Dominican Republic Real Estate Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Real estate investment in the Dominican Republic offers advantages such as affordable property prices, a growing tourism sector, and favorable climate and geography for investment.

- Foreigners are allowed to own property with the same rights as Dominican citizens, without the need for residency or special permissions.

- It involves choosing a property, securing a sales agreement, conducting due diligence, and completing the purchase through a notary.

- Real estate investment can impact residency status by potentially qualifying investors for residency under certain conditions, enhancing their eligibility for permanent residency or citizenship.

- Key areas for investment include popular tourist destinations like Punta Cana, Santo Domingo, and Sosúa, known for their beaches, resorts, and real estate development opportunities.

Did you know that the Dominican Republic is not only a popular tourist destination but also a leader in Caribbean economic stability, making it an increasingly attractive option for real estate investors?

Welcome to our deep dive into the flourishing world of real estate investment in the Dominican Republic, a hidden gem in the Caribbean known for its stunning beaches, diverse landscapes, and robust economic growth.

We’ll explore the nuances of the Dominican real estate market, providing you with the knowledge you need to make savvy investment choices.

In This Article, You Will Discover:

Join us as we uncover the potential and promise of real estate investment in this vibrant and culturally rich country…

*Disclaimer: All amounts mentioned in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

Why Should I Consider Investing in Real Estate in the Dominican Republic?

You should consider investing in real estate in the Dominican Republic for several enticing reasons, ranging from its thriving tourism sector to its stable economy.

The nation's stunning beaches and diverse culture highlight its burgeoning tourism industry, which fuels a strong demand for rental properties.

Its economic stability is a boon for real estate investments, often leading to increasing property values and a vibrant rental market.

Real estate in the Dominican Republic is also relatively more affordable than other Caribbean destinations, lowering the barrier to entry for investors and enhancing the potential for a higher return on investment.

What’s more…

The legal framework here favors foreigners, granting them the same property rights as Dominican citizens.

Further sweetening the deal are the tax incentives offered by the government, including property tax exemptions and reduced taxes on rental income, which can significantly boost the profitability of real estate investments.

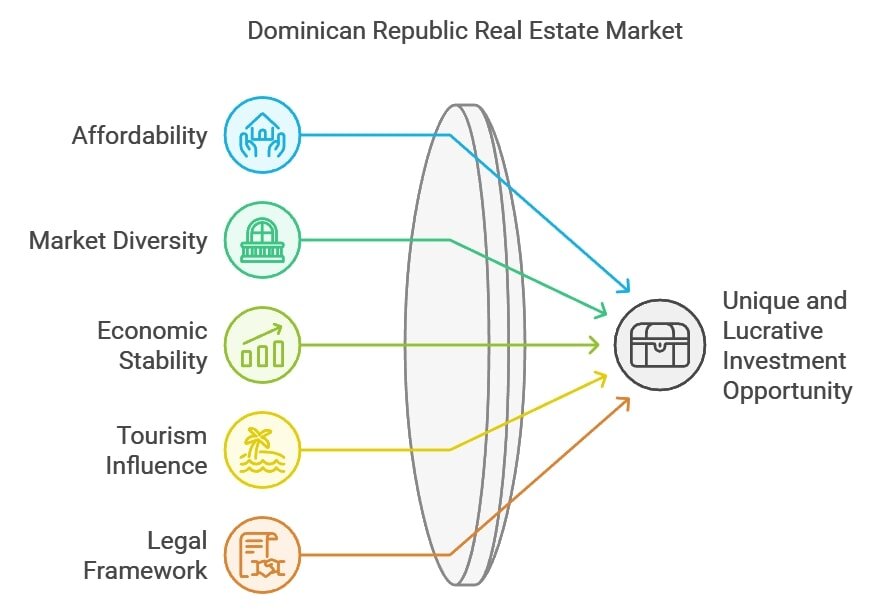

How Does the Real Estate Market in the Dominican Republic Compare With Other Caribbean Countries?

The real estate market in the Dominican Republic compares well with other Caribbean countries, particularly in that its growing economy frequently outshines some of its closest neighbors.

These are some of the main ways in which the Dominican Republic compares with other Caribbean countries:

- Affordability: The Dominican Republic generally offers more affordable real estate prices compared to other Caribbean countries, providing a lower entry point for investors.

- Market diversity: The Dominican Republic's real estate market is notably diverse, ranging from luxury beachfront properties to affordable urban housing, offering options for various investment strategies.

- Economic stability: The country has a more stable and consistently growing economy compared to many Caribbean nations, which contributes to a more reliable real estate market.

- Tourism influence: With a robust tourism industry, the Dominican Republic benefits from a high demand for short-term rentals and vacation properties, a sector that’s more developed than in some other Caribbean countries.

- Legal framework for foreign investment: The legal environment in the Dominican Republic is particularly favorable for foreign investors, offering the same rights as locals, a feature that's not as universally present in other Caribbean nations.

- Tax incentives: The Dominican Republic provides attractive tax incentives for real estate investors, including property tax exemptions and lower taxes on rental income, which are more generous compared to several other Caribbean countries.

- Retirement destination: It's a popular destination for retirees, especially from North America and Europe, due to its climate and lifestyle, driving demand for long-term residential properties more than in some other Caribbean locations.

- Infrastructure development: The Dominican Republic is investing in infrastructure improvements, enhancing accessibility and amenities, which can be a key differentiator from other Caribbean countries where such development may be slower.

These factors collectively position the Dominican Republic as a unique and potentially lucrative option for real estate investment within the Caribbean region.

Which Regions of the Dominican Republic Are Best for Real Estate Investment?

The regions in the Dominican Republic that are best for real estate investment range from beachfront vacation rentals to urban commercial properties, offering diverse opportunities for investors.

Here’s our expert breakdown of prime real estate locations in the Dominican Republic:

- Punta Cana: Known for its stunning beaches and resorts, Punta Cana is ideal for investment in vacation rentals and luxury properties, attracting a steady flow of tourists.

- Santo Domingo: As the capital city, Santo Domingo offers opportunities in both residential and commercial real estate, benefiting from a vibrant urban market and business growth.

- Sosúa and Cabarete: Popular with expatriates and retirees, these areas on the north coast are excellent for long-term rentals and properties catering to a growing international community.

- La Romana: Home to upscale resorts and golf courses, La Romana is a prime location for high-end residential and vacation properties.

- Puerto Plata: This historic area combines tourist appeal with local charm, making it suitable for a mix of vacation and residential investments.

- Las Terrenas: Attracting a mix of tourists and expats with its laid-back lifestyle and beautiful beaches, Las Terrenas is great for boutique property investments and vacation homes.

- Samaná Peninsula: Known for its natural beauty and quieter setting, it's ideal for eco-tourism and luxury developments, appealing to a niche market.

- Bávaro: Part of the Punta Cana region, Bávaro is rapidly growing, offering opportunities in residential and tourism-related real estate.

- Jarabacoa and Constanza: These mountainous regions offer unique investment opportunities in rural and eco-friendly properties for those looking at ecotourism and more temperate climates.

Dominican Republic Real Estate for Citizenship & Residency

If you’re investing in real estate in the Dominican Republic, you might be wondering whether such a sizable investment might result in Dominican residency or even citizenship.

Let’s examine this possibility.

Can I Get Dominican Citizenship If I Invest in Dominican Republic Real Estate?

No, you can’t get citizenship by investment if you invest in Dominican Republic real estate.

You can certainly apply for citizenship in the Dominican Republic after 2 years of permanent residency, but making a large investment in the country won’t confer citizenship on you immediately.

Will I Need to Become a Resident of the Dominican Republic to Buy Real Estate There?

No, you won’t need to become a resident of the Dominican Republic to buy real estate there.

The Dominican Republic welcomes foreign investment in real estate.

Foreign investors in the Dominican Republic have the same rights as local investors.

Can I Get Residency If I Invest in Dominican Republic Real Estate?

Yes, you can get residency if you invest in Dominican Republic real estate.

Real estate investment is one of the accepted routes to obtaining residency by investment in the Dominican Republic.

Your dependents will be included under the renewable residency permit you’ll obtain through this investment.

What’s not to love?

Are There Any Restrictions on Foreign Investment in Dominican Republic Real Estate?

No, there aren’t any restrictions on foreign investment in Dominican Republic real estate.

The Dominican Republic welcomes foreign investment and merely requires its Title Registry Offices to keep a record of all purchases made by foreigners.1

This is done purely for statistical purposes.

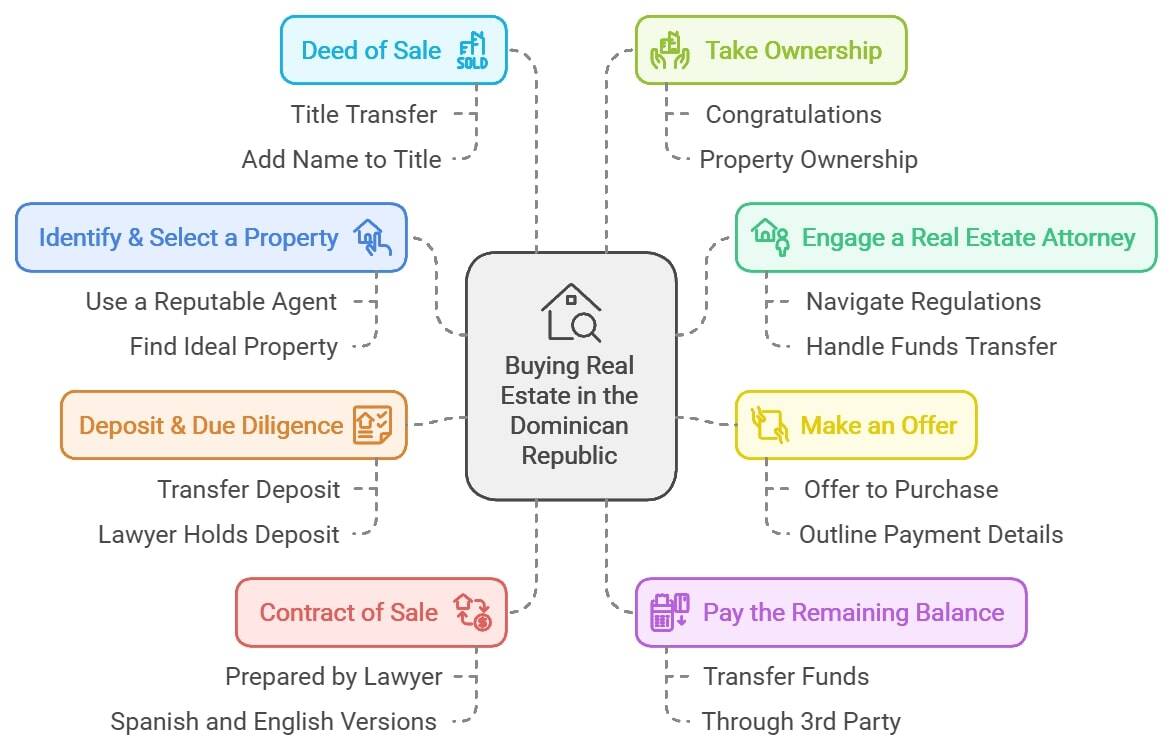

What’s the Process for Buying Real Estate in the Dominican Republic?

The process for buying real estate in the Dominican Republic follows a system that closely resembles that of the USA because the country maintains a strictly regulated system of land titles.2

Let’s see how close the resemblance is in our step-by-step guide to finding and purchasing your new property in the Dominican Republic:

Step 1: Identify & Select a Property

This is the obvious first step in your Dominican real estate investment process.

Using a reputable real estate agent can help you find the right property a little faster.

Step 2: Engage a Real Estate Attorney

An experienced real estate attorney will help you navigate the regulatory aspects of your Dominican Republic real estate investment process.

There’s more, though

One of the reasons you’ll need a reputable lawyer is that funds transfers in Dominican real estate transactions must go through a 3rd party.

More on that in Step 4.

Step 3: Make an Offer

When you find your ideal real estate, your estate agent will submit an Offer to Purchase on your behalf.

Your offer will outline details such as the property price, the payments you plan to make, and when you’ll make those payments.

Step 4: Deposit & Due Diligence

If the seller accepts your offer, you’ll transfer a deposit to the property to secure it.

A typical deposit for real estate in the Dominican Republic is between 10% and 20% of the agreed-upon property value.

This is important:

Your deposit must be transferred to your lawyer, who'll hold it until the Contract of Sale is signed and their due diligence has been completed on the property.

The advantage of this is that if the seller changes their mind, you’re able to reclaim your deposit with relative ease.

Step 5: Contract of Sale

While the estate agent prepares your Offer to Purchase, the Contract of Sale is prepared by your lawyer.

The Contract of Sale must be in Spanish, although an English version will also be provided.3

Once this document is signed by both you and the seller, your deposit will be paid over to them.

Step 6: Pay the Remaining Balance

At this point, the balance of the agreed property price is due.

As with the deposit, you’ll transfer the funds through a 3rd party (likely your lawyer).

Step 7: Deed of Sale

The Deed of Sale (or ''A Contrato de Venta'') is the final contract used to convey the real estate from the seller to the buyer.

This final Deed of Sale allows the title to be transferred, meaning your name will be added to the real estate title in place of the previous owner’s.

Step 8: Take Ownership

The real estate is now yours.

Congratulations! You're a real estate owner in the Dominican Republic.

What Costs Are Involved in Investing in Dominican Republic Real Estate?

Although the closing costs of purchasing real estate in the Dominican Republic aren’t comparatively strenuous, it’s still wise to plan for them.

In our experience, these are the main costs to plan for:

Property Transfer Tax (Conveyance Tax)

Real estate transfer taxes are 3% of the property's value.

However, if you apply for Tourism Incentive Law No. 158-01 (''CONFOTUR law Dominican Republic'') you may not have to pay any conveyancing taxes.

Find out!

Property Tax

Property tax in the Dominican Republic is typically 1% annually.

It’s based on the cumulative value of all your properties and is only calculated for properties exceeding DOP8,138,353.26 (approximately US$146,000).

What’s the upshot?

If your property is worth less than US$146,000, you won’t be liable for this tax.

Legal & Professional Fees

Attorneys in the Dominican Republic charge between 1% and 1.5% of the property purchase price.

Estate Agent Fees

Real estate agent fees in the Dominican Republic usually amount to 5 to 10% of the purchase price of the property.

What Are the Tax Implications of Investing in Dominican Republic Real Estate?

The tax implications of investing in Dominican Republic real estate could make or break your investment experience.

That’s why it's crucial to understand the tax implications associated with such investments.

Below, we'll delve into the various taxes and fees you may encounter.

Property Transfer Tax

When you purchase property in the Dominican Republic, a property transfer tax is applicable.

This one-time tax is typically 3% of the property's assessed value by the government, not necessarily the purchase price.

Real Estate Tax

The real estate tax in the Dominican Republic is levied annually and assessed on real estate owned by individuals.

Charged at 1%, it's based on the cumulative value of all your properties.

Capital Gains Tax

Capital gains tax is levied on the profit made from selling a property.

This tax is generally calculated as 27% of the gain in the Dominican Republic.

However, if the seller is a non-resident, a 27% withholding tax on the gross sale price is applicable.

Rental Income Tax

If you earn rental income from your property in the Dominican Republic, it's subject to rental income tax.

This tax rate varies based on the amount of income, with a progressive rate up to 25%.

Wealth Tax

A wealth tax, or asset tax, may apply to property owners in the Dominican Republic.

This annual tax is typically 1% of the total value of the property, but exemptions apply for properties valued under a specific threshold.

Notary Public Fees

Notary public fees are charged for the legal services required during the property transaction process.

These fees are usually around 1% to 1.5% of the property's purchase price.

Title Registration Tax

This tax is required to register the property title in your name.

The title registration tax in the Dominican Republic is usually around 2% of the property's assessed government value.

Municipal Real Estate Tax

Property owners in the Dominican Republic are subject to a municipal real estate tax, which is typically 1% of the property value, excluding any exempted value.

Corporate Income Tax

If your Dominican Republic real estate is held through a corporate entity, corporate income tax may apply.

Typically, this tax is around 27% of the income the property produces.

Value-Added Tax (VAT)

VAT in the Dominican Republic is applicable to certain transactions related to real estate.

The standard VAT rate is 18%, but it might vary for specific transactions.

Common Questions

How’s the Property Market in the Dominican Republic Currently?

Is Airbnb a Good Investment in the Dominican Republic?

Are There Any Pitfalls in Investing in Dominican Republic Real Estate?

Why’s Real Estate So Cheap in the Dominican Republic?

How Much Does Real Estate Cost in the Dominican Republic?

Where Do Wealthy Individuals Live in the Dominican Republic?

What’s the Housing Problem in the Dominican Republic?

How Much Money Does It Cost to Build a House in the Dominican Republic?

In Conclusion

Investing in real estate in the Dominican Republic offers exciting opportunities, especially given its growing market, attractive prices, and diverse locations suitable for various investment strategies.

From beachfront properties to urban apartments, the possibilities cater to a wide range of investor preferences.

However, it's crucial to navigate the investment process with awareness of local laws, tax implications, and potential challenges.

For more insights and tips on international real estate investment, we invite you to explore some of our other articles, where we delve into real estate markets around the globe to provide valuable information to guide your investment journey.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure