Residency By Investment Factors

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- When choosing a residency by investment program, consider political stability, economic conditions, and the legal framework of the host country, as these factors directly impact the safety and profitability of your investment.

- Lifestyle, education, and healthcare quality are significant for families and individuals seeking a high standard of living, making some countries more attractive based on these criteria.

- Mobility, such as visa-free travel and future citizenship opportunities, is crucial for those looking to expand their global access and potentially relocate permanently.

- Financial considerations include understanding the tax implications, both in the host country and how it interacts with your home country's tax system, and assessing investment risks and costs.

- Evaluating these factors requires thorough research and possibly consultation with legal and financial advisors to align the investment with your long-term residency and citizenship goals.

The pursuit of better opportunities, financial security, and a more fulfilling lifestyle has led an increasing number of high-net-worth individuals to explore residency by investment (RBI) programs.

However, understanding all the factors associated with RBI can be a complex process to navigate, particularly as there are numerous matters to consider before you can start applying.

To help you prepare for a successful RBI journey, WorldCitizenship’s team of experts has diligently compiled an in-depth guide on all the factors you should keep in mind when applying for your chosen program.

In This Article, You Will Discover:

Don’t get caught out!

Read on to find out what you might not have considered yet…

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

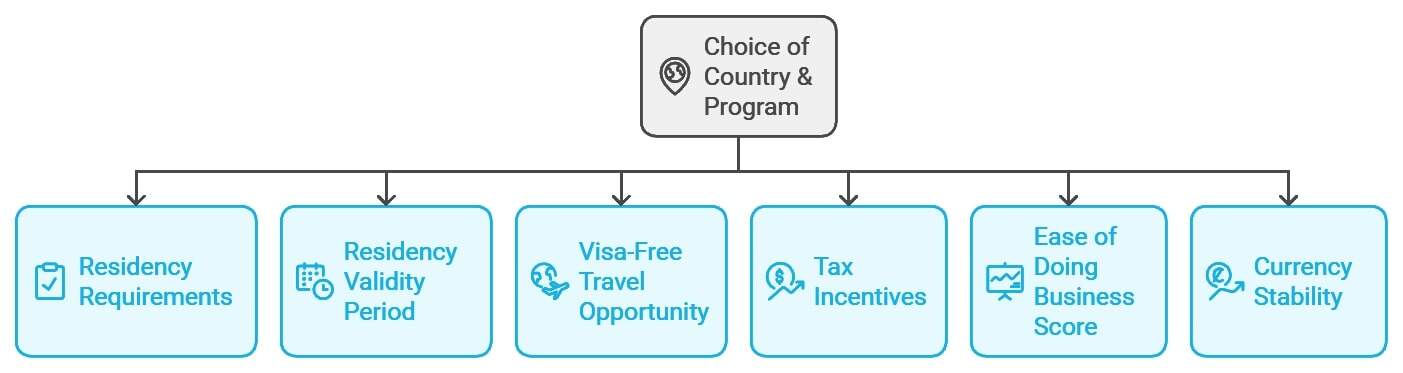

Choice of Country & Program

As you embark on your residency by investment journey, one of the most critical decisions you'll make is the choice of country and program.

This decision will shape your experience and determine your future.

Let us guide you through some key factors to consider when selecting a country and program to pursue residency by investment.

Read below:

Residency Requirements

The first factor to consider is the country's and program’s residency requirements.

Each country has its own set of unique requirements for residency by investment applicants, such as physical presence, language proficiency, or cultural integration.

It's essential to understand and be prepared to meet these requirements, as they directly impact your application's success.

Choose a program with requirements that you can comfortably fulfill to ensure a smooth transition.

Residency Validity Period

The next important factor to consider is your chosen RBI program’s residency timeline.

The duration for which you’re granted residency status in the country varies significantly between programs.

Some offer temporary residency with the option to renew or apply for permanent residency, while others grant permanent residency from the outset.

What's more

A few programs even offer the opportunity to pursue citizenship via RBI.

Consider the validity period and renewal process when selecting a program, as they’ll affect your long-term plans and stability in the chosen country.

Visa-Free Travel Opportunity

One of the significant advantages of residency by investment is the potential for visa-free travel to various countries.

Therefore, it's crucial to evaluate the extent of visa-free travel opportunities offered by the program, as it can greatly enhance your global mobility and provide greater access to business and personal opportunities.

Whether the Country Offers Tax Incentives

Another major factor to consider when choosing a program is the country’s tax environment.

Tax incentives can play a crucial role in maximizing the return on your investment.

As such, we recommend researching the tax environment of the countries you're considering, including income, capital gains, and inheritance taxes.

A favorable tax regime can significantly impact your overall financial situation and make a residency by investment program far more attractive.

Ease of Doing Business Score

If you plan on establishing or expanding a business in the country where you're seeking residency, our team highly recommends considering its ease of doing business score.

This score reflects the business-friendly environment and regulatory framework of a country.1

A higher score indicates a more conducive environment for business, which can contribute to your investment's success and overall satisfaction with the chosen program.

Stability of the Country's Currency

The final factor to consider is your chosen country’s currency.

The stability of a country's currency is an essential factor to consider, as it can directly affect your investment's value and returns.

We recommend opting for a country with a stable currency and a strong economy in order to minimize the risk of currency fluctuations and maximize the potential return on your investment.

Financial Requirements

As you delve deeper into the residency by investment process, you’ll find that there are numerous financial factors to consider.

In this section, we'll walk you through some key financial factors to consider, ensuring your chosen program aligns with your budget, investments, and financial goals.

Take a look.

Minimum Investment Amount

The first and most significant financial requirement that all applicants should consider when applying for residency by investment (RBI) is the program's minimum investment amount.

Each RBI program has a minimum investment amount that applicants must meet or exceed to qualify.

This amount can vary significantly between countries and types of investments.

It's essential to choose a program with a minimum investment that fits your financial capabilities while still providing the desired benefits and opportunities.

Expected Return on Investment

When considering various residency by investment programs, it's vital to evaluate the potential return on investment (ROI) for each investment route.

Factors such as the stability of the country's economy, real estate market trends, and the historical performance of investment types can provide insights into the expected ROI.

Selecting a program with promising returns will help you make the most of your investment while pursuing residency.

Taxes & Fees

The residency by investment journey is often accompanied by various fees, such as application fees, legal fees, due diligence fees, and more.

Therefore, we recommend finding the fee outline for your chosen program in order to prepare and budget accordingly.

In addition to fees, residency by investment programs often involves changes to your tax situation.

Once you obtain residency, you may be subject to local taxes, depending on the country's tax regime.

Cost of Living in the Country

The cost of living in your chosen country can significantly impact your overall financial situation and quality of life.

We suggest researching the cost of housing, utilities, transportation, education, healthcare, and other daily expenses in the countries you're considering.2

Select a country with a cost of living that aligns with your lifestyle preferences and financial expectations to maximize your satisfaction and comfort during your residency.

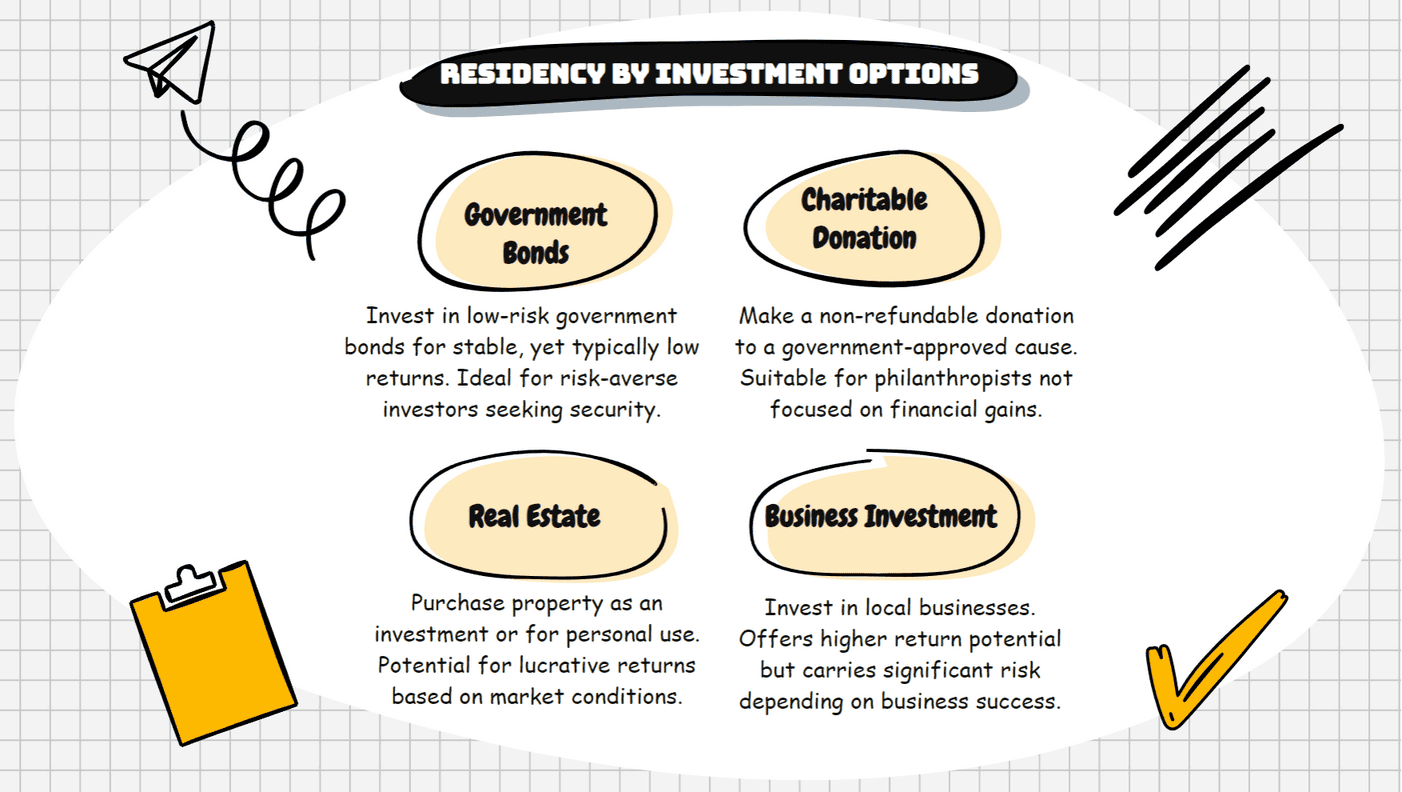

Type of Investment

Another pivotal aspect of your residency by investment journey is determining the most suitable type of investment for your financial goals and tolerance.

In summary, here are the possible investment options to obtain residency:

- Government bonds: Investing in government bonds typically involves purchasing interest-bearing securities issued by the country's government. This route is usually a lower-risk option compared to other investment types but may also yield lower returns.

- Charitable donation: Some residency by investment programs allow applicants to make a non-refundable charitable donation to a government-approved organization or cause. This route can be an attractive option for those who value philanthropy and aren’t primarily focused on financial returns.

- Real estate: Real estate investment involves purchasing property in the chosen country, either for personal use or as a rental property. This route can offer attractive returns, depending on the local property market's performance.

- Business investment: Business investment entails investing in new or existing businesses in the country, either through direct ownership or as a shareholder. This route can potentially provide higher returns but also comes with higher risks, as the success of the business directly impacts your investment.

Please note

It’s important to research the intricacies of each investment type of details, before proceeding with the process.

Processing Times

Processing times are a significant factor that we highly recommend you consider during your RBI application.

Below, we’ll walk you through the key aspects of processing times to help you better understand what to expect and how to plan accordingly.

Here’s what you should know:

Application Process Duration

The duration of the application process for residency by investment varies significantly between countries and even between different investment routes within the same country.

Some programs may take only a few months, while others could take over a year to complete.

It's essential to research and understand the expected processing time for your chosen program to ensure it aligns with your timeline and expectations.

By doing so, you’ll be able to plan your move and investments accordingly.

Residency Timeline

Once your application is approved, the residency timeline comes into play.

This refers to the period between obtaining your residency and potentially becoming eligible for permanent residency or citizenship (if applicable).

Residency timelines can vary between countries and programs, with some offering immediate permanent residency while others require a temporary residency period before applying for permanent status.

Why’s this important?

Understanding the residency timeline is vital for planning your long-term goals in the chosen country and ensuring a smooth transition as you embark on your new life.

Dependents Covered by Residency by Investment Programs

If you intend on applying for residency by investment with your family, it's crucial to understand that the coverage of dependents can vary significantly between countries and programs.

Most programs allow for the inclusion of your spouse and children, but the age limit for dependent children can differ.

Moreover

It’s important to note that the eligibility requirements for family dependents will vary significantly across programs.

As you evaluate various programs, we recommend that the chosen option accommodate your family members, providing them with the same residency benefits and opportunities for a seamless transition and a secure future together.

Choice of Residency by Investment Agency

There are a few things to keep in mind if you decide to work with a residency by investment agency.

A reputable and experienced agency can provide expert guidance, navigate complex regulations, and help you make well-informed decisions tailored to your unique needs and goals.

However, selecting the right agency for your unique circumstances is important for a successful outcome and navigating potential challenges.

Our experts recommend a few factors to consider when selecting an agency to work with:

- Reputation and track record

- Fees and payment structure

- Expertise and efficiency

- Range of services offered

- Location and reach

- Transparency and honesty

- Customer service and responsiveness

- Security and confidentiality

- Legal compliance

Common Questions

Are There Age or Language Proficiency Requirements for Residency by Investment Programs?

Can I Get Residency by Investment If I Have a Criminal Record?

Are There Any Restrictions on Qualifying for a Residency by Investment Program?

How Does the Residency by Investment Program Verify the Source of the Applicant’s Income & Wealth?

What Attracts Investors to Invest in Certain Countries Over Others?

In Conclusion

Selecting the right residency by investment program requires thorough research and careful consideration of various factors, including investment types, processing times, dependents' coverage, and choice of agency.

We at WorldPassports trust that our in-depth article has prepared you to embark on your residency by investment journey confident in the knowledge that you’ve considered everything.

We wish you all the best in your pursuit of your foreign residency by investment program.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure