Residency By Investment Costs

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Typical costs associated with residency by investment programs include the initial investment (ranging from $100,000 to over $2 million), processing fees, legal fees, and due diligence fees.

- Application and processing fees vary among programs, with some countries charging significant amounts for background checks, application processing, and legal documentation.

- Additional costs beyond the investment requirement may include government donations, real estate maintenance costs, or mandatory contributions to local development funds.

- Financial planning is essential, requiring applicants to budget for more than the stated investment minimum to cover all associated expenses.

- Some of the most cost-effective programs are found in countries looking to attract foreign direct investment, offering lower thresholds or incentives for investment in certain sectors or regions.

Did you know that some residency by investment (RBI) programs' financial requirements can reach as high as US$2 million?1

That’s before you’ve even considered additional costs such as application fees, accommodation, and transport.

Luckily, you can prepare and plan ahead with WorldPassports’ in-depth guide to residency by investment costs and fees.

In This Article, You Will Discover:

Read on to find out more…

*Disclaimer: All amounts mentioned in this article were correct at the time of publication and might have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

Why’s It Important to Understand the Costs Involved in Residency by Investment?

Understanding the costs involved in residency by investment programs is crucial for anyone considering this path to secure a new residency.

Here's why it's so important:

- Personal financial planning: Knowing the costs upfront allows you to plan your finances effectively, ensuring you have adequate funds to cover all expenses associated with the program.2

- Comparing options: Being aware of the costs helps you compare different residency by investment programs, enabling you to choose the one that best suits your financial situation and goals.

- Avoiding surprises: A thorough understanding of the costs involved can help prevent unexpected expenses, keeping your budget on track and minimizing stress throughout the process.

- Making informed decisions: Having a clear picture of the costs enables you to make well-informed decisions about whether a particular residency by investment program is the right choice for you and your family.

- Budgeting for additional expenses: Recognizing all the costs involved allows you to budget for any additional expenses, such as taxes, travel costs, and translation services, that may arise during the application process.

What Investment Costs Are Involved in Residency by Investment?

The first and foremost cost of any residency by investment program is the minimum investment requirement.

There are various qualifying investment routes offered by different RBI programs, catering to a range of financial situations and personal preferences.

Let our expert team guide you through each investment route’s costs in more detail.

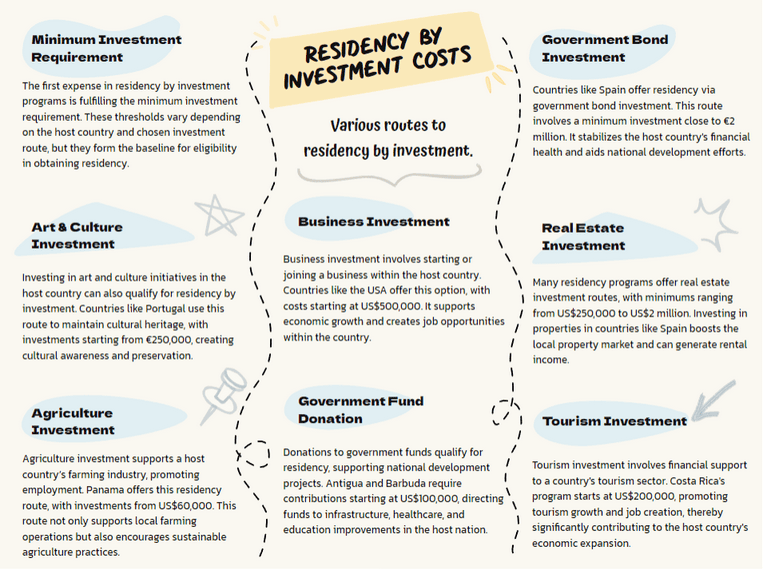

Art & Culture Investment

The first investment route involves supporting local art and culture initiatives in the host country.

Countries such as Portugal offer this as a qualifying investment route for their residency by investment program.

The minimum investment requirement to qualify for this route begins at €250,000 and contributes toward the country's cultural heritage and preservation.

Agriculture Investment

Agriculture is another qualifying investment route offered by residency by investment programs.

By investing in the country’s agriculture, you’re contributing to the host country's farming industry and promoting employment.

Countries such as Panama offer this investment route for their RBI programs.

The costs for this investment route begin at US$60,000 with Panama’s agricultural investor program but can vary significantly depending on the specific project and country.

This type of investment can create jobs and promote sustainable farming practices.

Business Investment

Business investment is a common qualifying investment route that requires setting up or investing in an existing business within the host country.

Many countries, including the United States and Canada, offer this option as part of their residency by investment programs.

Costs typically start at US$500,000 and can vary depending on the nature of the business and destination.

This investment route helps stimulate economic growth and job creation.

Read On: Residency by Investment in the US

Donation to a Government Fund or Project

Donating to a government fund or project is another investment route to qualify for many RBI programs.

Countries such as Antigua and Barbuda or Saint Lucia offer this route, with contributions typically starting at US$100,000.

These funds go toward supporting various national initiatives such as infrastructure development, healthcare, and education.

Government Bond Investment

Investing in government bonds is another common investment route for many residency applicants.

This option involves investing in government bonds issued by the host country.

Countries such as Spain offer this investment route, with minimum investment requirements starting at approximately €2 million.

By investing in government bonds, you're supporting the country's financial stability and development.

Investment Fund

In addition to bonds, many RBI programs offer government-approved funds as an investment route to residency.

Portugal is an example of a country offering this type of investment.

The minimum investment required for this route is approximately US$1.5 million.

These funds are designed to support various sectors such as technology, innovation, and job creation in the host country.

Real Estate Investment

According to our experts, real estate investment is a popular investment route for many RBI applicants.

This investment route involves investing in either qualifying residential or commercial property.

Countries such as Spain, Greece, and Cyprus offer this investment option, with minimum investments ranging from US$250,000 to US$2 million.

By investing in real estate, you're contributing to the local property market and potentially generating rental income.

Share or Partnership Investment

This investment route involves becoming a shareholder or partner in a local company.

Countries such as New Zealand offer this option as part of their residency by investment program.

Costs can vary significantly depending on the specific company and industry, but generally start at US$100,000 for each applicant.

This type of investment promotes business growth and job opportunities in the host country.

Tourism Investment

Tourism investment requires supporting the host country's tourism industry through a significant financial contribution.

Countries such as Costa Rica offer this investment route for their RBI programs.

The minimum investment to qualify for Costa Rica’s residency by tourism begins at US$200,000.

This investment option helps boost the country's tourism sector and create new job opportunities.

What Residency by Investment Legal Fees Can I Expect to Pay?

When pursuing a residency by investment program, the next major cost to be aware of is the various legal fees associated with the process.

These fees contribute toward ensuring that all legal requirements are met during your application and investment.

Our team will walk you through the specific legal fees in more detail.

Legal Advisory Fees

Legal advisory fees are paid to legal advisors who guide you through the residency by investment application processes.

Legal advisors help ensure your documentation is accurate and compliant with the host country's regulations.

The specific fees will vary significantly depending on the complexity of your case and your chosen program, but they can generally start at around US$5,000.

Notary Fees

Notary fees cover the cost of having your documents notarized by a licensed notary public.

This process is necessary to verify the authenticity of your documents, which is a crucial requirement for the majority of RBI programs.

Notary fees typically range anywhere from US$100 to $1,000, depending on the number of documents and the country you’re applying to.

Specific Fees if Investing in Real Estate

If you choose to qualify for residency via real estate investment, you’ll encounter specific fees relating to this investment.

For your convenience, we’ll walk you through the specific costs associated with real estate investment.

See below:

Stamp Duty

Stamp duty is a tax levied by the government on the transfer of property or real estate.

This cost varies depending on the country and the value of the property being transferred.

Typically, stamp duty costs can range from 1% to 5% of the property’s total value.

Transfer Fees

Transfer fees are charged by the relevant authorities for processing the transfer of property ownership.

These fees vary depending on the country and property value, but usually range from 0.5% to 2% of the property’s price.

Estate Agent Fees

The final real estate fee, estate agent fees, are commissions paid to real estate agents for their services in finding and facilitating the acquisition of real estate.

These fees typically range from 3% to 7% of the property price, depending on the country and your chosen agent.

What Government Fees Are Associated with Residency by Investment?

Government fees are another significant cost that all RBI applicants must budget for and plan ahead for.

These fees cover the costs of processing your RBI application, conducting due diligence, and more.

Let us walk you through the major government fees to uncover how your RBI journey will be impacted.

Government Fees Associated With Your Investment Route

The fees for processing your chosen investment route will vary significantly depending on the program and type of investment route you choose.

These fees are necessary to support and maintain the government's management and promotion of its RBI program.

In general, the various government fees can range anywhere from US$25,000 to $100,000 or more, depending on the program and investment category you choose.

Application Processing Fees

Application processing fees cover the costs associated with reviewing and processing your residency by investment application.

These fees help cover the administrative expenses incurred by the government in assessing your eligibility for the program.

Application processing fees typically range from US$1,000 to $10,000, depending on the country and the complexity of your case.

Due Diligence Fees

Due diligence fees account for the background checks and verification processes that governments perform to ensure the integrity of their RBI programs and the safety of the country.

This includes verifying your financial resources, criminal history, and overall suitability for residency.

Due diligence fees can vary widely but generally range between US$5,000 and US$15,000.

Visa Fees

Visa fees are charged by the host country for issuing the necessary visas and permits required for your residency.

These fees contribute to the administrative costs of processing your visa application and maintaining your residency status while in the country.

Visa fees usually range from a few hundred US dollars up to several thousand US dollars, depending on the country and type of visa you require.

What Additional Costs Should I Plan for in My Residency by Investment Process?

While we've covered the primary costs associated with residency by investment (RBI) programs, there are several additional expenses that you should be aware of throughout the process.

Let's explore each additional cost in more detail to help you better plan ahead for your RBI journey.

Taxes

When participating in an RBI program, your tax liabilities and responsibilities may shift significantly depending on the country and type of investment route you choose.

For example, you might need to pay income tax, capital gains tax, or property taxes in the country where you're seeking residency.

The exact tax rates you’ll be required to pay will vary widely based on the specific program and your personal circumstances.

Therefore, it's important to consult with a tax professional to remain compliant with the host country's tax regulations throughout your application and residency.

Travel Costs

During the RBI application process, you may need to travel to the host country to complete certain steps or attend interviews.

Additionally, once your residency is approved, you'll likely need to travel to the country to settle in and maintain your residency status.

Take note

Travel costs can vary greatly depending on factors such as your country of origin, the number of family members accompanying you, and the frequency of your trips.

It's essential to factor in these travel expenses when planning your overall RBI budget.

Translation Services

Many RBI programs require that your application documents be translated into the host country's official language.

This often means hiring a professional translator to ensure that your documents are accurately translated and properly formatted.

Translation services vary in cost depending on the number of documents, their complexity, and the language pair involved.

Expect to pay anywhere from a few hundred to several thousand US dollars for translation services during your RBI process.

How Can I Avoid Unforeseen Costs in Residency by Investment?

Navigating the residency by investment process can be complex, and unforeseen costs can sometimes arise.

To help you avoid unexpected expenses and better manage your budget, let's explore some strategies that can keep your RBI journey on track.

Here are our 5 suggested strategies to consider:

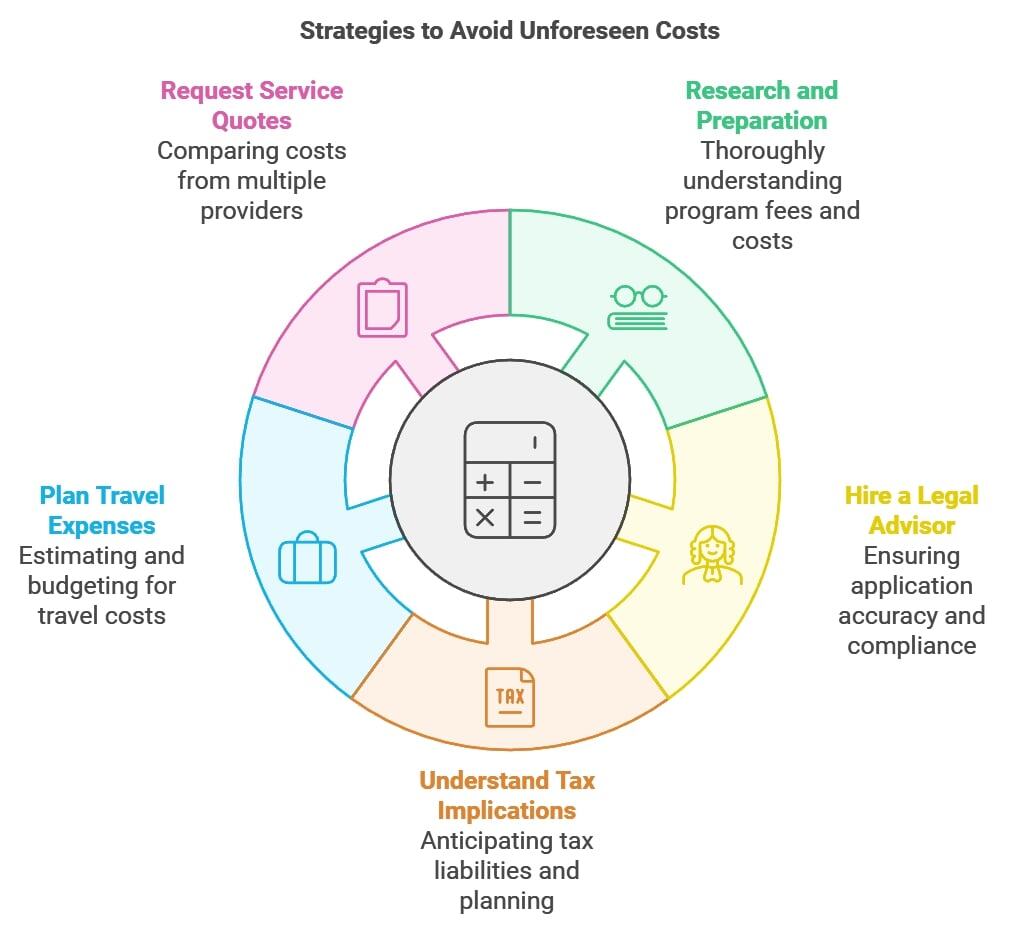

- Research and preparation: Thoroughly research the RBI program you're interested in, including all associated fees and costs. By understanding the full scope of expenses, you'll be better equipped to create a realistic budget and avoid financial surprises. Make sure to consult official government websites and seek advice from professionals experienced with the specific program of your choice.

- Hire a reputable legal advisor: Engaging a trustworthy and experienced legal advisor can help ensure your application is accurate and compliant with the host country's regulations. A good advisor will also be able to guide you through the process, alert you to potential hidden costs, and help you avoid costly mistakes.

- Understand tax implications: Consult with a tax professional familiar with both your home country's tax laws and those of the country where you're seeking residency. This will help you anticipate any tax liabilities related to your investment and plan for them accordingly, avoiding surprises down the line.

- Plan for travel and relocation expenses: Be proactive in estimating your travel and relocation costs during the RBI process. Research flights, accommodations, and other travel-related expenses ahead of time and factor these into your budget. This will help you avoid unexpected costs and ensure that you have adequate funds allocated for your trips and immigration.

- Request quotes from all service providers: Obtain quotes from several service providers for each aspect of your application, such as legal advice, translation services, or real estate agents. This will give you a better idea of the costs involved and allow you to choose providers that fit within your budget.

In summary

By taking a proactive approach and planning for the future, you give yourself the best chance to budget effectively and avoid financial pitfalls.

Common Questions

Do Countries Offer Free Residency?

What’s the Average Amount to Invest for a Residency by Investment Program?

What’s the Most Expensive Residency by Investment Program?

How Wealthy Must I Be to Get Residency by Investment?

Are There Any Fees That I Need to Pay to Include My Spouse in My Residency Application?

In Conclusion

We trust our comprehensive article has given you a better understanding of the various costs involved in pursuing residency by investment.

Our expertise in this field enables us to guide you through the process and help you make informed decisions on your path to foreign residency.

We wish you the best of luck on your residency by investment journey and remain committed to supporting you every step of the way.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure