EB-5 Visa Options

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

The EB-5 Immigrant Investor Program is a leading pathway for global investors seeking U.S. permanent residency. By investing in qualifying U.S. projects and creating jobs, foreign nationals and their families can secure green cards and, eventually, U.S. citizenship. This guide explores the latest EB-5 investment options, their benefits, risks, and how to choose the right path for your immigration and financial goals.

For a broader perspective on global investment migration, visit the WorldPassports citizenship by investment overview.

- The EB-5 visa offers two main investment routes: direct investment and regional center projects.

- Minimum investment is $1,050,000, or $800,000 for projects in Targeted Employment Areas (TEAs).

- Direct investments offer more control; regional center projects are passive and pooled.

- Choosing the right EB-5 project depends on your risk tolerance, involvement preference, and investment strategy.

- Professional guidance and thorough due diligence are essential for success.

Are you wondering about different EB-5 investment options?

As your expert guide in this intricate landscape, we offer a thorough examination of EB-5 direct investments and EB-5 regional center investments, helping you comprehend their benefits, risks, and potential for returns.

In This Article, You Will Discover:

Rest assured, our comprehensive analysis, coupled with actionable advice, will empower you to make informed decisions, leading you closer to your goals.

Read on and let us guide the way…

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

What Types of Projects Qualify for the EB-5 Investor Visa?

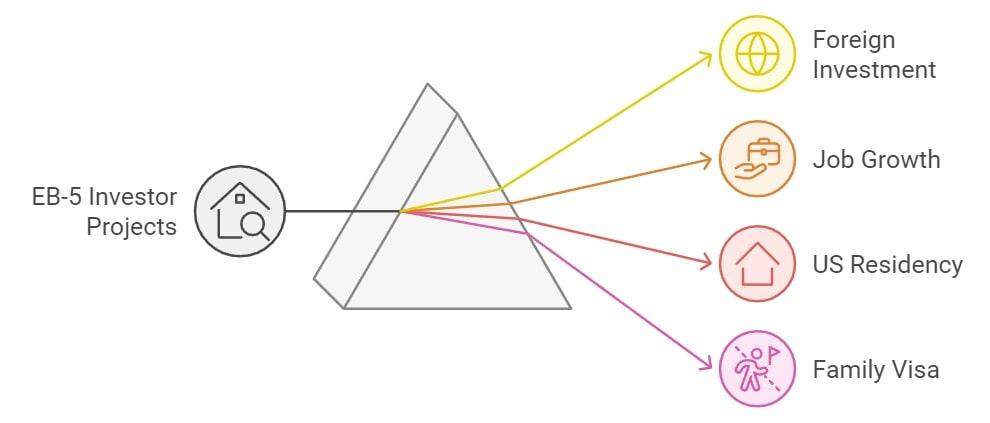

EB-5 investor projects are designed to stimulate the U.S. economy and create jobs. Understanding the requirements and benefits of these projects is crucial for making an informed decision.

Overview & Purpose

- Encourage foreign investment in the U.S.

- Stimulate job growth by requiring the creation of at least 10 full-time jobs for U.S. workers.

Requirements & Benefits

- Minimum investment: $1,050,000, or $800,000 in a TEA.

- Job creation: At least 10 full-time jobs for qualified U.S. workers.

- Benefits: Permanent U.S. residency, ability to live and work anywhere in the U.S., and inclusion of immediate family members.

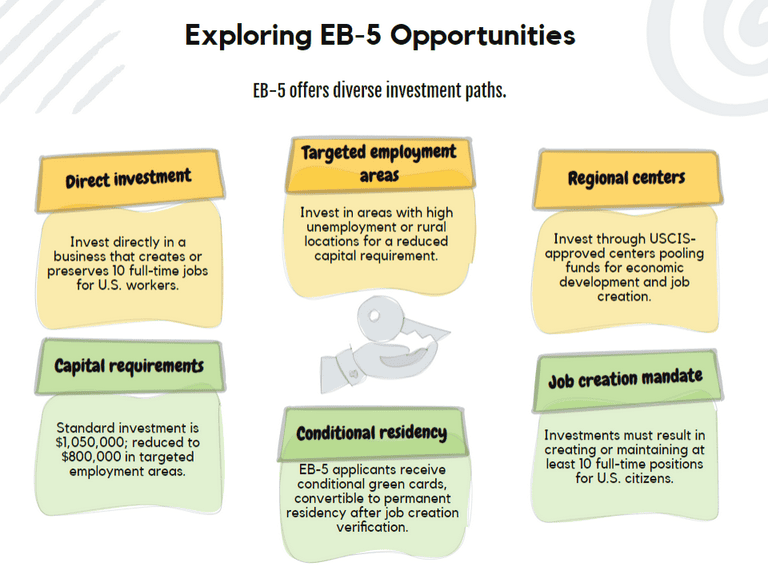

Main EB-5 Visa Investment Options

Choosing between direct and regional center investments is a pivotal decision. Each option has unique structures, requirements, and risk profiles.

Direct Investment

Direct investment means investing directly into a new or existing business. You must be actively involved in management and are responsible for meeting the job creation requirement through direct employment.

- Best for: Investors seeking control and hands-on involvement.

- Industries: Real estate, technology, hospitality, and more.

- Risks: Higher operational and financial risk, as success depends solely on the business’s performance.

Regional Center Investment

Regional centers are USCIS-approved entities that pool funds from multiple investors to finance large-scale projects. These investments are passive, and job creation can include direct, indirect, and induced jobs.

- Best for: Investors seeking a hands-off approach.

- Benefits: Easier job creation, risk is spread among multiple investors, and professional management.

- Risks: Less control over the project, but often more stable and compliant with EB-5 requirements.

For more on this structure, see the EB-5 regional centers guide.

Understanding Loan vs. Equity Models in Regional Center Investments

Regional center projects typically offer two investment models: loan-based and equity-based. Knowing the differences helps you align your investment with your risk and return preferences.

Loan Model

- Structure: Your funds are pooled and loaned to the project developer.

- Benefits: More predictable repayment timeline, lower risk, but typically lower returns.

- Exit strategy: Clearer, as loans are repaid at maturity.

Equity Model

- Structure: You acquire an ownership stake in the project.

- Benefits: Potential for higher returns if the project succeeds, but repayment is less predictable.

- Risks: Higher risk, as returns depend on project profitability and market conditions.

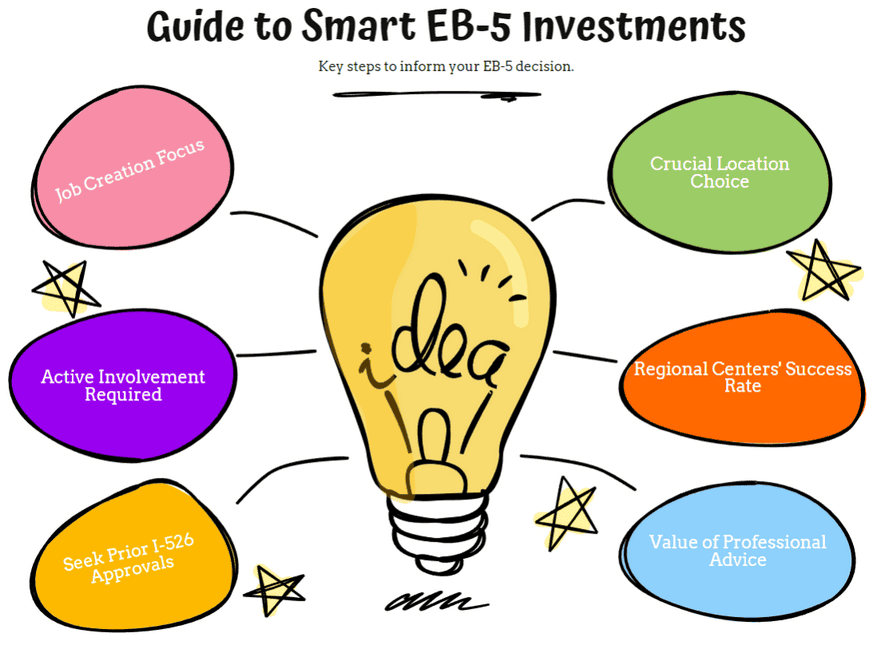

How to Evaluate and Choose the Best EB-5 Investment Option

Selecting the right EB-5 project requires a structured approach and careful research. Here’s how to make a confident, informed choice.

Key Considerations

- Job creation: Ensure the project can create the required jobs.

- Location: TEA projects offer lower investment thresholds and may have faster processing.

- Involvement: Decide if you want to be hands-on (direct) or passive (regional center).

- Track record: Review the success rate of the regional center or business.

- Business plan: Assess the project’s financials, timeline, and feasibility.

- Professional guidance: Work with experienced EB-5 advisors and legal counsel.

Due Diligence Tips

- Management team: Investigate the experience and track record of project leaders.

- Financials: Review audited statements, cash flow projections, and funding sources.

- Job creation methodology: Understand how jobs will be counted (direct, indirect, induced).

- Exit strategy: Ensure there’s a clear plan for return of capital.

- Compliance: Confirm the project meets all USCIS and securities regulations.

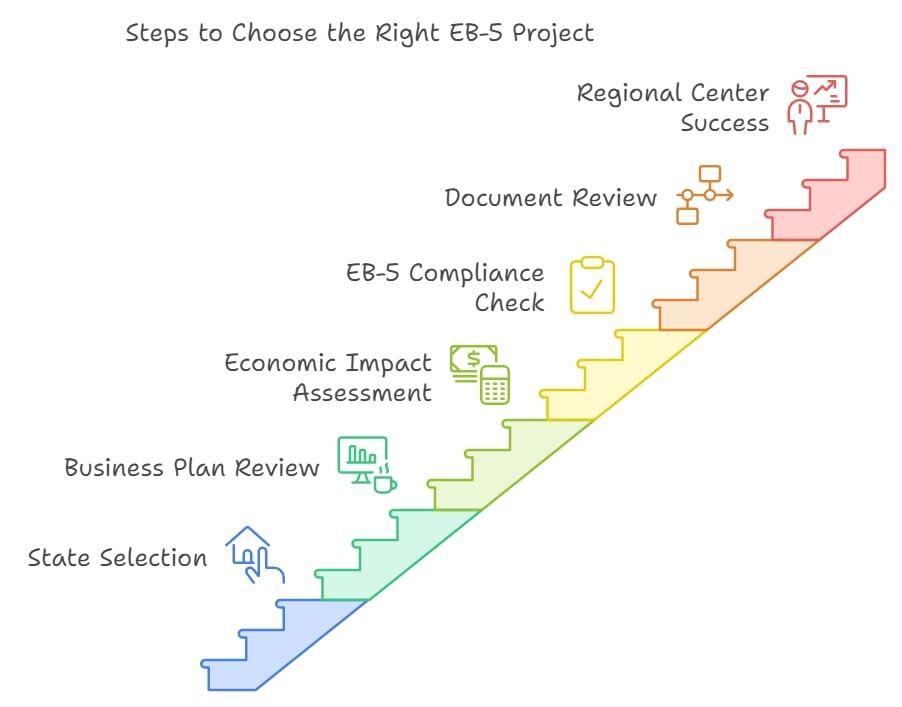

6 Essential Steps to Selecting the Right EB-5 Project

A step-by-step approach can help you navigate the complex EB-5 landscape:

- Choose your preferred state: Consider economic growth, job market, and personal lifestyle.

- Review the business plan: Look for clear timelines, budgets, and job creation strategies.

- Assess economic impact: Favor projects with strong local economic benefits.

- Ensure EB-5 compliance: Verify job creation and capital investment requirements.

- Review development documents: Analyze all legal and financial paperwork.

- Check regional center success: Evaluate past project outcomes and investor approvals.

EB-5 Investment Trends and Demand in 2025

Staying updated on EB-5 trends helps you make strategic decisions. In 2025, demand is rising from emerging markets like Vietnam, Latin America, and the Middle East, while China and India remain top sources. Visa retrogression and set-aside categories are key factors influencing wait times and project selection. Investors are increasingly favoring rural TEA projects for faster processing and lower investment thresholds.

Comparing EB-5 to Other Global Investment Migration Programs

The EB-5 program is just one of many global residency-by-investment options. If you’re exploring alternatives, consider programs in Europe, the Caribbean, or the Middle East. Each offers unique benefits, investment thresholds, and timelines. For a comparison of affordable options, visit the cheapest citizenship by investment programs.

Common Questions

How Involved Must I Be in the Management of My EB-5 Investment?

What’s the Best Investment Option for EB-5?

Do EB-5 Investors Get Their Money Back?

How Risky Is EB-5?

How Much Should I Invest in EB-5 to Get a Green Card?

Can I Take Out a Loan & Invest in EB-5?

What Happens If an EB-5 Investment Fails?

Can I Apply for the EB-5 Visa While on the H-1B Visa?

In Conclusion

The EB-5 visa program offers a flexible, powerful route to U.S. residency for global investors. By understanding the differences between direct and regional center investments, evaluating loan vs. equity models, and conducting thorough due diligence, you can make a confident, informed decision. For more insights and the latest updates, explore the EB-5 visa investment options hub.

Disclaimer: This article is for informational purposes only. Investment amounts and regulations are subject to change. Always consult with a qualified immigration professional before making investment decisions.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure