UAE Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- The UAE offers residency by investment through property purchases, with a minimum investment of AED 1 million (approximately USD 272,000).

- Benefits include access to a dynamic business environment, a tax-free lifestyle for personal income, and high-quality infrastructure.

- The program allows investors to include their families, enhancing its appeal for those looking to relocate to the Middle East.

- Apart from real estate, investments can also include business ventures that contribute to the local economy.

- The process for obtaining residency is efficient, with real estate investors often receiving their residency visa within a few months.

While many know the United Arab Emirates (UAE) for its opulent skyscrapers and thriving economy, did you know that the UAE is home to one of the world's most picturesque natural wonders, namely the Jebel Hafeet mountain?

In the shimmering desert landscape of the UAE lies an extraordinary opportunity that often escapes the global spotlight.

Join us on a journey into the intricacies of residency by investment in the UAE, where hidden gems await discovery amidst the golden sands.

In This Article, You Will Discover:

What are you waiting for?

A golden opportunity awaits…

*Disclaimer: All amounts mentioned in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

What Are the Benefits of Residency by Investment in the UAE?

The benefits of residency by investment in the UAE range from tax advantages to its exceptional business environment.

Here’s a definitive summary of the most compelling benefits to expect:

- Global access: Obtain a UAE residency permit that grants you access to a strategic global hub for business and travel.

- Member of key bodies: The UAE is a full member of the United Nations, Arab League, and Gulf Cooperation Council.

- Tax advantages: Benefit from the UAE's tax-friendly environment, with no personal income tax and low corporate taxes.

- Business opportunities: Invest in a thriving economy and explore lucrative business opportunities in various sectors. The UAE is rated in the Top 30 for ’Ease of Doing Business’.

- Family inclusion: Extend the benefits to your family members, including spouses and children, by sponsoring their visas.

- Stable environment: Enjoy political stability, security, and a well-developed infrastructure for a high quality of life.

- Property ownership: Invest in UAE real estate and own property, providing both investment potential and a place to call home.

- Education and healthcare: Access world-class education and healthcare facilities for you and your family.

- Residency flexibility: Choose between different investment options, such as real estate, investment funds, or setting up a company.

- No minimum stay: There’s no requirement to reside in the UAE continually, offering flexibility for your lifestyle.

- Renewable: Residency permits are typically renewable, allowing you to maintain your status as long as you meet the criteria.

- Visa-free travel: Gain visa-free or visa-on-arrival access to numerous countries, enhancing your global mobility.

- Long-term planning: Secure your financial future and retirement by establishing a foothold in a stable and prosperous country.

- Cultural diversity: Experience a multicultural society with a rich blend of traditions and modernity.

- Asset protection: Diversify your assets and benefit from strong legal protection for investments.

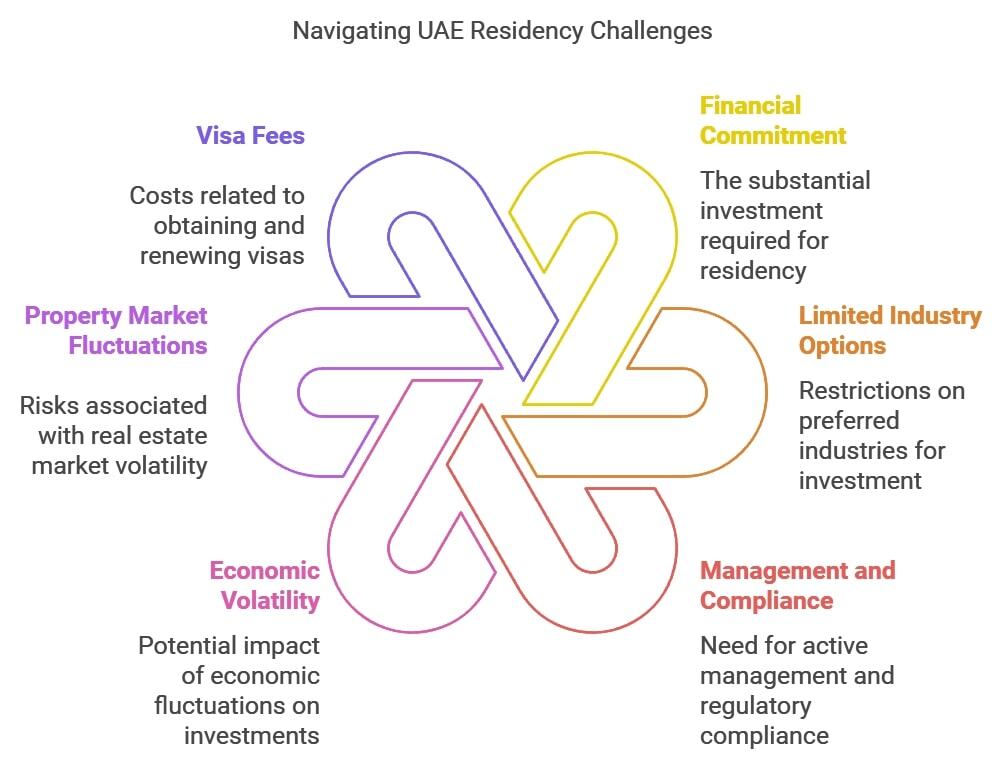

What Are the Limitations of Residency by Investment in the UAE?

As with any big investment, you can expect certain drawbacks and limitations; residency by investment in the UAE is no different.

In our expert opinion, these are the main limitations to plan around:

- Financial commitment: The investment required for residency can be substantial, which may not be feasible for everyone.

- Limited industry options: While there are various investment pathways, some individuals may find their preferred industry or business type isn’t covered.

- Management and compliance: Business investments may require active management and compliance with local regulations, which can be demanding.

- Economic volatility: While the UAE is stable, like any economy, it can experience economic fluctuations that may affect your investments.

- Property market fluctuations: The real estate market in the UAE can be volatile, so property investments may carry some risk.

- Visa fees: There are fees associated with obtaining and renewing residency visas, adding to the overall cost.

- Family sponsorship requirements: Sponsoring family members may involve additional financial commitments and responsibilities.

- Cultural adaptation: Adjusting to a new cultural environment and local customs may pose challenges for some expatriates.

- Language barrier: While English is widely spoken, language barriers can still be encountered in certain situations.

- Residency renewal conditions: Residency permits are typically renewable, but failure to meet renewal criteria could lead to their cancellation.

- Limited social benefits: Unlike citizens, residents may have limited access to certain social benefits in the UAE.

- Exit strategy: Planning an exit strategy can be important, as selling a business or property in the UAE may involve specific procedures and costs.

- Dependent age limit: There may be age restrictions for dependent children to be included in the residency sponsorship.

- Changing regulations: UAE immigration and investment regulations can change, affecting the program's terms and conditions.

- Lack of citizenship: Residency by investment doesn’t automatically grant citizenship; it provides residency rights without voting privileges.

Take note

Don’t let the limitations deter you; with adequate planning and research, most risks can be mitigated.

Which Investment Types Qualify for Residency by Investment in the UAE?

The investment types that qualify for residency by investment in the UAE include public sector investment and real estate investment.1

Here are the details:

Public Sector Investment

You have a choice of investment options if you choose to invest in the UAE’s public sector.

The public sector investment options are:

- Make a deposit in an investment fund.

- Start a company or become a partner in an existing UAE company, ensuring that your shares are worth the minimum required investment amount.

Important to note

The money you use to make your investment can’t be a loan, and you must maintain your investment for at least 3 years.

Real Estate Investment

You can get residency by investment by purchasing approved UAE real estate for the stipulated minimum investment amount.

You can either purchase one property or multiple properties, as long as the total purchase meets the minimum required investment.

Entrepreneur

The company you set up in the UAE must be of a technical nature, based on risk and innovation.

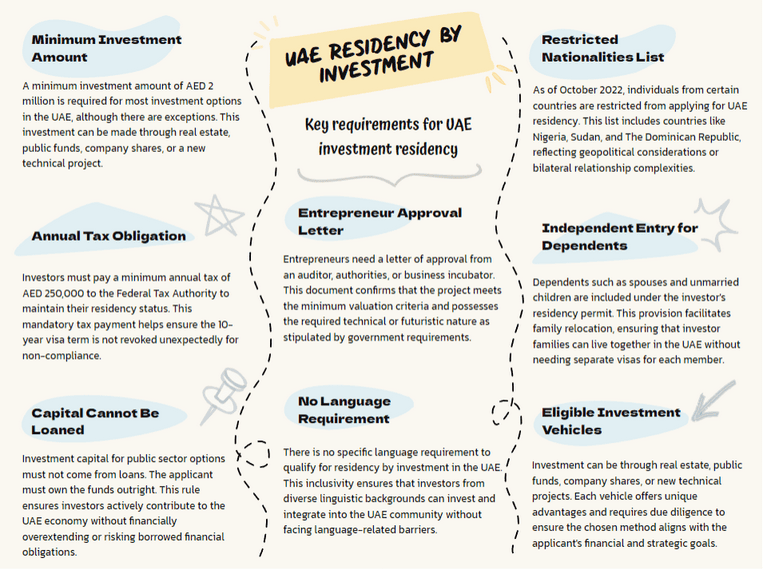

What Are the Eligibility Requirements for Residency by Investment in the UAE?

The eligibility requirements for residency by investment in the UAE will vary slightly depending on your chosen investment type.

To start with, however, you’ll need to be a non-UAE national, and you must have a clean criminal record.

Our seasoned team has compiled the most important facts for you:

Minimum Investment Amount

The minimum investment amount is AED 2 million (approximately US$550,000) for most investment routes, but not all.2

Here are the minimum investment amounts required for each investment vehicle:

- Real estate (one or more properties): AED 2 million

- Deposit in a public investment fund: AED 2 million

- Join an existing UAE company: Shares valued at a minimum of AED 2 million

- Start a new economic project of a technical nature: At least AED 500,000

Annual Tax Obligation

As a UAE investor resident, you’ll need to prove that you pay the Federal Tax Authority at least AED 250,000 annually.

This will ensure that the 10-year validity of this visa isn’t revoked.

Public Sector Investment Capital Can’t Be a Loan

If you choose to invest via any of the public sector options, you need to prove that you own the investment capital completely.

Letter of Approval for Entrepreneurs

If you choose to enter the country as an entrepreneur, you have to provide a letter of approval from certain bodies.

The letters must be from:

- an auditor in the UAE, stating that the project value isn’t less than AED 500,000.

- the authorities in the UAE, stating that the project is of a technical or futuristic nature.

- an accredited business incubator in the UAE to establish the proposed activity in the country.

Language Requirements to Qualify

There’s no language requirement to obtain residency by investment in the UAE.

Nationalities Restricted from Applying

As of October 2022, the UAE has banned certain countries from obtaining a UAE visa.3

These countries include:

- Benin

- Burkina Faso

- Burundi

- Cameroon

- Comoro

- Congo

- Democratic Republic of Congo

- Gambia

- Ghana

- Guinea Bissau

- Ivory Coast

- Liberia

- Nigeria

- Republic of Guinea

- Rwanda

- Senegal

- Sierra Leone

- Sudan

- The Dominican Republic

- Togo

- Uganda

Will My Dependents Be Included Under My UAE Residency by Investment Permit?

Yes, if you obtain your UAE residency by investment permit, your dependents will be included under it.

Dependents include your spouse and any unmarried children.

How Long is the UAE Golden Visa Valid & Can It Be Extended?

The UAE Golden Visa’s validity period differs depending on your chosen investment route.

Read on.

Validity Period

If you choose to invest in the UAE’s public sector, your residency permit will be valid for 10 years.

If you choose to invest in real estate or as an entrepreneur starting a technical- or future-based project, your UAE residency permit will be valid for 5 years.

Visa Renewal

The UAE Golden Visa, regardless of whether yours is valid for 5 years or 10 years, is generally renewed automatically.

The UAE also has an easy One-Touch Golden Visa online service to facilitate renewals.

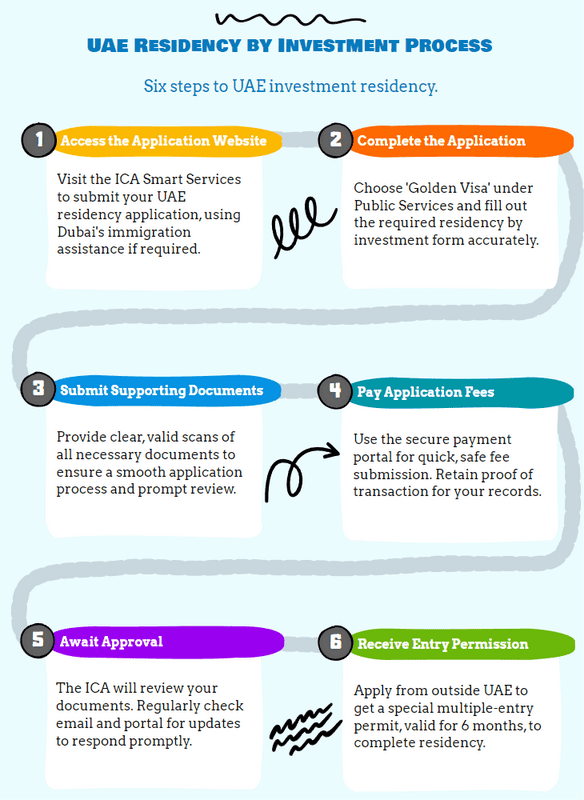

What’s the Application Process for Residency by Investment in the UAE?

The application process for residency by investment in the UAE can be completed online and entails rigorous due diligence checks.

We’ve taken the liberty of breaking down the application process into simple steps for you; you’re welcome!

Here you go:

Step-by-Step Application Process

The Federal Authority for Identity, Citizenship, Customs, and Port Authority oversees Golden Visa applications for the UAE.

It oversees an online application service for golden visa applications.

Here are the application steps:

Step 1: Access the Application Website

The ICA Smart Services platform is where you’ll submit your UAE residency by investment application.

If you need assistance, Dubai’s immigration service, the General Directorate of Residency and Foreigners Affairs, has a team that specifically assists golden visa applicants and high-profile people.4

Step 2: Complete the Application

Under Public Services, select “Golden Visa” and fill out an application form for Golden Residency.

Step 3: Submit Supporting Documents

Attach clear and valid scans of all requested documents.

Ensuring you complete this step accurately will facilitate a smoother turnaround on your application.

Step 4: Pay Application Fees

A secure payment portal will allow you to make this payment quickly and safely.

We strongly advise that you retain proof of the transaction.

Step 5: Await Approval

The ICA will now review your application and supporting documents.

Top tip

Keep a watchful eye on your email and the application portal for any updates or notifications from the ICA.

This way, you can respond promptly to any important information about your visa application status.5

Step 6: Receive Entry Permission

This step only happens if you’re applying from outside the UAE.

You’ll need this special multiple-entry permit (valid for 6 months) to enter the UAE and complete the Golden Residency application process.

What’s the purpose of this?

This permit allows you to attend in-person interviews, undergo final checks (such as a medical examination), and apply for your UAE identity card.

Required Documents

The documents required as support for your residency by investment application serve as proof of the information contained in your application forms.

In our experience, you can expect to supply the following documents:

- Passport: Original and a copy of the passport, valid for at least 6 months

- Passport-size photographs: As per the UAE specifications

- Current visa: If you’re already residing in the UAE

- UAE establishment card: If applicable, for business owners or investors

- Health insurance: Valid health insurance with UAE coverage validity

- Proof of investment: Typically in real estate, a business, or a deposit in a UAE-based bank

- Title deed: If the investment is in real estate

- Bank statement: Reflecting the investment amount

- MOU (Memorandum of Understanding): If investment is in a business

- Proof of ownership/shareholding: For a project or a business

- Business plan: Detailing your proposed or current venture in the UAE

Worth noting

Depending on your unique circumstances, you may be required to provide additional documents or proofs.

What Costs Are Involved in Getting Residency by Investment in the UAE?

Aside from the investment amount, you can expect to incur other costs in the process of obtaining your UAE residency by investment application.

Here’s our experts’ breakdown of the main costs and fees to expect:

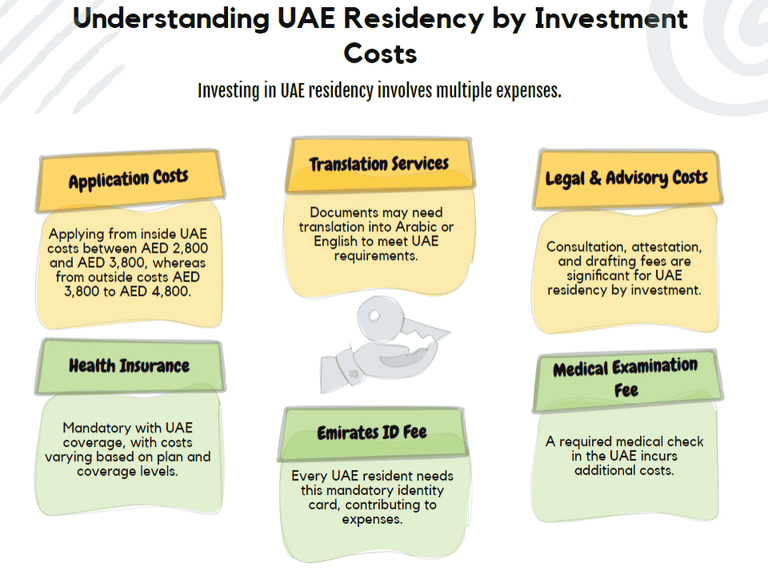

Application Costs

If you apply from inside the UAE, the price ranges between AED 2,800 and AED 3,800.

If you apply from outside the UAE, it tends to cost between AED 3,800 and AED 4,800.

Legal & Advisory Costs

Legal and advisory costs are an almost unavoidable part of investing in a residency.

In our view, these are the main ones to plan for:

- Consultation fees: Costs associated with seeking advice from immigration experts or lawyers specializing in UAE visas

- Document attestation fees: For validating the authenticity of your documents from the country of origin or other institutions

- Translation services: If you need to get your documents translated into Arabic or English, as per UAE's requirements

- Legal drafting fees: For any legal documents, agreements, or business plans that need to be drafted or modified

- Visa application service fees: If you're employing a firm to handle the visa application process on your behalf

- Appeal costs: In case your initial application is rejected and you decide to appeal the decision

Additional Associated Costs

The additional, often unplanned, costs associated with your UAE residency by investment application need to be factored in, too.

Consider these:

- Health insurance: It's mandatory to have health insurance with UAE coverage. This can range in cost depending on the plan and coverage.

- Medical examination fee: You'll need to undergo a medical examination in the UAE, which comes at a cost.

- Emirates ID fee: Costs associated with getting an Emirates ID, which is a mandatory identity card for residents.

- Establishment card fee: For business owners or investors who need this card.

- Title Deed registration fee: If your investment is in real estate.

- Property valuation fee: For validating the value of a property if investing in real estate.

- Bank charges: In the case of opening a bank account or making a fixed deposit as a part of the investment criteria.

- Health assessment and vaccination: Some categories may require specific health checks and vaccinations.

- Travel and relocation expenses: Costs associated with traveling to and setting up your home in the UAE, if you're not already residing there.

What’s the Processing Time for UAE Residency by Investment?

While processing times for residency by investment applications can vary, we do have some estimates for you when it comes to the UAE residency by investment program.

Take a look below.

Average Processing Time

On average, UAE residency by investment applications take between 2 and 8 weeks to be processed.

Factors Affecting Processing Time

Factors affecting processing times range from application volumes to the completeness of your application.

Here’s the full list:

- Application volumes: Periods with high application volumes, especially during promotional events or changes in visa regulations, can delay the processing time.

- Application category: The golden visa has various categories, including investors, entrepreneurs, professionals, and students. Each category might have its unique processing time, depending on the intricacy of the required evaluations.

- Document verification: Any discrepancies, inconsistencies, or missing information in the submitted documents can lead to delays. This includes the time taken to verify the authenticity of documents, especially if they are from foreign institutions.

- Medical examination results: The time it takes to conduct and receive results from mandatory medical tests can influence the overall processing time.

- Inter-departmental communication: Sometimes, visa processing might require communication between various government departments, such as real estate for property investors or educational departments for student applications.

- Public holidays: The UAE has several public holidays, including national holidays and Islamic celebrations, which can affect the working days and thereby the processing times.

- Appeals and revisions: If the initial application is rejected or requires additional clarification, the process of appeal or resubmission can add to the processing time.

Expedited Processing Options

For regular visas, the UAE offers a “Rushed” and “Super Rushed” visa application option for an extra fee.

However, given the due diligence process required for the golden visa, there’s no official way to expedite the approval process.

How Soon Will I Receive My Residency Permit After My Residency by Investment Application is Approved?

You’ll typically receive your residence permit within 7 days if your application is approved.

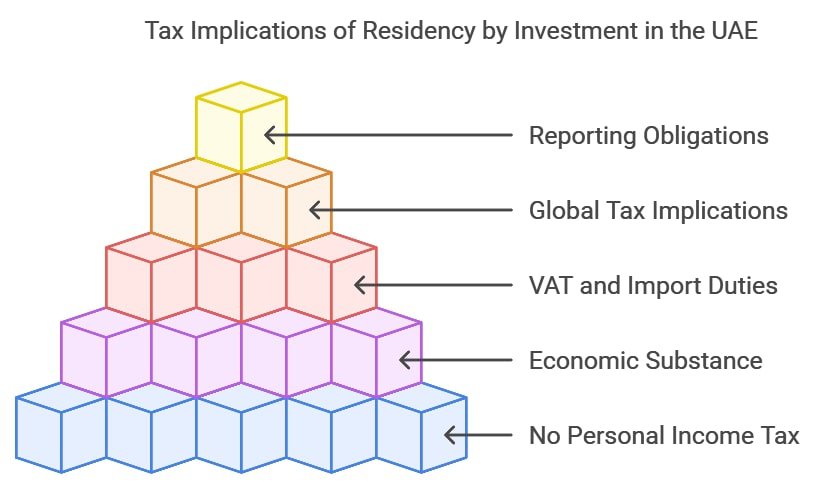

What Are the Tax Implications of Residency by Investment in the UAE?

The tax implications of residency by investment in the UAE begin with one of the eligibility criteria to retain your residency permit: the required minimum payment of AED 250,000 annually to the UAE’s tax authority.

This means that, regardless of other tax residency requirements,6 you’ll be bound to pay taxes in the UAE as a direct result of your residency by investment permit in the country.

These are the main tax implications to keep in mind:

- No personal income tax: One of the primary attractions of the UAE is that there’s no personal income tax for residents.

- No capital gains tax: Residents and investors don’t need to pay capital gains tax on the sale of assets or investments.

- No corporate income tax for most businesses: Most businesses in the UAE, especially those outside the banking and oil sectors, aren’t subject to corporate income tax.

- No withholding tax: There's no withholding tax on interest, dividends, and royalties in the UAE.

- Value-added tax (VAT): Introduced in 2018, the UAE has a 5% VAT on certain goods and services, which businesses need to consider in their operations.

- Import duties: The UAE imposes import duties on various goods, but certain zones, like the free zones, may offer exemptions.

- Tax treaties: The UAE has numerous double taxation avoidance agreements (DTAAs) with countries worldwide, which can benefit residents by avoiding double taxation on foreign incomes.

- Potential global tax implications: Residents might still be subject to taxes in their country of origin or citizenship. For example, US citizens and green card holders are subject to worldwide taxation, even if they reside in the UAE.

- Property tax: There’s no property tax per se in the UAE. However, there might be service charges or community fees associated with property ownership, which aren’t taxes but obligatory expenses.

- No estate or inheritance tax: The UAE doesn’t impose inheritance or estate taxes.

- Reporting obligations: While the UAE has favorable tax regimes, individuals might have foreign reporting obligations, especially in their original country of citizenship or other countries where they hold significant assets.

- Economic substance regulations: Introduced in 2019, these regulations require certain business entities to have substantial activities in the UAE. It's geared towards businesses in specific sectors, and they might need to fulfill certain requirements to avail of the tax benefits.

- Beneficial ownership regulations: Entities in the UAE must maintain a real-time register of their beneficial owners and report the same to authorities. This is to ensure transparency and prevent tax evasion or money laundering.

We strongly advise

If you’re considering residency by investment in the UAE, consult with a tax advisor or legal expert to fully understand the implications and ensure compliance with both UAE regulations and any obligations in your home country.

Is Residency by Investment in the UAE a Pathway to UAE Citizenship?

No, residency by investment in the UAE isn’t a pathway to citizenship.

You can renew your residency permit indefinitely, but you will likely only be able to apply for citizenship in 30 years.

It’s worth noting that the exact requirements for obtaining eventual citizenship in the UAE are fairly opaque, and there’s no guarantee that your citizenship application will be successful, even with 30 years of strong ties to the country.

Common Questions

How Much Do I Have to Invest in the United Arab Emirates to Get Permanent Residency?

Should I Apply for My UAE Golden Visa Through an Agent?

Is the UAE Golden Visa Worth It?

Can Foreigners Get Permanent Residency in the UAE?

How Risky Is Residency by Investment in the UAE?

Is It Difficult to Get Residency by Investment in the UAE?

Can I Get Residency in the UAE if I Buy Property There?

What’s the Age Limit for the UAE Investor Visa?

Can I Open a Bank Account in Dubai With an Investor Visa?

What’s the Difference Between the UAE Golden Visa and the Property Investor Visa?

Can I Work in Dubai With a Property Investor Visa?

In Conclusion

Residency by investment in the UAE offers a unique blend of long-term stability, lucrative tax advantages, and a gateway to one of the world's most dynamic economies.

While residency pathways like the golden visa are attractive, it's imperative to approach the process with due diligence and a clear understanding of all criteria.

Whether you're an entrepreneur, investor, or professional, the UAE's forward-thinking policies can be the key to unlocking new horizons in both personal and business realms.

Let WorldPassports help you navigate those horizons!

The UAE isn’t the only country with a residency by investment program in the African and Middle Eastern regions; have a look at some of the other countries our team has covered.

Learn More: Residency by Investment in Africa & the Middle East

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure