EB-5 Visa History

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

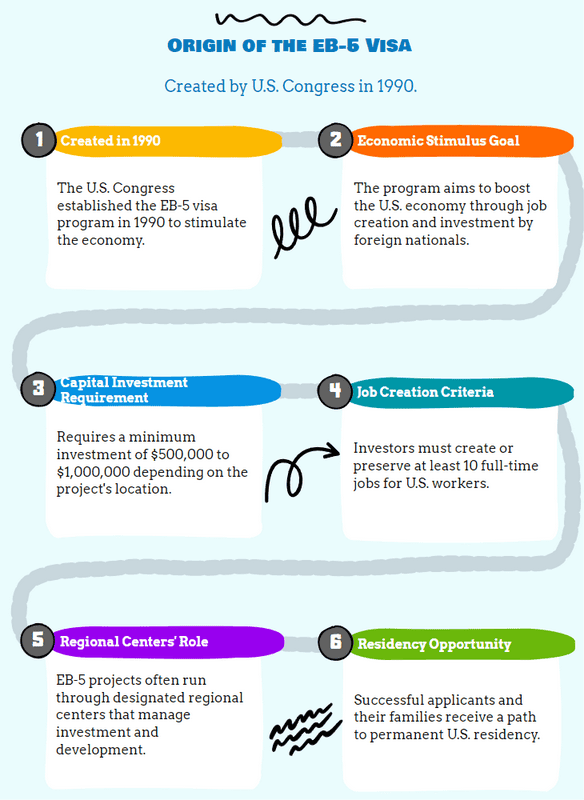

- The EB-5 visa programme was launched in 1990 to boost the U.S. economy through foreign capital and job creation.

- In 1992, the Immigrant Investor Pilot Program introduced regional centers, revolutionising how EB-5 investments are structured.

- Over the decades, the programme has experienced policy reforms, increased oversight, and adjusted minimum investment levels.

- Key legislative milestones have aimed to prevent fraud, protect investors, and improve programme accountability.

- Understanding the history of EB-5 helps investors make informed decisions and appreciate the programme's long-term role in U.S. immigration policy.

The history of the EB-5 visa program began in the early 1990s, but a number of amendments and updates have occurred to make it the program we’re familiar with today.

You may know it as one of the quickest routes to obtaining a US green card, but there’s more to this immigrant visa program than meets the eye.

The EB-5 program was designed to enrich the USA and the savvy foreign investors who funnel their capital into the country’s economy, but it hasn’t been entirely free of controversy over the years.

In This Article, You Will Discover:

Knowing a little about the background of this US immigration visa provides context for some of the procedures that characterize it.

Come along with us as we unpack the evolution of the EB-5 visa program…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

The EB-5 Immigrant Investor Program is a cornerstone of U.S. immigration policy, offering a direct pathway to permanent residency for foreign investors. Since its inception in 1990, the program has evolved through legislative reforms, increased oversight, and changing investment thresholds, all aimed at boosting the U.S. economy and ensuring program integrity.

For a comprehensive overview of citizenship by investment options worldwide, visit the WorldPassports citizenship by investment guide.

What Is the EB-5 Visa Program?

The EB-5 visa was established under the Immigration Act of 1990 as the fifth employment-based preference category. Its primary goal is to stimulate the U.S. economy by attracting foreign capital and creating jobs for American workers. Initially, the minimum investment was set at $1 million, or $500,000 for projects in Targeted Employment Areas (TEAs).

Key Milestones in EB-5 Visa History

1990s: Foundation and Early Amendments

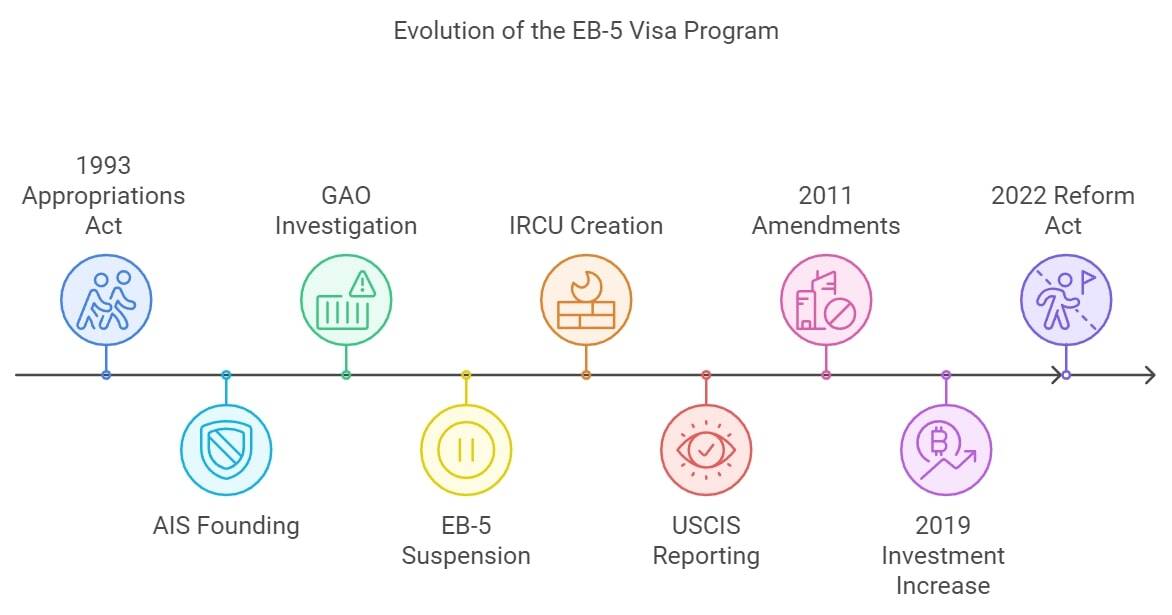

- 1990: U.S. Congress launches the EB-5 program to encourage foreign investment and job creation.

- 1992: The Immigrant Investor Pilot Program introduces regional centers, allowing pooled investments and expanding the program’s reach.

- 1998: Regulatory scrutiny increases after high-profile fraud cases, leading to temporary suspension and subsequent reforms.

2000s: Oversight and Investor Confidence

- Early 2000s: The program is reinstated with enhanced oversight. The Investor and Regional Center Unit (IRCU) is established to improve transparency and application processing.

- 2005: Reports highlight challenges such as suspended cases and complex application procedures, prompting further reforms.

2010s: Growth and Modernization

- 2010: The U.S. Securities and Exchange Commission (SEC) steps up supervision, increasing investor protection.

- 2011: Amendments allow investments in existing commercial enterprises, leading to a surge in applications.

- 2014: The program reaches its annual cap, reflecting its growing popularity.

- 2019: The minimum investment increases to $1.8 million ($900,000 in TEAs), and the Department of Homeland Security (DHS) is granted greater oversight.

2020s: Reform and Integrity

- 2020: New legislation allows investors to participate outside TEAs and grants certain applicants the right to reside in the U.S. while awaiting visa approval.

- 2021: The EB-5 Reform and Integrity Act introduces stricter compliance, requiring regional centers to report changes, maintain records, and undergo regular audits.

- 2022: The program is reauthorized, with the minimum investment set at $1.05 million ($800,000 in TEAs). Regional centers remain authorized until at least September 30, 2027, with five-year renewal cycles.

For a detailed explanation of the EB-5 process, see EB-5 Visa Explained.

The Role and Development of EB-5 Regional Centers

Regional centers are designated entities that pool investments from multiple EB-5 applicants to fund large-scale projects. These centers are responsible for meeting job creation requirements and have become the preferred route for most investors due to their streamlined processes and reduced risk.

To learn more about how regional centers operate, visit the EB-5 Regional Centers resource.

Recent Updates and Current Status

- The EB-5 program continues to adapt to economic and regulatory changes, with a focus on transparency, investor protection, and economic impact.

- The minimum investment amounts and compliance requirements are subject to periodic review, ensuring the program remains competitive and secure.

- The program is currently active, with regional centers authorized through at least 2027.

Common Questions

What’s the Current Status of the EB-5 Program?

How Long Has the EB-5 Visa Been Around?

Has the EB-5 Program Stopped?

What’s the SEC’s role in the EB-5 Visa?

Which Countries Do Most EB-5 Visa Applicants Come From?

How Many EB-5 Visas Are Issued Per Year?

In Conclusion

The EB-5 Immigrant Investor Program remains a dynamic and attractive pathway to U.S. permanent residency. Its evolution reflects a commitment to economic growth, investor protection, and regulatory integrity. For the latest updates, expert advice, and a step-by-step guide to the EB-5 process, trust the resources and experience of WorldPassports.

Disclaimer: This article is for informational purposes only. Investment amounts and regulations are subject to change. Always consult with a qualified immigration professional before making investment decisions.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure