Citizenship By Investment Tax

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Tax implications vary, with some countries offering tax advantages such as no taxation on worldwide income, while others may require tax on global earnings.

- Citizenship by investment can lead to tax optimization opportunities, though it's crucial to understand the tax regime of the host country.

- Countries like Antigua and Barbuda, Saint Kitts and Nevis, and Monaco offer favorable tax regimes for new citizens.

- Ensuring compliance with tax regulations involves consulting with tax professionals familiar with the laws of both the home country and the new country.

- Tax advantages can include no inheritance taxes, no capital gains taxes, and in some cases, no tax on worldwide income, making citizenship attractive from a fiscal perspective.

When investing in citizenship by investment, there are numerous potential benefits that may be attained, such as visa-free travel, increased security, and access to multiple business opportunities.

However, understanding the tax consequences related to citizenship by investment is also important.

In This Article, You Will Discover:

So, to help you better navigate the complexities of international tax, WorldPassports has you covered with the ultimate guide to help you prepare and design financial strategies that get the most out of your citizenship investment.

Read on…

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

What Is The Tax Implication Of Citizenship By Investment Programs?

The tax implications of citizenship by investment programs vary depending on the specific program and the individual's tax residency.

In some cases, individuals who obtain citizenship through investment may be subject to additional taxes, such as wealth or inheritance taxes, in the country of their new citizenship.

However, it is important to note that many citizenship by investment programs are designed to attract investors by offering favorable tax regimes, such as low or zero personal income tax rates, exemptions on capital gains or dividends, and tax incentives for businesses.

Therefore, it is crucial to carefully research and understand the tax implications of a specific citizenship by investment program before making a decision.

Citizenship by investment programs can have both positive and negative tax implications.

On one hand, some countries offer attractive tax benefits to individuals who obtain citizenship through investment, such as low or zero personal income tax rates and exemptions on capital gains or dividends.

This can provide significant tax savings for individuals looking to optimize their tax planning strategies.

On the other hand, it is important to consider the potential tax consequences in both the individual's home country and the country of their new citizenship.

Some countries may impose additional taxes, such as wealth or inheritance taxes, on individuals who obtain citizenship through investment.

Therefore, it is crucial to seek professional advice and thoroughly understand the tax implications before participating in a citizenship by investment program.

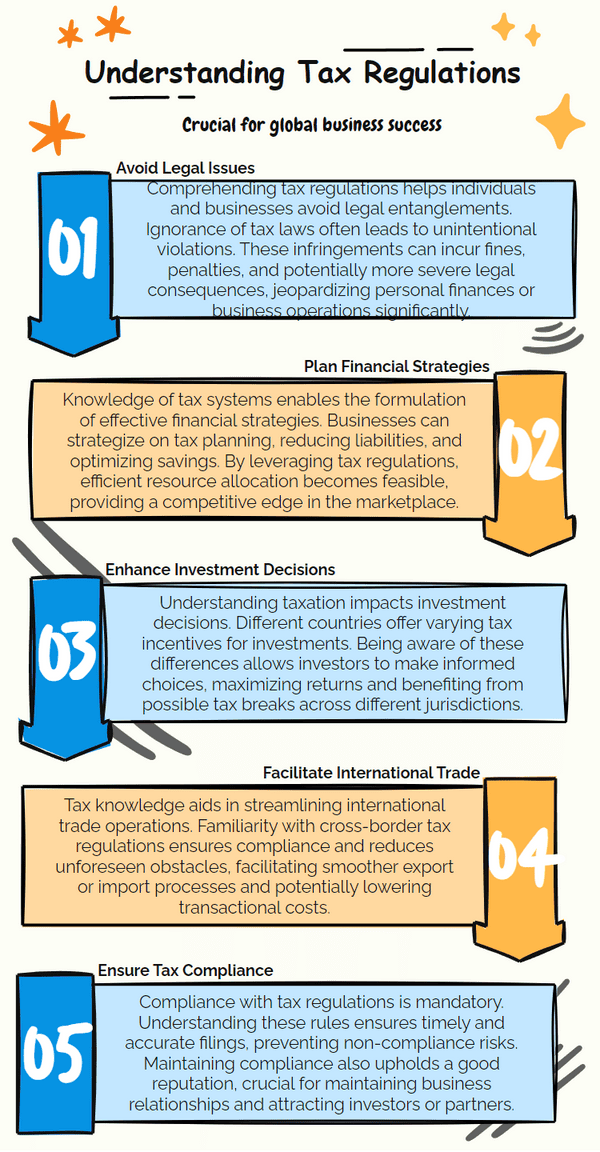

Why’s It Important to Understand Countries’ Tax Regulations?

It’s important to understand countries’ tax regulations when considering citizenship by investment (CBI), because it can help you avoid complex tax complications and minimize your tax liability.

With tax laws varying significantly between countries, obtaining citizenship in one country may have tax implications that differ from those in another country.

So we’ll walk you through the different tax requirements of citizenship by investment according to continent and country.

Taxes in European Countries

Obtaining citizenship by investment in European countries can provide access to a range of benefits and opportunities.

However, it’s important for investors to understand the taxation rules associated with second citizenship before committing to any financial decisions.

Depending on the country of residence, citizens may be subject to taxes on income, dividends, and interest payments, as well as property income gains.

So, let’s take a look at the tax implications for Citizenship by Investment in European countries:

Austria

Austria is a favorite destination for investors, primarily because of its Citizenship by Investment program.

When investing in Austrian citizenship, investors should be aware of the tax implications they’ll be liable to pay.

Here are the tax implications for investors with Austrian citizenship:

- Income tax: Foreign investors who participate in Austria's citizenship by investment program are taxed on their worldwide income, which includes income earned both within and outside of Austria.

- Wealth tax: Austria imposes a wealth tax on individuals whose net worth exceeds a certain threshold, which is currently set at €1,000,000.

- Inheritance and gift tax: Austria imposes inheritance and gift taxes on both residents and non-residents. The tax rates vary based on the relationship between the donor and the recipient, as well as the value of the asset being transferred.

- Real estate tax: Foreign investors who purchase real estate in Austria may be subject to a real estate tax. The tax rate varies depending on the location and value of the property.

- Value-added tax (VAT): Austria imposes a standard VAT rate of 20%, as well as reduced rates of 10% and 13% for certain goods and services.

Malta

Malta is another popular investment option for prospective citizens.

As such, it’s important for investors to be aware of the associated tax implications.

Here are a few tax implications that prospective citizenship investors in Malta should be aware of:

- Income tax: The standard income tax rate in Malta is 15%, but it can vary depending on individual circumstances.

- Capital gains tax: Gains made from the sale of shares or other property are subject to a capital gains tax of 5%.

- Property and gift tax: Gifts valued over €250 are subject to a duty rate of 10% to 15%. Property transfers that occur as part of an exchange between parties in Malta, or transfers involving family members, may be exempt from some forms of taxation.

- Inheritance tax: Non-residents of Malta are liable for a flat inheritance tax rate of 20%, while residents are subject to different rates dependent on their relationship with the deceased in question.

- Value added tax (VAT): Goods and services consumed in Malta are subject to VAT at varying rates ranging from 0% to 18%.

In Malta, you may minimize your tax liabilities by taking advantage of tax exemptions or applying for reduced-rate agreements.

North Macedonia

North Macedonia’s CBI program is attractive to many foreign investors.

However, certain taxes are payable under this CBI program.

Here’s a list of the specific taxes individuals should be mindful of when applying for citizenship in North Macedonia:

- Personal income taxes: Regardless of the amount, individuals must pay a flat 10% tax on all taxable income.

- Corporate income tax: The rate of corporate income tax is 10% on all taxable income that businesses generate.

- Value added tax (VAT): The standard VAT rate in North Macedonia is 18%, while the reduced VAT rate is 5%.

- Property tax: Property tax rates in North Macedonia range from 0.1% to 0.6% of the property's tax base.

- Inheritance tax: In North Macedonia, inheritance tax is charged at a flat rate of 2%.

Turkey

Investors participating in Turkey's CBI program may be subject to certain tax implications.

Here’s a list of the specific taxes an investor in Turkish citizenship will be liable to pay:

- Income tax: Foreign investors will be taxed on income earned within Turkey. Income earned outside of Turkey is exempt from taxation.

- Corporate tax: Companies domiciled in Turkey are subject to corporate income tax on their worldwide income.

- Value-added tax (VAT): Turkey imposes VAT on goods and services at a standard rate of 18%. Certain goods and services are eligible for reduced rates ranging from 1% to 8%.

- Real estate tax: Property owners in Turkey, including foreign investors, are subject to property tax, which is calculated based on the assessed value of the property and the location.

- Inheritance and gift tax: Turkey imposes inheritance and gift tax on individuals whose beneficiaries are Turkish residents. The tax rate ranges from 1% to 30% depending on the value of the asset and the degree of the relationship between the donor and the recipient.

Taxes in Caribbean Countries

Obtaining citizenship in a Caribbean country often comes with comparatively favorable tax conditions. For example, it generally doesn’t involve taxes on capital gains or inheritance.

Additionally, some of these countries have no income tax.

While the tax systems of these countries are generally similar in structure, there are important variations to be aware of when making an informed decision about investing for citizenship in the Caribbean region.1

So let’s take a look at the country-specific tax implications:

Antigua & Barbuda

When applying for citizenship by investment in Antigua & Barbuda, the main taxes to consider are income tax (10%), capital gains tax (12.5% on gains over $50,000 USD), withholding tax (10% on fees and royalties) and stamp duty (5% of property transfer value).2

Other taxes, such as inheritance tax, property tax, and social security tax, don’t apply.

Dominica

Aspiring citizens of Dominica through investment should be aware that their income tax may reach up to 25%.

Withholding taxes are implemented on certain services, such as consultancy, and capital gains tax is applicable for all profits over US$12,000.

However, individuals applying for CBI in Dominica aren’t required to pay any additional taxes, such as property tax, wealth tax, or social security contributions. Inheritance tax also doesn’t apply.

Grenada

When applying for citizenship by investment in Grenada, the main taxes to consider are income tax, capital gains tax (20% on gains over $10,000 USD), and withholding taxes (25% on royalty payments).

Other taxes, such as inheritance tax, property tax, wealth tax, and social security contributions, are all non-applicable to those applying for citizenship by investment in Grenada.

St. Kitts & Nevis

Individuals applying for citizenship by investment in St. Kitts and Nevis should be aware of the income tax (maximum rate of 35%), withholding tax (on certain services like consultancy), and capital gains tax (applicable to all profits over US$20,000).

Individuals applying for citizenship by investment in St. Kitts and Nevis aren’t required to pay any additional taxes (such as property tax, inheritance tax, wealth tax) or social security contributions.

St. Lucia

Individuals applying for citizenship by investment in St. Lucia should be aware of the income tax (maximum rate of 33%), capital gains tax (applicable to all profits over US$25,000), and stamp duty (applied to certain types of transactions).

People applying for citizenship by investment in St. Lucia don’t have to pay any additional taxes such as property tax, wealth tax, social security contributions, or inheritance tax.

Taxes in Other Countries

Next, we’ll take a look at the tax implications of citizenship by investment programs outside of European and Caribbean countries.

Take a look at the below details for Jordan and Vanuatu:

Jordan

Prospective investors in Jordan's citizenship should know that the country follows a territorial tax system.

Residents are taxed up to 30% on their earnings within the country, while non-residents face up to 15% tax rates on their income sources in Jordan.

Investors can expect to pay these same tax rates on their investment returns, in addition to withholding taxes ranging from 5% to 10%.

Additionally, Jordan offers double taxation agreements with 30 countries, including the United Kingdom, Canada, China, and France, amongst others.

Vanuatu

Individuals applying for citizenship by investment in Vanuatu should be aware of the income tax (maximum rate of 30%), capital gains tax (applicable to all profits over US$25,000), stamp duty (applied to certain types of transactions), as well as VAT and business turnover tax.

No other taxes apply, including inheritance tax.

Besides the taxes mentioned above, there are no other taxes applicable for people applying for citizenship by investment in Vanuatu.3

Optimising Your Tax Legally

Citizenship by investment is a legal approach to optimizing your tax liability.

By gaining citizenship through investment, you’re able to take advantage of the new country's various tax incentives and regulations, which can help lower your overall taxes.

Here are 3 ways you can legally optimize your tax through CBI:

Select a Tax-Efficient CBI Program

You can apply for a CBI program in a country that doesn’t levy taxes on income generated outside of its borders.

This can be an effective way for individuals to avoid paying taxes on the majority of their earnings, as most countries with these programs don't require residence or physical presence within their borders.

Tax Deductions & Exemptions

Citizenship programs can provide financial benefits, such as reduced taxation or exemption from certain taxes, if certain requirements are met.

These programs often require you to invest in specific areas, typically in real estate or business activities, which can enable you to pay reduced taxes when filing returns in the host country’s jurisdiction.

Taking advantage of these residencies can provide you with substantial reductions in the amount of tax you’ll pay each year.

Understand Tax Treaty Agreements

Take advantage of tax treaty agreements between the country in which you’re a citizen and other countries.

Many countries have treaties with other countries that allow individuals to pay lower taxes than they'd normally pay if they went through regular channels.

Taking advantage of these agreements can help you reduce the amount of taxes you owe each year without violating any laws.

What’s a Double Taxation Treaty?

A double taxation treaty is an agreement between 2 countries that prevents an individual or corporation from being taxed twice on the same income.

It works by designating which country can impose taxes, as well as when and how much should be paid.

Why’s this important?

This is particularly valuable for those engaging in international investments, such as citizenship by investment programs, because double taxation treaties ensure individuals aren’t overburdened with global taxes.

Common Questions

What Are the Tax Implications of Citizenship by Investment Programs?

Can I Reduce My Tax Liability Through Citizenship by Investment Schemes?

Are There Any Countries With Citizenship by Investment Programs That Offer Tax Benefits?

How Can I Ensure Compliance With Tax Regulations When Obtaining Citizenship Through Investment?

What Are the Advantages of Obtaining Citizenship by Investment in Terms of Taxes?

How Does Citizenship by Investment Work?

What Are the Best Citizenships to Have in Term of Taxes?

Can You Avoid Taxes by Renouncing Citizenship?

Does the UK Apply Tax Based on Citizenship?

Do You Have to Pay Taxes With Dual Citizenship?

How Can a Dual Citizen Avoid Double Taxation?

What Countries Don’t Tax Their Citizens?

In Conclusion

A second or alternative citizenship can offer a wealth of benefits, from visa-free travel to increased security and access to multiple business opportunities.

However, it’s important to be aware of the tax consequences associated with this type of investment.

We trust we’ve helped you understand the tax implications of citizenship by investment in order to maximize the value of your investment.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure