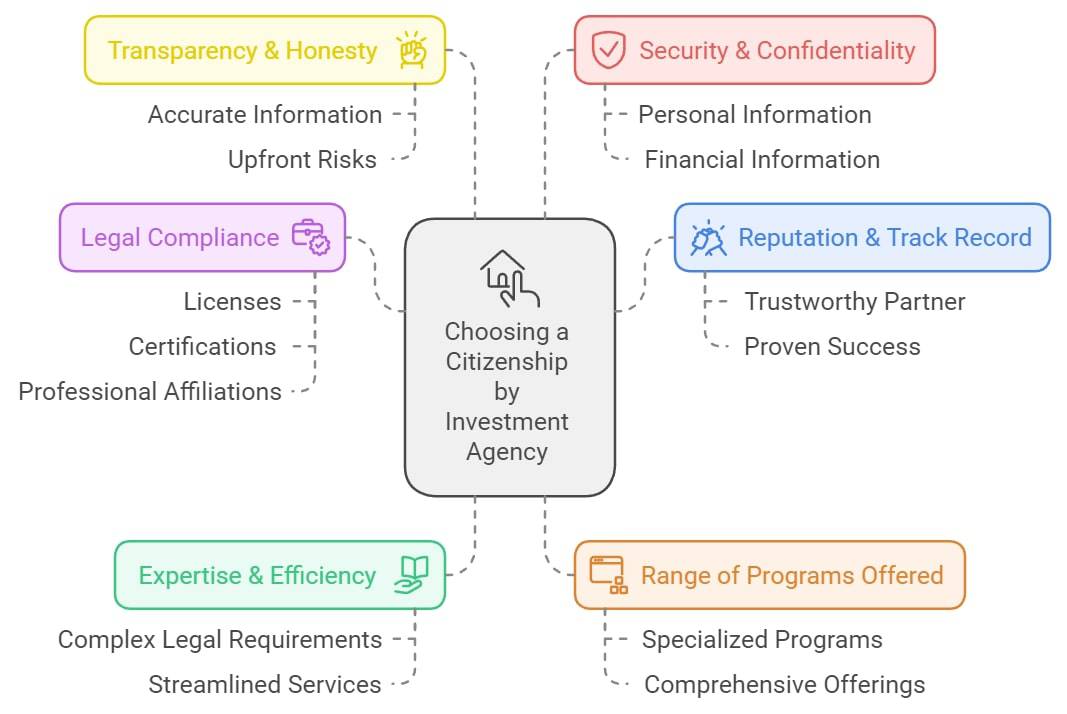

Choice of Citizenship by Investment Agency

A citizenship by investment agency is a firm that provides professional services to individuals and families seeking to obtain citizenship through investment in a foreign country.

When selecting a CBI agency to help with your application, it’s essential to consider a range of factors.

These factors include:

- Reputation & Track Record - Ensure that you’re working with a trustworthy and experienced partner with a proven track record of success.

- Expertise & Efficiency - An agency with expertise and efficiency will have a deep understanding of the complex legal and regulatory requirements of CBI programs and be able to provide you with efficient and streamlined services.

- Range of Programs Offered - It's essential that you work with a CBI agency that specializes in the CBI program you’re interested in, so be sure to browse their website.

- Transparency & Honesty - A transparent and honest agency will provide you with clear and accurate information about the program, fees, and services, and they’ll be upfront about any potential risks or limitations associated with the program.

- Security & Confidentiality - The agency should be committed to safeguarding your personal and financial information and ensuring that it remains confidential throughout the application process.

- Legal Compliance - As a CBI applicant, you may verify an agency’s compliance with the law by checking their licenses, certifications, and professional affiliations.

Common Questions

What Factors Should I Consider When Applying for Citizenship by Investment?

What are the Main Criteria for Obtaining Citizenship Through Investment?

How Do I Qualify for Citizenship by Investment?

What are the Requirements for Obtaining Citizenship Through Investment?

What Factors and Criteria Do Countries Look for in Citizenship by Investment Applicants?

Are There Age or Language Proficiency Requirements for Citizenship by Investment Programs?

Can I Get Citizenship by Investment If I Have a Criminal Record?

Are There Any Restrictions to Qualifying for a Citizenship by Investment Program?

How Do I Know I Qualify for Citizenship by Investment?

How Does the Citizenship by Investment Program Verify the Source of the Applicant’s Income & Wealth?

What Attracts Investors to Invest in Certain Countries Over Others?

In Conclusion

We trust this article has provided you with valuable insights into the important factors that you should consider when applying for a citizenship by investment program.

At WorldPassports, we understand that the decision to obtain a second or alternative citizenship is a significant one.

That’s why we’re committed to providing you with the guidance and support you need throughout the process.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure