Residency By Investment Tax

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Tax implications of obtaining residency through investment can significantly impact your financial planning, with some countries offering tax incentives to attract foreign investors.

- Tax laws among residency by investment countries vary, with considerations around income tax, capital gains, inheritance tax, and how these are applied to residents versus citizens.

- Investors should consider tax planning strategies that might include structuring investments through certain types of entities or choosing a country with a favorable tax treaty with their home country.

- Countries with favorable tax treatments for investors often include those with low or no tax on foreign income, capital gains, or wealth, such as certain Caribbean nations.

- Understanding double taxation agreements is crucial to avoid paying tax on the same income in two countries, maximizing the financial benefits.

Did you know that the tax implications of residency by investment are largely determined by the type of residency by investment program you choose?

As experts in the field, we understand the importance of fine-tuning your tax responsibilities when venturing into the realm of investing in global mobility.

As onerous as managing your tax obligations can be, we agree with the late US President Franklin D. Roosevelt that “Taxes, after all, are dues that we pay for the privileges of membership in an organized society”.

To understand the tax implications of permanent residency, it’s essential that you research the tax laws of the relevant country and consult with tax professionals to obtain accurate and up-to-date information.

In This Article, You Will Discover:

Stay with us as we help you navigate the often complex landscape of international taxation and residency by investment.

*Disclaimer: All amounts quoted in this article were correct at the date of publishing and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

What’s the Difference Between Permanent Residency & Tax Residency?

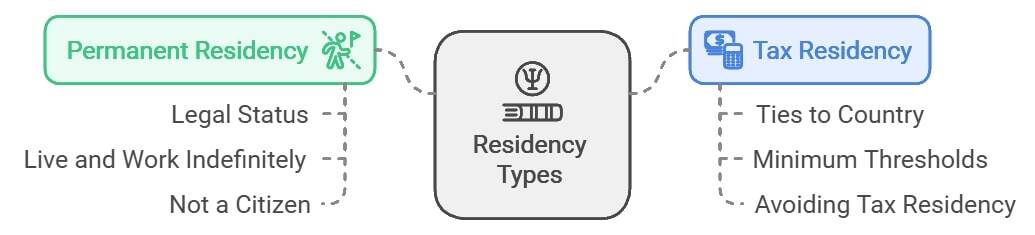

The difference between permanent residency and tax residency determines whether you’ll be liable for taxation in a country or exempt from taxation.

This means that you can be a permanent resident of a country without being a tax resident of that country.

Permanent residency refers to the legal status granted to a foreign individual, allowing them to live and work in a country indefinitely without being a citizen.

Whereas…

Tax residency is a measure of your ties to that country.

Essentially, if you meet the minimum threshold for length of stay, primary residence, or economic interests in the country, you can be taxed in that country.1

In most countries, if you can show that you spend more than a stipulated number of days outside of that country and earn most of your income internationally, you’ll avoid tax residency.

Therefore…

Although acquiring residency through a residency by investment program doesn’t necessarily mean you’ll be a tax resident, it's essential to confirm the possible tax consequences of obtaining permanent residency in your preferred country.

Why’s It Important to Understand Countries’ Tax Regulations?

It’s important to understand countries’ tax regulations when considering various residency by investment programs because it minimizes the risk of legal issues or unexpected financial burdens.

Understanding the tax structure of your chosen country of residency will help you make informed decisions.

Your new residency should open doors of opportunity, not hamstring you with unforeseen obligations.

That’s why we’ve compiled a synopsis of the tax implications of residency by investment, arranged by region and country.

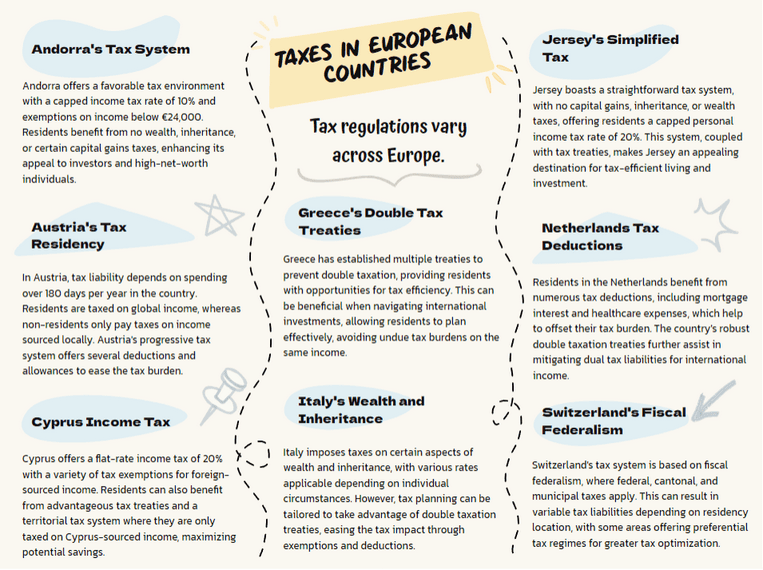

Taxes in European Countries

The tax environment in European countries varies significantly, with each nation having its own unique regulations and rates.

We strongly recommend that you consult with a reputable tax advisor to fully understand the tax implications and potential benefits of acquiring a new residency in another country.

Come with us as we provide an overview of the tax implications of residency in various European countries.

Andorra

Andorra is a somewhat hidden gem of Europe, attracting many international investors owing to its tax setup, political stability, and conducive business environment.

To be a tax resident in Andorra, you must spend more than 183 days per year in the country.2

The tax implications of tax residency in Andorra include the following:

- Low personal income tax: The income tax rate in Andorra is capped at 10%. Annual income up to €24,000 is tax-exempt, and income between €24,000 and €40,000 is taxed at a 5% rate.

- Territorial tax system: Residents of Andorra are only taxed on income generated within Andorra, not on their worldwide income.

- No tax on wealth, inheritance, or capital gains from qualifying participations: This perk provides a favorable environment for investors and high-net-worth individuals.

- Tax exemptions and deductions: This covers a broad list in Andorra, including exemptions for dividends earned from resident entities, interest, and rental income from foreign sources.

- No social security contributions: In Andorra, residents are exempt from this tax, resulting in additional savings for individuals and businesses.

- Favorable Value Added Tax (VAT) rate: The VAT rate in Andorra is 4.5%, which is lower than in many other European countries.

- Property tax: Property tax is applied at an average of €100 per property annually. Transfers of immovable properties between individuals are subject to a transfer tax of between 1.5% and 2.5% of the purchase price.

- Corporate tax rate: The corporate tax rate for companies registered in Andorra is set at between 3 and 10%.

- Double tax treaties: Andorra holds double taxation agreements with various countries, helping to prevent double taxation and providing further tax planning opportunities for residents.

Austria

Austria offers a captivating blend of stunning natural landscapes, rich cultural heritage, and a thriving economy, making it an ideal destination for those seeking a high quality of life and promising investment opportunities.

You’ll be a tax resident of Austria if you spend more than 180 days per year in the country.3

The tax implications of permanent residency in Austria include the following:

- Worldwide income tax: As a permanent resident of Austria, you’ll be taxed on your worldwide income. Non-residents are only taxed on income from specific sources in Austria.

- Progressive income tax system: Austria uses a pay-as-you-earn system. Anyone who lives in Austria is responsible for paying taxes all year. Foreigners who work but don’t live in Austria pay a limited tax on their Austria-earned income. With varying tax rates, Austria’s income tax reaches a maximum marginal rate of 55%.

- Deductions and allowances: A variety of deductions and allowances exist for business expenses, dependent family members, and certain investments, which can help reduce the overall tax burden.

- Double taxation treaty network: Austria has double taxation agreements with numerous countries, including Germany, the UK, and Switzerland, allowing for the avoidance of double taxation and providing tax planning opportunities.

- Capital gains tax: This tax is applicable in Austria, although there are certain exemptions and reduced tax rates applicable to specific assets and holding periods.

- Inheritance and gift taxes: These are subject to varying tax rates depending on the relationship between the donor and recipient.

- Value Added Tax (VAT): Different rates are applicable to various goods and services, typically ranging from 10% to 20%.

- Social security contributions: These are mandatory for residents in Austria, and include health insurance and pension contributions. They’re generally based on a percentage of income.

Cyprus

Cyprus, with its strategic location, favorable tax regime, attractive business environment, and breathtaking Mediterranean charm, offers a compelling destination for individuals seeking an exceptional lifestyle and promising investment opportunities.

Residents of Cyprus qualify as tax residents if they spend more than 183 days in a year within the country.

You can also apply for tax residency in Cyprus under the 60-day rule, which requires you to meet the following standards:4

- You stay in Cyprus for over 60 days in a calendar tax year.

- You’re not a tax resident of another country.

- You don’t reside for up to 183 days in total in another country.

- You have verifiable economic ties with the island, for instance, by owning or renting a permanent residence in Cyprus.

- You’re a worker in Cyprus, run business activities in Cyprus, or act as a Director in a Cypriot tax-resident company.

The tax implications of tax residency in Cyprus include the following:

- Flat personal income tax: Personal income tax in Cyprus is capped at a rate of 20% for residents. If your annual income is less than €19,500, you’ll be exempt from this tax.

- Territorial tax system: Tax residents of Cyprus are only taxed on their Cyprus-sourced income, with foreign income generally exempt from taxation.

- Double tax treaties: Cyprus has a wide network of double tax treaties, providing opportunities for tax planning and the possible avoidance of double taxation.

- No wealth tax, no inheritance tax, no withholding tax on dividends: This makes Cyprus an attractive destination for investors and high-net-worth individuals.

- Capital gains tax: This tax is applicable in Cyprus at 20%, but there are exemptions and reduced rates for certain assets, such as property and shares.

- Advantages for non-domiciled tax residents: If you choose to become a Cyprus tax resident, you can still benefit from a "non-domiciled" status to enjoy additional tax advantages.

- Incentives and exemptions: These are applicable to specific activities, such as the attractive "IP Box" regime for intellectual property-related income.

- Value Added Tax (VAT): In Cyprus, standard VAT rates range from 19% to 21%, depending on the goods or services.

Greece

Greece, with its stunning Mediterranean beauty, rich history, warm hospitality, and promising investment opportunities, offers an irresistible blend of cultural immersion, breathtaking landscapes, and economic potential.

To be considered a tax resident of Greece, you must have resided in Greece for at least 183 calendar days in a year.5

The tax implications of permanent residency in Greece include the following:

- Worldwide income tax: If you’re considered a tax resident, you’ll be liable to be taxed on your income from worldwide sources. However, foreign-source income may be eligible for a tax exemption or reduced tax rate under certain conditions, such as the Non-Domiciled Resident regime.

- Progressive income tax system: Greece’s income tax system is applied according to various tax brackets, ranging from 9% to 44%, depending on income levels.

- Double tax treaties: Greece holds treaties with many countries, helping to avoid potential double taxation and providing opportunities for tax planning.

- Capital gains tax: Capital gains from the sale of real estate in Greece are subject to a flat tax rate of 15%, while capital gains from other assets are taxed as part of the regular income tax.

- Inheritance and gift taxes: In Greece, varying tax rates are applied in this instance, depending on the relationship between the donor and recipient.

- Value Added Tax (VAT): Standard VAT rates in Greece range from 6% to 24%, depending on the goods or services.

- Social security contributions: These contributions are mandatory for residents of Greece and are based on a percentage of income. These contributions extend to healthcare and pensions.

Italy

With its unparalleled cultural heritage, breathtaking landscapes, world-renowned cuisine, and thriving business opportunities, Italy beckons investors.

In Italy, you’re a tax resident if:6

- You’re registered in the Records of the Italian Resident Population (Anagrafe).

- You have a ‘residence’ in Italy (habitual abode).

- You have a ‘domicile’ in Italy (principal center of business, economic, and social interests, e.g., the family).

Let’s have a look at the tax implications of permanent residency in Italy:

- Worldwide income tax: Italian tax residents are taxed on income derived from worldwide sources. However, foreign-source income may be eligible for a tax exemption or reduced tax rate under certain conditions, such as the Non-Domiciled Resident regime.

- Progressive income tax system: Income tax in Italy reaches a maximum marginal rate of 43%.

- Double tax treaties: Italy has double taxation treaties with many countries, helping to avoid double taxation and providing opportunities for tax planning.

- Capital gains tax: Capital gains from the sale of real estate in Italy are subject to taxation, with rates ranging from 20% to 26% depending on the holding period.

- Inheritance and gift taxes: These exist in Italy, with varying tax rates depending on the relationship between the donor and recipient.

- Value Added Tax (VAT): Standard VAT rates in Italy range from 4% to 22%, depending on the goods or services.

- Social security contributions: These include healthcare and pension contributions, are mandatory for residents in Italy, and are based on a percentage of income.

Jersey

For individuals seeking a combination of tranquility, economic advantages, and picturesque surroundings, Jersey offers a comparatively favorable tax environment, a robust financial services sector, and a high-quality lifestyle.

What an enticing opportunity!

In Jersey, any of the following constitutes residence status for tax purposes:7

- Spending a period or periods equal in whole to six months on the island in any one tax year.

- Maintaining a place of abode on Jersey, available for use if the individual then stays there for one night.

- Visiting Jersey year after year for a substantial period of time. The Jersey tax authorities would normally regard average annual visits of three months as 'substantial'.

Let’s have a look at the tax implications of investing in permanent residency in Jersey:

- Worldwide income tax: If you pay tax on the same income in another jurisdiction, a credit may be available for foreign taxes paid.8

- No capital gains tax, inheritance tax, or wealth tax: This is an example of Jersey’s appealing tax landscape.

- Simple and transparent tax system: This features a low personal income tax rate capped at 20% for residents.

- Foreign income tax: Income earned outside of Jersey could be subject to tax under certain circumstances, depending on residency status and source of income.

- Attractive tax planning opportunities for high-net-worth individuals: For example, trusts allow for potential tax efficiency and asset protection.

- Double taxation treaties: Jersey has agreements with several countries, helping to prevent double taxation and providing additional tax planning possibilities.

- Value Added Tax (VAT): In Jersey, a standard VAT rate of 5% is applied to most goods and services.

- Social security contributions: These are mandatory for residents in Jersey, with rates based on income and contribution thresholds.

Latvia

Latvia boasts a captivating mix of Baltic charm, a rich cultural heritage, a favorable business environment, and picturesque landscapes.

This offers an alluring destination for those seeking both a high quality of life and promising investment opportunities in the heart of Europe.

To qualify for tax residency in Latvia, you need to be in the country for 183 days or more in a year.

The tax implications of permanent residency in Latvia include the following:

- Worldwide income tax: If you’re considered a Latvian tax resident, you may be liable for worldwide income tax. However, foreign-source income may be eligible for a tax exemption or reduced tax rate under certain conditions, such as non-resident status.

- Income tax: Latvia’s system is progressive, with varying tax rates reaching a maximum marginal rate of 31.4%.

- Double tax treaties: Latvia has these agreements with some countries, helping to avoid double taxation in some instances and providing opportunities for tax planning.

- Capital gains: Capital gains from the sale of real estate in Latvia are generally subject to a 20% tax rate, while other capital gains may be taxed at a standard income tax rate.

- Inheritance and gift taxes: Inheritance and gifts are taxed according to varying tax rates in Latvia, depending on the relationship between the donor and recipient.

- Value Added Tax (VAT): VAT is applied according to a standard rate of 21% on most goods and services.

- Social security contributions: These are mandatory for residents of Latvia and include healthcare and pension contributions

Luxembourg

Luxembourg is politically stable, and its financial sector is renowned. It also offers a high standard of living.

Officially, spending more than 183 days of the year in Luxembourg qualifies you as a tax resident.9

But in practice, once you obtain permanent residency, you’re generally considered a tax resident of Luxembourg, meaning you’re subject to Luxembourg tax laws.

Let’s take a closer look at the tax implications of investing in residency in Luxembourg:

- Worldwide income tax: As a tax resident, you’ll be liable to pay income tax on your worldwide income, including salary, investments, and other sources of income.

- Income tax: Luxembourg operates a progressive income tax system, meaning that higher-income earners are subject to higher taxes; the rates range from 0% to 43%.

- Tax deductions and credits: Various deductions are available to residents, including deductions for mortgage interest, education expenses, and certain healthcare costs.

- Tax treaties: Luxembourg has agreements with many countries to avoid double taxation, allowing residents to claim tax credits or exemptions for income earned in other jurisdictions.

- Wealth tax: Luxembourg imposes a net wealth tax on individuals, which is based on the total value of your assets, including real estate, investments, and bank accounts.

Malta

As a Mediterranean island paradise that seamlessly blends ancient wonders with modern amenities, Malta’s appeal combines a rich history, vibrant culture, quality of life, and favorable tax incentives.

Malta is very investment-friendly!

The taxation system in Malta is based on domicile rather than residency.

The following factors are taken into account to determine your tax residency in Malta:

- Place of abode

- Being in the country for more than 183 days in a year

- Frequency of visits to Malta

- Intention to live in Malta

- Birth ties

- Family ties

- Business ties

The tax implications of permanent residency in Malta include the following:

- Flat tax rate on foreign income sent to Malta: A capped rate of 15% tax is applied to foreign income sent to Malta. Non-domiciled residents of Malta may benefit from certain tax exemptions and reduced rates on foreign income remitted to Malta.

- Flat tax rate for HNWIs: Malta offers a flat tax rate of 15% for high-net-worth individuals who meet specific criteria and opt for the Malta Global Residence Program.

- No inheritance or wealth taxes: In Malta, these taxes aren’t applied, making it an appealing destination for estate planning and wealth management.

- Tax credits, deductions, and incentives: Individuals who become permanent residents of Malta may be eligible for various tax credits, deductions, and incentives, such as the Malta Residence Program, which offers tax relief on foreign-source income remitted to Malta.

- Exemption from customs duty or VAT: Used household items and personal effects (including furniture and excluding weapons) may be imported free of import duty, as long as you import them within 6 months of arriving in Malta. You won’t need an import license in this instance.10

- Minimum tax contribution: €15,000 a year.

- Income arising in Malta: A flat rate of 35% tax is charged on income arising in Malta.

- Tax Treaties: Malta has an extensive range of double taxation treaties with other countries. This relief means that anybody living in Malta and paying taxes there can’t be made to pay dual taxes on the same income or event.

Monaco

Monaco is a prestigious global financial hub and haven for high-net-worth individuals, where your capital can thrive amidst a secure environment, unparalleled luxury, and favorable tax advantages.

This is how you become a Monaco tax resident:11

- Prove that you hold a valid administrative residence permit.

- Declare on your honor that you meet the tax residence criteria.

- Prove that you occupy a dwelling in Monaco.

The tax implications of permanent residency in Monaco include the following:

- Zero-income tax regime: This means that residents aren’t subject to personal income tax on their worldwide income. However, French nationals residing in Monaco are subject to French income tax on their French-source income.

- Annual lump-sum tax: Residents of Monaco are subject to a minimal annual lump-sum tax called "le minimum d'impôt" based on their personal and family situation. The lump-sum tax is generally lower than income tax rates in many other countries and can vary depending on factors such as marital status and number of dependents.

- No wealth taxes, capital gains taxes, or inheritance taxes: This makes Monaco an attractive destination for wealth preservation and succession planning.

Montenegro

Montenegro, an emerging European gem with stunning natural beauty, a thriving tourism industry, and a favorable business environment, is poised for exponential growth and lucrative returns.

For tax residency in Montenegro, the 183-day rule applies.12

The tax implications of permanent residency in Montenegro include the following:

- Territorial tax system: This means that Montenegro only imposes a tax on income generated within the country.

- Tax residency: If a resident of Montenegro spends more than 183 days in a calendar year in the country, they’ll be taxed on their worldwide income.

- Personal income tax: The system is progressive, with rates ranging from 9% to 15% on various income brackets.

- Capital gains from the sale of real estate: These are subject to a 9% tax rate.

- No wealth tax or inheritance tax: This makes Montenegro an attractive destination for wealth accumulation and estate planning.

- Transport transfer tax: If you buy a used aircraft, boat, car, or motorcycle in Montenegro, a 5% transport transfer tax is levied.

- Various tax incentives and exemptions: These exist for certain industries, such as tourism, renewable energy, and technology, to encourage investment and economic development.

Netherlands

The Netherlands is fast becoming one of the more popular investment destinations in the world.

It’s a thriving global hub renowned for its strategic location, highly educated workforce, business-friendly environment, and innovative ecosystem, offering limitless opportunities for growth and success.

Tax residency in the Netherlands is determined according to the following criteria:13

- You spend most of your time at a Dutch address.

- Your partner and/or family live in the Netherlands.

- You work in the Netherlands.

- You have insurance in the Netherlands.

- Your family physician is resident in the Netherlands.

- You’re a member of one or more clubs or societies in the Netherlands.

- Your children receive an education in the Netherlands.

The tax implications of permanent residency in the Netherlands may include the following:

- Worldwide income tax: As a resident of the Netherlands, you'll be subject to Dutch taxation on your worldwide income.

- Progressive income tax system: The Netherlands operates a progressive income tax system, meaning that varying tax rates are applied depending on your income level.

- Taxable income: This includes taxable income from work, taxable income from substantial interest, and taxable income from savings and investments. Your Dutch tax return must include all the income you generate.14

- Tax deductions and credits: These are available to residents, including deductions for mortgage interest, healthcare expenses, and education costs.

- Double taxation treaties: The country has a robust tax treaty network with many countries, which helps prevent double taxation and allows for tax credits or exemptions for income earned abroad.

- Wealth tax: The Netherlands imposes a wealth tax on individuals with substantial assets, although the thresholds and rates may vary.

- Tax-free allowance for skilled immigrants: If you’re considered a highly skilled migrant, you may be eligible for the "30% ruling," which allows for a tax-free allowance of 30% of savings and investments for a specific period.

Portugal

Portugal, a thriving European destination known for its strategic location, vibrant culture, favorable business environment, and attractive tax incentives, offers a gateway to European markets and an excellent quality of life.

As with many of the European countries already mentioned, if you spend more than 183 days in a year in Portugal, you’re generally considered to be a Portuguese tax resident.

The tax implications of permanent residency in Portugal may include the following:

- Worldwide income tax: Tax residents are subject to taxation on their worldwide income at progressive rates, from 14,5% to 48%.15

- Non-habitual resident (NHR) regime: This tax regime offers significant tax benefits for eligible individuals. Under the NHR regime, qualifying individuals can benefit from a flat income tax rate of 20% on certain foreign-source income, such as pension income, capital gains, and certain professional income, for a period of 10 years.

- Reduced tax on high-value-added activities: Income from these activities (such as scientific research, technology, and artistic professions) can benefit from a reduced tax rate of 20% or 10% under specific conditions.

- No wealth or inheritance taxes: This renders Portugal an appealing destination for wealth preservation and succession planning.

- Tax incentives and exemptions for specific investment activities: Portugal’s Golden Visa (or residency by investment) program benefits from these incentives.

Spain

Spain, a dynamic and diverse country offering a highly strategic gateway to Europe and Latin America, has a thriving economy, a rich cultural heritage, and a favorable business environment poised for growth and opportunity.

The 183-day rule applies most commonly in Spain; in effect, if you spend more than 183 days in a year in the country, you’ll qualify as a tax resident.

The tax implications of permanent residency in Spain may include the following:

- Worldwide income tax: As a resident of Spain, you’ll be subject to Spanish taxation on your worldwide income.

- Progressive income tax system: This means various taxation rates apply based on income levels.

- Tax deductions and credits available to residents: These include deductions for mortgage interest, education expenses, work effectively conducted outside of Spain, and certain healthcare costs.

- Tax treaty network: Spain has a double taxation treaty network with many countries to help avoid double taxation, allowing residents to claim tax credits or exemptions for income earned abroad.

- Special tax regimes in certain regions: For example, in the Canary Islands, there are special tax regimes that offer reduced corporate and personal income tax rates to attract investment.

- Wealth tax: Spain imposes this tax on individuals with substantial assets, although the thresholds and rates may vary between regions.

- Capital gains tax: This tax is applied to any gains not received from the transfer of assets. An example of this would be cash prizes.

Switzerland

A known global haven for stability, innovation, financial prowess, and a favorable business environment, Switzerland offers exceptional wealth management opportunities and a high standard of living.

If you meet any of the below criteria, you’ll be deemed a tax resident in Switzerland:16

- You have the intention to permanently establish your usual abode in Switzerland and will be registered with the municipal authorities.

- You stay in Switzerland with the intention of exercising gainful activities for a consecutive period (ignoring short absences) of at least 30 days.

- You stay in Switzerland with no intention to exercise gainful activities for a consecutive period (ignoring short absences) of at least 90 days.

Let’s see what the tax implications of permanent residency in Switzerland are:

- Worldwide income tax: Tax residents are taxed on their worldwide income and wealth. If you’re not a tax resident, you’ll be taxed on your Swiss-earned income only.

- Fiscal Federalism: Switzerland operates a system of taxation based on the principle of fiscal federalism, where taxes are levied at the federal, cantonal (state), and communal (municipal) levels. Tax rates and regulations can vary between cantons and municipalities, leading to potential differences in tax liabilities depending on the chosen location.

- Progressive income tax: The Swiss tax system is generally characterized by progressive income tax rates, with higher income earners subject to higher tax brackets.

- No wealth taxes at the federal level: However, some cantons and municipalities may have their own wealth taxes.

- Double tax treaties: Switzerland has treaties with numerous countries to prevent double taxation and provide relief for residents with income from abroad.

- Preferential tax regimes: Certain cantons offer preferential tax regimes, known as lump-sum taxation or "forfait fiscal," which provide a fixed tax amount based on the taxpayer's living expenses rather than their actual income and wealth.

United Kingdom

The United Kingdom, a global financial heavyweight and cultural hub with a diverse economy, relative political stability, strong infrastructure, and access to international markets, offers unparalleled opportunities and long-term growth.

If you spend more than 183 days in a year in the UK, you’ll be deemed a UK tax resident.

The tax implications of permanent residency in the UK may include the following:17

- Worldwide taxation: As a UK resident, you’ll generally be subject to UK taxation on your worldwide income and gains.

- Progressive income tax system: This system imposes different tax rates and thresholds depending on your income level.

- Income tax: Income from employment, self-employment, investments, and rental properties is typically subject to income tax.

- Tax allowances, deductions, and reliefs: The UK has various tax allowances, deductions, and reliefs available to residents, such as personal allowances, pension contributions, and certain deductible expenses.

- Capital gains tax: This is applicable on the sale of assets such as property, investments, and valuable possessions.

- Tax treaties: The UK has a double taxation treaty network with many countries to avoid double taxation and provide relief for residents with income from abroad.

- Inheritance tax: Inheritance tax is levied on the transfer of assets upon death, although certain exemptions and reliefs may apply.

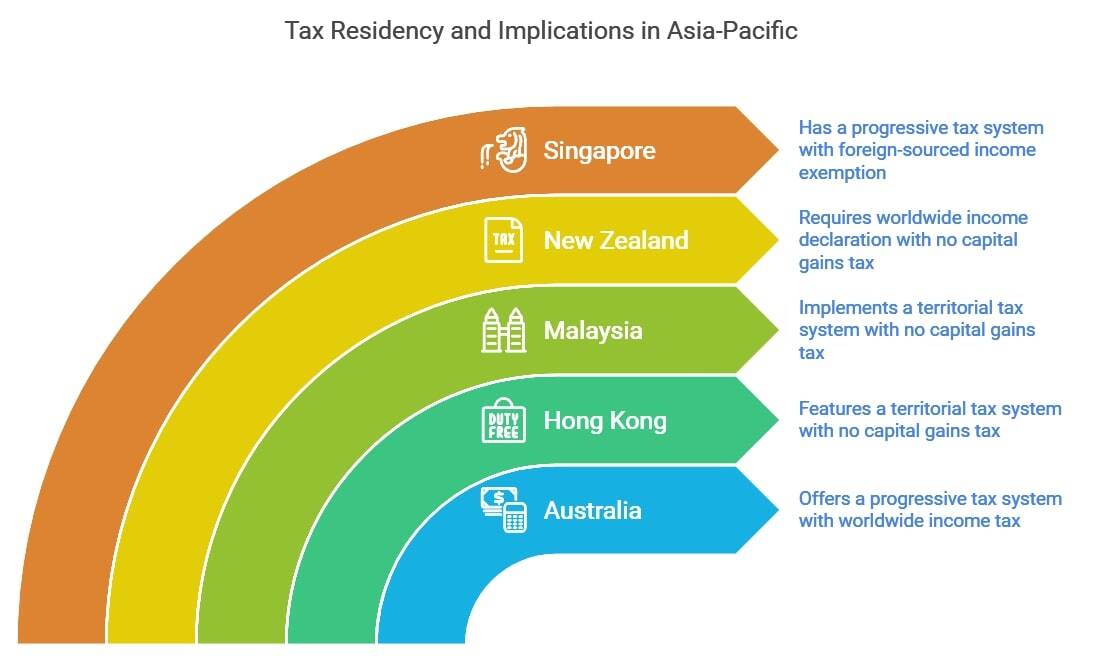

Taxes in Asian & South Pacific Countries

The tax landscape in Asia and the South Pacific region is diverse, ranging from countries with low or no personal income tax, such as Singapore, to those with progressive tax systems, like Australia.

Investors should be aware of the rigorous tax legislation in these countries, as it’s imperative that you comply with your chosen country’s tax laws to ensure a smooth residency experience.

Keep reading as we break down the tax implications of obtaining permanent residency in these countries:

Australia

Investing in Australia means not only gaining access to a thriving economy and diverse industries but also immersing yourself in the vibrant Aussie way of life, with its vast and stunning landscapes, rich cultural heritage, uniquely charismatic people, and robust legal and regulatory environment.

Australia has a range of tests to determine an individual’s tax residency in the country.

The most common one is the “Resides Test”.

The factors that comprise this test include:18

- Physical presence

- Intention and purpose

- Family ties

- Business or employment ties

- Maintenance and location of assets

- Social and living arrangements

If the Resides Test is inconclusive, the Australian government applies the Domicile Test19 (or 183-Day Test20), or the Commonwealth Superannuation Test.21

The tax implications of tax residency in Australia may include the following:

- Worldwide income tax: This means that Australia can tax you on income derived from outside Australia. Australia officially requires residents to declare all sources of income, including employment, investments, and rental income, in their annual tax returns. The general rule is that if you generate an income in Australia, you’re required to obtain a tax file number (TFN) and pay tax on the money you earn.22

- Various tax benefits: As an Australian resident, you’ll be eligible for tax benefits such as tax offsets, deductions, and concessions.

- Access tax-free thresholds and progressive tax rates: These are calculated according to your income brackets.

- Contributions to Medicare: You’ll be obligated to contribute to this system, which is Australia's public healthcare program, through the Medicare Levy.

- Tax credits: There’s a possibility of claiming tax credits for any taxes you may have paid overseas through Australia’s foreign income tax offset.

- Double Taxation Agreements (DTAs): Australia has entered into these treaties with many countries, allowing for potential tax relief or avoidance of double taxation.

- Various investment incentives and tax: Examples include the Research and Development Tax Incentive and small business concessions.

Hong Kong

Hong Kong, a global financial powerhouse and gateway to Asia, offers a strategic location, robust business infrastructure, political stability, low taxation, and a vibrant cosmopolitan lifestyle, making it an irresistible investment destination for long-term success and prosperity.

Hong Kong tax residency is generally determined in any of the following ways:23

- You ordinarily reside in Hong Kong SAR.

- You live in Hong Kong SAR for more than 180 days during a year of assessment.

- You live in Hong Kong SAR for more than 300 days in 2 consecutive years of assessment.

Let’s take a look at the tax implications of permanent residency in Hong Kong:

- Territorial tax system: Only income derived from Hong Kong sources is subject to taxation.

- Exemptions: These apply to tax on income sourced outside of Hong Kong, including dividends, capital gains, and offshore employment income.

- Progressive tax rate structure: This results in lower tax rates compared to many other jurisdictions.

- No capital gains tax, inheritance tax, or estate tax: This makes Hong Kong an attractive destination for wealth accumulation.

- Double taxation agreements (DTAs): Hong Kong has these treaties with numerous countries to avoid or minimize double taxation.

- Various tax deductions and allowances: These cover mortgage interest, charitable contributions, and education expenses.

- Tax returns: Requirement to file an annual tax return, disclosing all income earned from Hong Kong sources.

- Salaries tax: Obligation to pay salaries tax on income earned from Hong Kong employment or self-employment.

- Low corporate tax rate: The tax rate for businesses operating in Hong Kong is low and competitive.

Malaysia

Malaysia is strategically located and business-friendly, with a skilled workforce, attractive investment incentives, and a rich cultural heritage, all of which make it an ideal choice for investors seeking growth opportunities in Southeast Asia.

Malaysian tax residency comes down to fulfilling any of the criteria below:24

- 182 days rule: You spend at least 182 days in Malaysia during a year of assessment.

- Less than 182 days rule: Although you spend less than 182 days in Malaysia in a year, you were physically present for at least 182 days in the second half of the previous calendar year or the first half of the following calendar year (excluding temporary absence for specific reasons).

- 90 days rule: You spend at least 90 days in Malaysia during the calendar year and have been resident/present in Malaysia for 90 days in any 3 of the past 4 years.

- No physical presence: You’ve been a Malaysian resident for the past 3 calendar years and will be a resident the following year.

The tax implications of permanent residency in Malaysia may include the following:

- Territorial tax system: Only income derived from Malaysian sources is subject to taxation.

- Exemptions: These cover foreign-sourced income, including dividends, capital gains, and offshore employment income, if it isn’t remitted to Malaysia.

- Progressive tax rate structure: This results in lower tax rates compared to many other jurisdictions.

- No tax on capital gains, inheritance, or estate taxes: This renders Malaysia an attractive destination for wealth protection.

- Double taxation agreements (DTAs): Malaysia has these with various countries to avoid or minimize double taxation.

- Various tax incentives and allowances: These include investment tax allowances, pioneer status, and reinvestment allowances.

- Annual tax returns: Requirement to file an annual tax return disclosing all income earned from Malaysian sources.

- Income tax: An obligation on income earned from Malaysian employment or self-employment.

- Deductions for eligible expenses: These include medical expenses, education expenses, and contributions to approved retirement funds.

New Zealand

New Zealand, a land of breathtaking landscapes, innovation, and sustainability, offers a stable economy and a business-friendly environment, not to mention a sought-after quality of life.

New Zealand tax residency is achieved when you fulfill either of the following:25

- You spend more than 183 days of the year in New Zealand.

- You have a permanent home in New Zealand.

If you earn an income in New Zealand, you’ll be required to obtain an IRD number, which identifies you for tax purposes.

Let’s have a look at the tax implications of permanent residency in this attractive investment destination:

- Worldwide tax system: This will require you to declare your global income.

- Tax returns: A requirement to file an annual tax return disclosing all sources of income, including employment, investments, and rental income.

- Tax credits: These are available for taxes paid overseas through the foreign tax credit system.

- Various tax benefits and incentives: Permanent residency here makes you eligible for tax benefits and incentives for various things, including research and development, film production, and charitable donations.

- Progressive tax rates: These are calculated according to income brackets, allowing for a fair and balanced taxation system.

- Tax deductions for eligible expenses: These can be claimed for work-related expenses, self-education costs, and medical expenses.

- No inheritance tax, estate tax, or capital gains tax: This applies to most investments.

Singapore

Singapore, a well-regulated financial hub and innovation powerhouse, offers a robust infrastructure, political stability, low taxation, and a multicultural environment.

It’s an irresistible investment destination for those seeking unparalleled opportunities and sustainable growth.

You’re a Singapore tax resident if you fulfill any of the following characteristics:26

- You’re a Singapore citizen or Singapore permanent resident (SPR) who normally resides in Singapore except for temporary absences.

- You’re a foreigner who’s lived or worked in Singapore: For at least 183 days in the previous calendar year; or continuously for 3 consecutive years.

- You’re a foreigner who’s worked in Singapore for a continuous period straddling 2 calendar years, and your total period of stay is at least 183 days.

The tax implications of investing in permanent residency in Singapore include the following:

- Progressive tax system: Singapore's tax system is progressive, with tax rates ranging from 0% to 22%, calculated according to your income bracket.

- Foreign-sourced income exemption: Foreign-sourced income not remitted to Singapore is exempt from taxation, making it an attractive option for international investors.

- No capital gains tax or inheritance tax: This makes Singapore an enticing destination for wealth protection.

- Various tax incentives and schemes: An example of these is the “Not Ordinarily Resident (NOR)” scheme, which provides tax benefits for qualifying individuals. This scheme was specifically designed to attract global talent and high-net-worth individuals to live and work in Singapore.

- Double taxation treaties: Singapore has an extensive network of Avoidance of Double Taxation Agreements (DTAs) with many countries, reducing the risk of double taxation.

- Tax returns: Requirement to file an annual tax return, declaring all income earned both in Singapore and abroad.

- Central Provident Fund (CPF): Permanent residents are obligated to contribute to the Central Provident Fund (CPF), Singapore's social security savings plan, which provides retirement and healthcare benefits.

- Tax deductions: The possibility of claiming tax deductions for eligible expenses exists, such as medical expenses, donations, and approved business expenses.

- Notional Tax Credit (NTC) scheme: Potential eligibility for the Notional Tax Credit (NTC) scheme, which provides relief for taxes paid on foreign income that’s also subject to tax in Singapore.

Thailand

Thailand is an enticing investment destination for those seeking growth, a low cost of living, profitability, and a vibrant lifestyle in Southeast Asia.

Thai tax residency is assigned to you if you spend more than 180 days in the country.27

So, what are the tax implications of obtaining permanent residency in Thailand?

Let’s have a look:

- Worldwide income tax: As a resident of Thailand, you must pay tax on any income you earn both in Thailand and abroad.

- Income declaration: Requirement to declare all income earned in Thailand, including employment income, business income, and rental income, in your annual tax return.

- Tax rates: Thai tax rates are progressive and are calculated on income brackets, with varying tax rates ranging from 0% to 35%.

- Tax incentives and privileges: You may be eligible for these, with relevance to promoted investment activities or specific industries.

- No inheritance tax: Assets inherited in Thailand aren’t taxed.

- Tax exemptions or reductions: Certain types of income are exempt from tax, such as dividends received from Thai companies or interest income from Thai government bonds.

- Value-added tax (VAT): VAT is applied to goods and services provided in Thailand.

- Tax deductions for eligible expenses: These may include charitable donations, education expenses, and health insurance premiums.

- Double taxation agreements (DTAs): Thailand has these in place with various countries, allowing for potential tax relief or avoidance of double taxation on income earned in other jurisdictions.

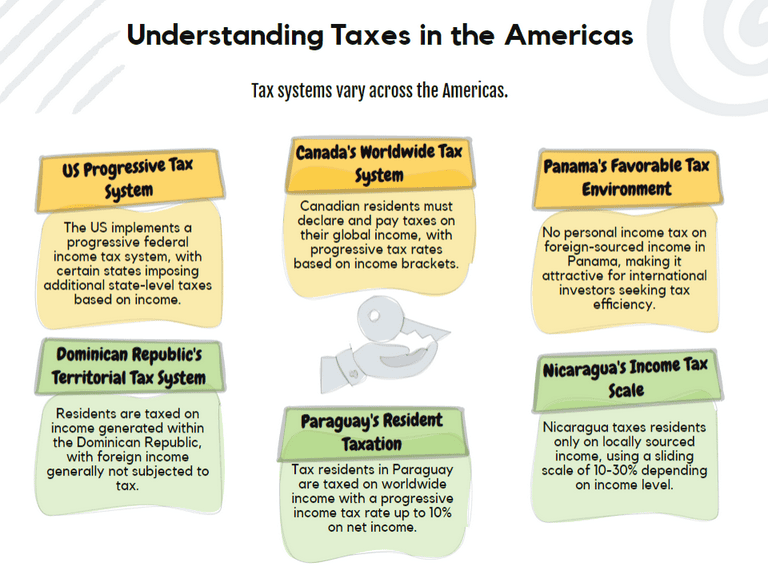

Taxes in the Americas

Tax environments in the Americas differ across North, Central, and South American countries, with varying rates and regulations.

For example, the United States has a progressive federal income tax system, while some states impose additional state-level taxes.

In contrast, countries like Panama have more favorable tax environments, with no personal income tax for foreign-sourced income.

Let’s get into the specifics.

Canada

A land of vast opportunity and natural splendor, Canada boasts a stable and advanced infrastructure, an excellent education system, and a rigorous business environment with a strong commitment to innovation.

The Canada Revenue Agency (CRA) considers you a newcomer to Canada for your first year of residency in Canada.28

You become a tax resident in Canada when you have “enough” residential ties there.

To elaborate…

In the words of Taxback, if Canada is the place where you, “in the settled routine of your life, regularly, normally or customarily live”, you’re a tax resident.29

Family ties, property ties, and work ties are taken into account in this analysis.

The tax implications of investing in permanent residency in this beautiful country include the following:

- Worldwide tax system: Requirement to declare your global income and pay income tax on worldwide income earned as a Canadian resident.

- Tax returns: Obligation to file an annual tax return disclosing all sources of income, including employment, investments, and rental income.

- Tax credits, deductions, and benefits: These are possible for eligible expenses, such as childcare expenses, medical expenses, and education costs.

- Progressive tax rates: The tax rates are calculated based on income brackets, ensuring a fair and balanced taxation system.

- Tax credits: these can sometimes be claimed for taxes paid overseas through the foreign tax credit system.

- Compliance: Canadian tax regulations are stringent. You’ll be required to adhere to them strictly, including meeting filing deadlines and fulfilling reporting requirements.

- Tax-deferred savings plans: Potential eligibility for tax-deferred savings plans, such as Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs).

- Provincial tax systems: Availability of various provincial tax systems with different tax rates and regulations depending on the province of residence.

- Canadian social benefits and public services: Your tax revenues will fund and allow you access to social benefits and public services in Canada, including healthcare and education, funded through tax revenues.

Dominican Republic

With its strategic location, stable economy, growing tourism sector, and favorable incentives for foreign investment, the Dominican Republic offers a unique blend of opportunities, making it a prime destination for fruitful and diverse investment prospects.

In the Dominican Republic, you’re considered a tax resident if you stay in the country for more than 182 days in a year.30

The tax implications of permanent residency in the Dominican Republic include:

- Territorial tax system: The Dominican Republic operates on a territorial taxation system. This means that, as a resident, you’d only be taxed on income generated within the country. Foreign-source income is generally not subject to tax.

- Income tax: Residents are subject to income tax on a progressive scale, ranging from 0% to 25% depending on income level.

- Value Added Tax (VAT): The standard VAT rate in the Dominican Republic is 18% on goods and services. Essential goods and services have lower rates or are exempt.

- Property tax: The Dominican Republic levies a 1% annual property tax (IPI) on any individual-owned property with a value greater than 7.2 million Dominican pesos (exclusive of the cost of any furniture present in the property).

- Capital gains tax: The capital gains tax rate is 27% on the gain from the sale of Dominican Republic-sourced assets, although certain exemptions may apply.

- Inheritance tax: Inheritance tax is levied at a flat rate of 3% on the net value of the property received.

- Tax on financial transactions: A tax of 0.15% is imposed on certain financial transactions.

- Foreign financial assets: While foreign income isn't generally taxed, the Dominican Republic does require residents to report foreign financial assets as part of their annual tax filing.

Nicaragua

Nicaragua, a land of thriving biodiversity and rich cultural heritage, presents a compelling investment opportunity with its fast-growing sectors like tourism, agriculture, and renewable energy, complemented by an affordable labor force, a strategic geographic location, and attractive investment incentives.

But, of course, if you obtain residency by investment in Nicaragua, you’ll want to stay on top of your tax situation.

You’re a tax resident in Nicaragua if you meet either of the following conditions:31

- You stay within the country for more than 180 days in a calendar year, whether continuously or not.

- Your main center of economic interest is located within Nicaragua, unless you prove your residence or tax domicile in another country through a corresponding certificate issued by the competent tax authorities. This won’t apply if the country is considered a tax haven by the authorities.

In general, the tax implications of residency in Nicaragua include the following:

- No worldwide income tax: Unlike the US, Nicaragua doesn’t tax its residents on their worldwide income. As a resident, you'll only be subject to taxes on income sourced within Nicaragua.

- Income tax: Income tax in Nicaragua operates on a sliding scale, ranging from 10% to 30%, depending on your income level. Only income generated within Nicaragua is subject to these taxes.

- Value Added Tax (VAT): All purchases of goods and services in Nicaragua are subject to a VAT of 15%.

- Property taxes: Property taxes in Nicaragua are relatively low compared to many countries. The rate is usually around 1% of the property's assessed value.

- Capital gains tax: As a resident, you’d be subject to a 10% capital gains tax on the sale of real estate in Nicaragua. However, there are some exemptions available, especially if you reinvest the proceeds in another Nicaraguan property.

- Inheritance tax: There’s no inheritance tax in Nicaragua, which might make it an attractive place for estate planning.

- Import duty: Nicaragua has a unique program that allows new residents to import household goods, a vehicle, and even construction materials (if you plan to build a home) duty-free. Some restrictions and conditions apply.

- Exit tax: When leaving Nicaragua, both residents and non-residents must pay an exit tax. The amount is typically around $42 but can vary.

Panama

Panama is situated at a strategic crossroads in the Americas.

This country has a thriving economy, a robust banking sector, attractive tax regulations, and the world-renowned Panama Canal, making it an exceptional investment destination for those seeking regional connectivity, financial opportunities, and a tropical lifestyle.

Tax residency in Panama is calculated using the 183-day rule. So, if you spend at least 183 days in the country, you’re a tax resident.

The tax implications of obtaining permanent residency in Panama include the following:

- Territorial tax system: Only income derived from Panama sources is subject to taxation.

- Declaration of income: Requirement to declare all income earned in Panama, including employment income, business income, and rental income, in your annual tax return.

- Progressive tax rates: These are based on income brackets, with lower tax rates compared to many other jurisdictions. If you earn between US$0 and US$11,000 annually, you won’t pay income tax. If you earn between US$11,001 and US$50,000, you’re taxed at 15% on all income above $11,000. If you earn more than US$50,000, you’ll pay US$5,850 in income tax, plus 25% on all income over US$50,000.32

- No tax on foreign-sourced income: Income not derived from Panama isn’t taxed, providing potential tax savings for international investors.

- Tax exemptions or reductions: Certain types of income, such as dividends received from Panamanian companies or interest income from Panamanian bank deposits, are eligible for deductions.

- No inheritance tax or capital gains tax: The sale of real estate in Panama is exempt from these taxes.

- Tax incentives and benefits: These apply to specific industries, such as the Panama Pacifico Special Economic Area and the Multinational Company Headquarters (SEM) regime.

- Tax deductions for eligible expenses: These include charitable donations, medical expenses, and home mortgage interest.

- Friendly Nations Visa: Potential eligibility for Panama's Friendly Nations Visa program, which offers expedited residency to citizens of specific countries, providing additional benefits and tax advantages.

Paraguay

For a country that’s ripe with untapped opportunity, look no further than Paraguay, a fast-growing, politically stable, and diverse economy with a competitive labor force.

If you spend more than 120 days in Paraguay in a calendar year, you’ll be considered a resident of Paraguay.33

Let’s have a look at the tax implications of obtaining Paraguayan permanent residency:

- Resident taxation: Permanent residents of Paraguay are taxed on their worldwide income. This means that if you reside in Paraguay for more than 120 days in a year, you're considered a tax resident and subject to income tax on your global earnings.

- Income tax: The personal income tax rate is progressive, up to a maximum rate of 10% on net income over a certain threshold. Income under this threshold is taxed at a lower rate or not taxed at all.

- Capital gains tax: Capital gains are typically taxed as regular income. This means any profit from the sale of property or investment, wherever located, can be subject to the standard income tax rates.

- Inheritance tax: Paraguay doesn’t impose inheritance or estate taxes, which can be an advantage for those with significant assets.

- Property tax: There’s an annual property tax on real estate located in Paraguay, but the rates are generally low compared to many other countries.

- Value Added Tax (VAT): Paraguay has a standard VAT rate of 10% on most goods and services. A reduced rate of 5% applies to certain basic goods and services

- Tax treaties: Paraguay is part of the Mercosur trade bloc, which has agreements that can impact taxation with Argentina, Brazil, Uruguay, and Venezuela.

- Foreign tax credit: Paraguay allows for a foreign tax credit, whereby residents can deduct taxes paid in foreign countries from their taxable income in Paraguay, but it has limitations.

- Corporate tax: For business owners, the corporate tax rate is 10% on net profits for Paraguayan source income.

United States of America

As a dominant force in the global economy, the United States of America offers investors access to a vast market, innovation-driven industries, and unparalleled opportunity.

With a rich culture of entrepreneurship and technological advancement, the USA provides fertile ground for investors to thrive and succeed in a dynamic business environment.

Compliance with the USA’s stringent tax regulations can make or break your permanent residency experience there.

So, how do I know I’m a tax resident of the USA?

According to the United States Internal Revenue Service (IRS), you’re a tax resident of the USA if you meet either the green card test or the substantial presence test in a calendar year.34

These tests are briefly described below:

- Green card test: This test is based on whether you’re a lawful permanent resident of the United States at any time during the calendar year.

- Substantial presence test: To meet this test, you must be physically present in the USA during at least:

- 31 days during the current year, and 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year, and

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year.

- 31 days during the current year, and 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

Let’s unpack the tax implications of obtaining US permanent residency:

- Worldwide income tax: The US tax system requires that you declare worldwide income.

- Tax returns: Obligation to file annual tax returns, disclosing all sources of income, both domestic and international.

- Tax benefits and credits: You may be eligible for various tax benefits and credits, such as deductions for mortgage interest, state and local taxes, and qualified education expenses.

- Federal income tax: Requirement to pay federal income tax on income earned within the United States, including wages, self-employment income, and investment income.

- Complex tax regulations: Compliance with complex tax regulations, including adherence to filing deadlines, reporting requirements, and proper record-keeping.

- Possibility of utilizing tax treaties between the United States and other countries to avoid or minimize double taxation.

- Tax-deferred retirement savings: The availability of tax-deferred retirement savings options, such as Individual Retirement Accounts (IRAs) and 401(k) plans, providing potential tax advantages.

- Social Security and Medicare taxes: Responsibility to pay Social Security and Medicare taxes on earned income, which fund retirement and healthcare programs.

- State and local tax incentives: Potential eligibility for certain state and local tax incentives or credits, depending on the specific jurisdiction of residence.

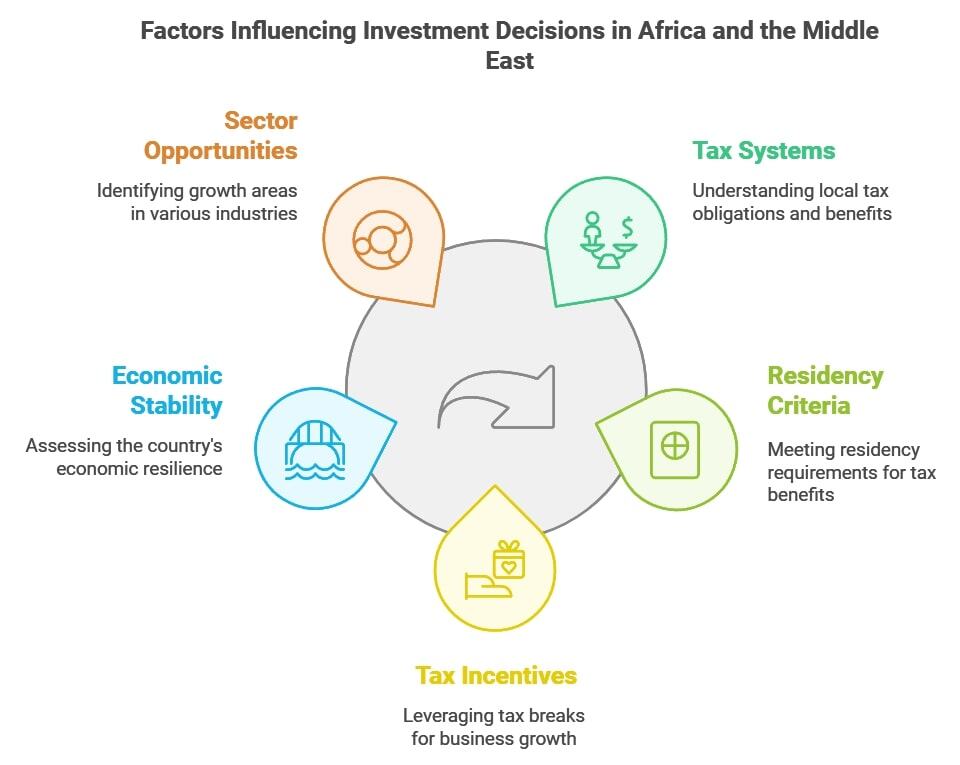

Taxes in African & Middle Eastern Countries

African and Middle Eastern countries present a diverse tax landscape.

Investors need to understand the specific tax regulations in these countries, including corporate tax rates, property taxes, and consumption taxes.

In addition, they should be aware of the tax residency criteria and potential tax liabilities to optimize their financial situation and ensure compliance with local tax laws.

Let’s get into it.

Mauritius

An idyllic island paradise off the east coast of Africa in the Indian Ocean, Mauritius offers a strategic business gateway, a stable economy, investor-friendly policies, attractive tax incentives, and a multicultural society.

It’s an irresistible investment destination for those seeking a combination of business opportunities, natural beauty, and a favorable tax environment.

You become a Mauritian tax resident when you spend more than 6 months in the country.35

The tax implications of permanent residency in Mauritius include the following:

- Territorial tax system: Only income generated from Mauritius sources is subject to taxation.

- Declaration of income: Requirement to declare all income earned in Mauritius, including employment income, business income, and rental income, in your annual tax return.

- Flat income tax rate: Individuals are taxed at a flat income tax rate.

- Potential tax exemptions or reductions: These are applicable to certain types of income, such as dividends received from qualified global business companies or interest income from Mauritian government securities.

- No inheritance tax or capital gains tax: This applies to most investments in Mauritius.

- Tax credits for foreign taxes: Availability of tax credits for foreign taxes paid, providing relief from potential double taxation.

- Tax incentives and concessions: Possibility of tax incentives and concessions for specific industries or activities, such as the Global Business License (GBL) regime.

- Double taxation agreements (DTAs): Access to Mauritius' network of double taxation avoidance agreements (DTAs) with various countries, minimizing tax implications on cross-border income.

- Occupation Permit and Residence Permit schemes: Potential eligibility for the Occupation Permit or Residence Permit schemes, granting certain tax benefits and privileges to qualifying individuals.

Namibia

Namibia, a captivating land of breathtaking barren landscapes and rich cultural heritage, offers vast investment opportunities in sectors such as mining, tourism, renewable energy, and agriculture.

For those looking for untapped potential and sustainable growth in Southern Africa, it’s an alluring investment destination thanks to a stable political environment, investor-friendly policies, and a thriving economy.

Similarly to many of the other countries covered in this article, Namibia designates you a tax resident if you spend more than 183 days in a tax year in the country, or an average of 91 days or more per year over a period of 5 consecutive tax years.36

The tax implications of obtaining permanent residency in Namibia include the following:

- Territorial tax system: Only income derived from Namibian sources is subject to taxation.

- Income declaration: Requirement to declare all income earned in Namibia, including employment income, business income, and rental income, in your annual tax return.

- Progressive tax rates: These are based on income brackets, providing a fair and balanced taxation system.

- No inheritance tax or wealth tax: Assets acquired in Namibia are exempt from these taxes.

- Potential tax exemptions or reductions: These apply to certain types of income, such as dividends received from Namibian companies or capital gains on the sale of Namibian securities.

- Tax deductions: Eligible expenses include charitable donations and certain business expenses.

- Double taxation agreements (DTAs): Namibia has DTAs with various countries, reducing the risk of double taxation on cross-border income.

- Investment incentives and concessions: The Namibian government grants these for specific industries or activities, such as the Manufacturing Development Program.

- Tax benefits and privileges: Potential eligibility for specific tax benefits and privileges under the Namibian residency or citizenship programs is subject to meeting the respective criteria.

United Arab Emirates

With its robust economy, diversified sectors, and visionary leadership, the UAE provides fertile ground for investors to flourish, innovate, and achieve remarkable success in one of the most prosperous and forward-thinking nations.

The UAE considers you a tax resident if you meet any of the following criteria:37

- Your usual or primary place of residence and center of financial and personal interests is in the UAE.

- You were physically present in the UAE for a period of 183 days or more during a consecutive 12-month period.

- You were physically present in the UAE for a period of 90 days or more in a consecutive 12-month period and you’re a UAE national, hold a valid residence permit in the UAE, or hold the nationality of any GCC Member State, where:

- You have a permanent place of residence in the UAE, or

- You're employed or have a business in the UAE.

Let’s have a look at the tax implications of investing in permanent residency in the UAE:

- Territorial tax system: Only income derived from UAE sources is subject to taxation. Foreign-sourced income isn’t taxed, making the UAE an attractive destination for international investors.

- No personal income tax on salaries or wages: This provides potential tax savings for residents.

- No capital gains tax, wealth tax, or inheritance tax: This is an attractive draw for investors who prioritize wealth protection.

- VAT (Value Added Tax): Individuals may be required to pay VAT on certain goods and services consumed within the UAE.

- Free zones: These zones offer tax incentives such as exemption from corporate and personal income taxes, customs duties, and other fees.

- Double taxation agreements (DTAs): Potential eligibility for tax residency certificates that can be utilized to claim tax benefits in countries that have a double taxation avoidance agreement (DTA) with the UAE.

- Favorable environment: This includes simplified business and tax processes and efficient government services.

Optimizing Your Taxes Legally

Optimizing taxes legally is crucial for a positive residency experience in another country.

By taking advantage of available tax incentives, deductions, and exemptions, you can minimize your tax burden and maximize your financial resources.

Proactively managing your taxes also demonstrates your commitment to compliance and financial responsibility, fostering a positive relationship with your host country's tax authorities.

Let’s take a look at 3 ways you can optimize your taxes legally.

Select a Tax-Efficient Residency by Investment Program

Some countries offer more favorable tax environments than others, such as territorial tax regimes, lower tax rates, or tax breaks for foreign investors.

By carefully researching and choosing a program that best suits your needs, you can optimize your tax situation and, in many ways, potentially incur savings.

Tax Deductions & Exemptions

Understanding and taking advantage of available tax deductions and exemptions can significantly reduce your tax liability.

Common deductions include business expenses, retirement contributions, charitable donations, and mortgage interest.

It's essential to familiarize yourself with the tax laws in the country where you’re pursuing residency and maintain accurate records to legally optimize your taxes.

Understand Tax Treaty Agreements

Tax treaty agreements are another strategy to optimize your taxes.

These are arrangements between 2 countries to prevent individuals from being taxed twice on the same cost center.

Being aware of these treaties can help you optimize your tax situation if you have income or assets in multiple countries.

Common Questions

Can I Be Taxed If I’m a Permanent Resident & Not a Citizen?

How Does Residency by Investment Work?

Can You Avoid Taxes by Renouncing Residency?

Is It Easier to Avoid Double Taxation as a Permanent Resident or a Citizen?

What Countries Don’t Tax Their Citizens?

In Conclusion

Residency by investment offers a unique opportunity for you to expand your socio-economic horizons, but potentially complex tax implications are an oft-forgotten consequence of obtaining a permanent residency.

By acquainting yourself with the tax implications of obtaining a new residency and utilizing various tax strategies, you can manage your finances effectively.

Make sure you know whether you qualify as a tax resident of your host country, and use that knowledge to optimize your taxes legally.

Our WorldPassports team of experts is standing by to answer any burning questions you may have on this topic!

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure