Jersey Real Estate Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Key Takeaways

- Investing in Jersey real estate offers stability, high-quality properties, and potential tax benefits, attracting global investors to this premier offshore financial center.

- Foreigners investing must comply with regulations, which may include obtaining a license to purchase property, depending on their residency status and the property type.

- Tax benefits include no capital gains tax and competitive rates for property and income taxes, making it an attractive location for investment.

- The market is competitive with other offshore locations by offering a safe, politically stable environment and high-quality living standards, appealing to high-net-worth individuals.

- It can lead to residency under certain conditions, allowing investors to benefit from the island's tax advantages and strategic location between the UK and France.

With its unique blend of British and French influences and a currency that’s pegged at par with the British pound, a lucrative landscape awaits Jersey real estate investors.

You may be wondering about the intricacies of the property market in Jersey; we’ve got the answers you’re looking for!

We’ll illustrate how making a substantial investment can open doors to residency through real estate investment in Jersey.

In This Article, You Will Discover:

Whether you're simply looking to diversify your investment portfolio or seeking a pathway to residency, we’ve tailored this Jersey real estate article to navigate you through the process with clarity and confidence.

Let’s get into it…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

Why Should I Consider Investing in Real Estate in Jersey?

You should consider investing in real estate in Jersey for its strategic location, tax advantages, and exceptional quality of life.

Although the real estate market in Jersey is extremely competitive, Jersey has a diverse and growing economy, which supports the real estate market.1

A strong economy can lead to increased demand for both residential and commercial properties.

What’s more

The real estate market in Jersey offers a range of opportunities, from luxury properties to commercial real estate, catering to different investment strategies and budgets.

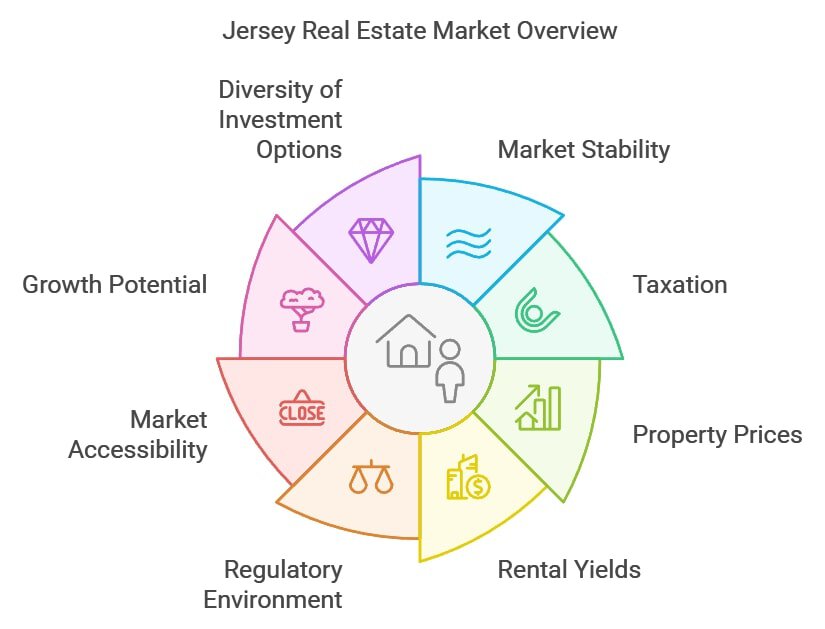

How Does the Real Estate Market in Jersey Compare With Other European Countries?

Jersey's real estate market is characterized by its exclusivity, stability, and unique lifestyle offerings, all of which set it apart from many other European real estate markets.

But that’s just the beginning.

Here’s our definitive summary of how the real estate market in Jersey compares with other European countries:

- Market stability: Compared to many European markets, Jersey typically offers greater stability, partly due to its mature market and robust legal framework.

- Taxation: Jersey stands out with its favorable tax regime. Unlike many European countries, it has lower tax rates and fewer regulations, making it an attractive option for investors seeking tax efficiency.

- Property Prices: Real estate prices in Jersey are generally higher than in many parts of Europe, reflecting its exclusivity, limited space, and high demand.

- Rental yields: While rental yields in Jersey are competitive, they may not always match the highest yields found in some European cities, especially those undergoing rapid development or regeneration.

- Regulatory environment: Jersey's real estate market is well-regulated, offering more security and transparency than some emerging markets in Europe.

- Market accessibility: The market in Jersey can be less accessible to foreign investors compared to some European countries due to strict local laws and regulations.

- Growth potential: While Jersey offers stable growth, some European markets, particularly in Eastern Europe or in cities experiencing significant investment and development, may offer higher growth potential.

- Diversity of investment options: Compared to larger European countries, Jersey has a smaller and less diverse real estate market, focusing mainly on high-end residential and commercial properties.

- Economic drivers: Unlike many European economies that have a broader industrial base, Jersey's economy is quite unique and driven by finance and services.

- Lifestyle and environment: Jersey offers a unique lifestyle with its blend of British and French influences, mild climate, and scenic beauty, which is different from the urban-centric lifestyle prevalent in many European cities.

Which Regions of Jersey Are Best for Real Estate Investment?

Each region in Jersey has its own unique characteristics and appeal, making it suitable for different types of real estate investment strategies.

Here are some key areas that our experts feel are prime for investment:

- St. Helier: As the capital and economic hub, St. Helier is a top choice for both residential and commercial investments. It offers a vibrant urban lifestyle, proximity to amenities, and generally higher rental demand.

- St. Brelade: Known for its beautiful beaches and high quality of life, St. Brelade is a popular area for luxury properties. It's ideal for investors looking for high-end residential real estate.

- Grouville: Offering a mix of rural charm and coastal beauty, Grouville attracts those seeking a quieter lifestyle. It's great for investment in family homes or properties that cater to a more relaxed living style.

- St. Aubin: This picturesque harbor area is highly sought-after for its unique character and charm. Properties here can be ideal for holiday rentals or high-end residential investments.

- St. Peter: Home to the Jersey Airport, St. Peter is a strategic location for commercial real estate investment and residential properties due to its accessibility and local amenities.

- St. Lawrence: Known for its rural interior and beautiful landscapes, St. Lawrence is attractive for those seeking a more secluded and tranquil setting. Investment here is typically focused on residential properties.

- Trinity: Popular for its rural atmosphere and community feel, Trinity can be a good choice for investing in family homes or properties that blend country living and proximity to urban areas.

Jersey Real Estate for Citizenship & Residency

Investing in real estate in Jersey, Channel Islands, comes with significant benefits.

You may be wondering whether those benefits include access to citizenship or residency in this exclusive jurisdiction.

Let’s see.

Can I Get Jersey Citizenship If I Invest in Jersey Real Estate?

No, you can’t get Jersey citizenship if you invest in Jersey real estate.

Citizenship in Jersey is obtainable only after 6 years of residence on the island.

Incidentally

Having a Jersey passport is on par with having a British passport, owing to the unique relationship between Jersey and Britain.

Will I Need to Become a Resident of Jersey to Buy Real Estate There?

Yes, you’ll generally need to become a resident of Jersey to buy real estate there (unless, of course, you're admitted to Jersey’s High Value Residency program).

Typically, foreigners are only eligible to buy property in Jersey if their status is “Entitled” or “Licensed”.

You’re an entitled immigrant if you’ve held 10 years of continuous residency on the island (prior to completion of that 10-year period, you’re considered a registered individual), and you’re considered a licensed individual if you’re an approved essential employee in Jersey.2

Can I Get Residency If I Invest in Jersey Real Estate?

Yes, you can get residency if you invest in Jersey real estate.

The way to do this is via Jersey’s residency by investment program, otherwise known as its High Value Residency (HVR) scheme.

The requirements to qualify for this scheme are extremely stringent, as it’s aimed at high-net-worth individuals who promise to bring an identifiable benefit to the island.

The real estate you invest in must be worth at least £1,750,000 (owned or rented), and your annual income must consistently exceed £725,000.

Are There Any Restrictions on Foreign Investment in Jersey Real Estate?

Yes, there are some restrictions on foreign investment in Jersey real estate.

As mentioned above, Jersey has a controlled housing market, so only foreigners who are deemed Entitled or Licensed can generally invest in Jersey real estate, with the exception being HVR holders.

Beside this, there are generally no restrictions on foreign investment in this Crown Dependency.

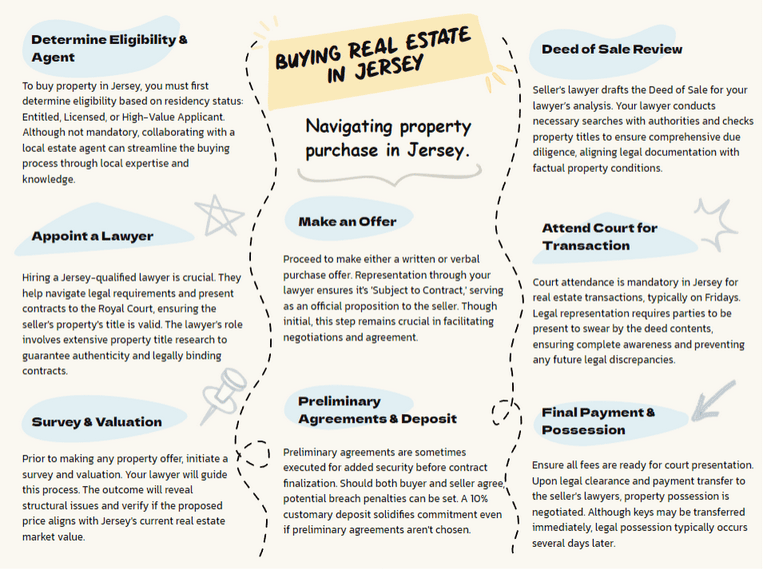

What’s the Process for Buying Real Estate in Jersey?

The process for buying real estate in Jersey can be quite different from purchasing property in other jurisdictions.

It's important to note that Jersey has its own legal system and property laws; for instance, all property transactions (except share transfers) are public procedures and go before the Royal Court.3

That’s why our hands-on team has broken the process down into simple steps for you.

Here’s what to expect:

Step 1: Determine Your Eligibility & Find an Estate Agent

First, you must establish if you’re eligible to buy property in Jersey.

This depends on your residential status – whether you're Entitled, Licensed, or a High-Value residency applicant.

Secondly, although an estate agent isn’t an essential part of this process, a reputable local agent can smooth the way in what can sometimes be a complex process.

Step 2: Appoint a Lawyer

Appoint a Jersey-qualified lawyer from the outset of this process.

Aside from the assistance you’ll need in navigating the regulatory landscape of Jersey real estate acquisition, your lawyer will also be the one to present the eventual sale contract to the Royal Court.

It’s also your lawyer’s responsibility to research the seller’s property title, and it'll ultimately also be your lawyer’s firm that effectively guarantees the property title.

Step 3: Survey & Valuation

Before making an offer on real estate in Jersey, it’s wise to have your attorney conduct a survey and valuation (a lender will usually stipulate this if you’re using a loan to purchase the property).

The report generated on the property should highlight possible defects and comment on whether the price offered reflects the actual market value in Jersey.

Step 4: Make an Offer

If everything is in order, you can make an offer on the property.

Interestingly, your offer to purchase can be verbal or written.

Your lawyer should make the offer ‘Subject to Contract’ and will represent you in the purchase.

Step 5: Preliminary Agreements & Deposit

Preliminary agreements aren’t always used in Jersey, but they can add some security prior to contract completion.

If you and the seller agree to a preliminary agreement, you can also stipulate a penalty for failure to complete the contract.

At this point (even if you elect not to use a preliminary agreement), you’ll pay the customary 10% deposit for the property.

Step 6: Deed of Sale

The seller’s lawyer is the one who will prepare the draft Deed of Sale, which your lawyer will then review.

At this point, your lawyer will perform the following additional checks:

- Searches: Searches will be made with various bodies, including the parish authorities, utility companies, and the Planning and Building Services Department. This will confirm information relating to the property.

- Confirmation of title: Your lawyer will research the title deed on the Public Registry. Your lawyer will also check the titles of neighboring properties to confirm the rights set out in those properties’ deeds against the information in your draft Deed of Sale.

- Site Visit: When the necessary searches have been done, your lawyer will visit the property to ensure the draft deed of sale aligns with reality.

Step 7: Attend Court

In Jersey, real estate transactions go before the Royal Court on a Friday afternoon.

You and the seller will be required to swear an oath that you’re both aware of the contents of the deed of sale and won't act against it on pain of perjury.

You or your lawyer (as your legal representative through Power of Attorney) must attend court in person.

The transaction won’t proceed if either of the parties (you or the seller) are absent.

Step 6: Make Final Payment

You’ll need to ensure that all required outstanding fees are transferred to your lawyer so that all the necessary capital is held by your lawyer on the day your final contract of sale is passed in court.

Your lawyer will then pay the balance of what’s owed on the property to the seller’s lawyers.

This is because Jersey’s laws stipulate that your lawyer will be personally liable for those fees.

Step 7: Possession of the Property

Your estate agent will generally negotiate the time for possession of your new real estate acquisition after Friday's completion at court.

You’ll likely be given the property’s keys upon the passing of the contract, but possession often happens around 4 days later.

Typically, you and the seller will agree to a short grace period to allow the seller to vacate the property if it’s inhabited.4

What Costs Are Involved in Investing in Jersey Real Estate?

The costs involved in investing in Jersey real estate range from stamp duty to insurance premiums.

Let’s look at the specifics:

Lawyer’s Fee

As we’ve seen, hiring a lawyer to assist in your property acquisition journey is essential in Jersey.

There are a variety of legal firms on the island, and prices for conveyancing can vary.

However

You can expect lawyer’s fees to be more expensive than in most other countries, including the UK.

Preliminary Agreement

If you and the seller agree to enter into a preliminary agreement, this will likely incur more fees from your lawyer.

We advise that you obtain a quote from your lawyer before proceeding with this.

Stamp Duty & Land Transaction Tax

This is a tax paid on the purchase of property.

Stamp duty in Jersey is generally levied at a rate of 0.5% of the overall sum, plus a registration fee of £80.

Land transaction tax may apply in addition to or instead of stamp duty, depending on the purchase circumstances.

Surveyor's Fees

If you choose to have a survey conducted (which is highly recommended), you’ll need to pay for a professional surveyor.

The cost can vary depending on the type of survey and the property size.

Valuation Fee

If you’re taking out a mortgage, the lender will usually require a valuation of the property.

The buyer is frequently responsible for paying this fee.

Mortgage Arrangement Fees

If you’re financing the purchase with a mortgage, there may be arrangement fees or other related costs charged by the lender.

Insurance

You’ll need to arrange building insurance from the date of completion of your purchase.

The cost will depend on the property and the level of coverage required.

Estate Agent Fees

The seller usually pays the estate agent fees.

However, this can vary, and it's important to clarify this early in the process.

What Are the Tax Implications of Investing in Jersey Real Estate?

The tax implications of investing in Jersey real estate are significant, especially if you’re investing through Jersey’s High-Value Residency Scheme.

Fortunately, there are no property taxes in Jersey,5 apart from income tax on Jersey-sourced property, but it’s worth planning for every outcome.

Let our experts guide you through the weeds of this issue:

Stamp Duty/Land Transaction Tax

When purchasing property in Jersey, you’re typically required to pay Stamp Duty or Land Transaction Tax.

The amount depends on the property's purchase price and can be a significant expense.

Goods & Services Tax (GST)

In some cases, the purchase of a property may be subject to GST at 5%.

This typically applies to new properties or properties that have been substantially renovated.

Income Tax on Rental Earnings

If you’re buying property as an investment and plan to rent it out, any income earned from renting the property is subject to income tax.

Jersey has its own income tax rates and brackets.

Capital Gains Tax

Jersey doesn’t levy capital gains tax.

This means that if you sell the property at a profit, the gain isn’t taxed in Jersey.

However

If you’re a tax resident in another jurisdiction, you may have tax liabilities there.

Inheritance Tax

Jersey doesn’t impose an inheritance tax.

However, if you’re not solely a Jersey resident, your estate may be subject to inheritance tax in your country of residence.

Property Tax

There are annual property taxes (known as 'rates') in Jersey, which are levied by the parish in which the property is located.

These rates are based on the size and value of the property.

High-Value Residency Taxation

High-net-worth individuals moving to Jersey and buying property might be subject to different tax rules under the High-Value residency program.

This often involves a different tax structure and requires meeting certain criteria.

Common Questions

Are Real Estate Agents in Jersey Regulated?

How Much Money Do You Need to Be a Resident of Jersey?

Is Jersey Residency by Investment Hard to Get?

What’s the Average House Price in Jersey?

Can Anyone Buy Property in Jersey?

Why’s It So Expensive to Live in Jersey?

How Much Deposit Do I Need to Buy a House in Jersey?

Can I Retire in Jersey?

Is Jersey Part of England or France?

Should I Use an Estate Agent to Buy Property in Jersey?

Is Jersey a Tax Haven?

What Are the Cons of Living in Jersey?

Can I Live in Jersey With a UK Passport?

In Conclusion

Purchasing real estate in Jersey, Channel Islands, presents a unique opportunity but comes with specific considerations.

Prospective buyers must navigate a regulated market with eligibility based on residency status and adhere to local laws and financial requirements.

Understanding these nuances, often with the assistance of local real estate agents and legal professionals, is crucial for a successful property acquisition in Jersey.

Jersey offers 1 of many lucrative global real estate markets waiting to be tapped by savvy investors!

Check out our library of other articles on the topic.

Learn More: International Real Estate Investment

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure