Jersey Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- To gain residency in Jersey through investment, individuals must demonstrate the ability to significantly contribute to the island's economy, generally through a minimum annual tax contribution of £125,000, based on worldwide income.

- Benefits include access to the British Isles, a stable and secure environment, and high standards of living and healthcare.

- The application process encourages bringing family members, including spouses and children, aligning with Jersey's inclusive approach to investor immigrants.

- The approach focuses on personal wealth and the ability to contribute to the local economy rather than direct investment into specific sectors or projects.

- The process for applying emphasizes financial solvency and the potential to enrich the local community, with individual assessments for each applicant.

Amidst the blue expanse of the English Channel lies Jersey, a picturesque island with more than just scenic beauty to offer.

Beyond its golden beaches and rich history, many are unaware that Jersey possesses the largest tidal range in the world, a testament to its unique geographical allure.

Officially known as the High-Value Residency Regime, for the discerning global nomad and investor, this presents a prime opportunity for residency by investment in Jersey and access to an intensely competitive economy.

In This Article, You Will Discover:

If you’re ready to learn how your investment in Jersey can pave the way for a life intertwined with both luxury and legacy, you’re in the right place.

Read on…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

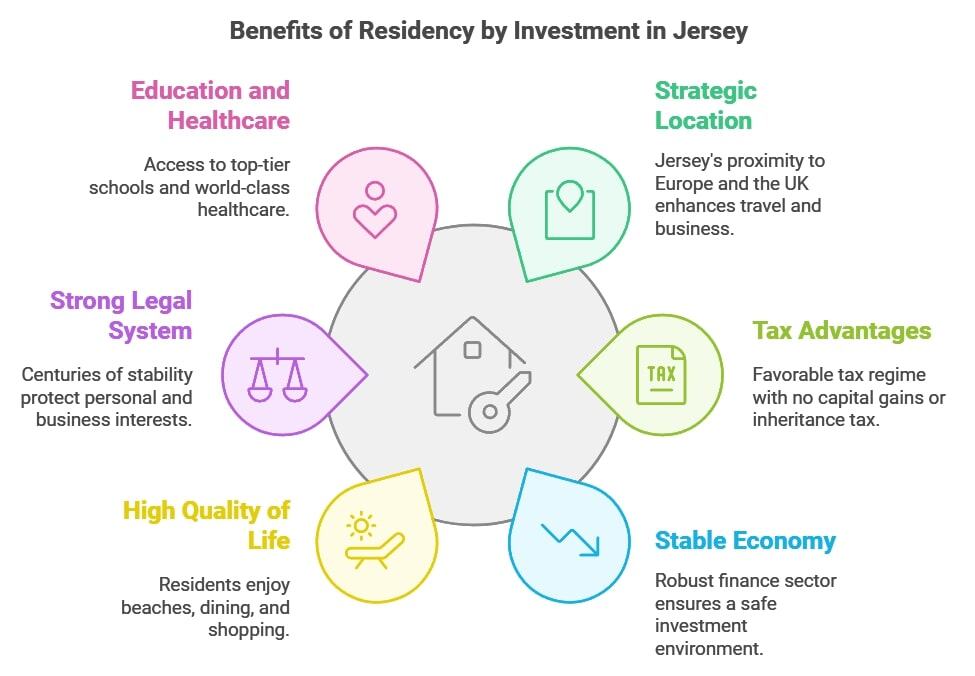

What Are the Benefits of Residency by Investment in Jersey?

The benefits of residency by investment in Jersey are compelling, ranging from its attractive location to excellent business networking possibilities.

Here’s our expert take on the most enticing benefits of investing in Jersey residency:

- Strategic location: Nestled close to the European mainland and the UK, Jersey offers a perfect base for travel and business operations across Europe.

- Tax advantages: Jersey offers a favorable tax regime with no capital gains tax, inheritance tax, or value-added tax, providing significant financial benefits to residents.

- Stable economy: With a robust finance sector and a resilient economy, Jersey offers a safe environment for both personal and business investments.

- High quality of life: From pristine beaches to world-class dining and shopping, residents enjoy a truly superior lifestyle.

- Strong legal system: Built on centuries of stability, Jersey's legal system offers protection for personal and business interests.

- Education and healthcare: Jersey offers access to top-tier schools and world-class healthcare facilities.

- English-speaking: As an English-speaking territory, it's easy for most global nomads and business professionals to integrate seamlessly.

- Cultural blend: Jersey is a rich blend of British and French cultures, offering a unique living experience.

- Real estate opportunities: In Jersey, you’ll find a thriving property market with potential for considerable investment growth.

- Networking: A growing community of international investors and professionals creates a diverse and vibrant networking environment.

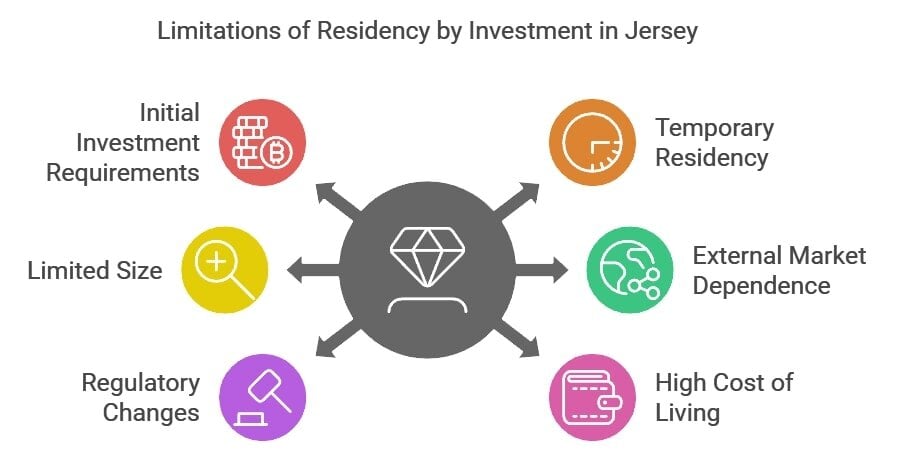

What Are the Limitations of Residency by Investment in Jersey?

The limitations of residency by investment in Jersey range from the expense involved in the investment to the cost of living on the island.

At WorldPassports, we believe in making well-informed decisions, which means weighing up the cons against the pros.

In our seasoned opinion, these are the potential limitations of residency by investment in Jersey:

- Initial investment requirements: A substantial financial commitment is needed to qualify for the program, which may be prohibitive for some investors.

- Initial residency is temporary: Initially, you’ll be granted temporary residency, which will only last for 3 years.

- Limited size: As a small island, Jersey has limited space, potentially impacting real estate choices and business expansion opportunities on the island.

- Dependence on external markets: While the local economy is strong, Jersey is still reliant on the UK and European markets for trade and services. This may not be a drawback for everyone, as this is part of Jersey’s appeal for many.

- Regulatory changes: As with many jurisdictions offering such programs, regulations and requirements can change, potentially affecting those looking to secure residency.

- Cost of living: A high standard of living can also mean a higher cost of living in certain areas or services.

- Seasonal climate: Jersey experiences a temperate maritime climate, which may not be ideal for those accustomed to tropical or consistently warm weather.

- Limited direct international flights: While well-connected to major European cities, direct global connections can be limited, requiring transit through larger hubs.

Which Investment Types Qualify for Residency by Investment in Jersey?

The only type of investment that qualifies for residency by investment in Jersey is the purchase or lease of real estate.

As mentioned above, the real estate market in Jersey is thriving and competitive, so the investment will need to be significant.

What Are the Requirements for Residency by Investment in Jersey?

The requirements for residency by investment in Jersey start with the generic eligibility requirements that apply in most countries, such as being of good character, proof that you’re at least 18 years old, and a clean criminal record.1

But, of course, there’s more.

The requirements for residency by investment in Jersey are listed below:

Benefit to Jersey

You’ll need to prove to the Jersey government that your residency in Jersey will benefit the island socially or economically.

Ways of proving this include, but aren’t limited to:

- Positive media coverage of activities undertaken (business or social), including past events outside of Jersey.

- Past charitable contributions or work.

- The impact your residency will have locally.

- Your plans for business activity in Jersey including:

- training

- diversification

- employment

- associated tax revenues

Minimum Investment Amount to Qualify

You must purchase real estate to the value of at least £1,750,000 to qualify for Jersey’s High-Value Residency program.

Uniquely, Jersey also allows investors to lease a property at this value.

But wait, there’s more

The Jersey government stipulates that you must also be able to pay at least £250,000 in annual tax.2

Personal Net Worth

The implication of being able to make such a large investment and meet the hefty annual tax requirement is that your annual income will need to exceed £725,000 consistently (which you’ll need to prove).3

Moreover, you’ll need to show that you have personal wealth exceeding £10 million in assets.

Language Requirements to Qualify

Jersey has 2 official languages, namely English and French, although English is the main language used in business and trade.

During your initial residency by investment period, you won’t need to prove English proficiency, but if you plan to apply for permanent residency (otherwise known as Indefinite Leave to Remain), you’ll have to prove that you can speak, read, and understand English.

Nationalities Restricted from Applying

All nationalities are invited to apply, assuming they can meet the substantial investment requirements.

Will My Dependents Be Included Under My Jersey Residency by Investment?

Yes, your dependents will be included under your residency by investment permit in Jersey, not least because you’ll be required to live there for most of the year.

How Long is Jersey's Residency by Investment Valid & Can It Be Extended?

Initially, your Jersey High-Value Residency permit will have temporary status.

You can then either choose to renew it or apply for permanent residency.

Here are the finer details:

Validity Period

Your initial Jersey residency by investment permit is valid for 3 years.

Note that this isn’t a permanent residence permit, although you’ll have the option of applying for one later on.

Visa Extension

At the end of your initial 3-year Jersey residency, you can choose to renew or extend your temporary residency permit for another 2 years, provided you’ve maintained your real estate investment and have kept up with the associated tax payments.

You may ultimately also choose to apply for permanent residency (or Indefinite Leave to Remain).

To do this, you must comply with the following conditions:

- Spend more than half the year in Jersey for at least 5 years before applying.

- Pay the annual £250,000 in taxes diligently.

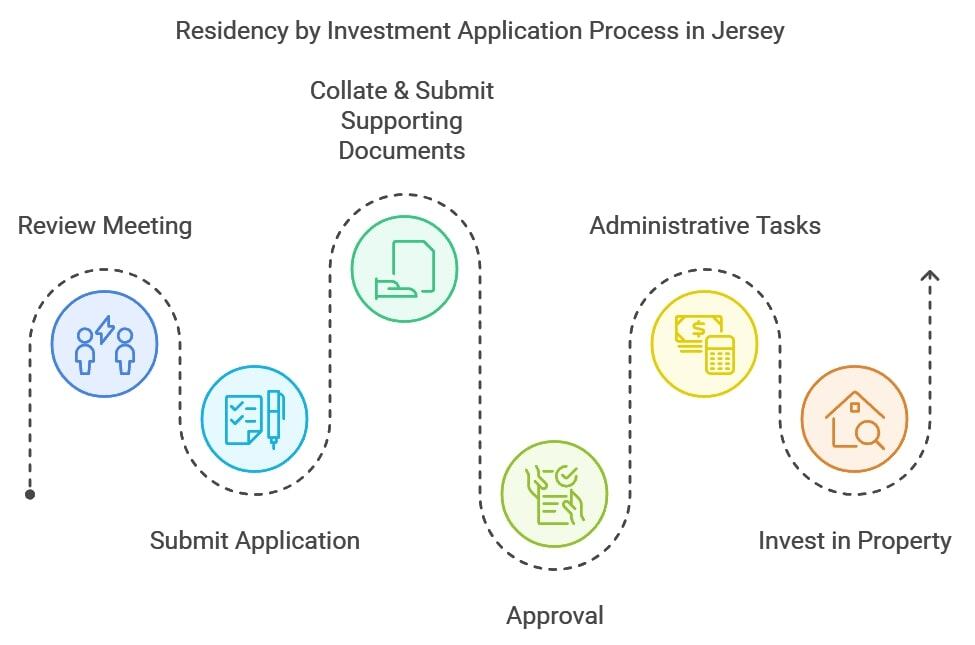

What’s the Application Process for Residency by Investment in Jersey?

The application process for residency by investment in Jersey isn’t complicated but is managed scrupulously by Jersey’s government.

Given the size of the investment you’re required to make in return for the privilege of claiming residency on this picturesque island, it’s well worth planning for every milestone in the process.

Here's what you must know about the process:

Step-by-Step Application Process

Our dedicated team has simplified the process into 6 basic steps for you.

Here’s what to expect from the application process:

Step 1: Review Meeting

Before you do anything else, you’ll need to reach out to Locate Jersey (an arm of Jersey’s government that specializes in inward investments) to attend a review meeting with Jersey’s Director of High-Value Residency.4

This meeting is intended to assess your investment capacity and offer you guidance and support in your application.

Step 2: Submit Your Application

Once you’ve confirmed that you’re able to meet the investment requirements of the Jersey High-Value Residency (HVR) program, submit the HVR Consent Form and the Application Profile Documents on the Locate Jersey website.

Step 3: Collate & Submit Supporting Documents

All supporting documentation must now be submitted to Locate Jersey.

Locate Jersey will then perform a due diligence process, after which your application will be assessed by the Controller of Taxes.

The Government of Jersey’s Housing and Work Advisory Group (HAWAG) makes the final decision.

Step 4: Approval

If your application is approved, a letter of confirmation will be sent to you by Locate Jersey.

As soon as you receive this letter, you’re allowed to travel to Jersey legally.

Step 5: Administrative Tasks

At this point, you’ll need to register for income tax and social security.

You must also apply for your Jersey Registration Card, which can be done via Locate Jersey’s website.

Step 6: Invest in Your Property

Once you’ve arrived in Jersey, you need to get the ball rolling on purchasing a property that meets the requirements of Jersey’s High-Value Residency (HVR) program.

Required Documents

As you can imagine, quite a few documents are required in order to prove that you’re capable of meeting the significant investment required to participate in Jersey’s residency by investment scheme.

In addition to your HVR application, you’ll likely need to provide documentary proof of the following:

- A personal letter of application

- Your business profile

- Your financial profile

- 2 personal references from reputable sources

- 2 business references from reputable sources

- A verified copy of your valid passport

- A Disclosure Certificate from the Disclosure & Barring Service (DBS) or equivalent (such as a police clearance certificate)

- Marriage certificate (if applicable)

How Soon Will I Receive My Residence Permit?

If all parts of your application are deemed to be in order, you should receive your residence permit in fewer than 3 weeks.

What Costs Are Involved in Getting Residency by Investment in Jersey?

By now, you’ll be aware that residency by investment in Jersey requires a substantial financial outlay.

Let’s take a look at a few costs that may not have been covered yet.

Application Costs

The extensive processing and due diligence conducted on Jersey’s HVR applications means that certain fees are likely to be charged for this process.

We advise that you budget for the following additional fees:

- Processing fees

- Due diligence fees

- Administrative fees

Residence Card Application Fee

If your application is approved, you’ll have to apply for a Jersey residence card.

Typically, this costs £7,500.

Legal & Advisory Costs

Given the considerable nature of the investment required by Jersey residency investors, it’s to be expected that you’ll likely need the services of reputable immigration professionals.

Here are some other services you may need to budget for:

- Legal consultation or representation fees

- Advisory fees

- Document preparation fees

- Translation and notarization fees

Additional Associated Costs

Additional costs associated with your Jersey residency by investment application may range from insurance to relocation costs.

Here’s an expert summary of the big costs to plan for:

- Health examination fees

- Insurance

- Relocation costs

- Renewal fees

- Taxes and duties

- Banking fees

What’s the Processing Time for the Jersey High-Value Residency Visa?

The processing time for Jersey’s High-Value Residency visa is known to be one of the fastest in the world, provided your application and supporting evidence are in order.

Find all the details below.

Average Processing Time

The average processing time for residency by investment applications in Jersey is as quick as 2 weeks.

This window allows authorities to perform necessary due diligence and background checks to ensure your integrity.

Factors Affecting Processing Time

Several elements can influence the time it takes for the application to move from submission to approval.

These might include:

- The completeness of your application

- Due diligence delays

- The volume of applications received

Expedited Processing Options

Currently, Jersey doesn’t offer a standardized expedited processing option for its residency by investment program.

However, ensuring that your application is complete, precise, and supported by a reputable legal team can enhance the speed of the process.

How Soon Will I Receive My Residence Permit After My Jersey Residence by Investment Application is Approved?

If your application is successful, you’ll be granted a 3-year temporary residency within as little as 2 weeks.

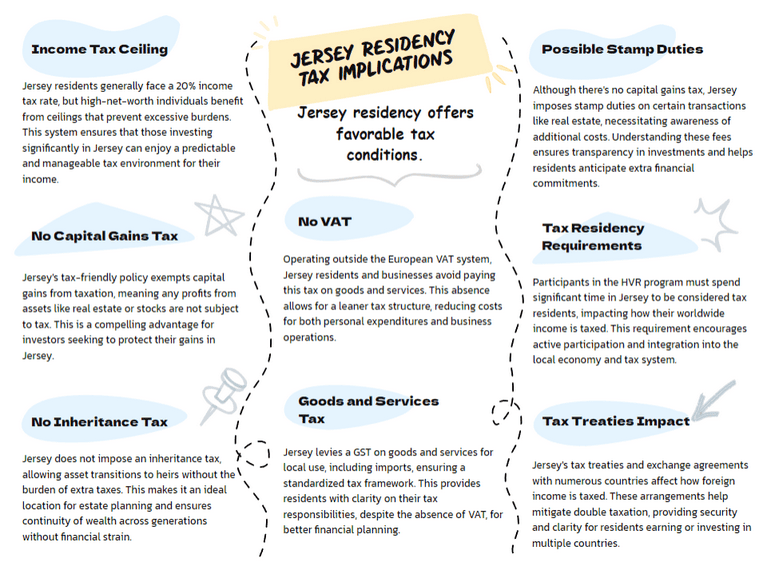

What Are the Tax Implications of Jersey Residency by Investment?

The tax implications of Jersey residency by investment are significant, particularly given the sizable value of the investment you’ll be making and the requirement for tax residency.

We’ve taken the liberty of summarizing these tax implications for you below:

- Income tax: Jersey residents are subject to a standard income tax rate, which may vary but typically hovers around 20%. However, there are ceilings for high-net-worth individuals to ensure they don't face disproportionate tax burdens.

- No capital gains tax: One of the most significant benefits is that Jersey doesn’t impose a capital gains tax. This means gains from the sale of assets, such as real estate or stocks, aren't taxed.

- No inheritance tax: In Jersey, there’s no inheritance or estate tax. This allows for smoother transitions of assets to heirs without additional tax burdens.

- No Value Added Tax (VAT): Jersey is outside the European VAT regime, which means that residents and businesses don’t pay this tax on goods and services.

- Goods and services tax (GST): Instead of VAT, Jersey has a GST, which is levied on most goods and services supplied in Jersey for local use, including imports.

- Stamp duties: While there's no capital gains tax, there might be stamp duties on certain transactions, such as real estate sales.

- Tax residency: If one spends a significant portion of the year in Jersey (which will be required under the HVR program), one might be considered a tax resident, leading to tax implications based on worldwide income.

- Tax treaties: Jersey has entered into various tax information exchange agreements and double tax treaties with numerous countries, which can influence how residents are taxed on foreign income.

- High-value residency tax concessions: High-value residents, or those who acquire residency through significant investment, might be eligible for certain occasional tax concessions or caps to incentivize their move to Jersey.

- No wealth or net worth tax: Jersey doesn’t tax residents based on their global assets or wealth, which is beneficial for high-net-worth individuals.

A word of advice:

It's essential to consult with a tax advisor familiar with Jersey's tax regulations to get detailed and tailored advice, especially when considering residency by investment.

Is Residency by Investment in Jersey a Pathway to Jersey Citizenship?

Yes, ultimately, residency by investment in Jersey can pave a pathway to Jersey citizenship.

If you live in Jersey for 6 years and maintain permanent residency for at least 1 year, you’ll be eligible to apply for citizenship.

Common Questions

How Much Money Do You Need for Jersey Residency by Investment?

If I Buy a House in Jersey, Can I Get Jersey Residency by Investment?

Is It Difficult to Get Jersey Residency by Investment?

Is Jersey Still a Tax Haven?

Is Jersey Part of the UK?

Do I Have to Be a Millionaire to Live in Jersey?

Can I Retire to Jersey?

In Conclusion

In an ever-evolving global landscape, Jersey emerges as a beacon for discerning investors seeking both lifestyle elevation and strategic growth.

With its blend of European charm and a stable business environment, the island offers a compelling proposition for high-net-worth individuals eyeing residency by investment.

As you chart your global journey, let Jersey be a chapter worth exploring; our seasoned team is right here to guide you on your adventure!

Are you wondering about other residency by investment opportunities in Europe?

You can explore some of them in our library of residency by investment articles.

Learn More: Residency by Investment in Europe & the UK

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure