Dominican Republic Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- The Dominican Republic offers a residency by investment program designed to attract foreign capital into the country, with options including real estate investment, capital investment in Dominican companies, and investment in government bonds.

- The program's investment thresholds vary depending on the chosen route but are designed to be accessible to a broad range of investors, with real estate and business investment opportunities particularly appealing due to the country's vibrant economy and growing tourism sector.

- Benefits include a favorable tax regime, a fast-track process to permanent residency, and, eventually, the option to apply for citizenship, which offers visa-free travel to many countries.

- The application process requires thorough documentation, including proof of investment, and may involve legal assistance to navigate the requirements efficiently.

- Investors should evaluate the potential for economic growth in their chosen investment sector and the overall stability of the country to ensure their investment provides both short-term benefits and long-term residency security.

Imagine waking up to the gentle sound of waves, a warm Caribbean breeze, and the promise of endless adventures.

This isn't just a holiday dream; it's an invitation to you.

With the Dominican Republic’s residency by investment programs, it beckons those seeking more than just a tourist's glimpse.

And while many are enchanted by its pristine beaches and lively merengue rhythms, few are aware that the Dominican Republic - not to be confused with Dominica - is where Christopher Columbus made his first landing in the New World.

Did you know that it's also home to the oldest colonial city in the American Caribbean?

In This Article, You Will Discover:

If you’re ready to turn your dream into reality, dive into our detailed exploration to discover how you can make this tropical wonderland your home.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

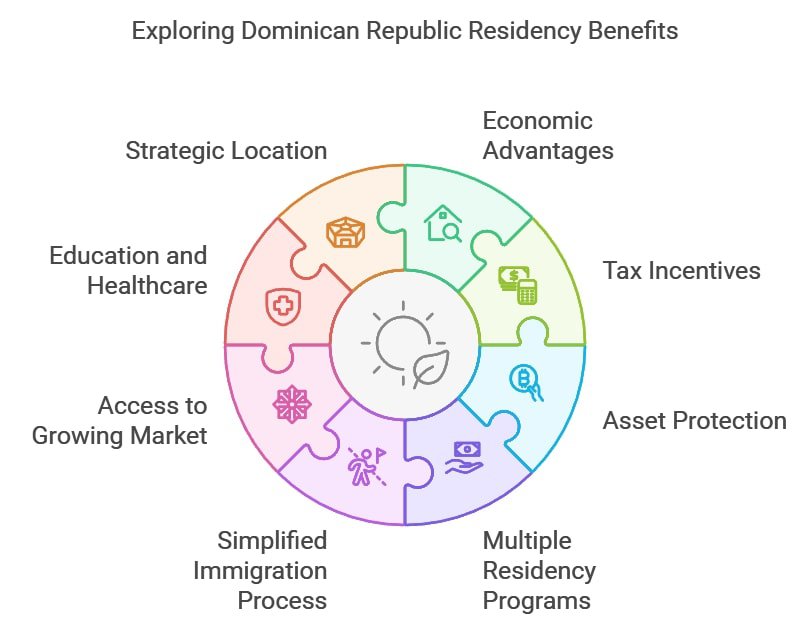

What Are the Benefits of Residency by Investment in the Dominican Republic?

The obvious benefits of residency by investment in the Dominican Republic include its pristine tropical beaches and gorgeous climate, but there’s so much more.

Here’s our master list of the best benefits of residency by investment in the Dominican Republic:

- Economic advantages: There’s a potential for significant returns on investments due to the country's steadily growing economy and real estate market.

- Tax incentives: There’s a favorable tax regime for new residents, which can include exemptions on certain income and assets.

- Asset protection: This is one of the major drawcards for expat investors.

- More than 1 residency by investment program: Depending on available resources and personal goals, interested investors can apply via 2 different investment options, namely the Person of Independent Means Program (or Rentier Program) or the more simply named Residency by Investment Program.

- Simplified immigration process: The Dominican Republic has a faster and more streamlined residency approval process compared to traditional routes.

- Access to a growing market: The Dominican Republic boasts a dynamic economy, opening opportunities for business and trade.

- Education and healthcare: Residents gain access to the country's education system and healthcare services.

- Strategic location: Situated in the heart of the Caribbean, the Dominican Republic offers easy connectivity to North, Central, and South America.

- Cultural richness: Investors get to embrace the Dominican Republic's vibrant culture, traditions, and festivals.

- Natural beauty: Get unlimited access to some of the Caribbean's most breathtaking beaches, mountains, and tropical forests.

- Potential citizenship: After fulfilling certain criteria, residents may have the opportunity to apply for full Dominican citizenship.

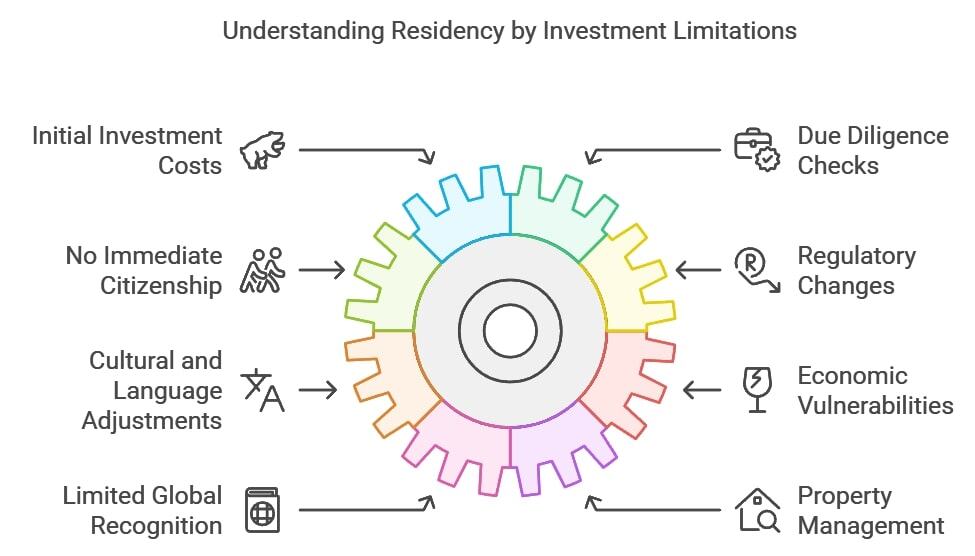

What Are the Limitations of Residency by Investment in the Dominican Republic?

Like many residency by investment programs, the limitations of residency by investment in the Dominican Republic include the significant expense required and physical presence considerations.

In the interests of making a truly informed decision, let’s look at all of the limitations worth considering in this residency by investment opportunity:

- Initial investment costs: The program often requires a significant upfront financial commitment, which may be out of reach for some individuals.

- Due diligence checks: Applicants undergo rigorous background checks, which can lead to delays or potential disqualification based on past records.

- No immediate citizenship: While residency is granted, immediate citizenship isn’t. Applicants often have to wait and fulfill specific requirements.

- Regulatory changes: As with any government program, regulations and requirements can change, which might affect investors' status or benefits.

- Cultural and language adjustments: New residents may face challenges adapting to the local culture and language, especially if they aren’t fluent in Spanish.

- Economic vulnerabilities: Like any emerging market, the Dominican Republic might face economic instabilities that could impact investments.

- Limited global recognition: The Dominican passport may not carry the same weight or global recognition as those from more established residency by investment countries.

- Property management: If the investment is in real estate, non-resident investors might face challenges in property management and maintenance.

- Residency obligations: Some programs may have minimum stay requirements or other obligations to maintain the residency status.

- Renewal and reporting: Depending on the program's structure, there may be periodic renewals, fees, or reporting obligations to maintain the status.

Which Investment Types Qualify for Residency by Investment in the Dominican Republic?

The types of investments that qualify for residency by investment in the Dominican Republic differ slightly under the 2 different programs, namely the Person of Independent Means (or Rentier) program and the Residency by Investment program.

The investment types that qualify under the Person of Independent Means (or Rentier’s) program include:

- Bringing your passive income or pension into the country

- Real estate investment

The investment types that qualify under the Residency by Investment Program include:

- Real estate investment

- Investment in stocks or bonds

What Are the Eligibility Requirements for Residency by Investment in the Dominican Republic?

The overarching requirements for residency by investment in the Dominican Republic include general criteria such as a clean criminal record and a clean bill of health, but the minimum investment amount varies depending on which program you opt for.

Take a look:

Minimum Investment Amount for the Person of Independent Means Program (Rentier’s Program)

The minimum investment under this program requires you to transfer at least US$2,000 per month from a foreign source into a local Dominican Republic bank account for at least 5 years.

This must be passive income, such as a pension.

Minimum Investment Amount for the Residency by Investment Program

The minimum investment under this program is US$200,000 invested in a Dominican entity, a fixed-term deposit, stocks or securities, or real estate.

Physical Presence Requirements

Neither of the 2 Dominican Republic residency by investment options requires a minimum physical presence.

How accommodating!

Language Requirements to Qualify

Spanish is the official language in the Dominican Republic and is widely spoken, with English being more popular in tourist areas.

You won’t need Spanish fluency to obtain residency, but if you plan to apply for citizenship eventually, you’ll need to prove proficiency in Spanish.

Nationalities Restricted from Applying

No nationality is restricted from applying for residency by investment in the Dominican Republic, provided you can meet the minimum requirements and pass the due diligence process.

Will My Dependents Be Included Under My Dominican Residency Permit?

Yes, your dependents will be included under your Dominican Republic residency permit for additional fees.

These will be covered in the section on costs involved in residency by investment in the Dominican Republic.

How Long is the Dominican Residency by Investment Permit Valid & Can It Be Extended?

The validity period of your Dominican residency by investment permit varies depending on which investment program you’ve opted for.

Here’s a quick overview:

Validity Period for Person of Independent Means (Rentier’s) Program

Your residence permit under this program will initially be valid for 1 year, after which you must renew it.

Once you’ve renewed it the first time, you’ll only need to renew it again every 4 years.

Validity Period for Residency by Investment Program

Your residency permit under this program will be valid for 5 years and is renewable.

What’s the Application Process for Residency by Investment in the Dominican Republic?

The application process for residency by investment in the Dominican Republic plays out similarly for both the Person of Independent Means Program and its Residency by Investment Program.1

Read on.

Step-by-Step Application Process

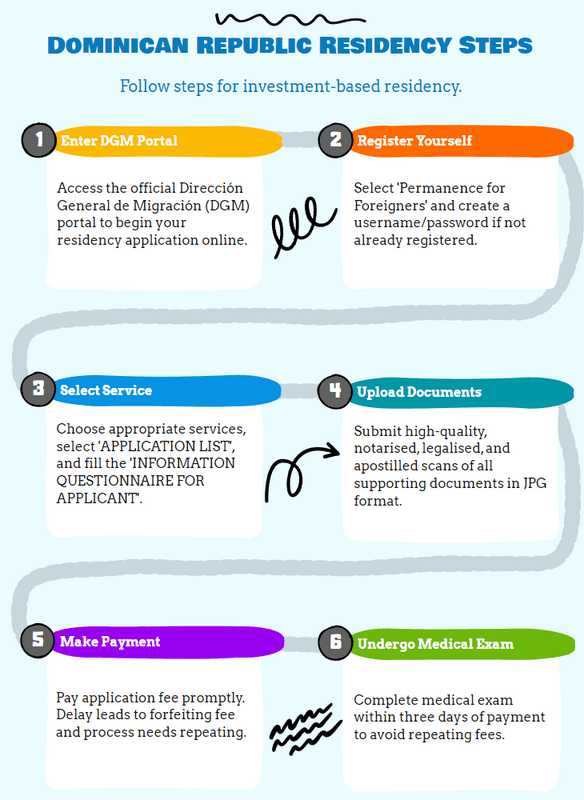

The application process can be broken down into a sequence of 5 steps.

Here’s how you can expect it to roll out:

Step 1: Enter the DGM Service Portal

Enter the Dominican Republic’s official government website service portal, Dirección General de Migración (DGM).

Step 2: Register Yourself

Select “Permanence for Foreigners”, and if you’re not already registered, create a username and password for yourself.

Step 3: Select Service

Once you’ve logged in, you’ll need to select the appropriate service in order to apply.

Follow this sequence:

- Choose the “APPLICATION LIST” option.

- In the “AVAILABLE SERVICES” option, select “LOCATION-OFFICE” where you’ll receive the service.

- From the “LIST OF SERVICES”, choose the service you need.

- Complete all the information required under “INFORMATION QUESTIONNAIRE FOR APPLICANT”.

Step 4: Upload Supporting Documents

You’ll need to submit high-quality scans of your supporting documentation.

Bear in mind

All your scanned documents will need to be in JPG format and must be notarized, legalized, and apostilled.

Step 5: Make Payment & Undergo a Medical Exam

Once you’ve paid the application fee, you must go for your medical examination within 3 days of payment.

If you fail to do this, you’ll need to make the payment again and repeat the process.

Required Documents

The required documents for your Dominican Republic residency by investment application will serve as evidence for the information you provide in your application.

In our expert opinion, these are the documents you’ll need for this application:

- Your passport, which should be valid for a minimum of 18 months.

- Letter of Incorporation into the Foreign Investment Program.

- A Certified Certificate of Foreign Investment.

- Your birth certificate.

- An affidavit of support for your dependents.

- 4 recent passport-type photographs of the same set: 2 frontal and 2 of your right profile.

- Certificate of clean criminal record from your country of origin or of the country where you’ve lived in the last 5 years.

- Proof of the existence of your account with a Dominican bank.

- A letter of recommendation from your existing bank.

- Bank statements.

- Proof of pension (if applicable).

- Marriage certificate, declaration of singleness, or proof of living together, apostilled or legalized.

- An insurance guarantee policy contracted with ARS Reservas.

- Medical examinations in one of the institutions authorized by the DGM.

What Costs Are Involved in Getting Residency by Investment in the Dominican Republic?

The exact costs for obtaining residency by investment in the Dominican Republic can vary depending on the specific route chosen, the investment type, and other variables.

We’ve summarized the costs for you below.2

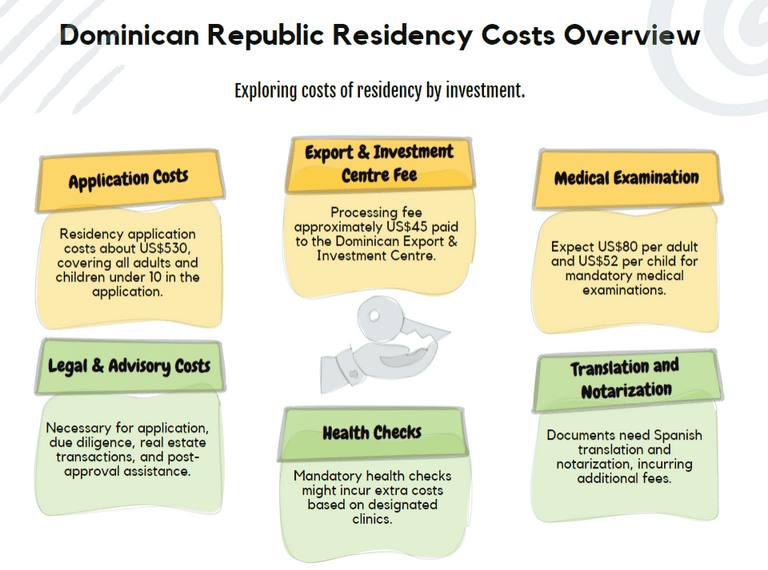

Application Costs

Residency by investment application costs come to approximately US$530.

This fee is identical for adults and children under the age of 10 included in the application.

Medical Examination

You can expect to pay around US$80 per adult and US$52 per child for your medical examination.

Dominican Export & Investment Centre Payment

This payment relates to the processing of your investment.

You can expect this to come to approximately US$45.

Legal & Advisory Costs

With any investment that involves significant expenses and lifestyle changes, you’ll likely need to retain legal and advisory services at certain points in the process.

In our seasoned experience, these are the main legal and advisory costs to plan for:

- Application preparation and submission: Preparing and submitting the application requires expertise to ensure all details are correct and in order. This step often includes verifying the authenticity of documents, organizing them properly, and legalizing them correctly.

- Due diligence assistance: Legal experts often assist in the due diligence process, guiding applicants on what to expect, preparing them for interviews or questions, and addressing any potential issues that arise.

- Real estate transaction assistance: If choosing the real estate investment route, lawyers may aid in the property purchasing process, ensuring all documentation is in order and that the transaction is in compliance with Dominican laws.

- Retainer fees: Some firms work on a retainer basis, where clients pay a fixed amount, ensuring the firm's services are available throughout the residency process.

- Post-approval assistance: After gaining residency, there might be additional legal steps to take or queries to address. Some firms offer packages that cover these post-approval services.

Additional Associated Costs

It’s often the additional unplanned costs that derail a carefully planned budget.

Here are some of the common additional costs we see crop up:

- Translation and notarization: Documents in languages other than Spanish typically require professional translation. Once translated, they might also need notarization, incurring additional fees.

- Health checks: Mandatory health examinations or medical checks may come at an extra cost. Some specific clinics or hospitals might be designated for these checks, each with its own pricing structure.

- Insurance premiums: Residency by investment programs might mandate applicants to have health insurance in the Dominican Republic. The premiums for these policies can vary based on coverage, age, and other factors.

- Real estate maintenance: If investing in property, one should account for annual costs like property taxes, homeowners' association fees, utility bills, property maintenance, and insurance.

- Renewal fees: Some residency programs may have periodic renewal requirements, which come with associated fees to maintain the residency status.

- Taxes and stamp duties: Depending on the type of investment, there could be taxes, stamp duties, or other associated governmental charges.

What’s the Processing Time for Dominican Republic Residency by Investment?

Regardless of the residency by investment route you opt for, the processing times are very similar.

Here’s the low-down:

Average Processing Time

On average, you can expect it to take 3 months for your Dominican Republic residency by investment application to be processed.

This is true for both the Person of Independent Means (or Rentier) program and the Residency by Investment program.

Factors Affecting Processing Time

No system is perfect; a number of factors can affect the processing time of your residency by investment application in the Dominican Republic.

These might include:

- Completeness of application: An application that's thorough and complete, without any missing documentation or details, is processed faster than one that requires additional information or clarifications.

- Due diligence delays: The depth and complexity of the due diligence process can vary based on an applicant's background. Those with complex financial histories or past legal issues might face longer processing times.

- Volume of applications: During periods when the Dominican Republic's Residency by Investment program experiences a high volume of applications, processing times can increase.

- Government changes or updates: Any changes or updates in the regulations, policies, or staff of the relevant government departments might result in delays.

- Document verification: The time taken to verify the authenticity of submitted documents, especially if they're from multiple countries or in languages other than Spanish, can affect the overall processing time.

- Health and medical checks: Delays in scheduling or receiving results from mandatory health checks can extend the application processing time.

- Delay between fee payment and medical exam: If you don’t go for your medical exam within 3 days of paying for your application, you’ll be required to make payment again and start the process all over. This can create delays.

Expedited Processing Options

Officially, the Dominican Republic doesn’t offer expedited processing options for residency by investment applications.

Our advice is that you ensure your documentation is scrupulously in order before applying and to follow the recommended procedure to the tee.

How Soon Will I Receive My Residency Permit After My Residency by Investment Application is Approved?

You’ll receive your residency permit within a few weeks of receiving approval for your residency by investment application.

What Are the Tax Implications of Residency in the Dominican Republic?

The tax implications of residency by investment in the Dominican Republic will depend primarily on whether you’re a tax resident.

Barring exceptional circumstances, you’ll be considered a Dominican Republic tax resident if you spend more than half the year in the country, regardless of whether your in-country days are consecutive.3

Some of the possible tax implications of residency by investment in the Dominican Republic are listed below:

- Residency-based taxation: Once you become a tax resident, you’re taxed on your worldwide income in the Dominican Republic, regardless of where that income was generated.

- Income tax: The country employs a progressive tax rate on personal income. The rates range from 0% to 25%, depending on the amount of income.

- Capital gains: Capital gains from the sale of securities and other assets are typically subject to tax. The rate might vary based on the type of asset and the duration of ownership.

- Value-added tax (VAT): Goods and services in the Dominican Republic are subject to a VAT. The standard rate is 18%, but this can change at any point.

- Property tax: Owners of real estate might be subject to an annual property tax. However, properties below a certain value threshold might be exempt.

- Inheritance and gift tax: The Dominican Republic imposes taxes on inheritance and gifts, although there might be certain exemptions and varying rates based on the relationship between the giver and receiver.

- No double taxation: The Dominican Republic has treaties with certain countries to prevent double taxation, ensuring that residents don't pay tax on the same income in both the Dominican Republic and their home country.

- Tax incentives for investors: The government offers certain tax incentives for foreign investments in specific sectors or projects. This can include tax holidays or reduced rates.

- Dividend tax: Dividends received from a Dominican company might be subject to a withholding tax.

- Foreign tax credit: Residents might be eligible for a credit for taxes paid in other countries, reducing the overall tax burden in the Dominican Republic.

- Exit tax: There may be an exit tax for residents or citizens who decide to relinquish their residency or citizenship.

Always consult with a tax advisor or expert familiar with the Dominican Republic's tax laws when considering residency, as tax laws can be complex and subject to change.

Is Residency by Investment in the Dominican Republic a Pathway to Dominican Citizenship?

Yes, residency by investment in the Dominican Republic can be a pathway to citizenship by naturalization.

Take note that you must be willing to undergo a Spanish proficiency and culture test.

Common Questions

How Much Does It Cost to Get Residency in the Dominican Republic?

If I Buy a House in the Dominican Republic, Can I Get Permanent Residency?

Are People from Dominica & the Dominican Republic Both Called Dominicans?

How Easy Is It to Get Residency by Investment in the Dominican Republic?

How Can I Retire in the Dominican Republic?

How Risky Is Residency by Investment in the Dominican Republic?

What Language Is Spoken in the Dominican Republic?

In Conclusion

The Dominican Republic offers an enticing blend of tropical allure, promising investment opportunities, and a structured pathway to residency for those looking to call it home.

While residency by investment programs can be a viable route for many, it's essential to be well-informed about the costs, benefits, and potential risks involved.

By leveraging expert guidance and a thorough understanding of the program's intricacies, you can navigate the process seamlessly and embrace the vibrant life that awaits in this Caribbean gem.

Find out more about residency by investment opportunities in the Caribbean in our expertly curated selection of other articles.

Learn More: Caribbean Countries Offering Residency by Investment Programs

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure