Jordan Real Estate Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Jordan offers opportunities for real estate investment in commercial, residential, and tourism sectors, with incentives for foreign investors in specific zones.

- Foreign investors can acquire property, subject to government approval, with ownership rights for residential or investment purposes.

- Real estate investment can qualify for citizenship or residency under certain programs designed to attract foreign capital, with specific investment thresholds.

- Key real estate markets for investors include Amman, Aqaba, and the Dead Sea area, focusing on residential developments, commercial properties, and tourism projects.

- Foreign investors must follow legal procedures to purchase, including obtaining approval from the Ministry of Finance and ensuring compliance with local regulations.

Jordan's real estate market is a sector rich with opportunity and complex in nature.

Nestled at the crossroads of Asia, Africa, and Europe, Jordan boasts a unique blend of cultural and economic influences that shape its property landscape.

Its ancient city of Petra, a UNESCO World Heritage Site, reflects the country's rich history, subtly influencing modern real estate trends.

We’ll guide you through all the considerations of taking this leap, so you understand the nuances of Jordan's real estate market and the possibilities of this investment opportunity.

In This Article, You Will Discover:

Whether you're a seasoned investor or a first-time homebuyer, WorldPassports offers valuable insights so you can navigate this vibrant and evolving market with aplomb.

Stay with us…

*Disclaimer: All amounts quoted in this article were accurate and correct at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

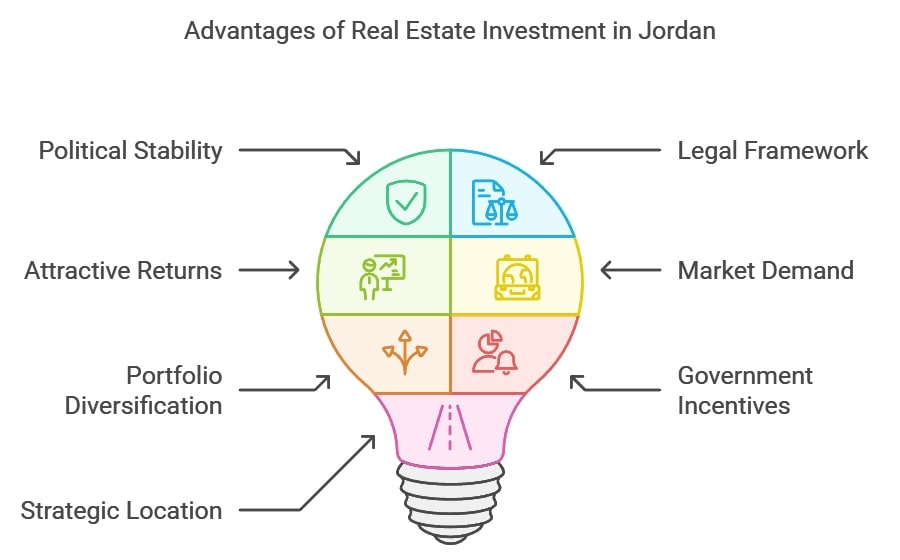

What Are The Benefits Of Real Estate Investment In Jordan?

Real estate investment in Jordan offers numerous benefits for both local and international investors.

Firstly, Jordan has a stable political and economic environment, which provides a secure and reliable investment climate.

This stability is further reinforced by the country's well-developed legal framework, which protects property rights and ensures a transparent and efficient process for property transactions.

Additionally, real estate in Jordan offers attractive returns on investment, with the potential for long-term capital appreciation and steady rental income.

The growing tourism sector and increasing demand for housing in urban areas provide a promising market for real estate investors in Jordan.

Furthermore, investing in Jordan's real estate market allows for diversification of investment portfolios.

With a range of property types available, including residential, commercial, and industrial properties, investors can choose the option that aligns with their investment goals and risk tolerance.

Moreover, the government's commitment to attracting foreign investment through various incentives, such as tax exemptions and streamlined regulations, makes investing in Jordan's real estate even more appealing.

Finally, the strategic location of Jordan, at the crossroads of Europe, Africa, and Asia, positions it as a gateway for regional trade and commerce, offering potential opportunities for investors seeking international business connections and market expansion.

Why Should I Consider Investing in Real Estate in Jordan?

You should consider investing in real estate in Jordan for the unique opportunity to tap into a market that’s both historically rich and increasingly attractive for foreign investment, thanks to government incentives and a stable political climate.

The country's strategic location as a gateway between Europe, Asia, and Africa adds to its potential for robust capital appreciation and rental yields, particularly in emerging urban and touristic areas.

Additionally

Jordan's growing economy, coupled with its urban development and infrastructure improvement initiatives, presents a promising landscape for long-term real estate investment and growth.

How Does the Real Estate Market in Jordan Compare With Other Middle-Eastern Countries?

The real estate market in Jordan compares favorably with other Middle Eastern countries; the country’s stable political situation invites foreign investment and promises lucrative returns.

Following is a list of the main ways in which the real estate market in Jordan compares with others in the region:

- Diverse investment opportunities: Unlike many Middle Eastern countries that focus predominantly on luxury or high-end real estate, Jordan offers a diverse range of investment opportunities, including affordable housing, commercial properties, and touristic developments.

- Stable political climate: As mentioned, Jordan is known for its relatively stable political environment compared to some of its neighbors, which adds a level of security for real estate investments.

- Rapidly growing economy: While some Middle Eastern countries rely heavily on oil, Jordan's economy is more diversified, which can lead to more stable and sustainable growth in the real estate sector.

- Accessibility to foreign investors: Jordan has less restrictive laws regarding foreign real estate ownership compared to some Middle Eastern countries, making it more accessible for international investors.

- Development and infrastructure initiatives: Jordan actively invests in urban development and infrastructure improvements, unlike some oil-rich nations where such initiatives may be less prioritized due to existing wealth.

- Tourism impact: The unique cultural and historical attractions of Jordan, like Petra and the Dead Sea, influence its real estate market, offering opportunities in hospitality and tourism-related properties not as prevalent in other Middle Eastern countries.

Which Regions of Jordan Are Best for Real Estate Investment?

Several regions in Jordan stand out as particularly attractive for real estate investment, each offering unique opportunities.

Each area presents different investment opportunities, from high-end residential and commercial properties in Amman to tourism and cultural investments in Aqaba and Petra.

According to WorldPassports’ analysts, these are the best regions of Jordan for real estate investment:

- Amman: As the capital and largest city, Amman is the hub of economic and commercial activities in Jordan. The city's western areas, like Abdoun and Dabouq, are especially popular for high-end residential and commercial investments.

- Aqaba: Aqaba, known for its strategic location on the Red Sea, is growing as a tourism and trade center. The Aqaba Special Economic Zone Authority (ASEZA) provides incentives for investors, making it a lucrative spot for tourism and commercial real estate.

- Irbid: The second-largest city in Jordan, Irbid is an educational and cultural center housing several universities. This makes it an ideal location for student housing and residential investments.

- Zarqa: As an industrial center, Zarqa offers potential for commercial and industrial real estate investment. Its proximity to Amman also makes it a viable option for affordable residential real estate.

- Dead Sea region: This area is growing in popularity for tourism-related investments, especially in resort and hospitality developments, due to its unique natural attractions and therapeutic sites.

- Petra: A world-renowned archaeological site, Petra attracts tourists globally, making it a prime area for investment in the hospitality sector, including hotels and tourist facilities.

- Al Salt: Recently gaining UNESCO World Heritage status, Al Salt is emerging as a cultural tourism destination, offering the potential for investments in boutique hotels and restoration projects.

Our advice?

Consider your specific goals and the unique attributes of each region when making your investment decisions.

Jordanian Real Estate for Citizenship & Residency

With so many enticing reasons to invest in real estate in Jordan, you may wonder whether such an investment might lead to citizenship or residency in the Hashemite Kingdom.

Let’s investigate:

Can I Get Jordanian Citizenship If I Invest in Jordanian Real Estate?

No, you can’t get Jordanian citizenship if you invest in Jordanian real estate.

Citizenship by investment in Jordan is possible through other investment avenues; unfortunately, real estate isn’t one of these avenues.

Will I Need to Become a Resident of Jordan to Buy Real Estate There?

No, you don’t need to become a resident of Jordan to buy real estate there.

You can own or lease property in Jordan as a foreigner, provided that your country of origin allows reciprocal property ownership rights for Jordanian citizens.1

Can I Get Residency If I Invest in Jordanian Real Estate?

Yes, you can get residency if you invest in Jordanian real estate.

If you invest at least JOD200,000 (approximately US$282,000) in 1 or more properties, you’ll be eligible for Jordanian residency by investment.

Are There Any Restrictions on Foreign Investment in Jordanian Real Estate?

Yes, there are some restrictions on foreign investment in Jordanian real estate.

However, most of the restrictions apply to property acquisition for the purposes of obtaining residency status.

The following restrictions will preclude you from investing in real estate in Jordan:2

- If your country of origin isn’t recognized by the Jordanian government.

- If your desired real estate is located in border or heritage areas.

- If you fail to get prior permission from the relevant Jordanian authorities to purchase and own the property.

- If your country of origin doesn’t adhere to the principle of reciprocity, which applies to non-Arab foreigners. This means that if your country of origin doesn’t allow Jordanians to purchase real estate there, Jordan won’t allow you to buy Jordanian real estate.

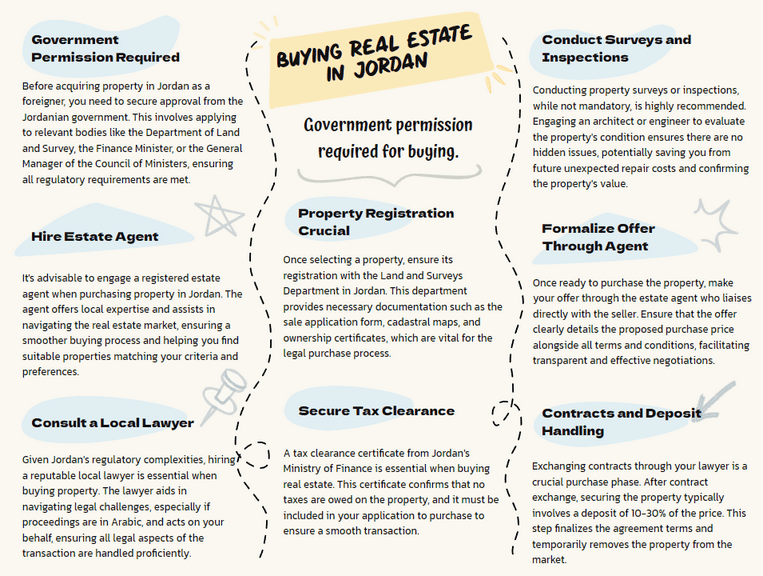

What’s the Process for Buying Real Estate in Jordan?

The process for buying real estate in Jordan is fairly unique in that you’ll need permission from the Jordanian government before any property acquisition in the country is possible.

Don’t be discouraged by this; we’ve mapped the entire process for you, so you’ll be well-prepared!

Our devoted experts have outlined the process in detail here:

Step 1: Obtain Sign-Off from the Jordanian Government

As a foreigner, you must obtain approval from the Jordanian government to buy real estate in the country.

Specifically, you’ll need to apply to the Department of Land and Survey, the Finance Minister, or (ultimately) the General Manager of the Council of Ministers.

Step 2: Find an Estate Agent

It’s a good idea to use a registered estate agent (or broker) for the purchase of real estate in Jordan.

The estate agent can assist you in your property search and bring their local expertise to bear in navigating the purchase process.

Step 3: Find a Reputable Lawyer

Owing to the regulatory landscape you’ll need to navigate, it’s a good idea to hire a reputable local lawyer to guide you through the process and, at times, act on your behalf.

This will be particularly necessary if you don’t speak Arabic, as some of the proceedings may be conducted in Arabic.

Step 4: Ensure Property is Registered with Land & Surveys Department

Once you’ve found your ideal property, this is the very first step to complete.

The Land and Surveys Department will provide you with the official sale application form and a cadastral or base map detailing utilities, transportation, and land use.

This department will also give you the property's ownership certificate; include it in your application to purchase!

Step 5: Obtain Tax Clearance Certificate

Your next step is to obtain a tax clearance certificate from the Ministry of Finance in Jordan.

Ensure that this is also included in your application to purchase.

Step 6: Surveys & Inspections

Although this isn’t essential, we strongly advise that you arrange a survey (or inspection) of the property before making an offer.

Consider whether you may need to retain the services of an architect or engineer to assess the property's condition.

Step 7: Make an Offer

If all is in order and you’re ready to make an offer on your chosen real estate, your estate agent can liaise with the seller directly on your behalf.

Ensure that your offer includes the purchase price and the terms and conditions of the sale.

Step 8: Exchange of Contracts & Deposit

Your lawyer will play a significant role at this stage of the purchase.

Your lawyer will exchange contracts with the seller’s lawyer.

Secure the property

In Jordan, paying a deposit at this stage is customary, which officially takes the property off the market.

Real estate deposits in Jordan are generally 10–30% of the purchase price.

Step 10: Pay Fees & Taxes

Ensure that all associated fees and taxes are paid at this point.

Costs will likely include the Lands and Surveys Department’s registration fee, transfer tax, brokerage fees, stamp duty, and property taxes.

Step 11: Pay Balance

Paying the balance of what’s owed on your new Jordanian property will conclude the purchase process.

Congratulations! You're the proud new owner of real estate in Jordan!

What Costs Are Involved in Investing in Jordanian Real Estate?

The costs involved in investing in Jordanian real estate include stamp duty, transfer tax, brokerage fees, lawyers’ fees, and possible translation fees.3

Let us explain this in more detail:

Stamp Duty

In order to transfer ownership of the property’s title, a registration fee must be paid.

Typically, this fee comes to 9% of the property’s total.

The seller and the buyer often split this cost, so consider this option in your negotiations.

Transfer Tax

A 10% government transfer tax must be paid.

Usually, the seller is liable for 4%, and you, as the buyer, will be liable for 6%.

Real Estate Broker Fee

Real estate agents in Jordan charge 2% of the total real estate price, not to mention a 16% sales tax.

This fee will be for both your account and the seller’s.

Lawyer’s Fees

Lawyer’s fees vary, so it’s wise to get a sense of your lawyer’s billing structure before retaining them.

Lawyers sometimes have a set fee structure for certain services, but they also often charge an hourly rate.

Annual Property Tax

Property tax will depend on your municipality and the size of your property.

On average, you can expect the annual property tax to be around 15% of the value of your property.4

This is important:

If you’re investing in Jordanian real estate to obtain permanent residency status in the country, you must retain the property for at least 5 years.

That’s 5 years of property taxes.

What Are the Tax Implications of Investing in Jordan's Real Estate Market?

The tax implications of investing in Jordan’s real estate market range from property transfer taxes to rental income taxes.

Tax laws can change and vary based on specific circumstances.

Consult with a local tax expert or legal advisor to thoroughly understand the tax implications for you and how they apply to individual investment scenarios in Jordan.

That said, these are the main tax implications of investing in Jordanian real estate:

Property Transfer Tax

When purchasing property in Jordan, a transfer tax is typically applicable.

The seller and buyer each pay 4% and 5% of this tax, which is typically around 9% of the property's value.

However, for non-Jordanians, the buyer's portion may be higher.

Annual Property Tax

Property owners in Jordan are subject to an annual property tax.

The rate varies depending on the property's location and type, but it's generally around 15% of the rental income value for residential properties and 25% for commercial properties.

Capital Gains Tax (CGT)

CGT is imposed on the sale of property in Jordan and is calculated as a percentage of the sale price.

The CGT rate for residential properties is 10%, while the rate for commercial properties is 20%.

Inheritance Tax

There’s often no inheritance tax on properties in Jordan, although this depends on the relationship between the inheritor and the deceased.

It can therefore range from 0% to 20%.

This makes it more straightforward to pass real estate assets to heirs.

Stamp Duty

Stamp duty is applicable on property transactions, which is a small percentage of the property value.

Rental Income Tax

If you earn rental income from your property in Jordan, this income is subject to income tax.

The rate depends on the amount of income generated.

VAT Exemptions

Certain real estate transactions may be exempt from Value-Added Tax (VAT), particularly in special economic zones or for specific types of properties.

Common Questions

What are the Benefits Of Investing in Jordan Real Estate?

How Can I Invest in Real Estate in Jordan As a Foreigner?

What Is the Current Real Estate Market Like in Jordan?

Are There Any Restrictions or Regulations for Foreign Real Estate Investors in Jordan?

What are the Potential Risks and Challenges Of Investing in Jordan Real Estate?

How Can I Get Permanent Residency in Jordan?

If I Buy Real Estate for Jordanian Residency, How Long Do I Have to Wait Before I Can Resell It?

Can a Foreigner Live in Jordan?

Where Do Most Expats Live in Jordan?

Can You Speak English in Jordan?

How’s the Real Estate Market in Jordan?

What’s the Quality of Life in Jordan?

What Are the Most Common Real Estate Types in Jordan?

Can a Foreigner Open a Bank Account in Jordan?

How Much Money Do You Need to Live in Jordan?

In Conclusion

Real estate investment in the Hashemite Kingdom of Jordan presents a unique and promising opportunity.

With its stable political environment, diverse investment options (ranging from urban apartments to touristic developments), and favorable conditions for foreign investors, Jordan stands out in the Middle Eastern market.

Thorough research and understanding of local laws and market trends will ensure your success in this vibrant market.

International real estate investment is experiencing a significant uptick in popularity, so check out our other articles on global real estate investment to stay ahead of the curve.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure