Types Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- Residency by investment programs typically include options for real estate investment, business investment, and purchasing government bonds, each catering to different investor preferences and financial capabilities.

- Acquiring real estate often involves buying property within the host country, engaging in a local business may require starting or contributing financially to one, and securing government bonds involves lending money to the government in exchange for residency.

- Countries like Portugal, Greece, and Malta offer unique opportunities in real estate, while others may present niche options like engaging in specific economic sectors or development projects.

- Deciding on the best avenue requires evaluating personal financial goals, risk tolerance, and the desired lifestyle, as well as considering the program's requirements, benefits, and potential for return.

- Current trends include increasing options for sustainable and eco-friendly projects, investments in the digital and tech industries, and simplified application processes, reflecting global economic and social shifts.

Did you know that global high-net-worth individuals are increasingly seeking residency through various investment routes to secure their families' futures and expand their businesses?

With an ever-changing world and growing uncertainty, having a second residency has become more than just a luxury; it's become a strategic move.

To help you keep up with this global trend, our team of experts at WorldPassports has diligently compiled a comprehensive breakdown of the various investment routes to qualify for RBI.

In This Article, You Will Discover:

Whether you're an entrepreneur looking to tap into new markets or an individual striving for a higher quality of life, this article will provide valuable insights to help you make informed decisions on your path to global residency.

Without further ado, let’s get started…

*Disclaimer: All amounts mentioned in this article were correct at the time of publication and might have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

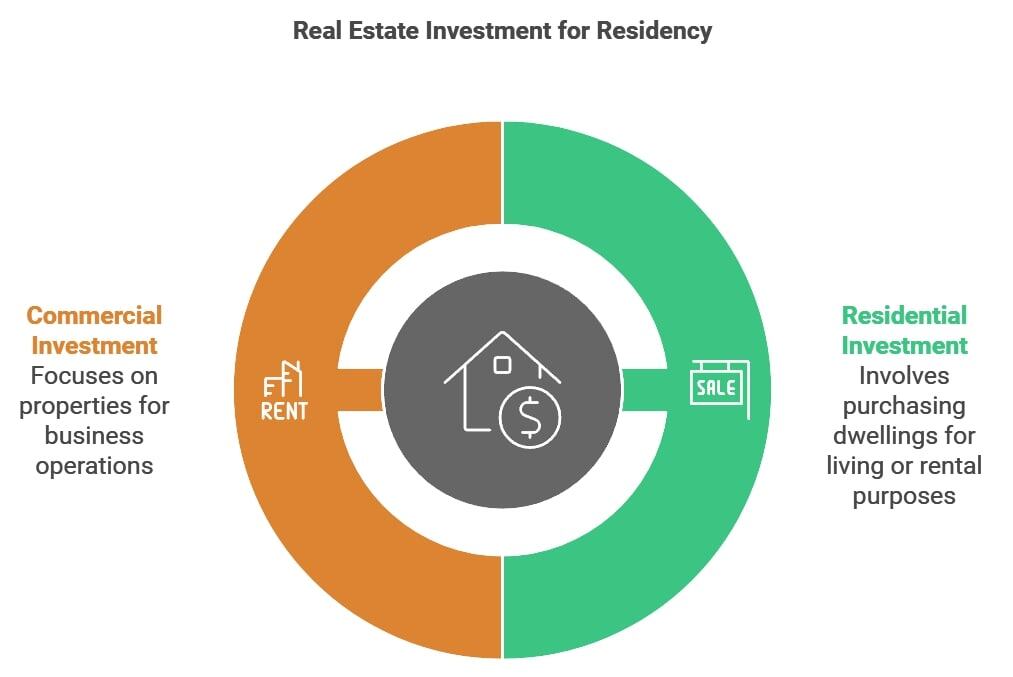

Real Estate Investment

One of the most popular routes to residency by investment is through real estate investment.

This investment route not only allows you to secure a second home or lucrative business property but also grants you access to a new country and its benefits.

Let's explore the 2 main types of real estate investments that can pave your way to residency.

Residential Real Estate Investment

Residential real estate investment involves purchasing a house, apartment, or other dwelling in the host country with the intent of either residing there or renting it out.

The costs can vary greatly, ranging from US$100,000 to over US$1 million, depending on the location, size, quality of the property, and specific program requirements.

Programs such as those in Portugal, Spain, and Greece offer residency through this type of investment.1

Remember

Each country has specific requirements, so it's essential to research and understand the program details before making a decision.

Learn More: Real Estate Investment in Portugal

Commercial Real Estate Investment

Commercial real estate investment, on the other hand, focuses on properties intended for business purposes, such as office spaces, retail outlets, or warehouses.2

This type of investment can require a higher capital commitment, typically starting at around US$500,000 and going up to several million US dollars.

Countries like the United States and the United Kingdom offer residency by investment programs that include commercial real estate options.

Take note

When considering this route, it's crucial to assess the potential returns on investment and ensure that the property aligns with your long-term business goals.

Capital Transfer

Capital transfer requires a specified amount of money to be invested directly into the host country's economy.

This can be in the form of government bonds, development projects, or other approved financial instruments.3

The minimum investment amount typically ranges from US$100,000 to over US$1 million, depending on the specific country and program.

Countries such as Portugal, Estonia, and Monaco offer residency through capital transfer investment routes.

What’s more

When considering this option, it's essential to weigh the potential returns, risks, and long-term benefits of your investment.

Additionally, be sure to diligently research each program's specific requirements and consult with experts to make an informed decision that aligns with your financial goals.

Purchase of Securities

The purchase of securities is another investment route offered by many residency by investment programs.

To qualify for this route, an investment must be made in stocks, bonds, or other financial instruments issued by companies or the government of the host country.4

This option allows you to diversify your investment portfolio and potentially earn a return on your investment while securing residency.

Additionally

The required investment amounts can vary, typically starting at around US$100,000 and reaching up to US$1 million or more, depending on the specific program.

Countries such as Portugal, Malta, and Montenegro offer residency through the purchase of securities.

When considering this investment route, we recommend assessing the risks associated with the chosen securities and their potential returns, as well as the overall stability of the host country's economy.

Business Investment

Business investment involves investing in, establishing a new business, or expanding an existing business in the host country.

This option allows you to tap into new markets, create jobs, and contribute to the local economy while securing your residency.

The required investment amounts for this route can vary significantly, starting at around US$100,000 and going up to several million dollars, depending on the country and program.

Countries such as the United States, the United Kingdom, and Canada offer residency through this type of investment.

When exploring this investment type, it's essential to assess the potential profitability of the business venture as well as the overall economic and political stability of the host country.

What’s the Most Popular Type of Residency by Investment?

Real estate investment is often the most popular type of RBI and there are several reasons why this is the case.

Our team compiled the top reasons why this is the case:

- Tangible assets: Real estate is a tangible asset that can appreciate over time, reliably providing investors with a return on their investment.

- Income generation: Depending on the property and its location, it can be used for rental income generation, creating an additional revenue stream for the investor.

- Personal use: The property can also serve as a second home or vacation property for the investor and their family, adding a personal benefit.

- Ease of understanding: Compared to other types of investments, such as securities or business investments, real estate is generally easier for most people to understand and navigate, making it a more accessible choice for many.

However

It's important to note that, although it's popular, real estate investment might not be the right option for you.

Popularity can vary depending on the specific country's RBI program and the individual investor's financial capabilities, goals, and risk tolerance.

Is There an Ideal Investment Option to Achieve Residency?

As world citizenship experts, we’ll say that there isn't a single "ideal" investment option to achieve residency.

The best choice depends on several individual factors, including one's financial capabilities, risk tolerance, future plans, and personal and business needs.

Here are a few thoughts you can consider regarding each investment option:

- Real estate investment could be an excellent choice for those looking for a tangible asset, a potential second home, or a steady income from rental. However, this method might require a substantial initial investment and ongoing costs such as maintenance and property taxes.

- Capital transfer is typically straightforward, but it often doesn't offer direct financial returns, so it may be more appealing to individuals who prioritize residency or citizenship over financial gain.

- Investing in securities allows for portfolio diversification and potential earnings. Still, it comes with its own set of risks associated with the volatility of financial markets.

- Business investment is often a great choice for entrepreneurs willing to expand their operations, tap into new markets, and contribute to the local economy. However, this method typically requires a significant investment, a sound business plan, and more involvement in ongoing business operations.

Take note

The best investment option for you is the one that aligns with your personal goals, financial situation, risk appetite, and long-term plans.

It's essential to do extensive research, possibly consult with experts, and evaluate all options before making a decision.

Common Questions

Which Residency by Investment is Easiest to Get?

What’s the Most Commonly Used Type of Residency by Investment?

Can I Buy Residency?

Which Is the Easiest Country to Get Permanent Residency?

For Residency by Investment, Should I Use a Lawyer?

In Conclusion

In this article, we’ve covered the main investment types that qualify for residency by investment, including real estate, capital transfer, purchase of securities, and business investment.

Our team at WorldPassports has done the due diligence so you have a solid starting point! We trust that our comprehensive article has helped you embark confidently on your residency journey with the knowledge to make financially informed investment decisions.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure