International Real Estate Risks

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Investing in international real estate involves several main risks, including market volatility, which can be influenced by local economic conditions and political stability, potentially affecting property values and rental yields.

- Political risk is a significant consideration, as changes in government policies, land ownership laws, or political instability can impact the safety and profitability of investments. Investors can mitigate this risk by diversifying their investment locations and staying informed about local political developments.

- Currency risks arise from fluctuations in exchange rates, which can affect the value of investments and returns. Hedging strategies and investing in countries with stable currencies can help manage this risk.

- Market and liquidity risks involve the potential difficulty in selling or renting out the property due to various factors, such as economic downturns or oversupply in the market. Thorough market research and selecting properties in high-demand areas can mitigate these risks.

- Legal risks must be considered, as laws regarding property ownership, taxes, and tenant rights vary by country. Engaging local legal experts and conducting thorough due diligence are critical steps in navigating these challenges.

International real estate investing has become increasingly popular as investors seek new opportunities to diversify their portfolios and capitalize on global market trends.

However, venturing into foreign markets comes with its own set of unique challenges and risks for investors.

Lucky for you, our seasoned WorldPassports team has scoured the web and chatted with investment gurus and actual real estate investors to uncover the risks of investing in international real estate.

In This Article, You Will Discover:

Without further ado, let’s take a closer look at the specific risks of investing in international real estate and how we believe you can navigate them successfully.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

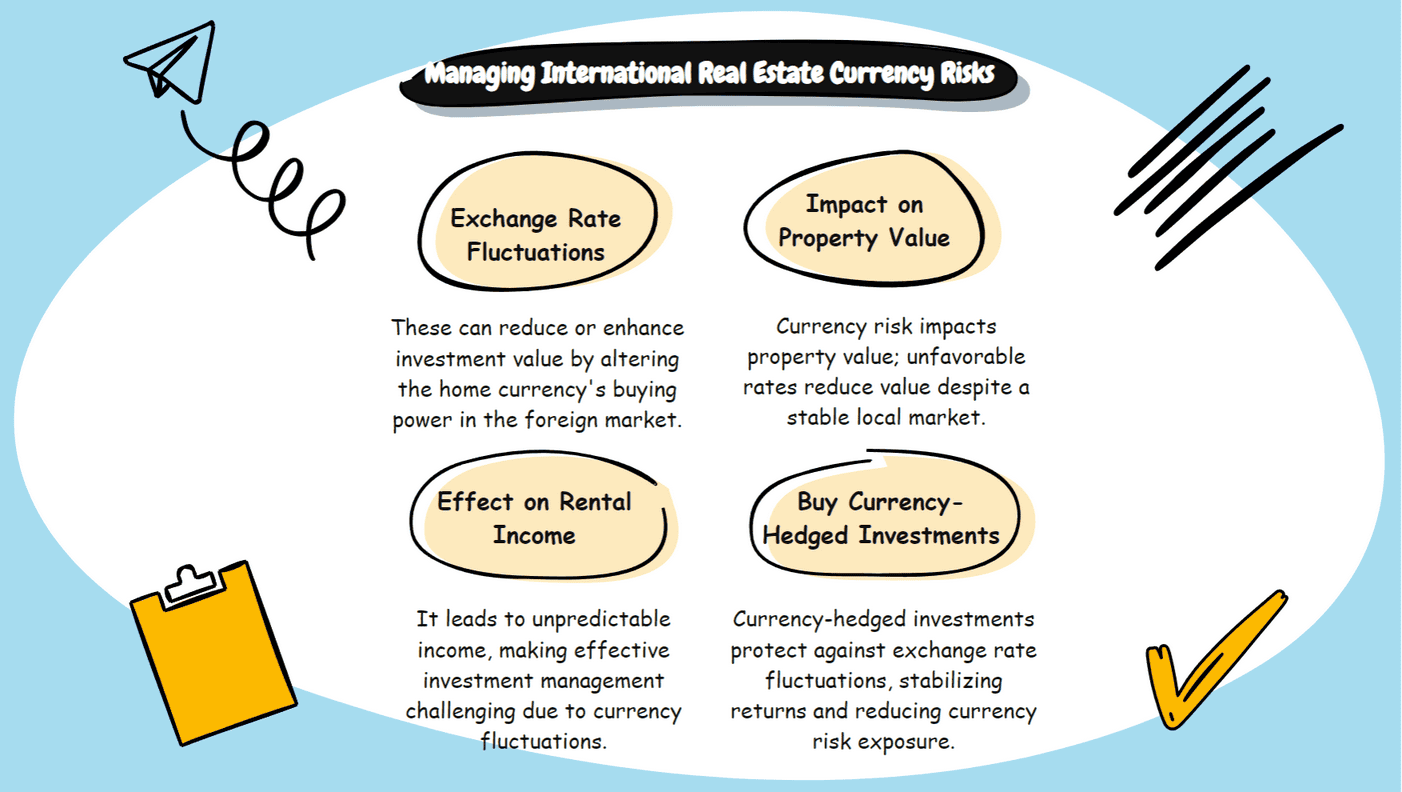

Currency Risks

As you venture into the world of international real estate, one of the first risks you'll encounter is currency risk.

This financial challenge can have a significant impact on your investment's profitability and even viability.

Let’s take a closer look at what currency risks entail.

How Do Exchange Rate Fluctuations Affect Investments?

Exchange rate fluctuations can greatly influence the value of your investment as they determine the buying power of your home currency in the foreign market.

When the exchange rate shifts unfavorably, your property's value and potential income may decrease, even if the local market remains stable.

Conversely, favorable exchange rate movements can boost your returns.

What’s the Impact of Currency Risk on Property Value & Rental Income?

Currency risk can directly affect both property values and rental income.

If your home currency weakens against the foreign currency, the value of your property in your home currency will increase, but so will your mortgage payments, which could offset potential capital gains.

Moreover, if rental income is received in a foreign currency, fluctuations can lead to unpredictable income, making it challenging to effectively manage your investment.

How Can Investors Mitigate Currency Risk?

To reduce currency risks, investors can utilize numerous strategies.

Here are a few strategies for you to consider:

- Buy currency-hedged investments.

- Use forward contracts to secure exchange rates.

- Spread your investments across multiple countries and currencies.

- Work with experienced financial advisors and real estate agents.

Political Risks

Another challenge in international real estate is political risk.

It's essential to understand how political factors can affect your real estate investment and take steps to minimize potential impacts.

Take a look at what you need to know about political risks below.

How Does Political Stability Affect the Real Estate Market?

Political stability plays a crucial role in the health of the real estate market.

In stable countries, property values and rental incomes are more likely to grow consistently over time.

However, in politically unstable regions, property values may fluctuate or even decline, and investors might face difficulties managing their assets.1

Real estate investment in a politically stable country is essential to ensuring your investment is safeguarded against political instability.

Potential Shifts in Government Policies & Property Rights Regulations

Changes in government policies and property rights regulations can significantly impact your international real estate investment.

New laws or regulations may alter taxation, property ownership rules, or rental income regulations, affecting your investment's profitability in the long run.

Keeping an eye on local politics and staying informed about potential changes is vital for successful real estate investing.

How Can Investors Assess Political Risk?

There are several ways that investors can assess their investments' political risk.

These strategies include:

- Researching the political climate of the country you're considering investing in, focusing on factors like government stability, corruption levels, and property rights protections.

- Consulting local experts or hiring a political risk analyst can provide valuable insights into the specific risks associated with your target market.

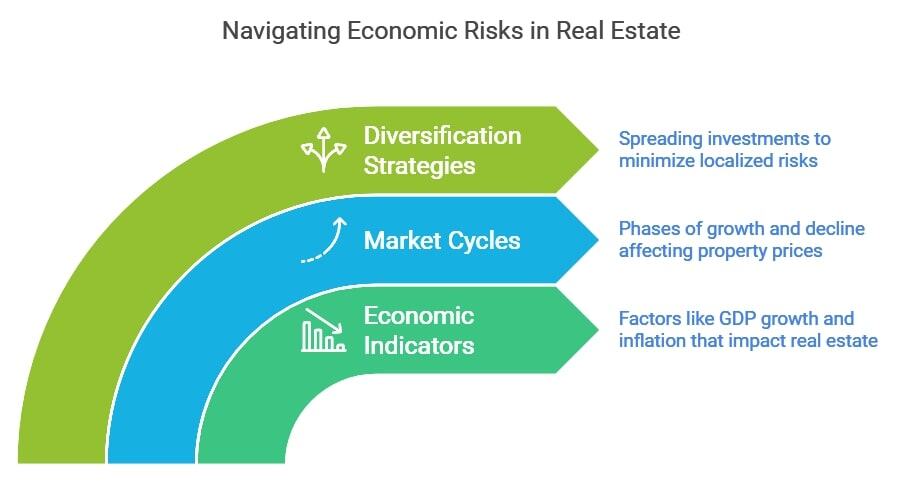

Economic Risks

A country’s economy and economic indicators are essential factors to consider when considering international real estate investment.

Understanding how economic factors can influence your investment will help you make informed financial decisions and protect your investment interests.

Here’s everything you need to know about the economic risks of international real estate investment:

Which Economic Indicators Impact Real Estate Investments?

Various economic indicators can impact real estate investments, such as GDP growth, unemployment rates, inflation, and interest rates.2

These factors can affect property values, rental demand, and overall market conditions.

Monitoring these indicators can help you gauge a country's economic health and predict potential changes in the real estate market, safeguarding your investment against economic risks.

How Do Market Cycles Influence Property Prices?

Market cycles, which consist of periods of growth, stagnation, and decline, can significantly influence property prices.

During growth phases, property values typically rise, while during downturns, they may decrease.

Recognizing and understanding market cycles can help you identify the best times to buy or sell properties and maximize your returns.

How Can Diversifying Investments Minimize Economic Risk?

Diversifying investments is an effective strategy to minimize economic risk.

By spreading your investments across different countries, property types, and even asset classes, you can reduce the impact of localized economic downturns or market fluctuations on your portfolio.

This approach will help you protect your investments from potential losses due to adverse economic events.

Legal & Regulatory Risks

Legal and regulatory risks are yet another essential aspect to consider when investing in international real estate.

Being aware of these risks can help you make better decisions and protect your investment.

Let’s take a closer look at what these legal and regulatory risks entail.

How Can Differences in Legal Systems Affect International Real Estate Investors?

Differences in legal systems between countries can have significant implications for international real estate investors.

Property rights, contract enforcement, and dispute resolution processes can vary greatly, which may negatively affect the security of your investment and your ability to manage it effectively.

As such, understanding the local legal system of your international investment is crucial to safeguarding against potential legal or regulatory risks.

Are There Property Ownership Restrictions for Foreigners?

Yes, in some countries, there may be property ownership restrictions for foreigners, such as limits on the type or amount of property that can be purchased or requirements to obtain government approval before buying.

These restrictions can impact your investment options and the overall feasibility of investing in a specific market.

Researching local regulations and consulting with local experts can help you identify viable real estate and navigate foreign ownership restrictions with ease.

How Can Investors Navigate Local Laws & Regulations?

Investors can navigate local laws and regulations successfully by conducting thorough research on the target market's legal framework and seeking advice from local professionals, such as real estate agents, lawyers, and accountants.

These experts can provide valuable insights into local regulations, help you understand your rights and obligations as a foreign investor, and guide you through the process of purchasing and managing your international investment.

By staying informed and working with knowledgeable professionals, you can overcome legal and regulatory risks, ensuring a smooth investment experience.

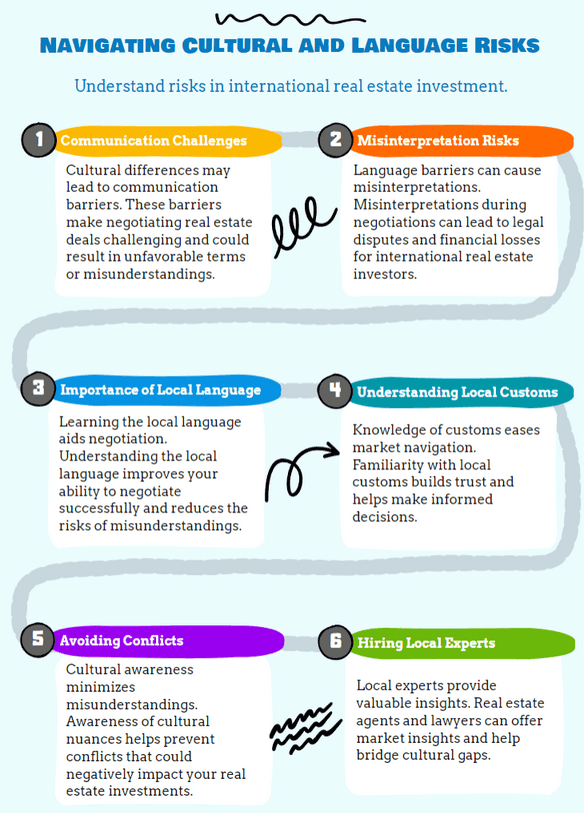

Cultural & Language Risks

Cultural and language risks are equally important for investors to consider when investing in international real estate, particularly if you're looking to live in the country for any period.

Scroll on to find out what you need to know about cultural and language risks.

Communication & Negotiation Risks for Investing in International Real Estate

Cultural differences and language barriers can create communication challenges when investing in international real estate.

Misunderstandings or misinterpretations during negotiations may lead to unfavorable deals or even legal disputes.

Developing strong communication skills and learning the local language can help mitigate these risks and improve your ability to negotiate and invest successfully in a foreign country.

Why’s Understanding Local Customs & Practices Important?

Understanding local customs and practices is important because it’ll allow you to navigate the local market more effectively, build trust with local partners, and make better-informed financial decisions.

Being aware of cultural nuances can also help you avoid potential misunderstandings or conflicts, which could negatively impact your investment.

How Can Hiring Local Experts Benefit Investors?

Hiring local experts, such as real estate agents, lawyers, and property managers, can benefit investors by providing invaluable insights into the local market and helping to overcome cultural and language barriers.

These professionals can guide you through the entire investment process, from identifying suitable properties to managing your assets effectively.

By leveraging their expertise, you can ensure a smooth investment experience and increase your chances of success in the international real estate market.

Property Management Risks

Managing your overseas property will come with its own set of risks and challenges, too.

Developing strategies to overcome these challenges can help ensure the success of your international real estate investment.

Allow us to tell you more about property management risks below.

How Can Investors Find Reliable Property Managers?

Investors can find reliable property managers by narrowing down an essential list of needs and priorities for managing your international property.

Finding a reliable property manager is crucial for the successful management of your international investment.

Conduct thorough research, seek recommendations from other investors or local professionals, and interview multiple candidates before making your decision.

Look for managers with a proven track record, strong communication skills, and proven experience working with international investors like yourself.

What Strategies Can Help Overcome Distance & Time Zone Differences?

The strategies to help overcome distance and time zone differences include clear communication channels and performing regular check-ins with your property manager.

Utilize technology, such as video calls and property management software, to stay updated on your property's condition and performance.

Additionally, consider scheduling visits to your property to maintain a hands-on approach and build stronger relationships with your property manager and tenants.

How Can Proper Maintenance & Tenant Management Be Ensured?

Ensuring proper maintenance and tenant management requires setting clear expectations with your property manager and establishing a well-defined maintenance plan.

Regular inspections and prompt attention to repairs can help prevent costly issues in the long run.

What’s more

For tenant management, develop a thorough screening process and work with your property manager to create fair and clear rental agreements.

By taking a proactive approach to property management, you can protect your investment and promote long-term success for your international investment.

Climate Change Risks

As climate change increasingly impacts our environment, it’s crucial for property investors to thoroughly assess the associated risks and implement strategies to mitigate them.

To effectively evaluate climate change risks in real estate investments, our experts have compiled the following recommendations:

- Allocate resources to adhere to evolving greenhouse gas (GHG) emissions and energy regulations.

- Determine the climate hazards most relevant to your property (e.g. hurricanes, rising sea levels, heatwaves, or extreme cold) and take appropriate precautions.

- Implement climate resilience measures such as floodgates or fire-resistant doors in your properties.

- Evaluate the broader community's climate change risks beyond your individual property.

- Plan for the long term by considering the investment duration, whether it be 5, 10, or 20 years.

- Understand that climate change data may be reported differently across sources, so choose providers based on metrics relevant to your portfolio.

Moreover

Experts recommend combining catastrophe models (insurance data) and climate risk models to devise a comprehensive assessment of the climate change risks pertaining to your property investments.

By analyzing both models, you can leverage historical, current, and future data to make informed decisions about climate change risks.

Common Questions

What Are the Disadvantages of Investing in a Foreign Country?

What Are Some Advantages of Foreign Investments?

Do Citizens Have to Declare International Real Estate Investment?

Which Country Is Safest for Foreign Investment?

Does Owning Foreign Property Affect Tax Liability?

In What Countries Can US Citizens Own Land?

Which US Banks Offer International Mortgages?

How Do Investors Identify Promising International Real Estate Markets to Invest In?

Are There Any Specific Industries or Sectors That Typically Drive Real Estate Growth in International Markets?

In Conclusion

Investing in international real estate can offer exciting opportunities for growth and diversification.

However, it's vital to take into account and prepare for the risks associated with real estate investment, especially when investing in the international market.

Our team at WorldPassports trusts that with the help of our comprehensive guide, you'll feel more confident and equipped to navigate the various risks associated with international real estate investment.

Now you're apprised of how to avoid the risks of investing in international real estate, you might be wondering about the top countries for real estate investment. We've got you covered.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure