Residential vs. Commercial Real Estate

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Key differences include the nature of tenants (individuals vs. businesses), length of lease terms, and operational complexity, with commercial real estate often requiring more hands-on management.

- Profitability can be higher in commercial real estate due to longer leases and tenants covering more expenses, but initial investments and risks are also greater.

- Financing for commercial properties often has stricter requirements and higher interest rates compared to residential investments.

- Risks and rewards vary, with commercial real estate offering potential for higher returns but facing greater sensitivity to economic conditions.

- Lease terms are generally longer in commercial real estate, providing more stable income streams but requiring commitments to property maintenance and improvements.

Are you having a hard time deciding between residential and commercial property investments?

In this extensive guide, our seasoned team unravels the intricate maze of residential and commercial real estate, arming you with knowledge on every aspect.

In This Article, You Will Discover:

Our in-depth analyses and research-backed insights will empower you to make informed decisions in your real estate investment journey.

Read on…

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

Residential vs. Commercial Real Estate: An Overview

Deciding which real estate to buy and if residential or commercial real estate will be best for your investment strategy can be tricky.

Our team will give you an overview of these 2 real estate types:

Understanding Residential Real Estate

Residential real estate encompasses properties designed for individual or family living, such as single-family homes, condominiums, or multi-family dwellings like apartment complexes.

Top 5 benefits of residential real estate:

- Steady income: When you invest in residential real estate, it can provide you with an ongoing flow of rental income, especially when it’s in high-demand areas.

- Capital appreciation: Over time, residential properties usually increase in value, leading to a potential profit upon sale.

- Tax advantages: Homeowners and investors can take advantage of some tax deductions like mortgage interest and property taxes.

- Leverage: Investors can leverage their capital to buy more expensive properties and increase potential returns.

- Diversification: When you invest in residential real estate, it gives your portfolio diversity, which can help mitigate risk.

Understanding Commercial Real Estate

Commercial real estate includes properties used exclusively for business purposes like offices, retail spaces, warehouses, and other types of facilities where commerce is conducted.

It’s primarily designed to generate profit, either from capital gains or rental income.1

But what exactly are the benefits?

Top 5 benefits of commercial real estate:

- Higher income potential: Commercial real estate generally has a higher annual return on the purchase price. This is due in part to higher rental rates and multiple streams of income from different tenants in multi-tenant properties.

- Longer lease terms: Commercial leases are usually longer, sometimes even several years long. This can provide investors with a more predictable and stable income stream.

- Less competition: As commercial real estate investing requires a larger initial investment and more specialized knowledge, there tends to be less competition than residential real estate.

- Value-add opportunities: With commercial properties, there's often more opportunity to enhance the value through property improvements or optimizing lease terms. This can significantly boost the property's income potential.

- Inflation hedge: Just like residential properties, commercial properties can also serve as a protective hedge against inflation. As prices rise, so too can rental rates, increasing the property's income over time.

Important Differences Between Residential & Commercial Real Estate

Now that you understand what residential and commercial real estate are, we can look at their differences to see what’ll suit your strategy the best.

Here are the 17 main differences:

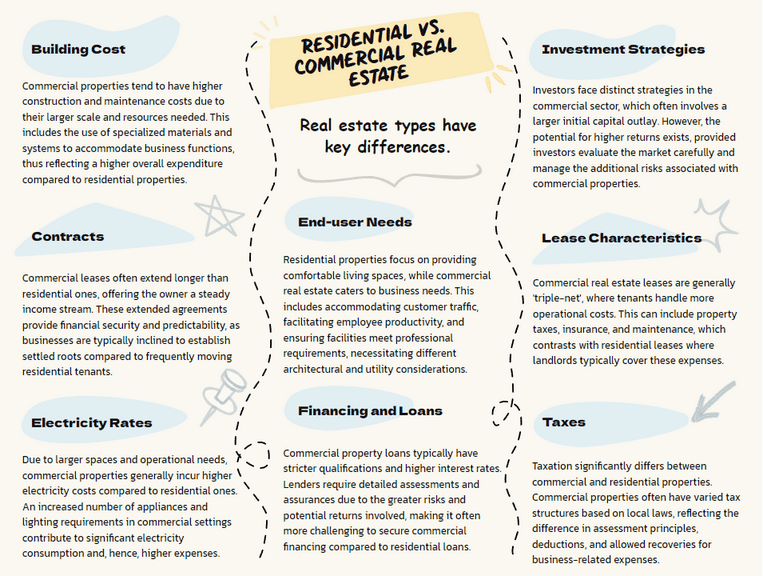

- Building cost: Commercial properties often require more extensive resources to construct and maintain, which can translate to higher costs.

- Contracts: Commercial lease agreements tend to be longer than residential leases, providing more financial stability for the property owner.

- Electricity rates: Commercial properties, due to their size and use, generally have higher electricity consumption and, consequently, higher electricity rates.

- End-user needs: Residential properties are designed for living comfort, while commercial properties need to cater to business needs such as customer traffic and employee productivity.

- Evictions: The process for evicting a tenant varies between residential and commercial properties, with commercial evictions typically being more complex.

- Financing and loans: Loans for commercial property often have stricter requirements and higher interest rates.

- Formalities in purchasing: The purchasing process for commercial real estate is typically more complicated, involving numerous assessments and contract negotiations.

- Investment strategies: Strategies can differ vastly, with commercial real estate often requiring a larger initial investment but potentially offering higher returns.

- Lease characteristics: Commercial leases are generally triple-net, meaning the tenant assumes many of the costs associated with the property, unlike most residential leases.

- Legislation: The laws governing commercial and residential properties differ significantly, especially regarding tenant rights, zoning, and land use.

- Location: Location is crucial in both sectors, but the factors considered can differ. A good residential location might be near schools, whereas a commercial property might need high traffic flow.

- Management needs: Commercial properties often require professional property management. Residential properties can often be managed by the owners.

- Permissions and codes: Commercial properties usually face more stringent code requirements, inspections, and requirements to obtain necessary permissions than residential properties.

- Real estate agents: Agents specializing in commercial properties require a deeper understanding of business needs, market conditions, and commercial property laws.

- Risks and returns: While both of these sectors carry risks, commercial properties can give investors higher potential returns but may also have higher vacancy risks.

- Tenant expenses: Commercial tenants usually bear more of the property's expenses, such as maintenance costs, compared to residential tenants.

- Taxes: Property taxes for commercial and residential properties are calculated differently and can vary significantly depending on local laws.

Property Management in Residential vs. Commercial Real Estate

Below are important factors to consider when managing your property, whether residential or commercial.

Responsibilities Involved in Residential vs. Commercial Property Management

Residential property managers handle lease negotiations, tenant issues, maintenance and repairs, and rent collection.

Commercial property managers also deal with business-related tasks like adherence to commercial building codes, property improvement projects, and extensive financial reporting.

Challenges Involved in Residential vs. Commercial Property Management

Residential property management can face challenges such as dealing with unruly tenants, maintenance problems, and high tenant turnover rates.

With residential leases typically running for a year, finding new tenants regularly can be a daunting task, and vacant periods can affect the steady income stream.

On the flip side

Commercial property management might need to navigate business disruptions, complex commercial laws, fluctuating market conditions, and the specific requirements of commercial tenants.

Unlike residential tenants, commercial tenants may require customizations or specific build-outs to suit their business needs, leading to significant costs and negotiations.

Residential vs. Commercial Real Estate Sectors

You might be wondering where you can find realtors or real estate companies to help you in the residential or commercial sector.

Let’s dive in.

National Association of Realtors

The National Association of Realtors (NAR)2 is a major player in both sectors, offering resources, advocacy, and educational opportunities for real estate professionals.

This expansive organization sets standards for professionalism and ethics in the real estate industry, acting as a central hub for networking and information.

Furthermore

With over 1.4 million members across the United States, NAR serves its members through numerous programs and initiatives designed to enhance their career growth and success.

Influence of Real Estate Companies

Real estate companies play a pivotal role in both sectors, from developing and managing properties to offering investment and brokerage services.

They shape urban landscapes, contribute to local economies, and influence housing and commercial trends.

Here’s how it works:

These companies provide various services, including market research, property valuation, marketing strategies, and negotiating transactions.

Furthermore, through innovative practices and adopting sustainable construction methods, real estate companies also contribute to social and environmental objectives.

Companies’ expertise and their services are extremely helpful and necessary for individual and institutional investors, property owners, and tenants.

Real Estate Investment Trusts (REITs)

Investors can purchase real estate portfolios that include both residential and business properties through Real Estate Investment Trusts (REITs).

Investors can also invest in these trusts without having to personally purchase or manage the property.

Factors to Consider Before Choosing Between Residential & Commercial Real Estate

Before choosing the right real estate option for you, you’ll need to consider some factors.

Take a look at the 2 main factors:

Is It a Good Return on Investment (ROI)?

ROI3 is a metric used in real estate to determine how much money is made back in relation to the expenditure.

While both sectors can offer good returns, commercial real estate often provides higher potential returns due to longer leases and higher rental income.

That being said

These investments may also come with increased risks, such as market volatility and higher upfront costs.

What Kind of Real Estate Is the Most Lucrative?

Different types of commercial real estate offer varying levels of profitability.

Retail and office spaces can be highly profitable, but this can depend on location, tenant stability, and market conditions.

Warehouses and industrial properties have seen increased demand with the rise of e-commerce, potentially offering attractive investment opportunities.

In contrast…

Profitability in residential real estate can vary widely.

Single-family rentals, multi-family apartments, and luxury properties can all be profitable, depending on location, market trends, and management practices.

Understanding local market conditions, including demographic trends and housing demand, is key to identifying the most profitable residential investments.

Common Questions

What Are Examples of Residential & Commercial Real Estate?

How Do I Invest in Residential & Commercial Real Estate?

What’s the Difference Between a Residential & Commercial Address?

How Do You Determine if an Address Is Residential or Commercial?

What’s the Difference Between Designing Residential & Commercial Real Estate?

What’s the Difference Between Residential & Commercial Maintenance?

Is Residential Real Estate a Good Investment if I’m Not Planning to Live In It?

In Conclusion

Residential and commercial real estate each have unique opportunities and challenges.

The choice between residential or commercial real estate hinges on your financial means, risk tolerance, investment horizon, and interests.

Remember, successful investing stems from thorough knowledge, understanding, and strategic decision-making.

So arm yourself with the right information, seek professional advice when needed, and choose whether residential or commercial property investment aligns best with your strategy.

If you're interested in learning more about the real estate topic, consult our treasure chest of articles.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure