Netherlands Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- The Netherlands offers a "wealthy foreign investor" visa, requiring a minimum investment of €1.25 million into a Dutch company or a designated investment fund.

- Benefits include access to the Schengen Area, high-quality living standards, and inclusion of family members under the residency permit.

- The application process emphasizes the innovative impact and added value of the investment to the Dutch economy, with assessments by the Netherlands Enterprise Agency.

- Residency permits are initially granted for three years, with the possibility of renewal and eventual application for permanent residency or citizenship, contingent on integration and residency requirements.

- The program is attractive for non-EU/EEA and Swiss nationals seeking to leverage the Netherlands' strategic location and economic climate for business expansion.

Did you know that the residency by investment program in the Netherlands is one of the most popular in Europe?

The Netherlands, with its high living standards and strategic location in Europe, has long been a sought-after destination for expatriates from around the world.

This highly developed country boasts one of the strongest economies in the world and is a full member of the UN, NATO, the WTO, and the OECD.

In This Article, You Will Discover:

Please be aware that this valuable opportunity is no longer available, as the Dutch government ended its residency by investment program on January 1, 2025.

So, let’s not delay!

Read on to learn more about this exciting opportunity and how it could be your gateway to a new life in the Netherlands…

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

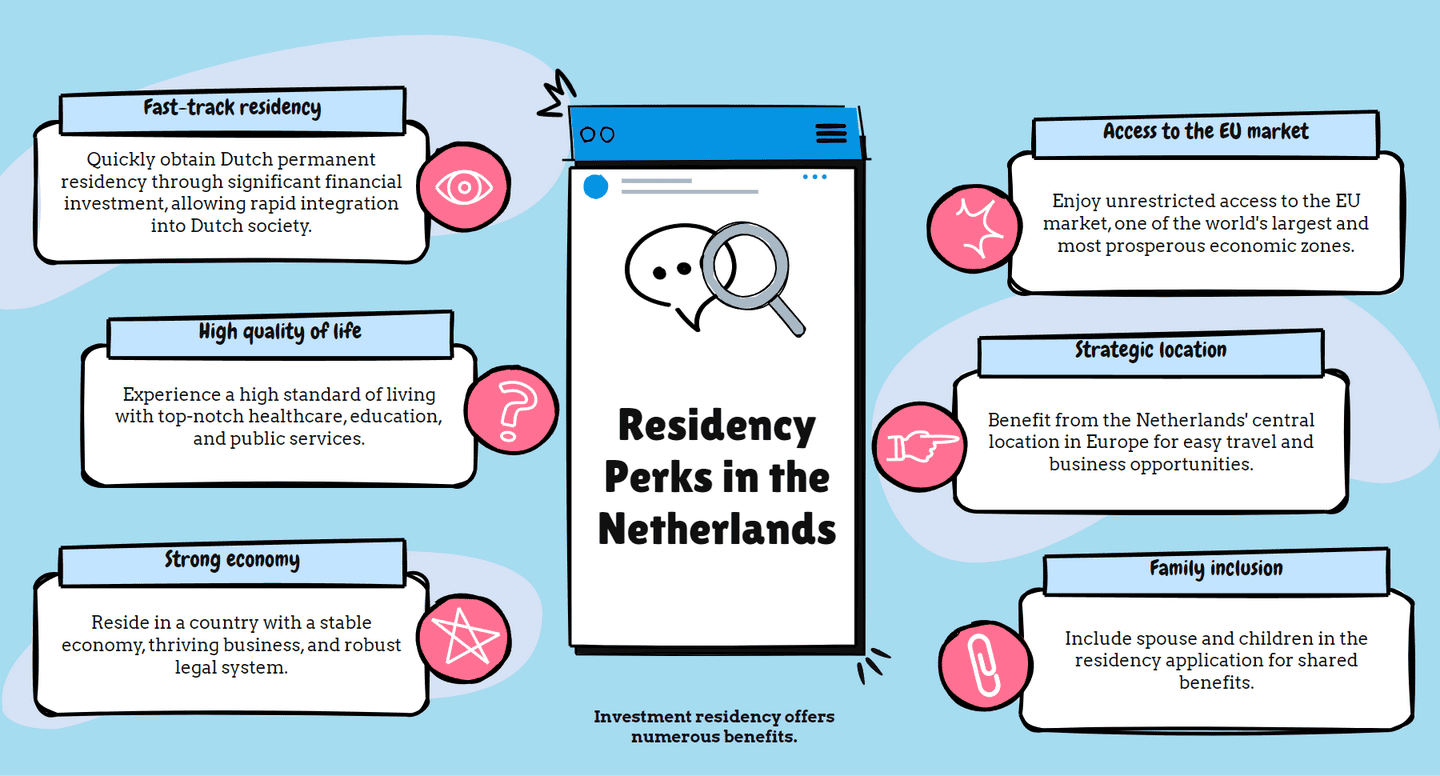

What Are the Benefits of Residency by Investment in the Netherlands?

The benefits of residency by investment in the Netherlands include unfettered access to the EU and the joy of living amongst world-class infrastructure, but there’s so much more.

Here’s our expert breakdown of the main benefits of RBI in the Netherlands:

- Fast-track residency: The process of obtaining Dutch permanent residency by making this significant financial investment in the Netherlands is comparatively quick.

- Access to the EU market: You’ll gain unrestricted access to the European Union market, one of the world's largest and most prosperous economic regions.

- High quality of life: Enjoy a high standard of living, excellent healthcare, education, and public services in a country consistently ranked among the best places to live globally.

- Strategic location: You’ll benefit from living in a country with a strategic location in Europe, making it easy to travel visa-free across the Schengen region and do business across the continent.

- Strong economy: You’ll become a resident of a country with a robust and stable economy, a thriving business environment, and a strong legal system.

- Family inclusion: Include your spouse and dependent children in the application, allowing your entire family to obtain residency and enjoy the benefits of living in the Netherlands.

- World-renowned education: Schools and universities in the Netherlands are excellent and offer a highly competitive education.

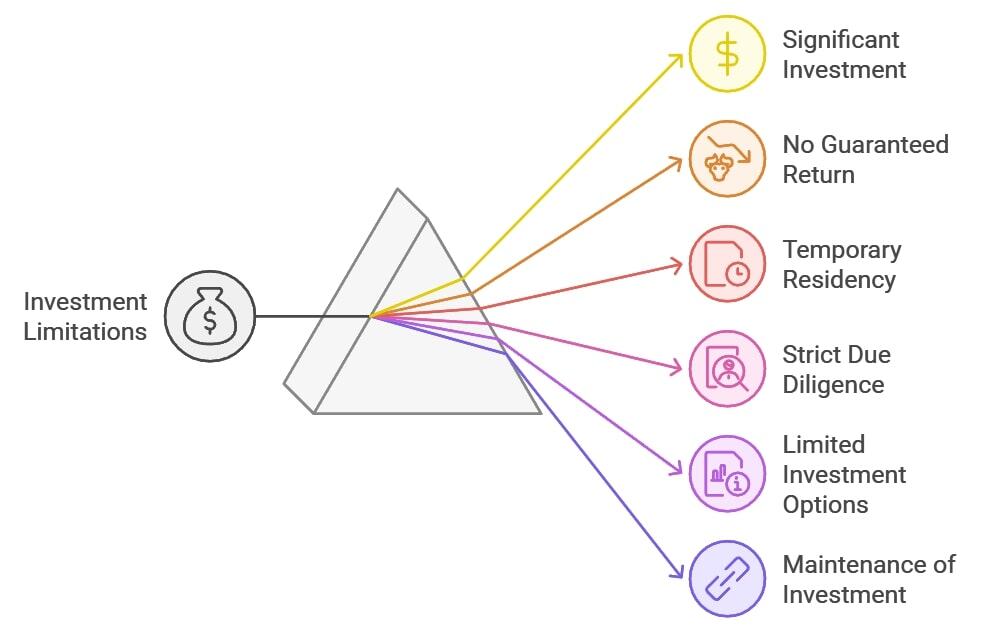

What Are the Limitations of Residency by Investment in the Netherlands?

As appealing as the benefits may be, it’s pragmatic to apprise yourself of the potential limitations of the residency by investment opportunity in the Netherlands, too.

WorldPassports has done the legwork for you.

Here’s our team’s list of the limitations of residency by investment in the Netherlands:

- Significant investment required: A substantial financial investment is needed to qualify for the program, which may not be feasible for all applicants.

- No guaranteed return on investment: The success of your investment isn’t guaranteed, and there’s a risk of financial loss.

- Temporary residency initially: The program initially grants temporary residency, which needs to be renewed and may eventually lead to permanent residency and citizenship, subject to meeting specific criteria.

- Strict due diligence process: Applicants must undergo a thorough due diligence process, including background checks, financial audits, and proof of source of funds.

- Limited scope of investment options: The investment options eligible for the program may be limited and may not align with every investor's preferences or investment strategy.

- Maintenance of investment: The investment must be maintained for a specified period, which may limit your financial flexibility.

- Requirement to reside in the Netherlands: You may be required to spend a certain amount of time in the Netherlands each year to maintain your residency status.

Which Investment Types Qualify for Residency by Investment in the Netherlands?

The investment types required under the Netherlands residency by investment program include investment into a Dutch startup or venture capital fund, as well as a real estate purchase.

Both the initial investment and the real estate investment are mandatory and need to happen in a specific sequence.

Let’s break down the steps:

- Invest at least the minimum required amount in any of the following:

- A Dutch startup business

- A fund that fits into the SEED scheme

- A capital joint venture

This investment must take place prior to submitting your residency by investment application. It must be deposited into a Dutch bank account or the bank account of another EU member state with a branch in the Netherlands.

- Buy or rent residential real estate: Once your residency by investment application is approved, you must buy or rent property in the Netherlands within 8 months of receiving approval. No minimum is stipulated for this investment.

In order to keep your residence status in the Netherlands, you’ll need to maintain both your initial investment and your real estate commitment.

What Are the Requirements for Residency by Investment in the Netherlands?

Although the eligibility requirements for residence by investment in the Netherlands aren’t complicated, it’s important that you adhere to them strictly to ensure application success.

Take note

Meeting these initial requirements will grant you temporary residency in the Netherlands.

After 3 years of holding this temporary residency permit, you’ll qualify to apply for Dutch permanent residence.

Let our experts guide you.

Minimum Investment Amount to Qualify

For your investment in the Dutch startup, SEED fund, or venture capital fund, you’ll need to invest a minimum of €1,25 million.

For the second stage of your investment (buying or renting Dutch real estate), there’s no stipulated minimum.

Your Investment Adds Value to the Dutch Economy

The Netherlands Enterprise Agency will perform a due diligence process to determine whether your investment meets this criterion.1

To add value to the Dutch economy, your investment must fulfill at least 2 of the below 3 stipulations:

- Create at least 10 jobs within 5 years.

- Contribute to increasing the innovativeness of the Dutch company. This may be proven through the introduction of a patent, investing in technological and non-technological innovation, or investing in a company that belongs to a leading sector.

- Contribute non-financial added value. This might include specialized knowledge, networks, clients, and your active involvement in the investment.

Legal Source of Funds

The capital you invest must be gained through legitimate means.

Language Requirements to Qualify

There’s no language requirement for residency by investment in the Netherlands, as you’ll be granted a 3-year temporary residency initially.

However, if you wish to apply for Dutch permanent residence or citizenship, you’ll need to pass a Dutch language and culture test.

Tuberculosis (TB) Test

Depending on your nationality, you may need to prove that you don’t have TB.

Alternatively, you may have to submit to a TB test once you arrive in the Netherlands.

Nationalities Restricted from Applying

The Netherlands doesn’t specifically ban anyone from applying for its residency by investment program.

If you have a clear criminal record and the ability to meet the substantial minimum investment amount, your application is welcomed.

Will My Dependents Be Included Under My Dutch Residency by Investment?

Yes, your dependents will be included under your Dutch residency by investment permit.

The Netherlands allows investors to bring their families with them.

How Long is the Dutch Golden Visa Valid & Can It Be Extended?

As mentioned above, your initial Dutch Golden Visa is a temporary residence permit that can be renewed.

Here are the finer details:

Validity Period

The initial temporary residence permit under the Netherlands residency by investment program is valid for 3 years.

Visa Extension

After the initial 3 years of temporary residency, you can apply for a 2-year extension.

After maintaining your residence status for 5 years, you can either renew your visa for an 8-year period, apply for permanent residence, or apply for Dutch citizenship.

What’s the Application Process for Residency by Investment in the Netherlands?

While the application process for residency by investment in the Netherlands isn’t necessarily complicated, the due diligence process conducted by Dutch authorities is rigorous, so it’s best to be organized.

Our seasoned team has compiled the info you need.

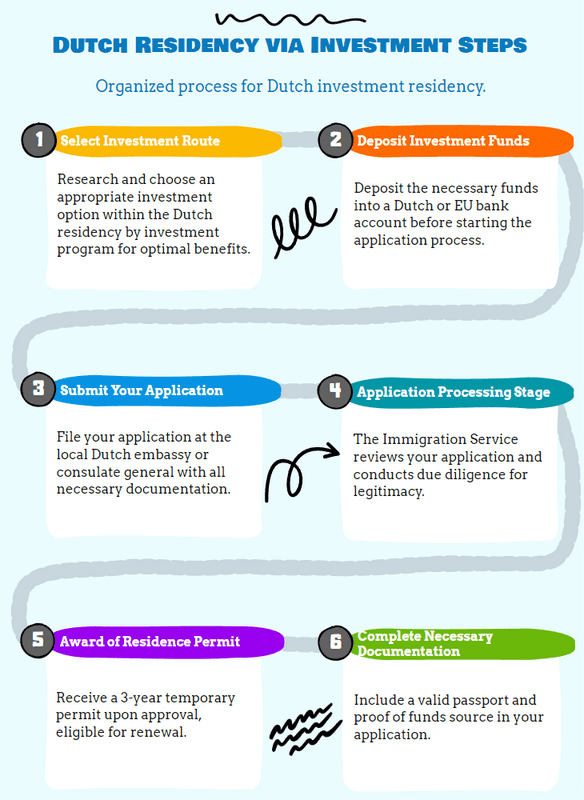

Step-by-Step Application Process

WorldPassports is in your corner; we’ve broken the application process for residency by investment in the Netherlands into a sequence of steps for you.

Let’s go.

Step 1: Select Your Investment Route

Do your due diligence on your investment options under the Dutch residency by investment program.

Once you know what you’ll be investing in, you can move on to the next step in the process.

Step 2: Deposit Your Investment Funds

You’ll need to deposit your minimum investment prior to applying for the residency by investment program.

The deposit must be made into a Dutch bank account or, alternatively, another EU bank account that operates within the Netherlands.

Step 3: Submit Your Application

If you’re applying from outside the Netherlands, you’ll need to apply via your local Dutch embassy or consulate general.

Application forms can be found on the Netherlands Immigration and Naturalization website and must be accompanied by all required supporting documentation.2

Step 4: Application Processing

The Netherlands Immigration and Naturalization Service (NLS) will review your application and perform due diligence on your supporting documentation.

This will include a verification of the legitimacy of your source of funds and whether your investment will contribute to the Dutch economy.

Step 5: Award of Residence Permit

If your application is approved, you’ll be awarded a 3-year temporary residence permit, which you can choose to renew when it expires.

Required Documents

In addition to a completed application form, the supporting documents required for your Dutch residency by investment application range from a valid passport to proof of the source of funds.

Our in-house experts have created the perfect shortlist of the most important documents you’ll need:

Valid Passport

This is an important identity document for international travel or business dealings.

Birth Certificate

A translated and legalized (apostilled) version of your birth certificate may be required.

Marriage Certificate

If you're bringing or joining a spouse, you'll need to provide a copy of your marriage certificate.

This, too, would need to be legalized or apostilled.

Antecedent Certificate

The Dutch government prohibits entry to individuals who may pose a threat to the Netherlands or its citizens.

For this reason, you’ll be required to provide an official account of your background in the form of an antecedent certificate.

Police Clearance Certificate

Providing a police clearance certificate is a good way to support the statements made in your antecedent certificate.

This is further proof that you have a clean criminal record and aren’t defending yourself against any criminal charges.

Proof of Investment

As you'll have made your investment deposit prior to submitting your application, you’ll need to include proof of this transfer.

Origin of Asset Proof

This will prove that your investment capital was lawfully and legitimately obtained.

For this, you can include documentary evidence in the form of bank statements, tax returns, and annual financial statements.

Business Plan

If you're investing in a Dutch startup or business directly, you’ll need to submit a clear and comprehensive business plan.

Remember

The Netherlands Enterprise Agency will determine whether your investment is likely to contribute to the Dutch economy based on a points system.

Therefore, your business plan will need to demonstrate that your business will add genuine value.

Several additional supporting documents will need to accompany this business plan and may include the following:3

- An investment agreement signed by the parties involved (investor and company) and which demonstrates the purpose of the investment.

- Annual accounts of the last 3 years, verified by an independent third party. Or, if the company is younger than 3 years old, the annual accounts since its inception.

- An investment plan (including details of planned job creation) of the company in which the purpose of the investment is described.

- Data showing the expected effects of the investment, including anticipated turnover, results (net profit), employment, and/or innovation, both technological and non-technological.

- Supporting documents demonstrating the non-financial contribution of the foreign investor and the level of active involvement in the company, such as specific knowledge, specific work experience, references, patents, networks, and clients.

- The innovative company that will receive the investment must be registered with the Commercial Register of the Chamber of Commerce. This means you must submit a registration number.

Supporting Documents if Investing in a Contractual Joint Venture (JV)

If you're investing in a contractual joint venture (JV), various supporting documents must be provided.

These may include the following:

- An investment agreement signed by the parties involved (investor and company) and which demonstrates the purpose of the investment

- An agreement between the participants in the JV demonstrating the size and conditions

- A fund plan demonstrating the nature of the organization and the investments

- Proof of continuity of the contractual JV, such as annual accounts

- Data showing the expected effects of the investment with respect to its capital position, anticipated turnover, results (net profit), employment and/or innovation, both technological and non-technological (e.g., patents)

- Supporting documents demonstrating your own non-financial contribution and level of active involvement in the company, such as specific knowledge, specific work experience, references, patents, networks, and clients

- The contractual JV company receiving the investment must be registered at the Commercial Register of the Chamber of Commerce. A registration number must be submitted.

Supporting Documents if Investing in a Fund within the SEED Scheme

If you're investing in a fund within the SEED Scheme, certain supporting documents will be needed to prove the legitimacy of this investment.

These may include:

- Proof of participation in the fund

- A declaration proving that the SEED fund is recognized by the Ministry of Economic Affairs

- If necessary, a declaration showing that the fund didn’t receive SEED recognition but fits within the SEED scheme, according to the Netherlands Ministry of Economic Affairs

Statement of Health

This document will prove that you don’t pose a health threat and won’t be a burden on the Dutch health system.

If you’re not from an exempted country, this statement will also need to show that you don't have tuberculosis (TB).

Proof of Health Insurance

Proof of comprehensive health insurance in the Netherlands will support your clean statement of health.

What Costs Are Involved in Getting Residency by Investment in the Netherlands?

As you can imagine, the costs of residency by investment in the Netherlands extend far beyond the substantial investment amount and add up fast.

Let’s break down some of the major costs to expect.

Application Costs

Your first application and the application for a change in purpose of stay will cost €2,394.4

If you choose to extend your residency permit after the initial 3 years, it’ll cost €1,197.

Legal & Advisory Costs

If you're employing the services of immigration lawyers or advisors, their fees can vary widely based on expertise, reputation, and the services provided.

As you’ll be making a substantial investment, it’s wise to retain the services of reputable legal and immigration consultants.

Additional Associated Costs

As with any major investment or move to a new country, you could incur additional unexpected costs.

These may include:

- Translation costs: All non-Dutch documents need to be translated and legalized or apostilled. Translation services will be charged based on the complexity and length of the document.

- Health insurance: You'll need to show proof of comprehensive health insurance in the Netherlands, which can vary in cost based on coverage and duration.

- Housing and living expenses: Depending on your circumstances, you might need to factor in housing costs, either rental or purchase, and other living expenses while your application is being processed.

- Integration exam fees: Depending on your situation and long-term plans, you might need to take Dutch integration exams, which have associated fees.

- Relocation costs: Moving to a new country can be expensive, so it’s wise to factor in this cost when budgeting for your move to the Netherlands.

What’s the Processing Time for the Dutch Golden Visa?

The processing time for this visa is a crucial aspect for potential investors to consider.

Although visa processing times can vary, this is largely based on context.

Let’s have a look:

Average Processing Time

Typically, the average processing time for the Dutch investor visa can range between 90 and 180 days from the date of application.

This assumes that all documentation provided is correct, complete, and satisfactory.

Factors Affecting Processing Time

Various factors can affect the turnaround time of your Dutch residency by investment application.

These can include:

- Documentation completeness: Any missing or incomplete documentation can significantly delay the process. Ensuring all required paperwork is present and correctly filled out is crucial.

- Due diligence checks: The investment's source and legitimacy must undergo a due diligence process. Any discrepancies or concerns can lead to delays.

- Volume of applications: Sometimes, the Immigration and Naturalization Department (IND) might face a surge in applications, leading to longer processing times.

- Legal or financial complications: If there are any legal or financial issues related to the investment, the review process might be longer.

- Background checks: Extensive background checks might be required, especially if there are concerns about the applicant's past.

Expedited Processing Options

The Netherlands doesn’t currently offer expedited processing options for residency by investment applications.

Occasionally, if there’s a pressing need or exceptional circumstance, applicants can reach out to the IND to inquire about the possibility of expediting their application, but there are no guarantees.

What Are the Tax Implications of Residency in the Netherlands?

The conditions of your residency by investment status in the Netherlands are very likely to render you a Dutch tax resident.

We’ve gone ahead and summarized some of the tax implications of residency by investment in the Netherlands for you:

- Income tax: Residents are taxed on their worldwide income. The Netherlands uses a progressive tax rate system for individual income, with several tax brackets based on income levels.

- Box system: The Dutch tax system divides income into 3 categories, or 'boxes,' each with its own tax rate:

- Box 1: Income from employment and primary residence

- Box 2: Income from a substantial interest (usually from owning shares in a company)

- Box 3: Income from savings and investments

- 30% ruling: This is a tax advantage for highly skilled migrants moving to the Netherlands for work. The scheme, in essence, allows for tax-free allowance amounting to 30% of gross salary subject to Dutch payroll tax.

- Wealth tax: In the Netherlands, there isn’t a distinct "wealth tax", but Box 3 taxes a presumed return on savings and investments.

- Inheritance and gift tax: The Netherlands imposes inheritance tax on assets received from someone who was a resident of the country at the time of their death. Gifts received from a resident of the Netherlands can also be subject to gift tax.

- Real estate tax: Owners of real estate in the Netherlands are subject to an annual municipal tax based on the value of the property.

- Value Added Tax (VAT): This is a consumption tax, and the general VAT rate in the Netherlands is 21%. A reduced rate of 9% applies to certain goods and services, like food and books.

- Social security contributions: Residents also need to contribute to the Dutch social security system, which covers things like old-age pensions and unemployment benefits.

- Double taxation treaties: The Netherlands has numerous double taxation treaties with other countries to ensure residents aren't taxed on the same income in both the Netherlands and their home country.

- Tax residency determination: It's essential to determine your tax residency status, as non-residents are only taxed on Dutch-source income.

Is Residency by Investment in the Netherlands a Pathway to Dutch Citizenship?

Yes, ultimately, residency by investment in the Netherlands can lead to Dutch citizenship.

To get to this point, you’ll need to maintain your initial 3-year temporary residency permit and then apply for either permanent residency or citizenship.

Common Questions

Is the Dutch Golden Visa Suspended?

Does a Dutch Resident Have the Same Rights as a Dutch Citizen?

If I Buy a House in the Netherlands, Can I Get Dutch Residency?

Is It Difficult to Get Dutch Residency by Investment?

Does Holland Have a Golden Visa?

Does the Netherlands Offer a Visa Lottery?

Is There an Annual Cap on Residency by Investment in the Netherlands?

How Risky Is Residency by Investment in the Netherlands?

Must I Speak Dutch to Get Residency by Investment in the Netherlands?

How Do You Qualify for Tax Residency in the Netherlands?

How Do I Know If I Qualify for a Dutch Golden Visa?

In Conclusion

The Netherlands offers one of the most expensive residency by investment programs in Europe, but it’s certainly worth it if you can afford it.

With its thriving economy, strategic location, and high quality of life, the Netherlands has long been an attractive destination for global investors and entrepreneurs.

By offering a win-win scenario, the Netherlands not only benefits from increased foreign investment that boosts its economy, but investors and their families also gain access to an unparalleled lifestyle, education, and business opportunities.

For a rundown on other European countries offering similar residency by investment programs, check out some of our other informative articles.

Learn More: Residency by Investment Programs in Europe & the UK

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure