How Can I Invest in Real Estate in Another Country?

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Initial steps involve researching market trends, legal frameworks, and investment opportunities in the target country, along with consulting real estate professionals.

- Due diligence is crucial, encompassing property inspections, title checks, and understanding local property laws and tax implications.

- Financing options for international investments might include local bank mortgages, international lenders, or personal funds, each with specific requirements and rates.

- Navigating foreign laws demands familiarity with purchase processes, ownership restrictions, and tax liabilities, often requiring legal assistance.

- Best practices include engaging local experts, considering property management services for rental investments, and staying informed about geopolitical and economic changes that could affect property values.

Do you want to invest in real estate abroad?

The seasoned team at WorldPassports will walk you through the essential rules and steps to investing in international real estate.

From defining your investment objectives to navigating local regulations and managing your property, we cover everything you need to know to make informed decisions in the global real estate market.

In This Article, You Will Discover:

So, let's dive into the world of global real estate investment and equip you with the knowledge to expand your investment portfolio globally.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

Rule 1: Evaluate Your Investment Goals

Investing in global real estate can be daunting, so it’s important to start at the top and evaluate your investment goals.

Our team will break this down for you.

Define Your Investment Goals

Before investing in real estate in another country, take time to define your investment goals.

Having well-defined objectives will guide your decision-making process and help you choose properties and strategies that align with your financial goals.

Determine whether you prioritize long-term capital appreciation, consistent rental income, or a combination of both.

Diversification in Your Investment Portfolio

Including international real estate in your investment portfolio is crucial for diversification.

By investing in properties across different countries and regions, you reduce the risk associated with having all your investments tied to a single market.

But wait, there’s more…

Diversification allows you to balance property types and geographic locations, making your overall investment strategy more robust and resilient to market fluctuations.

It provides a buffer against economic downturns in any specific region and potentially enhances your overall portfolio performance over the long term.

Rule 2: Understanding the Basics of Real Estate Investing

Understanding the basics of real estate investing means that you should consider all the benefits and risks.

Real estate can be a tangible and potentially highly profitable asset if you understand it well.

Our team has done the research for you so that you can have all the information you need in one place.

Let’s look at the main benefits and risks below.

12 Benefits of International Real Estate

International real estate comes with a long list of benefits.

Take a look:

- Diversification of your investment portfolio: Investing in real estate in another country allows you to diversify your investment portfolio beyond your domestic market. This diversification can provide a hedge against economic and market fluctuations in your home country.

- Higher potential for returns: Some international markets may offer higher potential returns compared to your domestic real estate market. Emerging markets, for instance, may experience rapid growth and appreciation, which leads to attractive returns on investment.

- You’ll gain access to growing markets: Investing internationally grants you access to real estate markets in countries with booming economies and rapidly expanding populations. These markets may present lucrative opportunities for property appreciation and rental income.

- Currency diversification: Owning real estate in another country means holding assets denominated in a foreign currency. This can act as a hedge against currency risk and add an additional layer of diversification to your overall investment strategy.

- Leveraging tax advantages: Some countries offer attractive tax incentives to foreign investors, such as lower property taxes or exemptions on rental income. Taking advantage of these tax benefits can boost your overall return on investment.

- Global citizenship and residency options: Some countries offer investor visa programs that grant residency or even citizenship to individuals who invest a certain amount in real estate. This can provide access to a new lifestyle and additional travel opportunities.

- Personal use and vacation homes: Global real estate can offer the opportunity to own a vacation home in a desirable location, providing you with a place to escape to while potentially generating rental income during periods of non-use.

- Hedging against political and economic risks: Diversifying your assets across different countries can help mitigate risks associated with changes in government policies, economic instability, or social unrest that may affect your investments in a single country.

- Expanding network and knowledge: Engaging in international real estate investment exposes you to a new network of investors, professionals, and industry practices, broadening your knowledge and understanding of global markets.

- Potential for bargain deals: In some international markets, you may find properties priced significantly below their market value due to economic conditions or seller motivations. This presents opportunities for bargain purchases and the potential for substantial long-term gains.

- Asset protection and privacy: Owning real estate in a foreign country can offer increased privacy and asset protection, shielding your international assets from legal issues or liabilities in your home country.

- Contributing to economic growth: International real estate investment can contribute to economic growth and development in the host country by creating jobs, stimulating local businesses, and enhancing infrastructure. It's essential to conduct thorough research, seek professional advice, and understand the legal and regulatory aspects before venturing into international real estate investment.

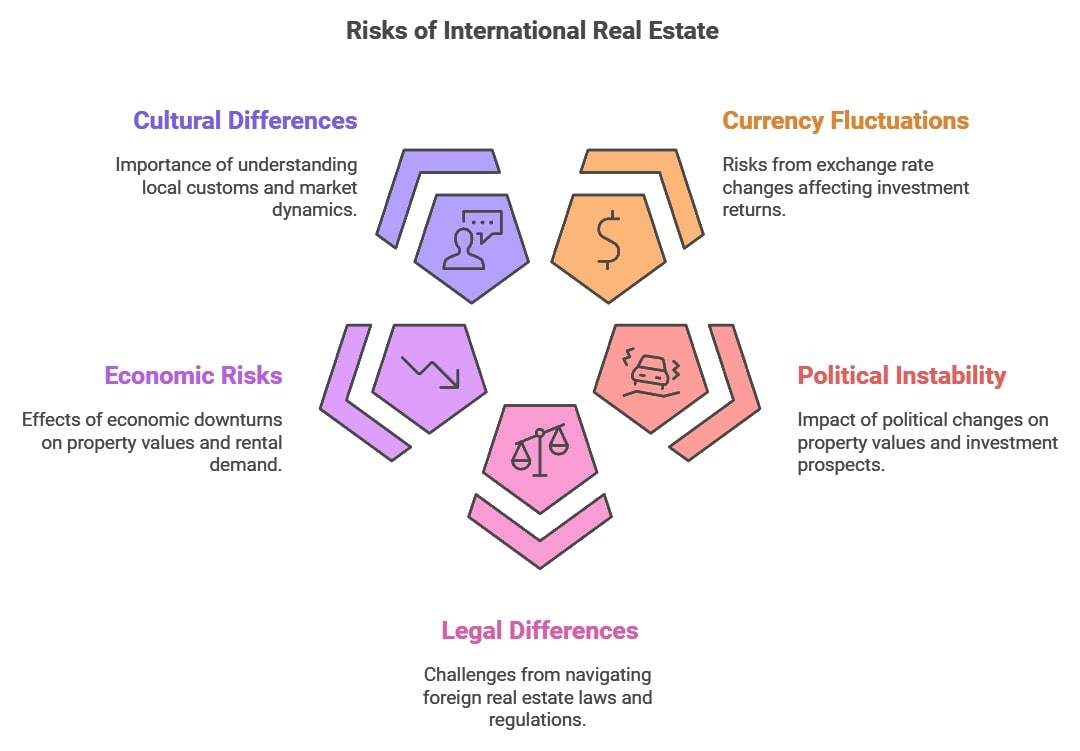

14 Risks of International Real Estate

International real estate investment also comes with some risks, and understanding these risks is crucial to ensure you make informed decisions about your real estate investment.

Read on.

- Currency fluctuations: Investing in real estate in another country exposes you to currency risk. Exchange rate fluctuations can impact the value of your investment and potentially reduce your returns when converting foreign currency profits back to your domestic currency.

- Political and geopolitical instability: Geopolitical factors, such as political instability, changes in government policies, or social unrest, can significantly impact the real estate market in the host country. Sudden shifts in the political landscape can also lead to uncertainties and affect property values and investment prospects.

- Legal and regulatory differences: Each country has its own set of real estate laws, regulations, and property rights. Navigating unfamiliar legal systems can be complex and may result in unforeseen challenges or difficulties in property acquisition, ownership, or dispute resolution.

- Economic risks: The economic stability and performance of the host country play a crucial role in real estate investment outcomes. Economic downturns, recessions, or financial crises in the country can negatively impact property values, rental demand, and overall investment viability.

- Cultural and market differences: Understanding the local culture, customs, and market dynamics is vital for successful international real estate investment. Misinterpretation of cultural norms or failure to adapt to local market preferences can affect property management and rental strategies.

- Lack of market knowledge: Investing in a foreign real estate market without adequate research and knowledge can lead to poor investment decisions. It's crucial to familiarize yourself with the local real estate landscape, property trends, and demand-supply dynamics.

- Management and distance challenges: Owning property in another country can be logistically challenging, especially if you reside far away. Managing the property, overseeing maintenance, and handling tenant-related matters from a distance may require additional effort and expenses.

- Transaction and ownership costs: International real estate transactions may involve higher costs, including taxes, fees, and legal expenses. Additionally, owning property in a foreign country may entail ongoing expenses for compliance, property management, and maintenance.

- Market volatility and liquidity concerns: Real estate markets in some countries may experience higher volatility with limited liquidity. Selling the property during unfavorable market conditions could lead to extended holding periods or potential losses.

- Potential scams and fraud: Being unfamiliar with local practices and regulations puts investors at a higher risk of falling victim to scams or fraudulent activities, making due diligence and verification essential.

- Expropriation and political changes: In extreme cases, there might be a risk of government expropriation of property or changes in property ownership laws that could affect your investment.

- Unforeseen natural disasters: Properties located in certain regions may be exposed to natural disasters like earthquakes, hurricanes, or floods, leading to potential property damage and financial losses.

- Limited legal recourse: In some countries, legal recourse for foreign investors may be limited, making it challenging to enforce property rights or resolve disputes through the legal system.

Rule 3: Choose the Right Country for Your Investment

Before you invest internationally, you need to evaluate potential countries for your real estate investment.

You should thoroughly research potential countries by considering factors like market stability, economic growth, and the legal framework for foreign investors like you.

Let’s dive in.

Key Economic Indicators to Consider

When investing in real estate in another country, it’s essential to analyze key economic indicators, such as GDP (gross domestic product) growth, inflation rates, and employment trends.

These indicators provide valuable insights into the country's economic health and growth prospects.

A stable and growing economy typically indicates a favorable investment environment with potential for property appreciation and rental demand.

Political Indicators to Consider

In addition to economic factors, political stability and favorable regulations play a significant role in creating a secure investment environment.

Assess the country's political landscape and stability to ensure a lower risk of unexpected policy changes or disruptions that could impact your investment.

What’s more

Favorable regulations for foreign investors - such as clear property ownership rights and investor-friendly policies - further enhance the attractiveness of the market for international real estate investment.

A politically stable and investor-friendly environment can provide greater confidence and security in your investment decisions abroad.

Rule 4: Do the Groundwork

It’s important that you do the groundwork to understand the local real estate laws and regulations in your preferred country,

Familiarize yourself with local property laws, ownership rules, and restrictions relevant to foreign buyers.

Our global citizenship experts have done some of this groundwork for you:

Property Rights & Land Ownership Rules

Each country has its own legal framework governing property ownership, and it can vary significantly from what you are familiar with in your home country.

Our research shows

Some countries may restrict foreign ownership of certain types of properties, while others may have complex regulations regarding land usage or leasing agreements.

To avoid potential disputes or legal issues, consult with a local real estate attorney who’s well-versed in the laws of the host country.

They can help you navigate the intricacies of property rights, ensure proper documentation, and clarify any ambiguities that might arise during the acquisition process.

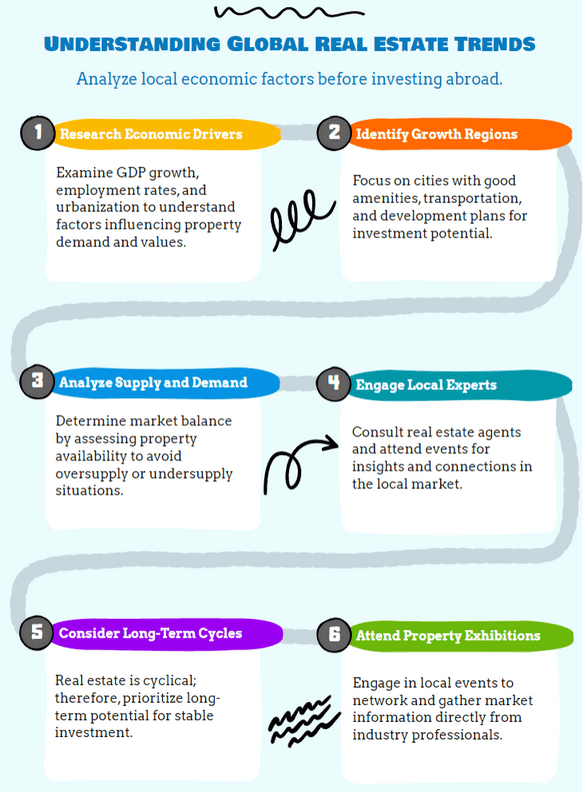

Local Real Estate Market & Trends

Before investing in real estate in another country, thoroughly research and analyze the local market conditions and trends.

Make sure you do the following:

- Understand the economic factors driving the real estate market: Look into key indicators such as GDP growth, employment rates, population trends, and urbanization patterns, as they all influence property demand and value.

- Identify the regions or cities that show strong potential for growth: Consider factors like proximity to essential amenities, transportation infrastructure, and planned developments.

- Examine the supply and demand dynamics in the market: Assess if there’s an oversupply or undersupply of properties.

- Engage with local real estate agents, property managers, or market experts: These professionals can provide valuable insights into market conditions. Also, attend local property exhibitions or networking events to gain a better understanding of the real estate landscape and to build relationships with professionals in the industry.

- Take a long-term perspective: Remember that real estate markets can be cyclical, so think long-term when assessing investment opportunities.

- Economic prospects: Look for areas with positive economic prospects and potential for future development to maximize your chances of a successful investment outcome.

Rule 5: Consider Financial Factors

If you want to establish a comprehensive budget, factor in acquisition costs, taxes, ongoing expenses, and potential currency fluctuations.

Below are some of the factors you need to consider:

Taxes & Investment Incentives

Different countries have varying tax laws and regulations that may affect your rental income, capital gains, and property ownership.1

Additionally, exploring any available investment incentives for foreign investors, such as tax breaks or special investment zones, can significantly enhance your overall return on investment.

Exchange Rates & Their Effect on Investment

Fluctuations in exchange rates can have a significant impact on the profitability of your international real estate investment.2

When your investment is denominated in a foreign currency, changes in exchange rates can either increase or decrease your returns when converting profits back to your home currency.

But wait, there’s more

Assessing currency risks and implementing hedging strategies, like currency futures or options, can help mitigate potential losses and protect your investment from adverse exchange rate movements.

Obtaining Financing for International Real Estate Investments

If you're considering international real estate investment but lack sufficient funds, exploring financing options is essential.

Investigate local mortgages and loans available in the host country, as they may offer favorable terms and interest rates for foreign investors.

Additionally

Cross-border financial arrangements, such as international partnerships or joint ventures, could provide alternative avenues for securing funding and sharing risks.

However, it's crucial to understand the terms and risks associated with any financing option thoroughly before proceeding with your investment.

Rule 6: Build a Local Network

If you have real estate in a foreign country, you’ll feel much more at ease if you have someone to help with all the responsibilities that come with real estate.

Get in touch with the following people:

Local Agents

Having reliable local partnerships and working with reputable real estate agents, developers, and property managers is crucial for a successful international real estate investment.

Think about it

These local experts possess in-depth knowledge of the market, property values, and rental demand, which can help you make well-informed decisions and avoid potential pitfalls.

Financial Experts

Establishing relationships with local legal and financial experts is highly advantageous when investing in international real estate.

Consulting with local attorneys and financial advisors will provide you with invaluable guidance on navigating complex regulations, tax implications, and transaction processes in the foreign market, ensuring a smoother and more secure investment journey.3

Rule 7: Find & Purchase the Right Property

You want to be sure that you find and buy the right property, so you’ll need to do some research.

Below are some ways to find your property:

How to Search for International Real Estate Opportunities

There are a few key methods by which you can search for international real estate opportunities.

Take a look:

- Utilize reputable real estate websites: Websites that specialize in international properties often offer filters and search criteria specific to your desired location, property type, and budget.

- Attend international property expos and real estate conferences: These events, which take place both in person and online, provide a chance to meet developers, agents, and other investors, offering valuable insights into emerging markets and investment opportunities.

- Leverage your existing local network and connections: Friends, family, or colleagues may have experiences or recommendations regarding international real estate investments, and their insights can be valuable.

- Experienced local real estate agents: Agents specializing in international properties can help you navigate the market, provide localized market insights, and present you with suitable property options.

Navigating the Property Purchase Process

Engage a trustworthy local real estate attorney who’s familiar with the laws and regulations of the target country.

They’ll guide you through the legal intricacies of the property purchase process and ensure your interests are protected.

Your attorney should review the purchase contract before you sign it.

Also

Ensure all terms and conditions align with your agreed-upon terms, and seek clarification on any ambiguous clauses.

Use secure payment methods and consider utilizing an escrow service4 to safeguard your funds until the purchase transaction is completed.

Doing Due Diligence: Inspections, Appraisals, & Surveys

You can hire a qualified local inspector to thoroughly assess the property's condition.

This inspection can uncover any hidden issues or necessary repairs that could impact your investment decision.

Obtain an independent appraisal to determine the property's fair market value, as this ensures you’re paying a reasonable price and prevents overpaying for the property.

If applicable, you need to conduct surveys to verify property boundaries and any potential encroachments or boundary disputes.

This step helps avoid legal issues and boundary conflicts in the future.5

Why?

Remember, international real estate investment can be complex, and seeking professional advice at every step is vital to making informed decisions and safeguarding your investment.

Rule 8: Manage Your International Property

If you’re buying real estate in a different country, you might be wondering how you’ll manage it.

Let’s have a look at ways you can manage your property:

11 Key Strategies for Remote Property Management

If you want to manage your global property effectively from another country, you need to follow these strategies.

Effective remote management strategies to implement:

- Hiring a local representative

- Building a trusted local team

- Having a tenant screening solution

- Getting a digital document signing tool

- Creating easy ways of communicating

- Managing rent payments online

- Creating a tenant portal

- Automating bookkeeping

- Enforcing the rules

- Scheduling property visits

- Installing surveillance cameras

Hiring Local Property Management

Consider the benefits and drawbacks of hiring local property managers to handle the day-to-day operations of your international real estate investment.

On the positive side, having a local expert can ensure efficient tenant management, property maintenance, and timely rent collection.

However

It's essential to evaluate the costs involved and determine if managing the property remotely or through periodic visits would be a more cost-effective and viable option.

Dealing with Maintenance, Insurance, & Other Logistics

As a property owner, you must address maintenance needs promptly and secure suitable insurance coverage to protect your investment from potential risks.

Handling logistical aspects, such as property taxes, utility payments, and compliance with local regulations, is crucial for the smooth operation of your investment.

If you’re not physically present in the country, consider enlisting the help of a reliable local representative to manage these tasks effectively and ensure your property remains well-maintained and compliant with all necessary requirements.

Rule 9: Figure Out Your Exit Strategy

Here's a scenario: you’ve had a great time owning international real estate, but it suits you better to do something else with the property - what do you do?

You need a clear exit plan.

Consider whether you want to sell, hold, or reinvest in the property.

If you want to sell, you’ll need to become familiar with the selling process in that foreign country.

Let’s dive into the exit process:

Navigating the Property Selling Process in a Foreign Country

Selling property abroad might sound daunting, but it doesn’t need to be.

Follow the steps below to guide you:

- Understanding the ins and outs: Comprehend the process of selling real estate in the country and research any tax implications that might be involved.

- Do your bit: Research the necessary documentation, legal requirements, and any restrictions that may apply to foreign sellers.

- Avoid surprises: Inquire about potential tax implications to avoid surprises and ensure a smooth and compliant sale.

- Ask for help: Seeking guidance from a local real estate agent can provide valuable insights into the process and help you make informed decisions throughout the selling journey.

Capital Gains & Other Tax Considerations Upon Sale

Be aware of potential capital gains taxes and other tax obligations upon selling the property. Then, you can feel assured about your real estate investment abroad.

Capital gains taxes are typically imposed on the profit earned from the sale of the property, so knowing the applicable rates and regulations is essential for accurate financial planning.

Why’s this important?

Understanding your tax liabilities in advance will provide peace of mind and allow you to factor in these costs when evaluating the overall returns on your international real estate investment.

Consult with local tax experts or accountants to help you navigate the tax landscape and ensure compliance with all relevant tax laws.

Common Questions

Can You Buy Property in Another Country Without Being a Citizen?

Is It a Good Idea to Invest in Real Estate Overseas?

Is International Real Estate Profitable?

What’s the 2 Percent Rule in Real Estate Investing?

What’s the 1 Percent Rule in Real Estate Investing?

How Can I Protect My Real Estate Investment in a Foreign Country?

How Does the Foreign Exchange Rate Affect My Real Estate Investment?

What Should I Know About the Local Culture & Regulations When Investing in Real Estate in Another Country?

Which Country Is Safest for Real Estate Investment?

Which Property Is the Best Investment?

Where’s the Cheapest Place to Buy a House Abroad?

What Type of Investment Property Is Best for Beginners?

Can I Invest in Real Estate Without Buying Property?

In Conclusion

Investing in international real estate can offer diversification and financial rewards, but it requires comprehensive research, meticulous planning, and some local expertise

By adhering to these essential rules, you can navigate the complexities of global real estate markets and make informed decisions for a successful investment journey.

Our expert advice is that you should conduct thorough research, work with local experts, and seek professional advice to make informed decisions and maximize the potential benefits while minimizing the associated risks.

If you’re interested in browsing through possible countries where real estate purchasing is popular, see our list.

Learn More: Real Estate Investment

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure